Original Author: Ignas

Original Compilation: Luffy, Foresight News

Everyone has felt it: the enthusiasm in the crypto market is waning, with a significant decrease in new token issuances and industry announcements.

Your Twitter timeline has become quiet, with AI-related posts and eye-catching content dominating the mainstream. But is this all real, or just a matter of emotional perception?

Looking at the data reveals the truth: this is the real state of the market. However, the truth behind it is far more complex than the conclusion that "cryptocurrency is dying."

Number of Developers

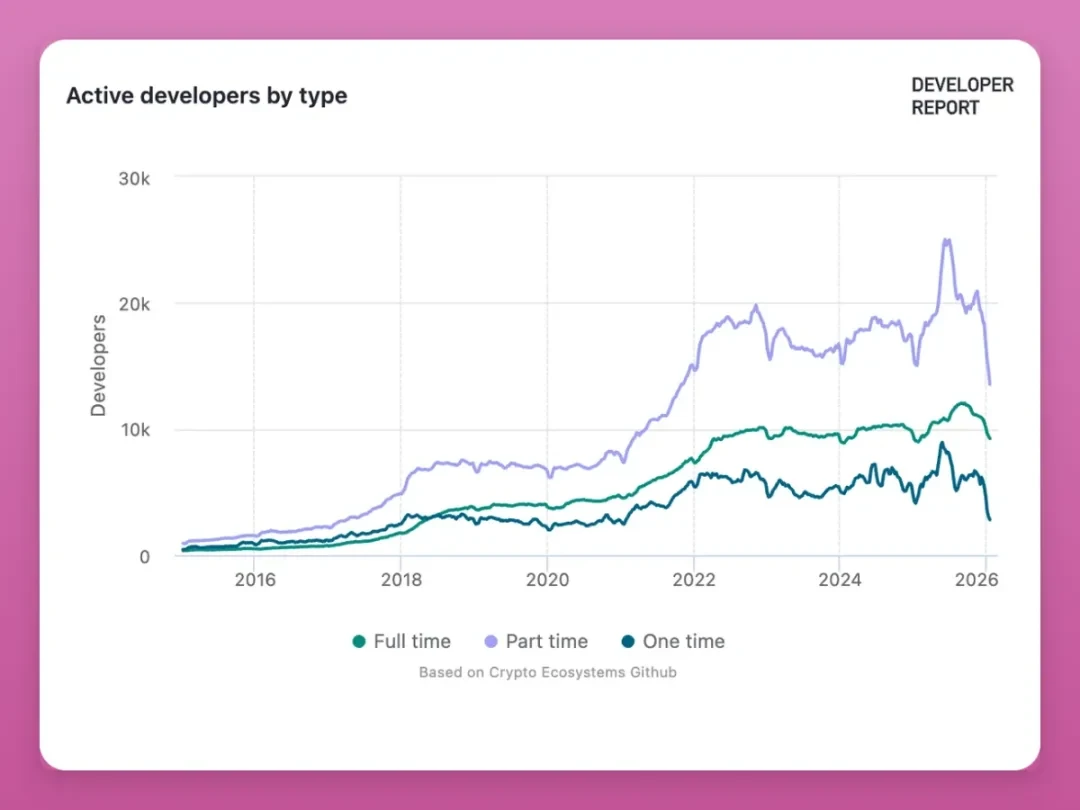

First, let's look at the changes in the number of active developers across different types:

Source: Electric capital dashboards

- Part-time developers: surged to 25,000 in mid-2025, now plummeted to about 12,000

- One-time participating developers: dropped sharply from 8,000 to 2,800, hitting a new low since 2020

- Full-time developers: steadily increased to a historical peak of 12,000, currently has receded slightly but the overall trend remains stable

