Written by: Yokiiiya

I. From Marginal Experiment to Paradigm Shift in Financial Core

Current prediction markets have gradually shed their ambiguous identity as "academic experiments" or "marginal gambling," officially evolving into mainstream financial instruments that hedge real-world risks through regulated derivative contracts. This transformation is not a result of natural evolution but is catalyzed by the fierce commercial and legal battles between the U.S. compliance pioneer Kalshi and its global competitor Polymarket.

This article will attempt to comprehensively analyze Kalshi's rise, delve into its historically significant legal battle with the U.S. Commodity Futures Trading Commission (CFTC), and compare the valuation logic differences and future landscape between it and blockchain-based giant Polymarket.

The core idea of prediction markets is based on Hayek's theory of information dispersion and the efficient market hypothesis: compared to polling experts or individual analysts, market participants with "real money" incentives can more accurately aggregate dispersed information to predict the future. However, for a long time, this industry has been trapped in the ambiguous zone between "gambling" and "finance." In the U.S., gambling bans since the 1930s and the strict limitations of the Commodity Exchange Act (CEA) have kept prediction markets in a gray area for a long time.

However, 2024 to 2025 is the "singularity" for the explosion of this industry. With the federal court's ruling in KalshiEx LLC v. CFTC, the regulatory ban on election prediction markets was effectively overturned. Meanwhile, the maturity of blockchain technology has allowed Polymarket to gather unprecedented liquidity globally. The convergence of these two forces—institutional legalization and technological decentralization—has pushed the annual trading volume of the entire industry to hundreds of billions of dollars.

II. The Origin of Kalshi: A Last-Ditch Effort in a Regulatory Wilderness

2.1 Founding Background: Wall Street Experience and MIT Sparks

Kalshi was founded in 2018 by Tarek Mansour and Luana Lopes Lara. This is not just a story about technological innovation but also about immigrant founders seeking gaps in the complex regulatory system of the U.S. Mansour (CEO) hails from Algeria, and Lara (COO) from Brazil, both being international students at the Massachusetts Institute of Technology (MIT).

They met during their undergraduate years at MIT, bonded by a shared interest in the history of financial markets. More importantly, they both have a strong quantitative finance background:

Tarek Mansour: Holds a degree in electrical engineering and computer science, having interned and worked at Goldman Sachs and Citadel, gaining deep insights into the workings of traditional financial infrastructure.

Luana Lopes Lara: Also studied at MIT, having worked at the world's largest hedge fund, Bridgewater Associates, and Citadel, with a profound understanding of macroeconomic hedging strategies.

In traditional financial markets, if investors want to hedge risks related to specific events like "Brexit" or "Federal Reserve interest rate hikes," they often need to construct complex stock or futures portfolios (e.g., shorting the pound, going long on gold). This indirect hedging is not only costly but also carries significant basis risk—the risk that market movements may decouple from event outcomes. Mansour and Lara realized that the market lacked a tool for directly trading "the event itself." They envisioned creating a "Bloomberg Terminal for Uncertainty," allowing retail investors, farmers, and CFOs to directly buy and sell event outcomes.

2.2 2018-2020: A Long "Near-Death Experience"

In stark contrast to Silicon Valley's typical "Move Fast and Break Things" startup model, Kalshi chose the most difficult path: not launching any products or acquiring any users before obtaining regulatory approval.

This strategy seemed almost suicidal in the early days. From its founding in 2018 to receiving approval at the end of 2020, Kalshi endured a three-year "valley of death."

Regulatory Long March: The founding team spent years negotiating with the Commodity Futures Trading Commission (CFTC). This was an extremely asymmetric game, with two young immigrant founders trying to persuade the world's strictest financial derivatives regulatory body to approve a new category of exchange that had never existed before.

Infrastructure Precedence: The CFTC required applicants to demonstrate a complete technical architecture, clearing mechanisms, and market monitoring systems before obtaining a license. This meant Kalshi had to invest heavily in building bank-grade trading systems, broker interfaces, and monitoring systems without any revenue.

Financing Dilemma: With no user data and uncertainty about whether the product could even launch, fundraising was extremely difficult. Many venture capitalists backed out due to regulatory risks. However, acceptance into Y Combinator (W19) became a turning point, followed by the involvement of heavyweight investors like Sequoia and Charles Schwab, providing the necessary endorsement and ammunition for this protracted battle.

