The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke bombs!

Bitcoin has once again refreshed its recent low at the 86,000 position, and you can rest assured that there will be lower levels. The rebound has also been relatively stable, which has led many friends to mythologize Lao Cui. I remind everyone again that Lao Cui does not accept any business, including so-called platform promotion; please do not look for Lao Cui anymore, you will be disappointed and waste Lao Cui's energy, look for others instead; Lao Cui himself also particularly loves to speak the truth. If one day I accidentally expose the insider information of your platform, it would be somewhat unkind. If there are peers who want to discuss the market together, you are welcome to exchange different insights with Lao Cui, but do not approach Lao Cui with ulterior motives. It is better for people to be more honest with each other. Thank you all for your cooperation. As the year-end approaches, everyone is very busy, so let's not waste each other's energy. For users, Lao Cui's articles should be read as news and not as references; they are heavily subjective, just for fun.

Back to our market, there will always be coin friends who hope Lao Cui will explain the logic of linear aspects, and I can feel what you want to see. However, linearity, in Lao Cui's eyes, is too one-sided. The so-called professional knowledge is all about speculating on the intentions of capital. If you have such needs, you can try using AI; AI's logic is superior to that of humans, especially in reasoning. Humans can dominate the Earth largely because they learn to use tools, and the emergence of AI can save you the time of learning these tools. Moreover, Lao Cui is not a university professor and not a teacher by profession, so it is also a painful thing for me to teach everyone. Therefore, Lao Cui is more concerned about whether you want to learn. Everyone's investment journey is different, and Lao Cui is even less clear about where your deficiencies lie. Most of the time, Lao Cui only provides his own views, and how you choose to unlock the lock of your destiny is still up to you.

Lao Cui also hopes that even if you find Lao Cui, you can come directly to ask questions without any formalities; getting straight to the point has always been Lao Cui's style. If you have problems and do not ask, then Lao Cui certainly will not take the initiative to find you to solve problems. Our industry is extremely special; we cannot take the initiative to seek you out, nor can we let everyone hand over their wealth to us to help manage their finances, as that is entirely a scammer's tactic. If you have questions, just ask, and Lao Cui will directly tell you what he knows. Returning to the linear issue, many times due to personal character, Lao Cui will only talk about the results he sees, and the reasoning process is rarely mentioned. Including the biggest linear event this year, which is the strong spike on October 11; Lao Cui mentioned it once. At that time, the conclusion given to everyone was that this spike completely destroyed the bullish trend, and it was highly likely that it would lead to new lows below.

In Lao Cui's eyes, this spike is a typical case, but from Lao Cui's perspective, it is not worth analyzing with everyone; because the rules in the coin circle are like this, a bull-bear turning point will not be like other markets, especially for those who have experienced the stock market; many friends have encountered circuit breakers or limit-up concepts. Why does this mechanism exist? It is simply to prevent panic emotions from continuing to lead to an inability to rescue the market from above. However, the coin circle does not have these concepts; any slight movement will cause panic among retail investors. Coupled with the market conditions at that time, it was in a state that no one could predict, after all, it was a historical new high. Therefore, any negative news that appeared at this time would have a great impact; it only takes a butterfly to gently flap its wings to cause retail investors and giants to exit. All predictions need time to verify; Lao Cui is not just talking after the fact; you can look back at previous predictions.

After this strong spike appeared, Lao Cui's conclusion was to go short, and the strategy was also to go long after going short, which clearly went wrong. If Lao Cui's memory is not mistaken, the biggest negative news at that time for the decline in the coin circle should be the tariff upgrades between the two. If you attribute the main cause of this decline to this, then the current state of the coin circle should be one of growth, as the tariff issue has been resolved. Lao Cui's thoughts at that time were also like this, which is based on the linear aspect, combined with the news aspect to arrive at this result. The final return will give us the answer, and this answer is clearly wrong. Perhaps if there had not been a surge in the US stock market and gold, the coin circle might have maintained a growth pattern, but it would not have become a bull market. If there are problems with the return aspect, it indicates that the clues in the calculations have gone awry, as the overall financial market's interference factors were overlooked at that time.

