The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

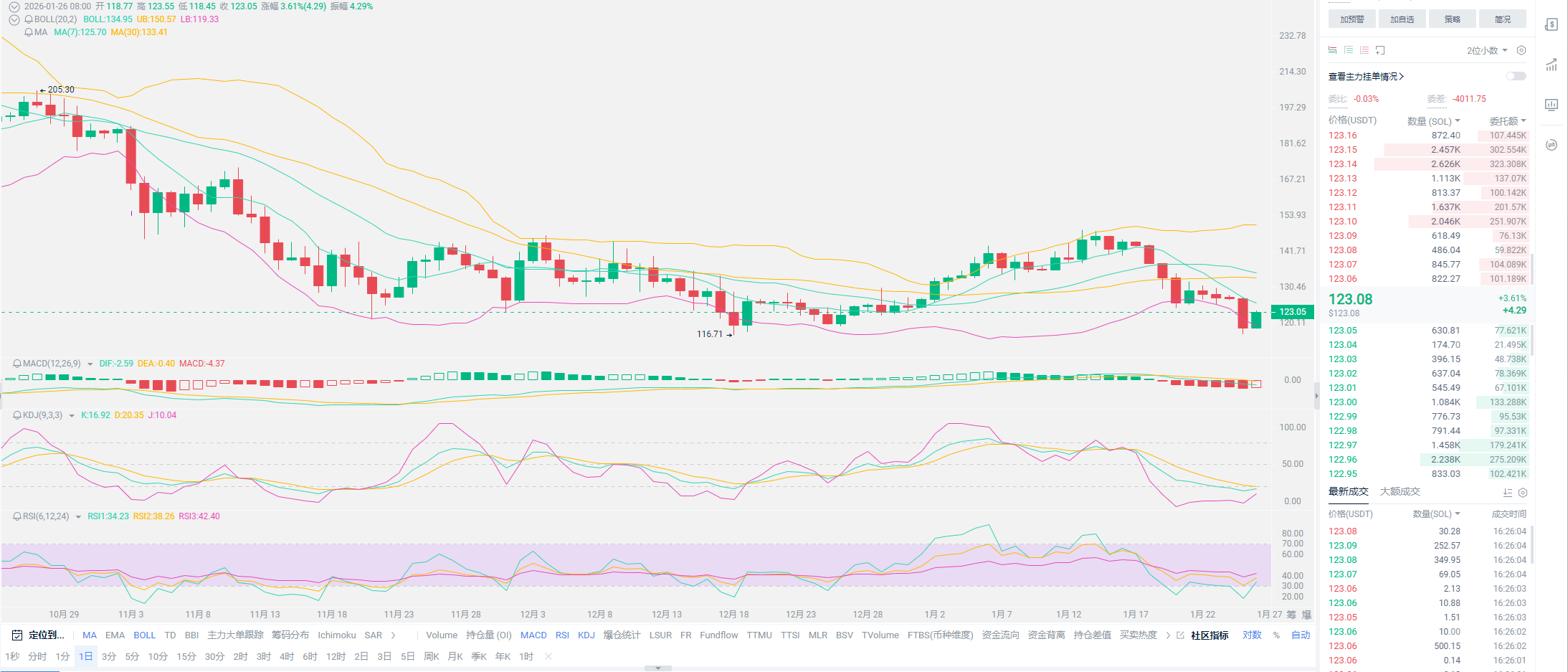

Recently, I have talked a lot about bearish trends, and most friends want to know from me where the new low is. Secondly, they want to know when a rebound can be expected, and everyone wants to know the exact time point. I will no longer keep you in suspense and will directly share my views. We need to clarify one point: the current support capacity in the crypto space is stronger than before the listing and compliance. Therefore, the mass escape that everyone is concerned about will only happen if a significant historical event occurs, such as the U.S. announcing a decoupling or no longer recognizing the legal status of the crypto space. Only under such circumstances is it possible to reach a new low. The new low I mentioned is based on the new low of 25 years, which is the state of 74. This prediction is relatively easy to confirm for Bitcoin. As for other cryptocurrencies outside of Bitcoin, there are no predictions for new lows, meaning there is no support. The two cryptocurrencies that are most concerning are Ethereum and SOL.

These two cryptocurrencies are also the ones I have recommended the most since the Bitcoin bull market. I have summarized the cryptocurrencies: Bitcoin is unique, followed by Ethereum and SOL, and finally, the cryptocurrencies that have not yet been listed. The new lows for Ethereum and SOL are likely to be refreshed again; these types of cryptocurrencies generally do not have strong support. Although on the surface, it may seem that Ethereum has support from giants, the biggest problem with Ethereum is based on its mechanism; the emergence of new highs relies entirely on Vitalik's conscience. If he wants to crash the market, he has unlimited power to do so. At the same time, Vitalik's attitude is also extremely ambiguous. He has publicly stated that the growth of Ethereum's ecosystem and price will keep it in a healthy state. This makes me think of Lao A's state, which is about adjusting in real-time and growing healthily and steadily. This measure of scale is controlled by individuals, and the final judgment standard is simply based on how much they want to earn.

