The world is bustling, all for profit; the world is bustling, all for the benefit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to fellow coin enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

There are 23 days left until the Spring Festival, and the market trends before the New Year are gradually becoming clear. What remains is the awareness of fraud, which has been Lao Cui's fundamental work over the years. Especially for those in the crypto circle, it is essential to be vigilant. Many coin friends have also arrived in Hong Kong, and Lao Cui may not update as frequently towards the end of the year. For any questions, please feel free to ask me directly, as I tend to be quite busy around this time. Today's article will start with answering questions, as many friends' inquiries have been focused on what price points we might drop to, possibly due to Lao Cui's recent pessimistic explanations about the crypto market. The answers in person will definitely differ from those in the article; in the article, Lao Cui can only say that currently, no analyst or individual institution has the predictive capability. When Trump took office, Lao Cui mentioned that this might be the historical high point for the crypto market, as subsequent favorable factors will not be as grand as in 2024.

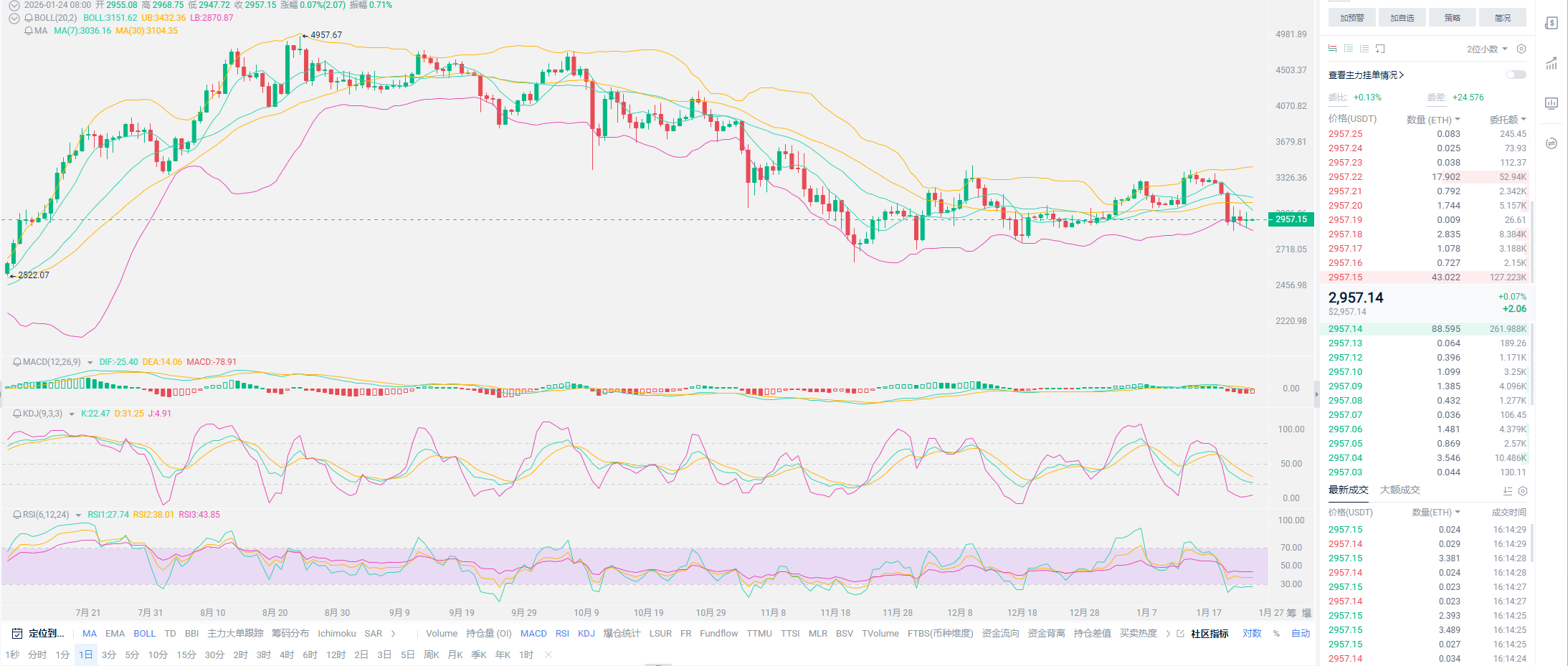

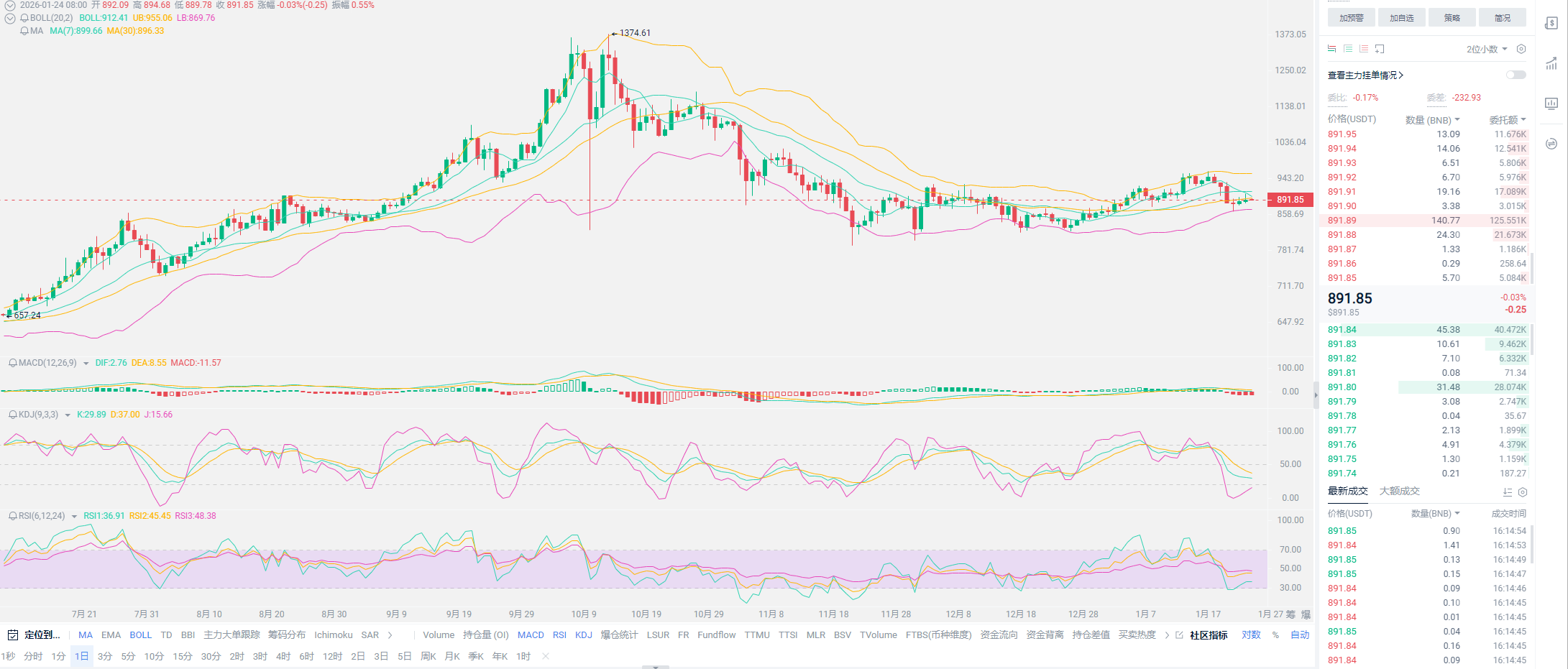

Especially with the recent market trends, Lao Cui is increasingly worried, as it seems that his earlier views are gradually being validated. Since Bitcoin reached a new high in October, it has not shown any significant recovery for nearly four months, and even in December and January, it has not surpassed the 100,000 mark. This is a typical downward range, with no arguments to be made; this is also something Lao Cui did not predict, marking a complete error. Yesterday's meeting with General Yan revolved around this topic, and today, I have organized some thoughts to share with everyone in article form. Looking at the entire Bitcoin trend, where is the starting point of this bull market? Strictly speaking, the lowest point was in November 2022, when Bitcoin hit a new low of 15,476, from which it began a surge all the way to last year's high of 126,000. If we count from the new low, the entire upward trend lasted nearly three years, which is a miracle, or even a divine miracle.

