Highlights

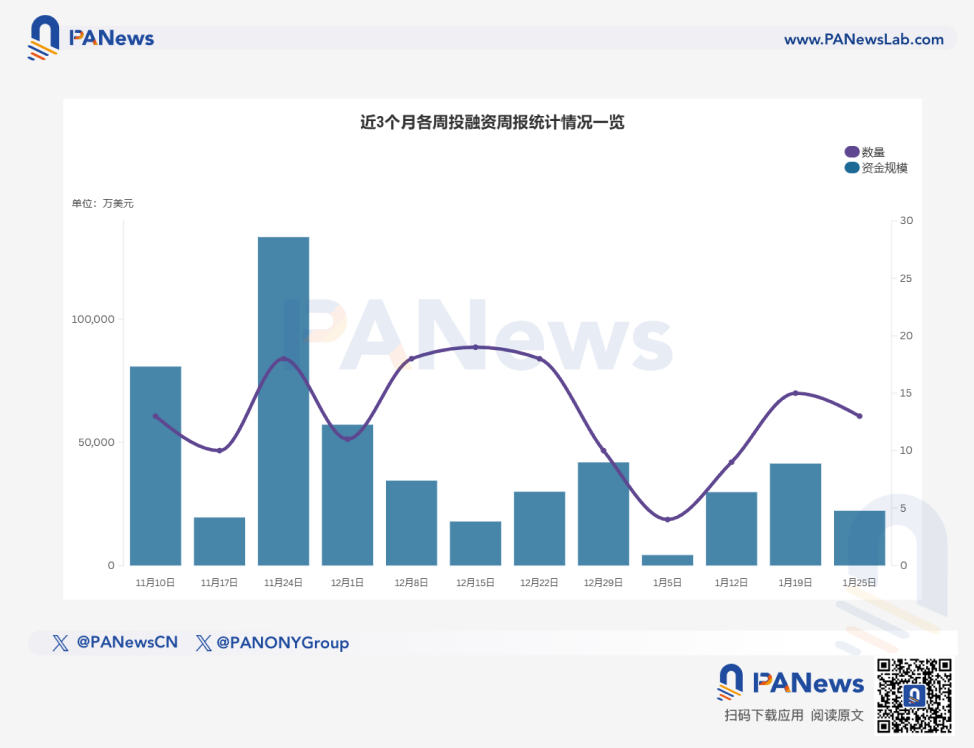

According to incomplete statistics from PANews, there were 13 financing events in the global blockchain sector last week (1.19-1.25), with a total funding scale exceeding $222 million. An overview is as follows:

- DeFi reported 5 financing events, including fintech and asset tokenization company Superstate announcing the completion of $82.5 million in Series B financing;

- The Web3+AI sector reported 3 financing events, including AI infrastructure and application layer Warden completing $4 million in strategic financing;

- The Infrastructure & Tools sector reported 2 financing events, including Bitcoin payment startup ZBD completing $40 million in Series C financing, led by Blockstream Capital;

- The Centralized Finance sector reported 3 financing events, including Argentina-based fintech company Pomelo completing $55 million in Series C financing, led by Kaszek and Insight Partners.

DeFi

Fintech and asset tokenization company Superstate completes $82.5 million in Series B financing

Fintech and asset tokenization company Superstate announced the completion of $82.5 million in Series B financing, led by Bain Capital Crypto and Distributed Global, with participation from Haun Ventures, Brevan Howard Digital, Galaxy Digital, Bullish, ParaFi, and others. The company plans to use this round of financing to build a complete on-chain issuance layer on the Ethereum and Solana blockchains for issuing and trading stocks registered with the U.S. Securities and Exchange Commission (SEC). Its goal is to leverage blockchain technology to make the fundraising and listing process for companies more efficient.

Superstate currently manages over $1.23 billion in assets and operates two tokenized funds. As an SEC-registered transfer agent, the company has supported public companies in directly issuing and selling digital stocks to investors on public blockchains through its "Opening Bell" platform, enabling real-time management of issuance, settlement, and ownership records.

River announced the completion of $12 million in strategic financing, with investors including Tron DAO, Justin Sun, Arthur Hayes' Maelstrom Fund, The Spartan Group, and several Nasdaq-listed companies from the U.S. and Europe. This round of financing will support River's expansion in both EVM and non-EVM ecosystems, including multiple networks such as TRON and Sui, and continue building on-chain liquidity infrastructure.