This is also the ultimate reason why I gave up on ETH and chose SOL purely based on market capitalization. If everyone thinks that Ethereum's value is enough to support a larger scale, then based on SOL's market capitalization, growing from 100 billion to 200 billion should not be too difficult. However, the audience for SOL is clearly smaller than that of Ethereum. The so-called large scale for giants is just a story that can drive the market, and it depends on whether SOL will experience downtime. According to this ecological structure, as long as SOL maintains a period of six months to a year without downtime incidents, it will attract capital inflow from giants. If we define future returns, then SOL's returns will definitely be higher than Ethereum's. From a stable investment perspective, Bitcoin is superior to all other cryptocurrencies. If we broaden our horizons, I also provided everyone with more choices yesterday, which is the gold market. I am not just following trends and shouting slogans, but judging based on future patterns. The more turbulent the situation, the more gold will reflect its value.

So, for these types of cryptocurrencies, the standard for judging new lows cannot be based on conventional views. Although these cryptocurrencies have already been listed, you need to be clear that under such favorable conditions last year, Ethereum also created a new low below 1400, while SOL even dropped below 100, which is not just a halving but a direct drop of two-thirds. If you share my views and want to achieve a doubling effect with these types of cryptocurrencies, you must accept the plan of losing half of your overall position. Especially regarding your mindset, many friends will consider giants as opponents, and whenever there is a decline, they will think that the giants are doing something behind the scenes. This mindset needs to be adjusted. As the saying goes, "the shadow is within the light, not opposite to it." In the investment market, what retail investors need to do is to stand with capital. When you clearly recognize that capital will short the market, why not choose to short?