2.3 Approval and Launch: Establishing the Status of "Designated Contract Market"

At the end of 2020, Kalshi finally welcomed its historic moment: the CFTC officially approved it as a designated contract market (DCM). This was not just a license but a declaration of the legitimacy of the entire prediction market industry.

Legitimacy Moat: Kalshi became the first federally regulated exchange in U.S. history specifically for trading event contracts. This meant it could directly connect to the U.S. banking system (ACH/Wire) and settle in U.S. dollars, eliminating the barrier for users to engage with cryptocurrencies.

Definition Difference: Unlike platforms like PredictIt that rely on academic exemptions (No-Action Letter) and have strict trading limits, Kalshi is a fully regulated exchange with theoretically no hard limits on trading amounts (although there were initial position limits), allowing it to serve institutional clients.

III. Regulatory Game: The Legal Epic of KalshiEx LLC v. CFTC

The history of Kalshi's development is essentially a history of legal struggle. Obtaining the DCM license was just the beginning; the real battle lies in what contracts you can list. The core conflict is between the CEA's requirement for "economic purpose" and the CFTC's expansive interpretation of "gambling."

3.1 Core Controversy: Economic Purpose Test and Gambling Definition

According to the CEA and CFTC regulations, any futures contract must meet the "economic purpose test," meaning the contract must primarily be used for hedging or price discovery, not merely for speculation. The CFTC has long held the authority under CEA Section 5c(c)(5)(C) to prohibit contracts involving "terrorism, assassination, war, gambling," or "violating federal or state laws."

The CFTC's traditional view is that election predictions, movie box office predictions, etc., are essentially "gambling," lacking a clear economic hedging function and violating the public interest of various states. This has become the biggest obstacle for Kalshi to expand its market.

3.2 2023-2024 Key Battle: The Election Contract Dispute

In 2023, Kalshi submitted a contract application for "Congressional Control Contracts," allowing traders to bet on which party will control the House of Representatives or the Senate in the 2024 election. After a lengthy review, the CFTC again denied the application on the grounds of "involving gambling" and "violating state laws," issuing an order prohibiting Kalshi from listing the contract.

Kalshi chose not to compromise but instead filed a lawsuit in the U.S. District Court for the District of Columbia (KalshiEx LLC v. CFTC), accusing the CFTC's decision of violating the Administrative Procedure Act (APA) and being "arbitrary and capricious."

3.2.1 District Court Ruling: A Victory for Textualism

On September 12, 2024, District Court Judge Jia M. Cobb made a ruling that shocked the legal and financial communities, supporting Kalshi and overturning the CFTC's ban.

In this ruling, the core logic includes:

Narrowing the Definition of "Gambling": The judge employed a textualist interpretation method. The CFTC attempted to define "gambling" as including any speculative competition, including elections. However, the court pointed out that in ordinary English context and legal texts, "Gaming" typically refers to sports competitions, chance games (like roulette), etc. Elections are serious political processes; while they can be said to be a "contest," they are certainly not a "game." Therefore, the CFTC has no authority to use the "Gaming" clause to prohibit election contracts.

Confirmation of Economic Purpose: The court acknowledged Kalshi's evidence that election outcomes have a significant and direct impact on the economy (tax policies, trade tariffs, etc.), and that businesses and individuals have legitimate economic hedging needs.

Regulatory Overreach (Ultra Vires): The court emphasized that the powers of regulatory agencies must come from congressional authorization. If Congress wishes to prohibit election betting, it should do so through new legislation, rather than allowing the CFTC to implement a ban through an expansive interpretation of existing laws.

3.2.2 Appellate Court's Final Word

The CFTC immediately appealed to the U.S. Court of Appeals for the D.C. Circuit and requested an emergency stay. However, on October 2, 2024, the appellate court denied the CFTC's request, allowing Kalshi to continue listing election contracts during the appeal. This decision effectively opened the green light for prediction trading during the 2024 election, leading to hundreds of millions of dollars flowing into Kalshi.