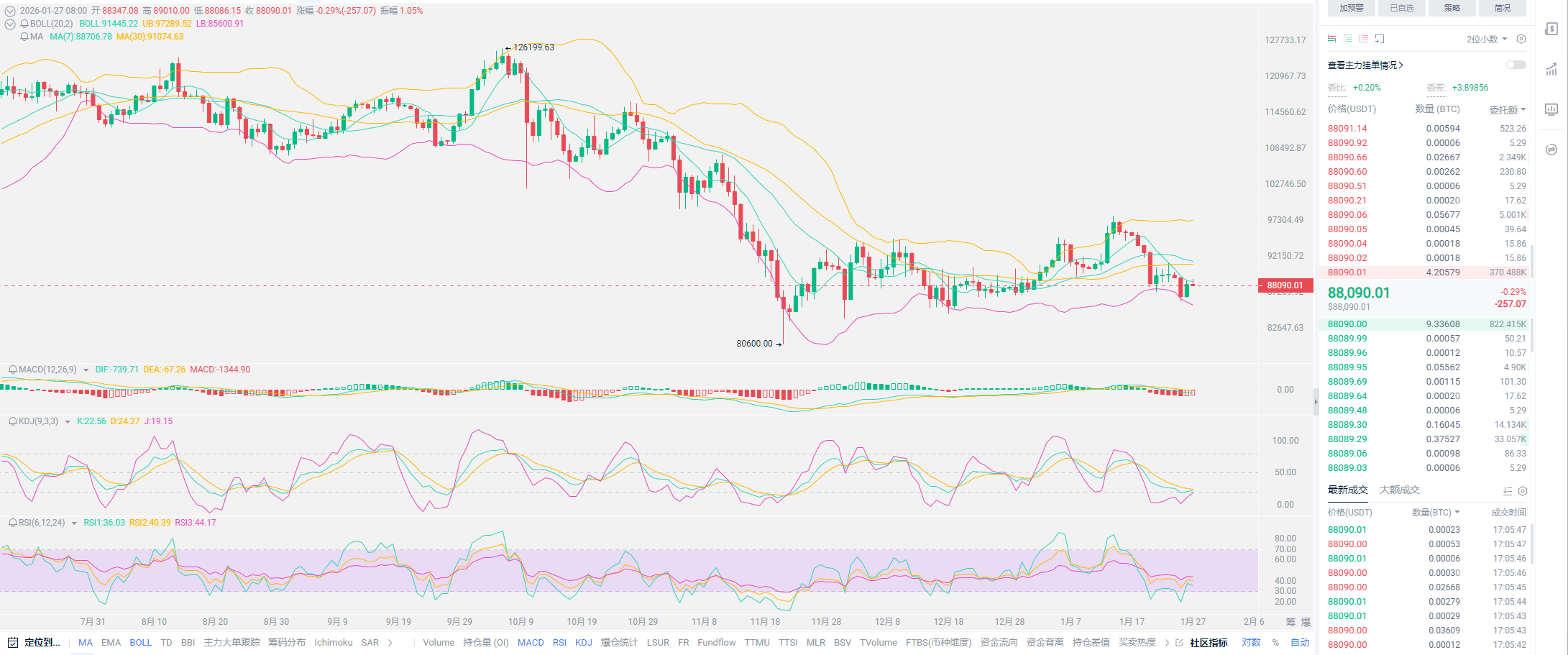

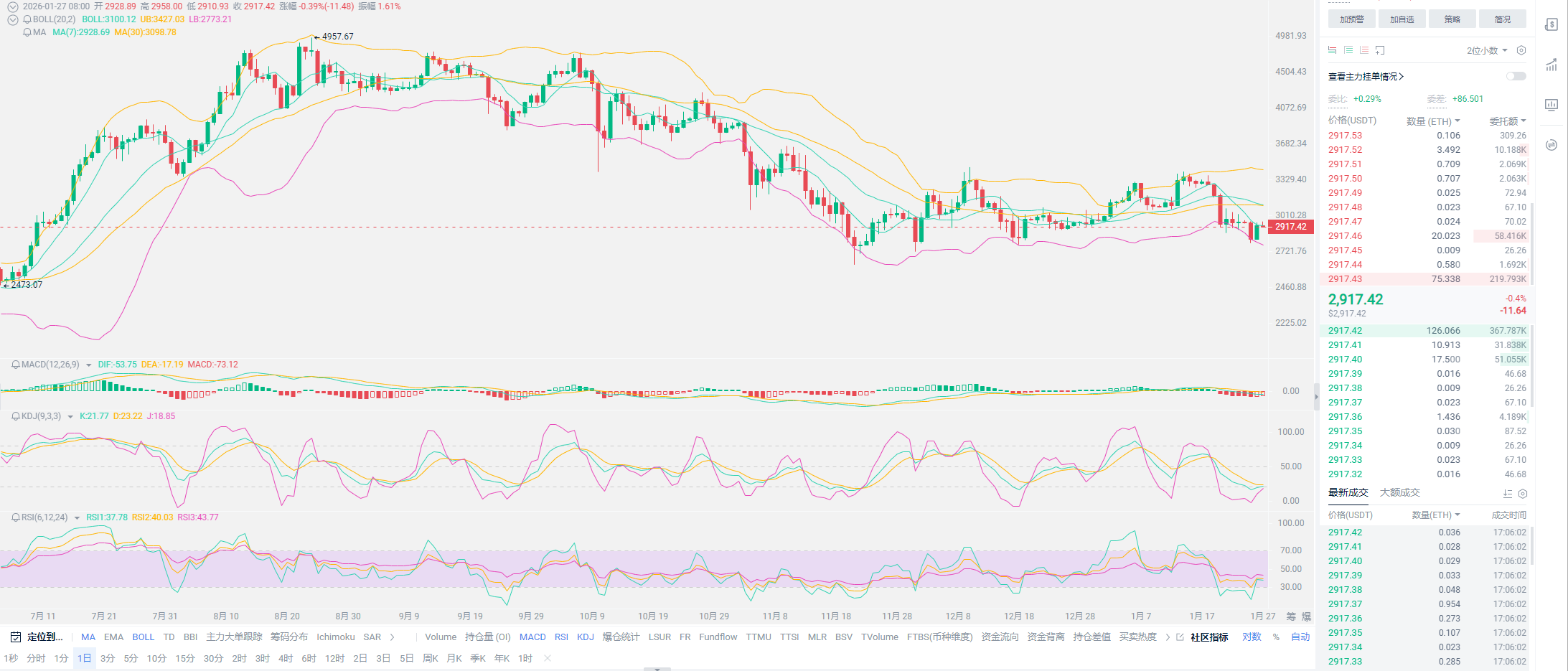

This is the main reason why Lao Cui's spot trading did not meet expected returns last year, and it also caused the subsequent profits in the coin circle to rely almost entirely on contracts to recover losses. When Lao Cui began to intervene around the 100,000 mark for Bitcoin, and it continuously fell to create a new low of 80,000, it awakened Lao Cui's reasoning logic. This also forged the idea of going short, but fortunately, the losses in spot trading have been recovered. In the short term, many friends attribute the spike at 80,000 to the same type as that on October 11, but Lao Cui's view at that time was completely different. The spike at the new high can disrupt all previous linear data, while the spike at 80,000 is generated from a downward trend. The pattern on the 11th disrupted the market, causing a collapse of over 20,000 points, while the spike at 80,000 was less than 7,000 points. One represents the end of a bull market, while the other only indicates that the decline has not ended. The rebound rates of the two can also illustrate many issues; since the rapid drop from 120,000, there has been no signal of a return, while the spike at 80,000 created a recovery space of 5,000 points within two days after a drop of 7,000 points.