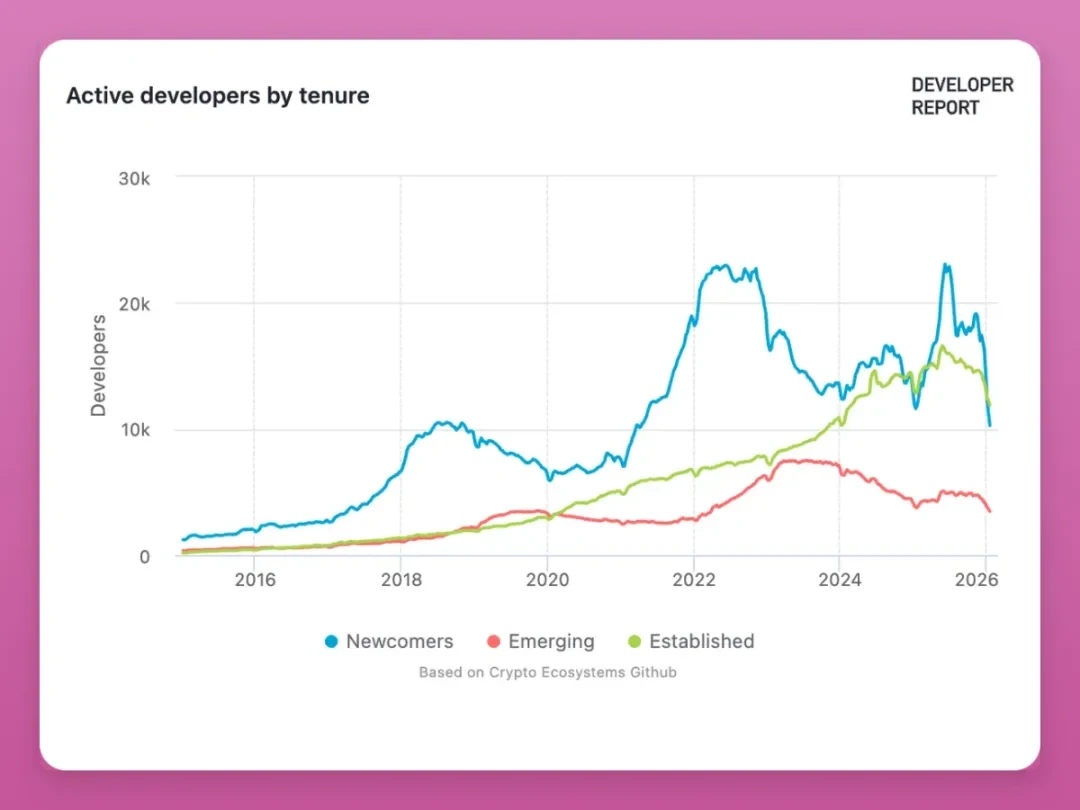

Now, let's examine the distribution of developers by years of experience:

- New developers: peaked at 23,000 in 2022, surged again in mid-2025, now has fallen to about 10,000

- Junior developers (around 1 year of experience): decreased by 50% from a peak of 8,000, currently about 4,000

- Senior developers (more than 2 years of experience): steadily increased to a historical peak, with a slight recent decline

The decline in the number of developers is mainly due to the exit of part-time developers and new entrants. During the market cycle of 2024-2025, a large number of developers flooded into the industry, trying to profit quickly through airdrops and token incentives, but when these benefits disappeared, they chose to leave.

However, even with the decline, the number of full-time developers and senior developers (more than 2 years of experience) is still close to historical peaks.

It is worth noting that in previous bear markets, the number of full-time senior developers continued to grow, but this time there is a downward trend. This phenomenon deeply concerns me.