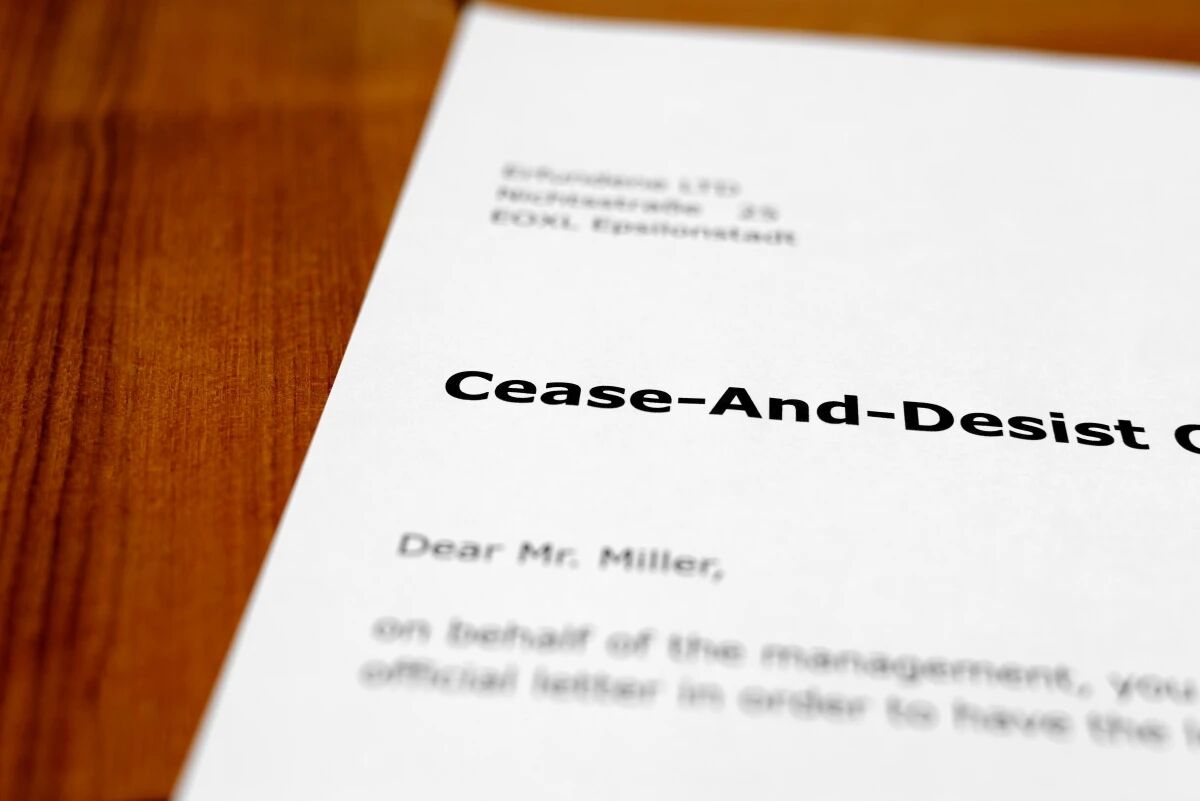

3.3 State-Level Regulatory Backlash: The Preemption Battle

Although Kalshi won a federal-level victory, it soon found itself embroiled in a guerrilla war with state gambling regulators. States such as New Jersey, Nevada, Massachusetts, and various California tribes issued cease-and-desist orders or filed lawsuits against Kalshi, accusing it of operating an unlicensed gambling business.

Kalshi's core defense is that, as a federally regulated exchange under the CFTC, it is governed by the Commodity Exchange Act (CEA). According to the Supremacy Clause of the U.S. Constitution, federal law takes precedence over state law.

Legal Argument: The CEA explicitly states that the CFTC has "exclusive jurisdiction" over commodity options and futures.

Mansour's Metaphor: Tarek Mansour vividly likened it to grain futures trading in Kansas—while Kansas law may prohibit certain forms of gambling, it cannot prohibit federally regulated wheat futures trading, even if such trading appears to be a "bet" on future prices.

Current Situation: As of early 2026, federal courts have issued inconsistent rulings across different jurisdictions. Federal courts in Nevada and New Jersey tend to support Kalshi's preemption claims, asserting that state law cannot interfere with federal exchanges. However, lawsuits from Maryland and California tribes remain stalled, forcing Kalshi to implement geographic fencing in some states.