Tokenized risk startup Cork completes $5.5 million in seed round financing, led by a16z and CSX

Startup Cork announced the completion of $5.5 million in seed round financing, led by Andreessen Horowitz (a16z), CSX, and Road Capital, with participation from 432 Ventures, BitGo Ventures, Cooley, DEPO Ventures, Funfair Ventures, G20 Group, Gate Labs, Hyperithm Gate, IDEO Ventures, PEER VC, Stake Capital, and WAGMI Ventures.

Cork aims to build a "programmable risk layer" designed to make the implicit risks in real-world assets transparent and tradable through tokenization. Its infrastructure allows asset managers, issuers, and others to create customized swap markets to enhance the redemption liquidity, risk transparency, and market confidence of on-chain assets. This tool can also be used to assess the risks of stablecoins, staking tokens, and other crypto-native products. The team plans to launch the first production-grade risk markets in the coming months and expand collaborations with vaults and asset issuers.

Lending platform HyperLend announced the distribution of its HPL token economic model, with 30.14% allocated for ecosystem growth and incentives, 25% for genesis distribution, 22.5% for core contributors, 17.36% for strategic investors, and 5% reserved for liquidity. The protocol has so far completed $1.7 million in financing, with investors including RockawayX, No Limit Holdings, Nucleus, Duplicate Capital, Dumpster, and others. Strategic investors will receive 10% equity at the token generation event (TGE), followed by a 4-month lock-up period, with the remaining shares gradually unlocked over 2 years.

Saturn announces completion of $800,000 financing, with participation from YZi Labs, Sora Ventures, and others

Saturn announced the completion of $800,000 in financing, with participation from YZi Labs, Sora Ventures, and several well-known angel investors in the cryptocurrency field. The funds will be used to create USDat, a Bitcoin-backed stablecoin protocol offering an 11%+ yield. Saturn stated that the yield is provided through the Strategy perpetual preferred stock STRC, while unlocking global on-chain digital credit access.

AI

AI infrastructure and application layer Warden completes $4 million in strategic financing

Warden, an infrastructure and application layer project for AI agents, announced the completion of $4 million in strategic financing, with a company valuation of $200 million. This financing was participated in by strategic partners and ecosystem contributors such as 0G, Messari, and Venice.AI. The funds aim to accelerate product development and expand its AI agent capabilities in trading, automation, and programmable wealth. Warden is building a full-stack agent internet, including next-generation agent crypto wallets.

AI-native content creation engine and publishing platform AKEDO announced the completion of $5 million in seed round financing, led by Karatage, with participation from investors in gaming, artificial intelligence, and cryptocurrency, including Sfermion, Collab + Currency, MARBLEX, Seed Club, The Open Platform, TON Ventures, Gagra Ventures, Kenetic Capital, Metalabs Ventures, and others.

AKEDO aims to build an "atmospheric coding" platform driven by multi-agent AI systems, designed to significantly enhance the efficiency of game and content development through collaborative AI agents. The platform allows users to create game collections, generate AIGC content, and plans to support one-click publishing of collection tokens in the future, unlocking diverse revenue streams for creators and protocols. The company's CEO stated that this round of funding will be used to expand its multi-agent infrastructure.

BNB Chain ecosystem AI companion project Lazbubu completes strategic round financing, led by Metis

BNB Chain ecosystem AI companion project Lazbubu announced the completion of strategic round financing led by Metis, with participation from Hotcoin Labs, Honey Capital, APUS Capital, and Becker Ventures. This round of financing will be used for core product development, global user growth, ecosystem collaboration expansion, and further refinement of the DAT (data anchoring token) mechanism.

Lazbubu is an on-chain AI companion agent based on the DAT mechanism, achieving personalized growth by recording user interaction data (such as conversations, decisions, etc.), with all data anchored through BNB Chain to ensure continuous verifiability and user control. Its testnet phase attracted over 80,000 users, generating over 1 million interactions.

The DAT mechanism supports real-time minting of AI interaction behaviors as on-chain assets, allowing users to view, transfer, or combine related data. Future plans for the project include expanding multi-modal interaction capabilities, achieving cross-chain compatibility, and launching a community governance mechanism.