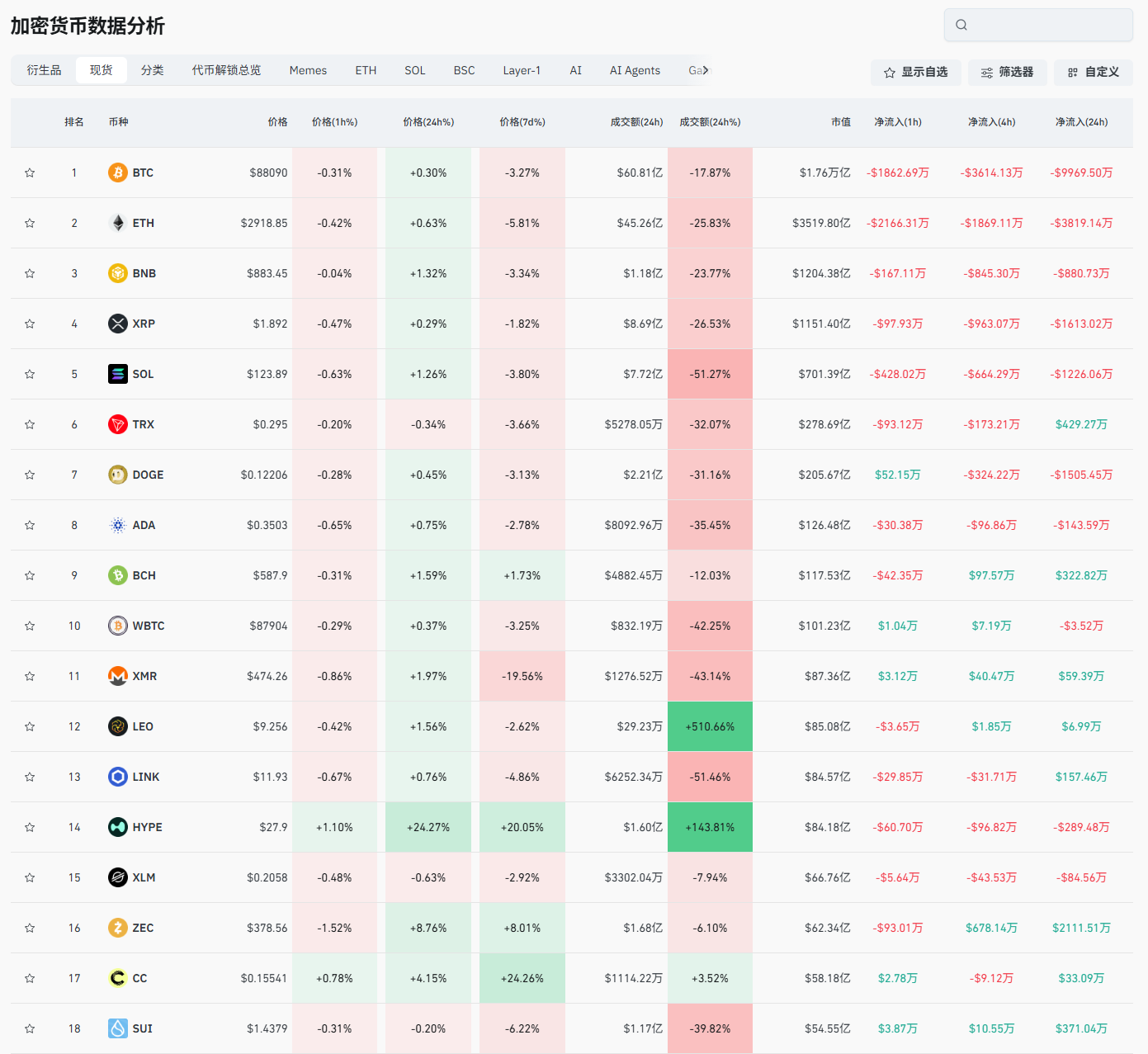

Lao Cui summarizes: this definition is extremely simple; one is a turning point, and the other is a continuation. Of course, combined with the news aspect, the four-year cycle and the impact of the October 11 crash, the impact of the yen's interest rate hike, and the lack of new purchases in the US BTC strategic reserves, the shorts are crazily using this opportunity to smash the market, and risk-averse funds are being siphoned off to gold, silver, and the stock market. Considering so many negative news, there is no sign of any rebound, especially since gold has been almost crazily maintaining a speed of hitting 100 points daily in the past two days. If I were a giant, I wouldn't even glance at Bitcoin. In the articles written in the past two days, I have mentioned too many negative factors; Lao Cui wants to encourage everyone. After all, the world's richest person is still in the market, and the US president is still around. The coin circle has almost been squeezed to the bottom, similar to the previous new high. The return of the bull market may only require a butterfly to flap its wings again. When everyone lives in fear, it is the moment when the bull-bear transition arrives. What comforts Lao Cui the most is that on-chain data can show that the giants are buying, which has already formed a sign of the early stage of a bull market. Gold, on the other hand, is in a situation opposite to that of the coin circle; the roles of these two are just swapped. If you have certain assets in hand, you can choose to hold them, and you must manage your positions well. It is very simple to convince yourself; your current purchase is just following Lao Cui's bottom. The price you are buying now is definitely lower than Lao Cui's. If you have spot holdings and cannot bear the torment, going short may be a good choice. At the end of the article, if you don't understand, just ask!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。