Who Left, Who Stayed

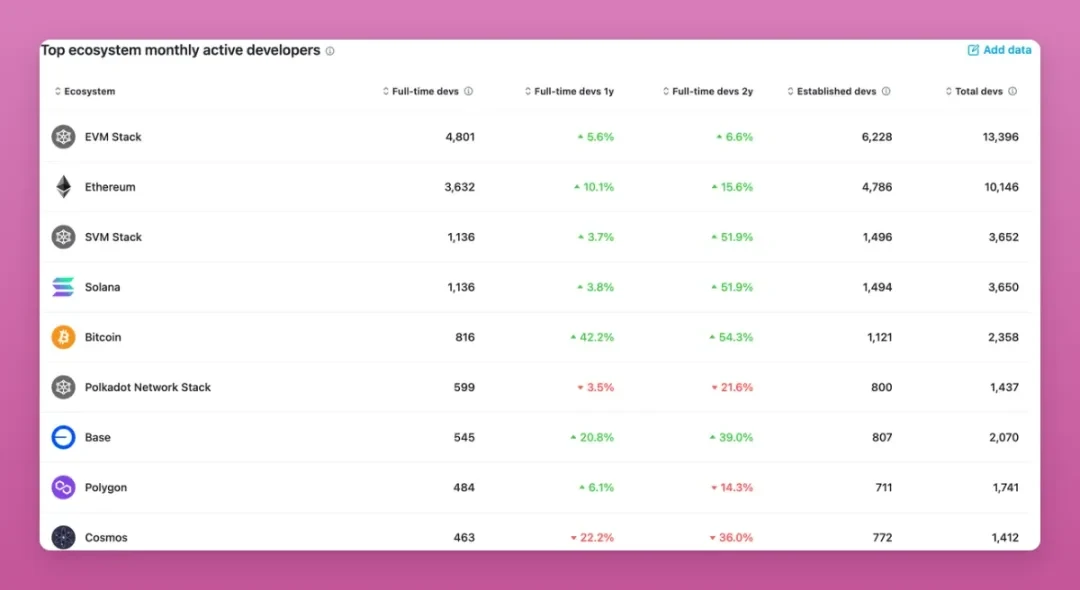

From the changes in the number of developers across various blockchain ecosystems, the market outlook is not entirely pessimistic:

- The number of developers in the Bitcoin ecosystem increased by 42%, driven by the development of ordinals, inscriptions, and layer two networks attracting a large number of developers back;

- The Ethereum ecosystem grew by 10.1%, with a total of 10,146 developers, still dominating the industry, and its layer two network Base is also developing well;

- The Solana ecosystem saw a year-on-year growth of 3.8%, but has increased by a staggering 51.9% over two years!

In contrast, many competitive public chains that emerged in 2021 (such as Polkadot and Cosmos) are heading towards decline; complete data can be found in related industry reports.

The number of full-time developers in leading public chains is still increasing. The decline in the previously mentioned developer numbers is only reflected in part-time and novice groups, while core developers have not exited.

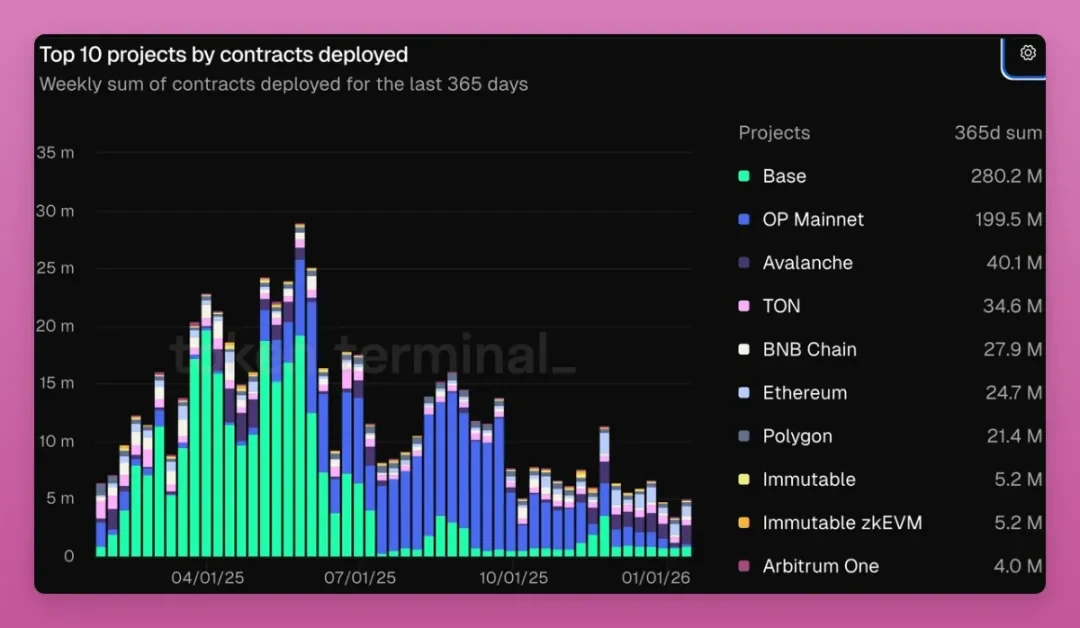

Note: It is also worth mentioning that the number of contracts deployed on the blockchain has decreased.

