Written by: Noah

Translated and Compiled by: BitpushNews

Core Summary

- Product Upgrade: On-chain lending will see necessary product improvements to better meet the demands of scaled capital.

- Demand Release: With functionality unlocking, the current low lending rates will trigger strong borrowing demand.

- Capital Inflow: Loan rates will begin to stabilize above the risk-free rate, driving capital inflow.

- Valuation Reversion: The industry's valuation multiples are compressing towards fintech levels, providing potential entry points for investment next year.

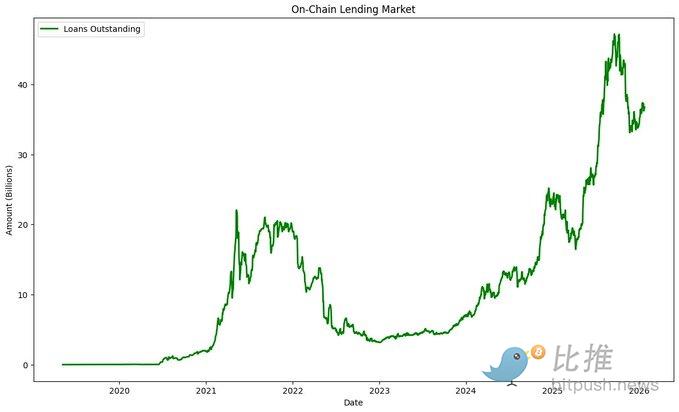

The Cyclical Patterns of On-Chain Lending

Historically, on-chain lending has followed a four-stage cyclical behavior:

- Low system capital, low interest rates.

- Rising interest rates, capital flowing into the system.

- Due to capital excess, interest rates begin to decline.

- Due to excessively low interest rates, capital leaves the system.

The token prices of lending protocols often follow a similar pattern: prices rise with increasing interest rates and capital inflow, and fall with decreasing interest rates and capital outflow.

We are currently in the fourth stage. In the past, the lending market could rely on the positive beta coefficient of the crypto market to induce leverage demand, thereby pushing up interest rates; or use token subsidies to stimulate higher yields. Token subsidies work in highly "reflexive" markets (high price = more subsidies = more platform capital = even higher prices), but there may no longer be an excess capital base willing to engage in such behavior. I believe that most lending protocols are no longer willing to pin their fate on the beta coefficient of the crypto market, and scaling subsidies without increasing costs is challenging.

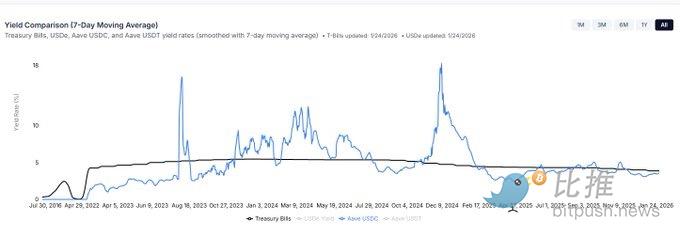

The current issue causing stablecoin lending rates to be lower than the U.S. Secured Overnight Financing Rate (SOFR) is: 1. Insufficient borrowing demand; 2. Capital inefficiencies caused by the protocol (such as cash drag from peer-to-pool models, lack of re-collateralization mechanisms, etc.). Furthermore, on-chain lending rates are far below most alternative capital sources, which is clearly not a long-term equilibrium.

How to Stimulate Borrowing Demand?

The key to inducing borrowing demand lies in offering lower prices than alternatives. The current problem is that lending protocols are unable to provide the collateral asset classes and loan structures that borrowers are accustomed to.

1. Higher Quality Collateral Assets

The security of "monolithic" lending protocols depends on their lowest quality assets, which often makes them overly conservative when introducing new assets. Currently, almost all protocols have shifted to a modular architecture to allow for higher-risk lending.