AI startup Humans& completes $480 million in seed round financing, with a valuation of $4.48 billion

Human-centered AI company Humans&, co-founded by members from Anthropic, xAI, and Google, has completed $480 million in seed round financing, with a valuation of $4.48 billion. Investors include Nvidia, Jeff Bezos, SV Angel, GV, and Emerson Collective. The company is dedicated to developing AI tools that enhance human collaboration, with team members from OpenAI, Meta, AI2, MIT, focusing on multi-agent reinforcement learning, AI memory, and user understanding, aiming to reconstruct AI model training and interaction methods.

(This financing is not included in the data statistics for this week's report)

Nvidia invests $150 million in AI inference company Baseten

AI inference startup Baseten has completed a $300 million financing round, reaching a valuation of $5 billion, nearly double its previous round valuation. This round was led by venture capital firms IVP and Alphabet's independent growth fund CapitalG, with chip giant Nvidia also participating, injecting $150 million into Baseten as part of the deal. This transaction highlights Nvidia's proactive positioning in the AI inference space with startups. As the industry shifts focus from training models to large-scale deployment and inference (i.e., AI models generating outputs based on inputs), Nvidia is increasing its investments in related startups while continuing to invest in its own AI chip customers.

(This financing is not included in this week's report data statistics)

Infrastructure & Tools

Bitcoin payment startup ZBD completes $40 million in Series C financing, led by Blockstream Capital

Bitcoin payment startup ZBD announced the completion of $40 million in Series C financing, led by Blockstream Capital (which invested $36 million), with other investors and the company's valuation undisclosed. Headquartered in New Jersey, ZBD primarily provides payment software solutions for video games, supporting multiple transaction processing options, including Bitcoin. The company does not engage in NFTs or crypto-based gameplay but focuses on using blockchain as a payment channel to help game developers establish direct financial relationships with players, facilitating user-to-user transfers and in-game reward distributions. The company currently employs 70 people and has partnered with 55 games by 2025. This round of financing will be used to expand its payment product suite over the next year.

Bitcoin-native L1 protocol Bitway completes $4.444 million seed round financing, led by TRON DAO

Bitcoin-native Layer 1 protocol and infrastructure platform Bitway announced the completion of $4.444 million in seed round financing, led by TRON DAO, with participation from HTX Ventures and others. To date, Bitway has raised over $5.8 million from institutional investors. After completing its initial seed financing, it also completed a targeted strategic financing round, bringing Bitway's valuation to $100 million.

Bitway was founded by former Binance team members and was previously incubated through YZi Labs' EASY Residency program and launched through Binance's booster program. Bitway has two core products, including the on-chain wealth management platform Bitway Earn and the Layer 1 application chain Bitway Chain, specifically designed for payment and financing solutions.

Centralized Finance

Argentina-based fintech company Pomelo has completed $55 million in Series C financing, led by Kaszek and Insight Partners, aimed at deepening its presence in the Latin American market and expanding globally. The funds will be used to expand its credit card payment processing business in Mexico and Brazil and to launch a global credit card settled in the stablecoin USDC. Pomelo also plans to develop a real-time and smart agent payment system that can operate cross-border, serving traditional banks and large international clients, with partners including Visa, Mastercard, Binance, and Western Union.

Dutch cryptocurrency platform Finst completes €8 million in Series A financing

Dutch cryptocurrency platform Finst has completed €8 million in Series A financing, led by Endeit Capital, with existing investors including Spinnin' Records founder Eelko van Kooten and DEGIRO co-founder Mark Franse participating. This financing brings Finst's total funding to €15 million.

Founded in 2023, the platform has obtained authorization as a crypto asset service provider from the Dutch Authority for the Financial Markets (AFM) and serves retail and institutional clients across 30 European countries. The company stated that this round of funding will be used to expand its European market presence, develop new products and services, including expanding staking coverage and market-leading rates, increasing asset options and platform features, and developing more product lines for institutional and professional users.

“Crypto as a Service” platform CheckSig completes €3.5 million in Series A financing

European “Crypto as a Service” platform CheckSig announced the completion of €3.5 million in Series A financing at a valuation of €33.5 million, bringing its total funding to €6.2 million. The company has obtained a MiCAR license this year and provides services such as crypto custody, crypto trading, and cryptocurrency tax withholding, aiming to offer secure and transparent cryptocurrency services for individual and institutional investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。