Since July 2025, the speculative boom of altcoins and meme coins in the Base ecosystem has receded, leading to a significant reduction in on-chain activity. If the Solana ecosystem is included in the statistics, this data would be even more dismal. This phenomenon has also directly triggered subsequent chain reactions…

Token Issuance Stagnation

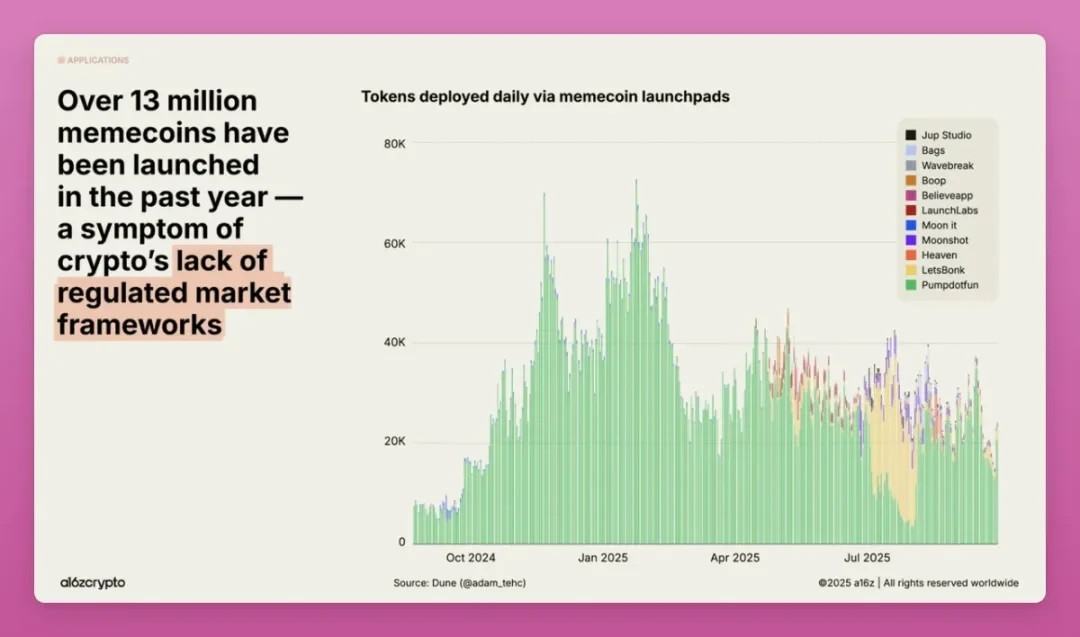

In the past year, over 13 million meme coins were issued in the market, but the number of tokens issued in September 2025 decreased by 56% compared to January.

Source: a16z

We have issued more tokens than ever before. According to CoinGecko data, the number of tokens issued in the market over the past five years is as follows:

- 2021: 428,383

- 2022: 724,706

- 2023: 835,183

- 2024: 3,032,501

- 2025: 20,170,928

I believe everyone can see the trend?

According to CoinGecko statistics, 53.2% of the tokens it tracks have now become "dead tokens" (with trading volumes below $1,000 for three consecutive months).

Moreover, 86.3% of token extinction events occurred in 2025. In just 2025 alone, 11.6 million crypto tokens exited the market.

The non-fungible token (NFT) market has also suffered a severe blow. Contrary to popular belief, while the NFT market once experienced a surge, it has never been able to maintain its upward momentum.

In 2024, the market saw a moderate fourfold increase, followed by a crash, and in 2025, there was another threefold increase, but it ultimately fell back again.

Currently, the trading volume in the NFT market is far from the peak in 2022, but the number of monthly active buyers continues to grow.

Although a16z's report states that the increase in buyer numbers is due to the market's "collecting demand," I believe this growth is actually thanks to the Zora model's social posts, which convert social platform content into NFTs that can be traded financially.

Layoff Wave Resurfaces

The last bear market in cryptocurrency (2022-2023) severely impacted the employment market in the industry:

According to data from Milk Road, the layoff rate in crypto companies reached as high as 50%:

- Crypto.com: laid off 2,700 employees (over 50% of total staff)

- Coinbase: laid off 2,000 employees (36% of total staff)

- Kraken: laid off 1,100 employees (30% of total staff)

After the market rebounded in 2024-2025, Coincub noted in its Web3 employment report that 66,494 new jobs were added in the Web3 industry in 2025, a rebound of 47% compared to 2024.

They found:

- The German market has cooled: job vacancies dropped from 22,000 in 2022 to 1,256 in 2025

- The U.S. market grew: added 21,000 jobs (an increase of 26%)

- 70% of jobs are still remote

- Compliance-related positions increased by 35%

"The demand for talent in the Web3 industry has rebounded, and the areas of demand are more diversified, covering compliance, security, and the integration of AI with Web3."

