On the afternoon of Jan. 26, 2026, the crypto economy appeared to shrug off President Donald Trump’s threat to impose 100% tariffs on Canadian goods. The ultimatum followed reports that Canadian Prime Minister Mark Carney had engaged in trade discussions with Beijing, signaling a potential shift in North American trade dynamics.

Market data reveals that bitcoin successfully navigated a volatile Sunday sell-off—which saw the asset briefly slip to $86,000—rallying to an intraday high of $88,750 by 10:15 a.m. EST.

Bitcoin’s resilience coincided with reports that Strategy added 2,932 coins to its balance sheet, bringing its total treasury to 712,647 BTC. While similar institutional announcements fueled massive rallies during much of 2025, their market-moving impact has progressively waned. Nevertheless, the news provided a necessary psychological floor, easing the bearish sentiment that gripped markets following Trump’s rhetoric against Canada.

The tariff threat emerged just days after a sharp exchange at the World Economic Forum in Switzerland. Carney had openly rebuked the Trump administration’s economic policies, prompting the U.S. president to retaliate by withdrawing Canada’s invitation to his newly formed “Board of Peace.”

While markets largely dismissed the withdrawal as a symbolic gesture, the threat of punitive tariffs on one of America’s largest trading partners sparked fears of a revived, high-stakes trade war. Despite the tension, bitcoin’s mini-rally helped propel the total crypto market capitalization from its Jan. 25 low of $2.96 trillion back above $3.05 trillion by Monday afternoon.

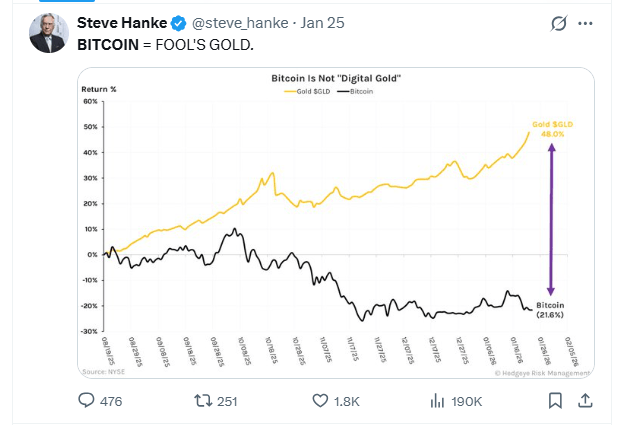

Bitcoin’s relatively flat performance in 2026 stands in stark contrast to the explosive growth of gold and silver. This divergence has emboldened gold proponents who argue that Bitcoin has failed to act as “digital gold” during this period of intense geopolitical instability.

Steve Hanke, an applied economics professor at Johns Hopkins University, has leveraged this performance gap to double down on his long-standing criticism. Using a comparative price chart, Hanke characterized bitcoin’s stagnation during a global crisis as definitive proof that the cryptocurrency is little more than “fool’s gold” with zero fundamental value.

- How did bitcoin respond to the 2026 U.S.-Canada tariff threats? Bitcoin successfully shrugged off President Trump’s threat of 100% tariffs on Canadian goods, rebounding from a weekend low of $86,000 to reach $88,750 on Jan. 26.

- What was the impact of Strategy’s latest bitcoin purchase? The company’s addition of 2,932 BTC to its treasury provided a psychological floor for the market, though institutional buys now show diminishing returns on price action.

- Why is the “Board of Peace” relevant to the current crypto market volatility? While markets dismissed Canada’s removal from the Board of Peace as symbolic, the underlying trade war fears helped drive the total crypto market cap back above $3.05 trillion.

- How has gold performed compared to bitcoin since the start of 2026? Gold has surged roughly 18% to record highs while bitcoin has traded sideways, fueling debates by critics like Steve Hanke over Bitcoin’s status as “digital gold.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。