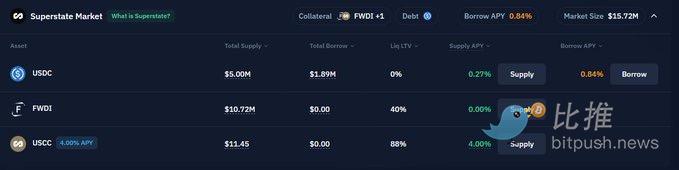

Many traditional collateral assets are still difficult to obtain on-chain. Securities lending is a multi-trillion dollar market, with settlement rates typically at $SOFR + 75-250 basis points. Although still in its early stages, we have seen the emergence of securities lending prototypes, such as Kamino's Superstate market, Aave's Horizon market, and Morpho's curated market.

2. Improvements in Protocol Design

Historically, lending protocols primarily offered "peer-to-pool" floating rate margin loans for highly liquid crypto assets. This only applies to a narrow borrower demographic and imposes substantial cash drag on lenders due to utilization-based interest rate models.

Kamino, Aave, and Morpho are all releasing upgrades this year to significantly expand the types of loans available. As protocols add features such as term loans, address whitelisting, tripartite agreements with compliant custodians, and direct matching, lenders will see interest rate spreads compress (more paid by borrowers flowing to lenders), while borrowers will gain more flexible loan options.

This will stimulate borrowing demand, push up interest rates, and attract capital supply, moving us towards the "second stage" of the lending cycle.

Creating High-Yield Opportunities

High-yield opportunities are crucial for the survival of crypto yield funds. While the market may survive without them, it is best not to take that risk. Historically, on-chain yield funds require a return rate of 12-15% to justify their existence and raise capital.

Due to the tokenized basis trade and improved capital efficiency of CME basis trading, basis yields have been compressed for the foreseeable future. A borrowing demand of over 10% would require an (unpredictable) crypto bull market.

This means funds will be forced to seek slightly higher-risk but well-risk-adjusted return opportunities. The most likely opportunities are the entry of tokenized yield products. For example, Figure has launched a tokenized Home Equity Line of Credit (HELOC) with an 8% yield, allowing yield funds to achieve returns exceeding their target rates through cyclical leverage on Kamino.

By 2026, more equivalents of credit funds may be tokenized, offering yields of 8-15%. It is important to note that cyclical leverage carries hard-to-quantify risks, and the legal structure of tokenized credit products must be sound.

Conclusion

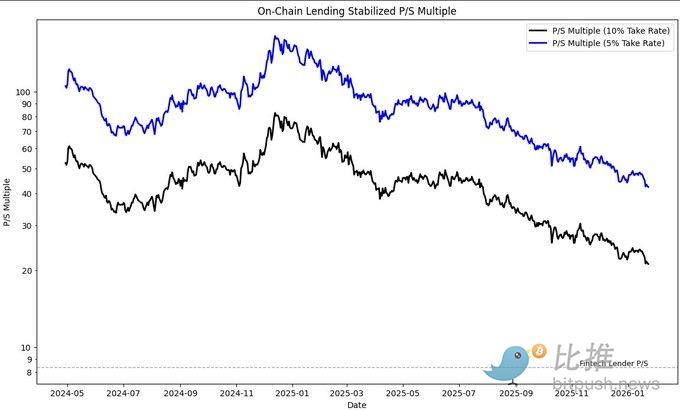

I believe there is a sound logic: even if token prices continue to decline, on-chain borrowing demand can still grow. While I do not make statements about the beta valuation of the crypto market, if the above logic holds, protocol valuations will become very reasonable at some point in 2026.

Data Calculation:

Assuming on-chain lending companies extract 5-10% of interest as income, with an average interest rate of 6.5%. Currently, the total market cap/sales (P/S) multiple for this sector is 21x to 42x, while publicly listed fintech lending companies are around 8.4x.

While the subtle differences between the two are not worth debating, you must remain optimistic about on-chain lending over the next two years, as the current valuation multiples appear reasonable. Even so, these multiples are rapidly compressing due to falling token prices and growth in key performance indicators (KPIs).

I believe 2026 will be an opportunity for a "major push" in this sector. Although growth may slow in the short term due to falling crypto asset prices, the upcoming fundamental catalysts may provide another growth inflection point for on-chain lending activities, with stronger sustainability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。