However, after a relatively stable market in 2025, the wave of layoffs hit the industry again:

- Polygon Labs: after spending $250 million on multiple crypto asset acquisitions, laid off as much as 30%

- MANTRA: conducted undisclosed layoffs after its OM token plummeted by 90%

- Consensys: laid off at least 7% in July 2025

- OKX: undergoing global business restructuring, layoff scale undisclosed

- DappRadar (a platform I once had high hopes for): completely shut down in November 2025

Additionally, the acquisition of Lens and Farcaster will inevitably lead to personnel adjustments in the related teams.

As a co-founder of a KOL studio, I can clearly feel the operational pressure on various projects. With fewer collaboration opportunities, KOLs have also lowered the prices for paid posts.

Shift in Project Announcements

I analyze Polygon's announcements in 2025 as a case study, highlighting its core business developments throughout the year:

Technical Upgrades

- Heimdall v2 Mainnet (July 2025): reduced final confirmation time from 90 seconds to 4-6 seconds

- AggLayer v0.3 (Q3 2025): achieved cross-chain liquidity sharing

- Madhugiri Hard Fork (December 2025): improved transaction processing capacity by 33%

Corporate Partnerships

- Partnered with Revolut to support stablecoin transfers

- Collaborated with Mastercard to implement wallet username verification

- Issued FRNT stablecoin in Wyoming (the first state-issued stablecoin in the U.S.)

Internal Corporate Adjustments

- Laid off 30%

- Spent over $250 million on multiple acquisitions (Coinme, Sequence)

I remember that in 2021-2022, the announcements from Polygon and other public chains were like this: launching new public chains, releasing new token standards, forming new partnerships with NFT projects, and signing celebrity endorsements.

Now, the vast majority of leading projects are showing the same trend: announcement content has shifted from "We will launch new products" to "We will optimize existing product experiences" and "Traditional financial institutions are using our technology."

Indeed, Avalanche announced plans to acquire its most successful meme coin within its ecosystem, but this plan quickly fell through. Instead, the platform is now fully focused on integrating decentralized physical infrastructure and bringing real-world assets on-chain.

Overall, while today's industry announcements may lack some of the hype, they carry more practical value.

Another notable change is that the token prices after announcements no longer show significant volatility; the market is no longer willing to pay for a single technical upgrade.

This has taken some of the speculative fun out of the cryptocurrency market, but it is a necessary price for the industry to achieve scalable implementation.

User Activity: Performance is Acceptable

Despite the slowdown in the pace of product implementation in the industry, user engagement and industry penetration rates are still on the rise, at least that is the overall trend.