IV. Duel of the Titans: A Multidimensional Comparison of Kalshi and Polymarket

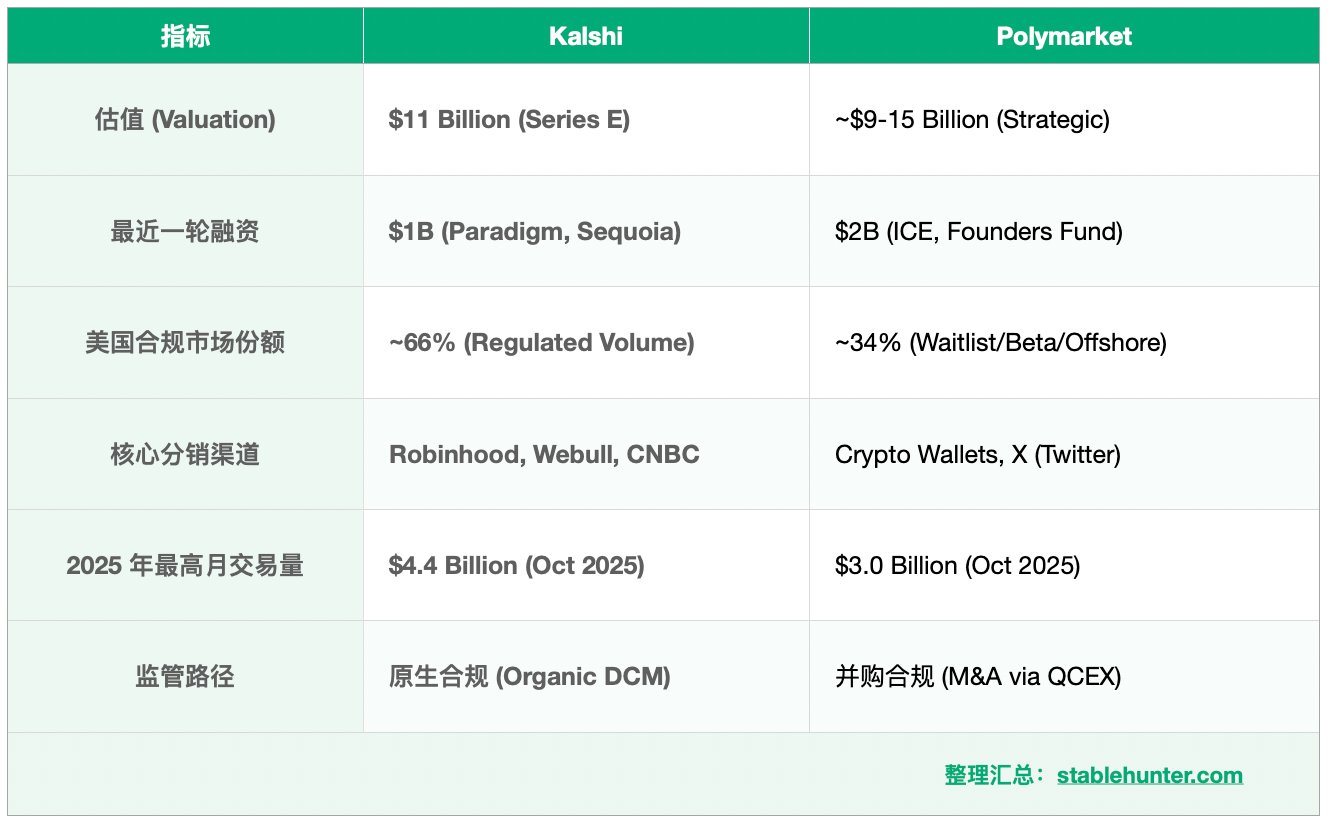

Before 2024, Polymarket held over 90% of the global prediction market share due to its offshore advantages and the frictionless nature of cryptocurrencies. However, with Kalshi's legal breakthroughs and ecosystem integration in 2025, the market landscape underwent a fundamental reversal. By the end of 2025, Kalshi had captured approximately 60% of the compliant prediction market trading volume in the U.S.

4.1 Comparison of Core Business Models and Infrastructure

4.2 The "Friction Inversion" Phenomenon in User Experience

Polymarket's long-standing advantage was its "permissionless" nature. However, as prediction markets attempted to penetrate mainstream audiences, the complexity of cryptocurrency wallets (gas fees, private key management, USDC conversion) became the biggest barrier.

For ordinary American investors, connecting a Robinhood account (Kalshi model) is much easier than purchasing USDC from Coinbase and withdrawing it to the Polygon chain (Polymarket model). Kalshi's "friction" for crypto enthusiasts is KYC, but for the general public, its fiat on-ramp eliminates "technical friction." This inversion of experience is a key reason Kalshi was able to surpass Polymarket in 2025.