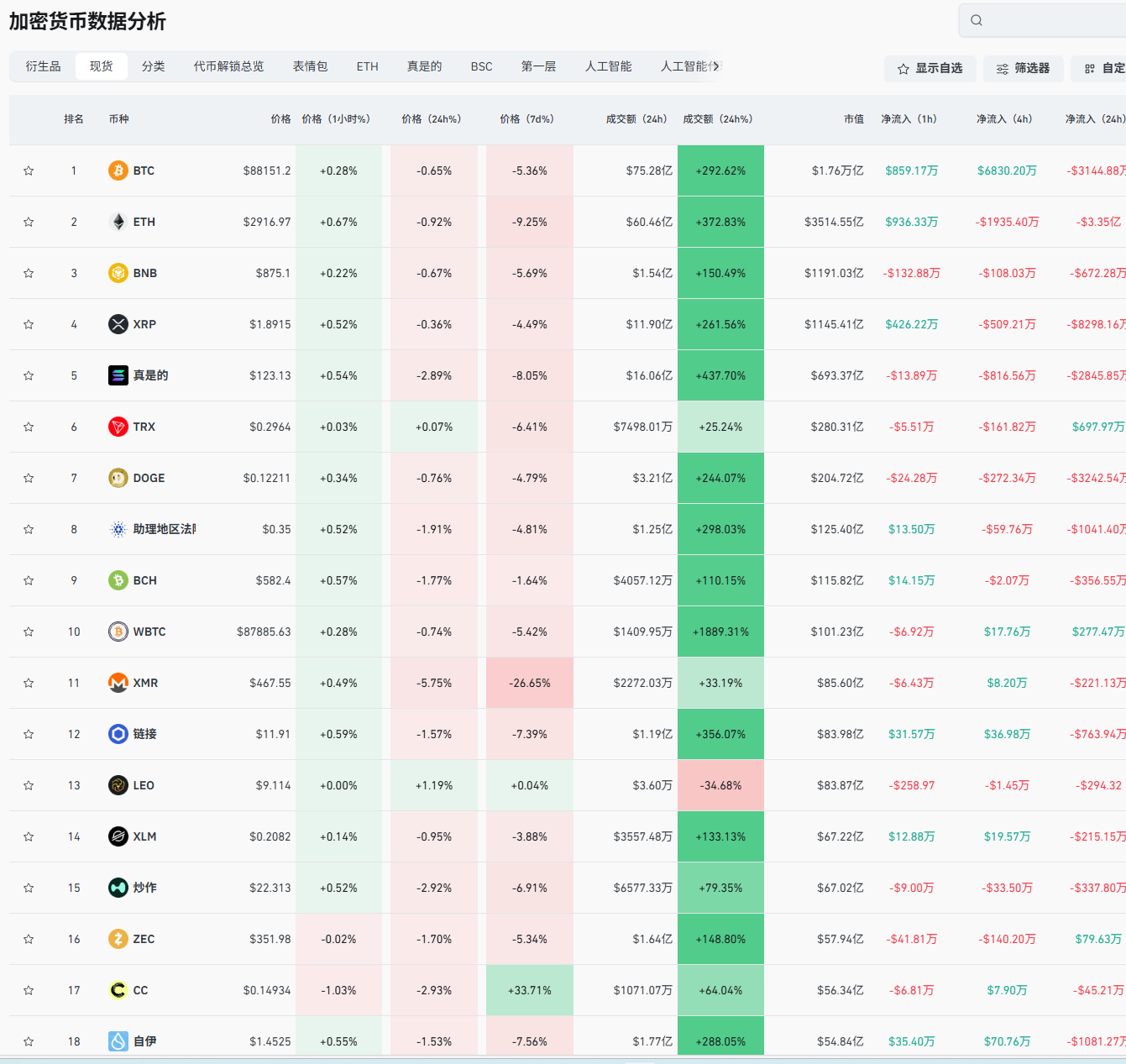

What I mean by encouraging everyone to buy spot is not to let everyone wait for the market rebound without taking certain measures. Holding spot is a significant test of personal mindset, and I will also be extremely tormented. As for other unlisted cryptocurrencies, they are even harder to predict. If we define the decline of these listed cryptocurrencies as still within a controllable range (no matter how far they fall this year, they will rebound later and still have the potential for new highs), then for these unlisted cryptocurrencies, if they decline without any signs of listing, it is highly likely that a rebound will not occur during the so-called altcoin season. The theory of altcoin season, in my eyes, is an outdated concept. Individual cryptocurrencies may have miraculous occurrences, but for all small cryptocurrencies to create historical new highs is almost impossible. When giants in the crypto space re-enter, they will definitely target listed cryptocurrencies for driving the market, while these unlisted cryptocurrencies can only rely on the capital behind them to continue writing their stories.

Here, I can directly provide the outcomes for these cryptocurrencies. If they continue to maintain a downward trend, with Bitcoin reaching a new low and listed cryptocurrencies experiencing a halving phenomenon, it is normal for these unlisted cryptocurrencies to drop by 80-90%. Moreover, the subsequent rebound will at most return to the current price level, making it almost impossible to profit. Returning to our short-term trend, the overall situation for the entire month is that it will continue to decline, especially since there is still no conclusion on interest rate cuts. Once the news of no interest rate cuts is officially established, it may lead to another wave of downward trends. In the short term, you should not hold onto an upward mindset regarding the entire trend; even now, it is still possible to short. Including the later interest rate cuts in March, which have been predicted by giants to be postponed until June, this blow to the crypto space is still significant. Among the favorable news in the first half of the year, we can only look at the decisions of Trump and Musk. Can they turn the situation around? My estimate is that it is highly unlikely.

In summary, through the trend of gold, you can once again confirm my speculation. Gold repeatedly breaks new highs, while the crypto space suffers heavy losses. The outflowing funds have too many choices in the market, and staying in the crypto space has become a foolish choice. Even the feedback from Lao A indicates that the priority of current choices is higher than that of the crypto space, so don’t think about rebounds in the short term. The compliance mentioned yesterday is suppressing the growth of the crypto space. Today, news has again flowed out of Dubai, clearly stating that non-legal stablecoins will face crackdowns. This place, once hailed as the world’s cryptocurrency center, is also starting to tighten its grip on the crypto space, which is not good news. The theory of decentralization has once again become a joke in the crypto space. This action indirectly indicates the official attitude towards the crypto market, which has never been able to face it squarely. Frankly speaking, no ruler wants to see the cryptocurrency market replace the status of traditional currency, which is also the most fatal aspect of the crypto space. At the end of the article, you can rest assured that cryptocurrencies will exist in the financial market and will grow in a coexisting manner. Although there is no capital to intervene in the short term, there will definitely be new highs this year. Backed by the cycle of interest rate cuts and balance sheet expansion, along with the fact that most regions will allocate crypto assets this year, the inflow will definitely continue; it just needs an opportunity. When the opportunity arises, Bitcoin will break through its highs in just a week to half a month, including Ethereum, SOL, and other listed cryptocurrencies. Their stories are far from over, and there will definitely be certain new highs this year. But for those currently holding spot, you need to consider whether you have the courage to face this wave of decline. If not, you need to start preparing for risk hedging.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。