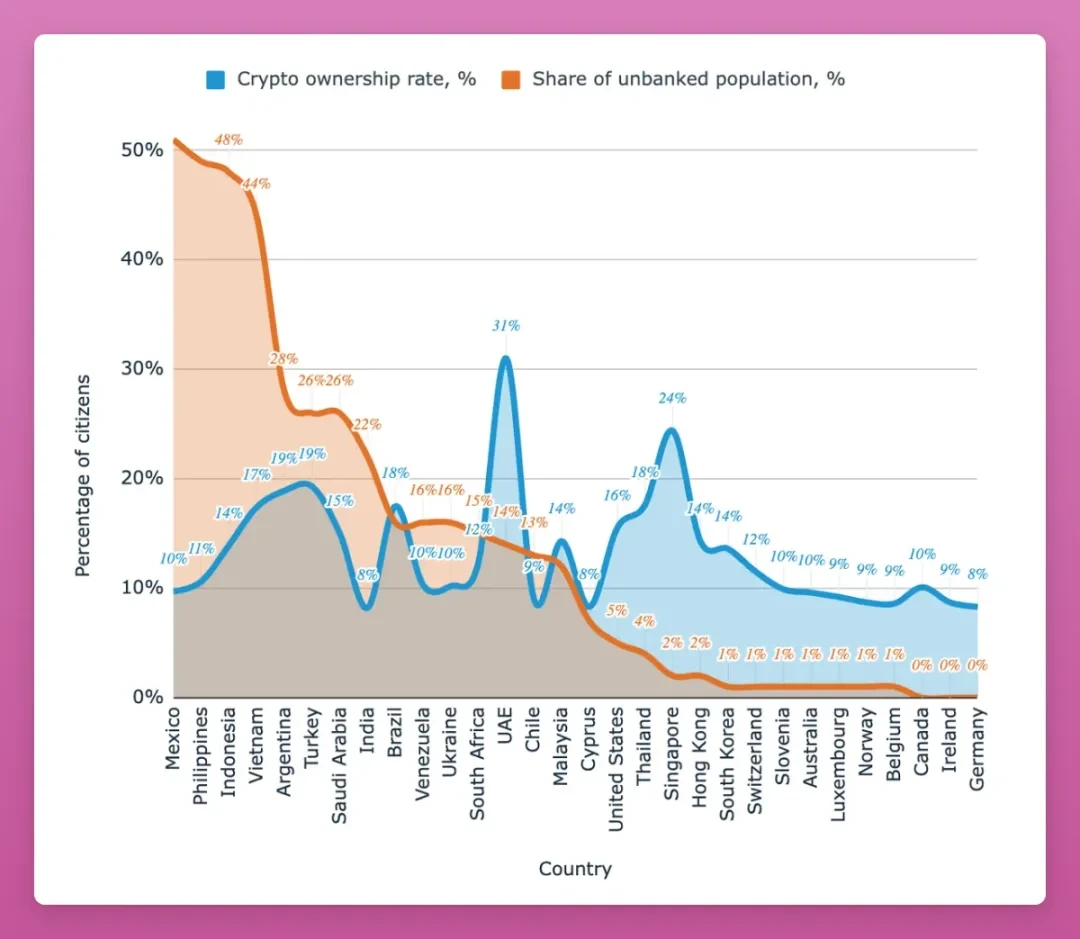

According to data from a16z, the number of global cryptocurrency holders has reached 716 million, but the number of active users is only between 40 million and 70 million, a gap of 90%.

One set of data I find most compelling is the correlation analysis between cryptocurrency penetration rates and the proportion of unbanked populations: countries with a higher proportion of unbanked populations also have higher cryptocurrency ownership rates. Cryptocurrency is filling the service gap left by traditional financial systems.

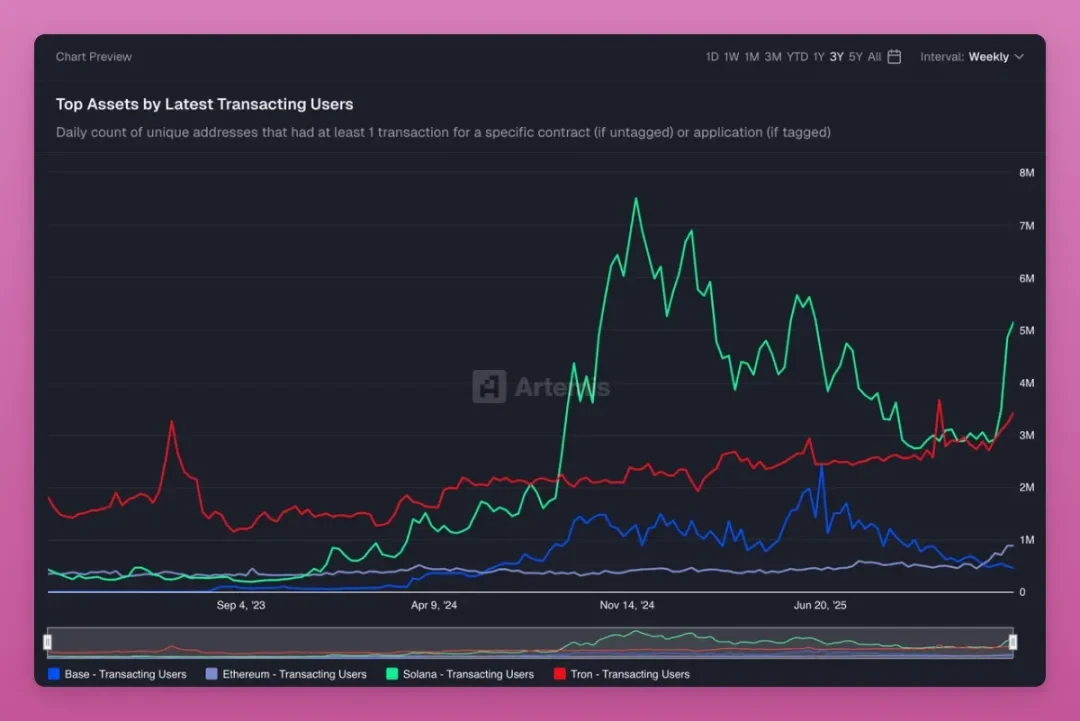

In any case, the number of active cryptocurrency users is sending positive signals.