4.3 Valuation Gap and Capital Logic: Pricing in Two Worlds

As of early 2026, both companies' valuations have surpassed $10 billion, but the underlying capital logic is entirely different.

Funding History:

Seed/Series A (2019-2021): ~$30M, led by Sequoia and Charles Schwab.

Series E (Dec 2025): $1B funding, valuation $11B, led by Paradigm, with Sequoia and a16z participating.

Valuation Support Logic:

Compliance Monopoly Premium: As the only fully compliant platform in the U.S., Kalshi can tap into broker traffic from Robinhood, Webull, and others. This distribution capability is its core asset.

Institutional Moat: Hedge funds and corporate clients cannot hedge on unregulated crypto platforms and must go through CFTC-regulated channels.

Data Mediaization: Kalshi's exclusive data partnerships with CNN and CNBC make it a "source of facts" for mainstream media reporting on elections and economic expectations.

Funding History:

Early: Supported by Founders Fund and Vitalik Buterin.

Strategic Round (Oct 2025): $2B funding, led by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, with a valuation of approximately $9B.

Reportedly seeking to raise a new round at a valuation of $12-15B.

Valuation Support Logic:

Global Liquidity Network: Although it has lost some U.S. market share, Polymarket monopolizes prediction trading in non-U.S. regions.

Technology Paradigm Premium: Its blockchain-based architecture allows for extremely low operating costs and resistance to censorship.

Bridge to Traditional Finance: ICE's strategic investment is crucial, suggesting that Polymarket may integrate more deeply with traditional financial infrastructure in the future, potentially being seen as a prototype for the next generation of financial exchanges.

V. Ecosystem Integration: The Robinhood Effect and Acquisitions

5.1 Decisive Victory of the B2B2C Model

Kalshi's key to achieving explosive trading volume and surpassing Polymarket in 2025 lies not in its own app but in its integration as "infrastructure" within Robinhood.

Integration Depth: Kalshi's contracts are embedded as an asset class directly within the Robinhood app. Users do not need to re-register for a Kalshi account; funds are directly deducted from their Robinhood balance. For tens of millions of Robinhood users, trading "Federal Reserve interest rate cuts" is as simple as buying and selling Tesla stock.

Revenue Sharing Model: According to a report by Bernstein analysts, Kalshi and Robinhood have adopted a roughly 50/50 revenue-sharing model (about 2 cents per contract). Given that Robinhood contributes the vast majority of traffic to Kalshi, this sharing reflects the strong bargaining power of the channel partner. In the third quarter of 2025, event contract trading volume on Robinhood exceeded 2 billion contracts, becoming its fastest-growing business line, with an annualized revenue of $300 million.

5.2 Spread of the Traffic War

Robinhood's success triggered a chain reaction, with the so-called "Robinhood Effect" forcing other brokers to follow suit:

Interactive Brokers: Quickly launched similar prediction market features through Kalshi or other compliant channels.

Webull & SoFi: Also integrated event contracts, attempting to get a piece of the pie.

Google Finance: Announced plans to integrate prediction market data, further pushing Kalshi's data into the mainstream.

This trend signifies that prediction markets are undergoing a process similar to "ETF-ization"—the underlying assets (event contracts) are created and cleared by the exchange (Kalshi), but distribution and user interface are handled by major brokers. This also puts immense pressure on Polymarket; if it cannot enter these mainstream apps, it will remain isolated from core liquidity.

5.3 Polymarket's Acquisition and Compliance Dilemma

In July 2025, Polymarket spent $112 million to acquire QCEX (QCX, LLC). QCEX is an exchange and clearinghouse holding a full CFTC license (DCM and DCO). Through this acquisition, Polymarket effectively purchased a ticket to legally enter the U.S. market without having to undergo Kalshi's lengthy and uncertain application process. Industry insiders have dubbed it the "Regulatory Heist of the Decade."

Although it obtained the license, the launch of Polymarket US did not go smoothly.

Conflict Between Technology and Compliance: Polymarket's core advantage lies in on-chain transparency and decentralized oracles (UMA). However, the CFTC requires exchanges to have complete control over transaction records, the ability to freeze funds, and conduct anti-money laundering (AML) checks. Integrating a decentralized tech stack with centralized regulatory requirements is technically challenging.

Release Delays: Originally slated for a full launch before the 2025 NFL season, as of January 2026, Polymarket US remains in an "invitation-only" or "waitlist" phase and has not fully opened to the public. This has allowed Kalshi to almost exclusively enjoy the explosive growth of the U.S. market in the second half of 2025.

