The selling pressure that defined the week after the U.S. market holiday on Jan. 19 never truly let up. From January 19 to January 23 (ET), crypto ETFs faced one of their most punishing stretches of the new year, with risk appetite fading sharply across the largest products.

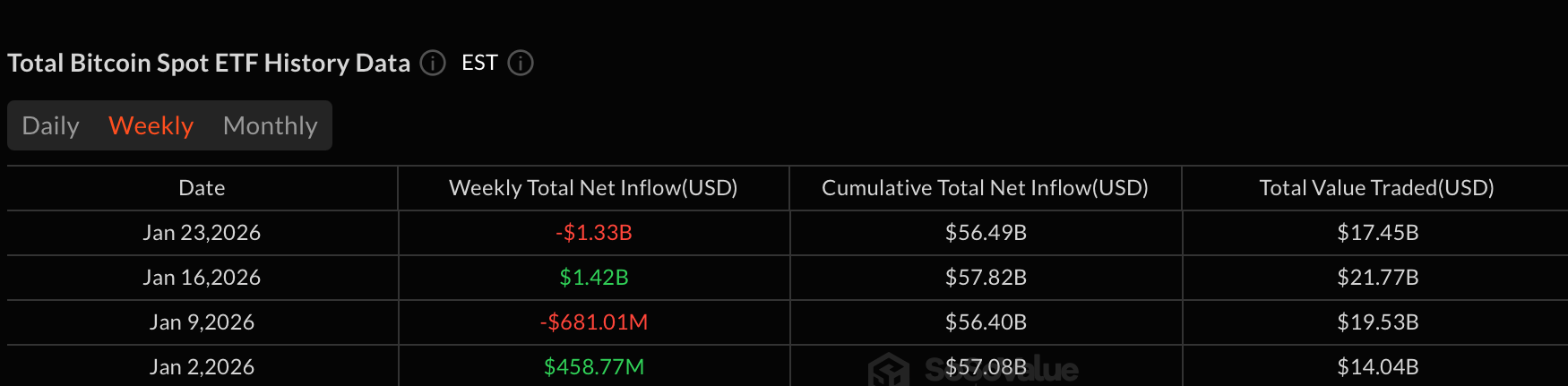

Bitcoin spot ETFs recorded $1.33 billion in net outflows, marking the second-largest weekly exit on record. Losses were led by Blackrock’s IBIT which shed $537.49 million over the week as institutional selling remained heavy. Fidelity’s FBTC followed closely with $451.50 million in redemptions, confirming that even the most liquid vehicles were not immune.

Grayscale’s GBTC continued its steady bleed, losing around $172 million, while Ark & 21Shares’ ARKB and Bitwise’s BITB posted weekly outflows near $76 million and $66 million, respectively. Smaller but persistent exits were also seen from Franklin’s EZBC (-$10.36 million), Valkyrie’s BRRR (-$7.59 million), and Vaneck’s HODL (-$6.3 million). The persistent outflows throughout the week cemented a decisive risk-off tone.

Mixed January for Bitcoin ETFs so far with two weeks each of inflows and outflows.

Ether spot ETFs fared little better, posting $611.17 million in net outflows. Blackrock’s ETHA accounted for the bulk of the damage with approximately $431.50 million in weekly redemptions. Fidelity’s FETH lost about $78 million, while Bitwise’s ETHW gave up roughly $46 million.

Grayscale’s ETHE saw net weekly losses of around $52 million, though its Ether Mini Trust partially offset pressure with a decent $17.82 million net inflow. Vaneck’s ETHV rounded out the red with nearly $10 million in exits.

XRP ETFs recorded $40.64 million in net outflows, their first negative week since launch. Grayscale’s GXRP was the primary drag, losing more than $55 million, which overwhelmed steady inflows into Franklin’s XRPZ, Bitwise’s XRP, and Canary’s XRPC that together added just over $15 million.

Read more: Selling Pressure Intensifies as Bitcoin, Ether ETFs Lose $1 Billion

Solana ETFs were the rare bright spot. Despite volatile conditions, they finished with $9.57 million in net inflows. Fidelity’s FSOL led contributions with $5.28 million, supported by steady demand for Bitwise’s BSOL, Vaneck’s VSOL, and Grayscale’s GSOL, comfortably offsetting a small pullback from 21Shares’ TSOL.

Overall, the week underscored a sharp reset in crypto ETF positioning. Bitcoin and ether absorbed heavy institutional exits, while Solana showed resilience and XRP hit its first real test, signaling a market still searching for firm footing.

- Why did crypto ETFs see heavy outflows this week?

Institutional investors reduced risk exposure after the U.S. holiday, triggering broad-based selling. - How large were Bitcoin ETF outflows?

Bitcoin spot ETFs lost $1.33 billion, the second-largest weekly outflow on record. - What happened to Ether and XRP ETFs?

Ether ETFs shed over $611 million, while XRP posted its first weekly net outflow since launch. - Which crypto ETF showed resilience?

Solana ETFs stood out, posting $9.57 million in net inflows despite market stress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。