The number of active addresses on Solana has finally seen a recovery, and user activity on Ethereum is also increasing (thanks to the implementation of scaling hard forks), while users on Tron have never left in large numbers. The user activity on Tron may be the clearest non-speculative application case in the cryptocurrency industry.

What Other Changes Are There?

Venture Capital Situation

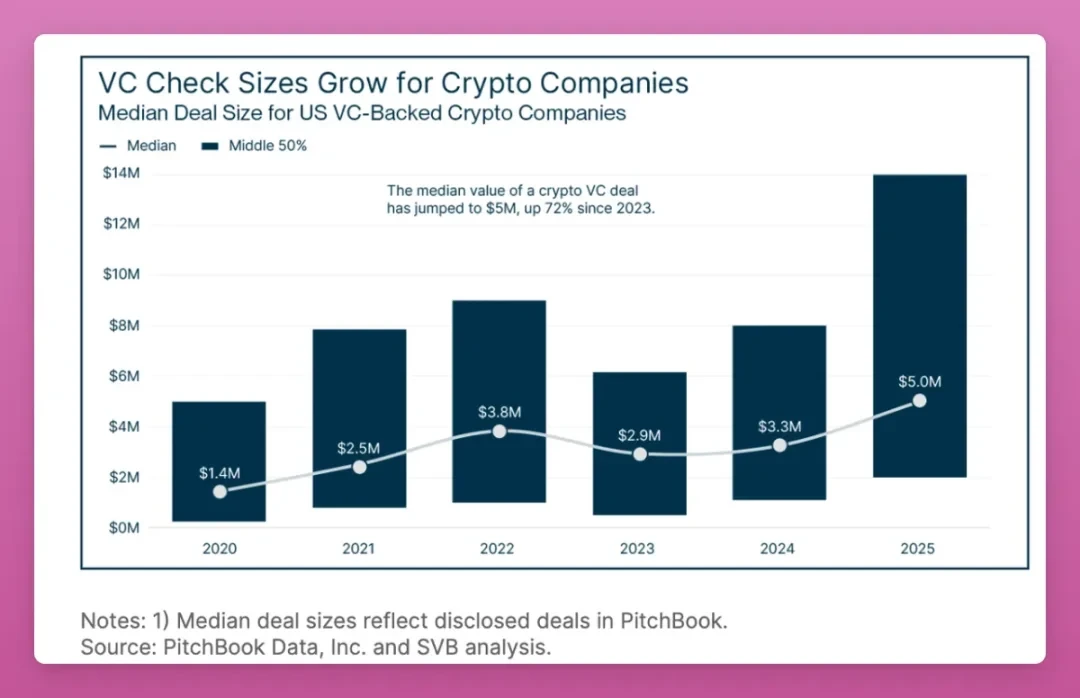

In 2025, the amount of venture capital in the cryptocurrency sector reached $16 billion, a 44% increase from 2024.

However, the number of transactions has decreased by 33%, with funds increasingly flowing to a few leading companies.

Since 2023, the median valuation for seed round financing has also risen by 70%.

Currently, well-funded leading teams still have enough capital to continue development, but it has become significantly more difficult for new startup teams to secure financing.

Industry Innovation: Dividends Exhausted, AI May Become the New Driving Force

In 2020, you could simply replicate the Compound protocol with minor adjustments to attract billions in locked value; by 2025, all conventional decentralized finance foundational applications have been implemented, and new projects must address more complex industry challenges to establish themselves.

Breakthrough innovations are gradually decreasing, and the industry is entering a phase of incremental innovation.

This is also why I believe the entire industry should boldly attempt Vibe Coding to encode smart contracts: although many projects may end in failure, this exploration will drive industry innovation!