Hybrid Model: Polymarket US is expected to adopt a hybrid model—appearing Web3 on the front end while using QCEX for compliance settlements on the back end, with funds potentially held in bank custody rather than on-chain smart contracts, which somewhat undermines its original technological advantages.

VII. Product Evolution and Potential Risks

7.1 From Elections to "Everything Markets"

While election predictions were the trigger point, both Kalshi and Polymarket are actively expanding into non-political contracts to smooth out the volatility brought by election cycles.

Macroeconomics (The Fed & Inflation): Kalshi has developed hedging products specifically for Chief Financial Officers (CFOs). For example, a construction company can purchase a contract for "the Federal Reserve not cutting interest rates" to hedge against rising loan costs due to high interest rates. The trading volume of such contracts surges around FOMC meetings.

Climate and Weather: With the increasing frequency of extreme weather, prediction contracts for hurricane landfall locations and average temperatures have become new hedging tools for agriculture and insurance industries. Kalshi has invested heavily in this area, attempting to establish standards for "climate risk pricing."

Sports Financialization (Sports as an Asset Class): This is the biggest growth point in 2026. Unlike traditional sports betting, which involves one-time bets, prediction markets allow users to buy and sell "team win probabilities" at any time during the game, similar to trading stocks. Robinhood users have shown great enthusiasm for these high-frequency, trading-oriented sports products. The 2026 World Cup is expected to be a breakout period for the sports prediction market.

7.2 Liquidity and Market Makers

A core challenge of prediction markets is fragmented liquidity. Unlike stocks, each specific event (e.g., "Will it snow in New York on January 31, 2026?") is an independent market.

Kalshi's Strategy: By introducing institutional market makers and matching them with Robinhood's massive retail order flow, Kalshi has achieved extremely narrow spreads on popular contracts.

Polymarket's Strategy: Utilizing liquidity incentives in the cryptocurrency space (Liquidity Mining) and automated market maker (AMM) technology, Polymarket has maintained good liquidity in long-tail markets.

7.3 Moral Hazard and Regulatory Boundaries

As the market expands, concerns about "assassination markets" or "terrorist attack markets" persist. Although the CFTC lost the lawsuit over election contracts, it may still establish rules prohibiting contracts involving war, death, or disaster. Additionally, insider trading poses a significant risk. If Federal Reserve insiders or sports event referees use insider information to trade in prediction markets, it would severely undermine market credibility. A KPMG report indicates that financial institutions need to establish new compliance frameworks to monitor employee trading behavior in prediction markets.

Critics argue that pushing prediction markets to the masses through Robinhood may exacerbate gambling addiction among the younger generation. Although termed "event contracts," their binary options nature (0 or 100 settlement) is highly speculative. Analysts like Santiago Roel Santos warn that this "casino-like" financial product, while capable of generating high short-term income, may accelerate user churn, as users' account funds are more likely to reach zero.

Final Thoughts: The Endgame and Future

Kalshi's rise is not just a success story for a startup but a classic case in the history of financial regulation. It demonstrates that in a highly regulated financial system, it is better to confront regulation directly, rather than attempting to circumvent it (as seen with early crypto projects), and to build an insurmountable moat through high compliance costs.

8.1 Solidification of the Duopoly

Looking ahead to 2026-2030, the U.S. prediction market is likely to form a duopoly between Kalshi and Polymarket, similar to Uber vs. Lyft or NYSE vs. Nasdaq.

Kalshi

Will firmly occupy the "whitelist" market, dominating collaborations with traditional financial institutions (banks, brokerages) and becoming the de facto "macro event exchange." Its high valuation stems from its control over mainstream financial traffic in the U.S.

Polymarket

Will continue to dominate the global offshore market and the crypto-native market, while also sharing a piece of the pie in the U.S. market through QCEX. Its high valuation is driven by technological innovation and global network effects.

8.2 The Ultimate Form of Prediction Markets

With more institutional funds flowing into the market in 2026, prediction markets are on the brink of transitioning from a "niche experiment" to a "trillion-dollar asset class." Future financial news may no longer cite polling data but instead directly reference Kalshi's contract prices. For investors, understanding the core of this market will no longer be about analyzing the odds of individual events, but rather about comprehending how this new financial infrastructure reconstructs our pricing of risk, information, and truth.

Appendix: Key Data Overview (As of January 2026)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。