Accelerated Industry Consolidation

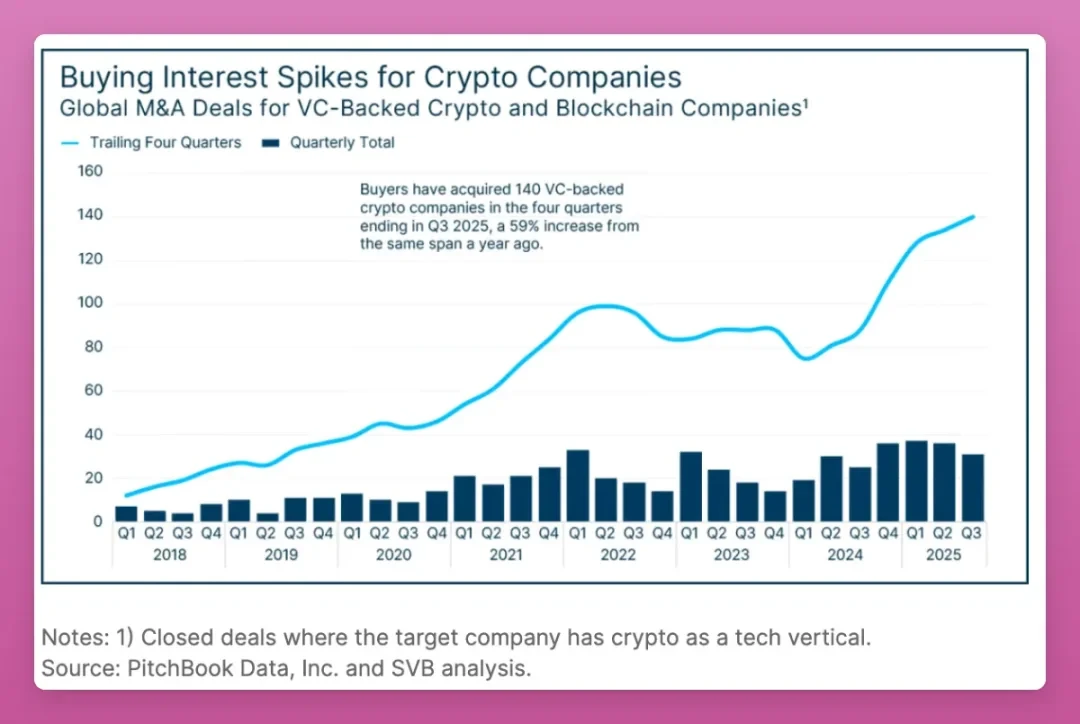

The number of mergers and acquisitions has reached a historical high.

In the four quarters leading up to the end of Q3 2025, over 140 venture-backed cryptocurrency companies were acquired, a year-on-year increase of 59%.

Source: Silicon Valley Bank

Coinbase acquired Deribit for $2.9 billion, and Kraken acquired NinjaTrader for $1.5 billion.

Brian Armstrong stated in an interview at the Davos Forum that M&A activity in the cryptocurrency industry will continue to increase.

Industry survivors are accelerating consolidation, but they are acquiring companies, not the tokens we hold.

Regulatory Clarity Changes Industry Incentive Direction

In July 2025, the GENIU Act was officially passed, Circle went public, and five cryptocurrency companies received bank licenses from the Office of the Comptroller of the Currency (BitGo, Circle, Fidelity Digital Assets, Paxos, Ripple).

This series of events has pushed industry projects towards compliant development, slowing down the pace of development and reducing the amount of publicly available information, replacing the previous model of "rapid development, rapid launch."

Companies are no longer clustering to issue tokens but are choosing to go public for financing. This method lacks appeal and has caused native cryptocurrency participants to miss out on dividends.

AI Captures the Attention of Native Cryptocurrency Speculators

Venture capital is flooding into the AI sector, and retail investors' focus has shifted accordingly.

Nowadays, my social media feed is split evenly between AI-related content and cryptocurrency content; even if I try to filter out unrelated content, I can't completely eliminate it, or else my feed would only contain my own posts.

A large number of talents and capital that could have flowed into the cryptocurrency industry have now turned to the AI sector.

Insights for Ordinary Investors

The past investment strategy was: look for newly launched projects, enter early, and sell for profit at the time of token issuance.

The premise of this strategy is that the market has a continuous stream of new projects launching, and token prices do not drop significantly.

A new investment strategy might be: look for protocols with actual revenue, hold during the quiet period of industry infrastructure development, and wait for real demand growth brought about by the integration of traditional financial institutions or an increase in industry penetration.

I also mentioned this viewpoint in my article "The Truth and Lies of the Cryptocurrency Industry in 2026." I believe that protocols like Pendle and Chainlink, which achieve institutional-level implementation, or leading lending protocols, will outperform the market.

Another strategy could be: hold stablecoins and wait for the next bull market to arrive.

Currently, the actual usage of cryptocurrency (stablecoin transactions, decentralized exchange volumes, protocol fees) is increasing, while the pace of industry implementation (new project launches, developer activity, industry announcements) is slowing down, which is a typical characteristic of industry consolidation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。