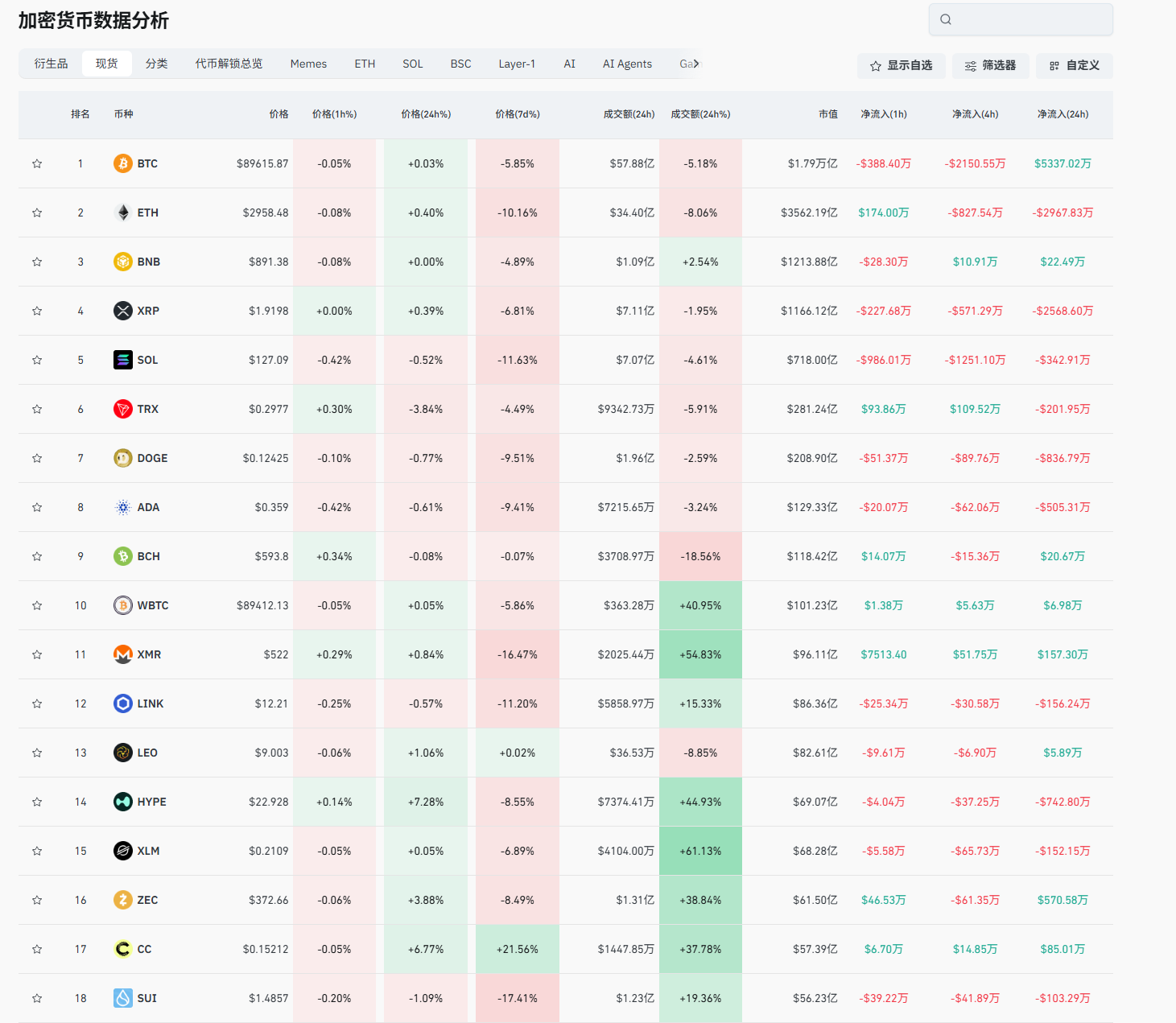

So where do we encounter problems? The question is whether we should start a new round of decline after October. Is the depth of this decline healthy? It has dropped a full quarter. For a financial market, a high followed by a pullback is a very normal occurrence, especially after reaching a historical high. Even a pullback to half, which is the previous bull market's high of 74,000, is considered normal. However, in the crypto circle, the timing of the pullback is wrong; the most inappropriate thing is to decline during a rate-cutting cycle. This is a malicious market crash. Everyone should understand that the funds in the crypto circle have not flowed out for the giants; looking at BlackRock's holdings, there has been no decrease in quantity, and they are still in a buying cycle. Furthermore, American pension funds and various state purchases, as well as ETF purchases, have not experienced any issues with capital flow.

Returning to the essence of the financial market, the market is merely formed by the transactions between buyers and sellers. A price drop must mean someone is selling; so who is selling? Lao Cui has provided an answer: most of the whales from the Satoshi Nakamoto era are gradually waking up, and their holding values are often less than 1 dollar. The revival of these whales is a fatal blow to the crypto circle; regardless of the price, as long as they sell, it is pure profit. During their frenzied selling, the only comforting aspect is that more is being taken over by the giants, namely the platform parties. This has led to a turnover of a major player; many markets cannot withstand such massive sell-offs, which has caused the arrival of the rate-cutting cycle, becoming a key point for whale turnover. The conditions for forming a bull market are extremely simple: 10% of people are selling, while 90% are buying, and the price will naturally reach new highs.

Currently, the market is in a phase where whales are selling at any price. Especially after escaping the rate-cutting cycle, there are not many favorable news in the crypto circle, so it is somewhat unrealistic to expect a return of the bull market in the short term. Don't be discouraged; this phenomenon will not last long. The selling by these whales is merely a response to growth in other markets; we won't delve too deeply into the factors of capital outflow. The growth patterns are something to pay attention to; I have previously summarized the factors causing the current trend. All financial trends give Lao Cui the feeling of being filled with a short-term romanticism; everyone is printing money and injecting liquidity, without considering who will clean up the mess in the end. This reminds Lao Cui of Wagner's opera, "The Ring of the Nibelung," summarizing the twilight of the gods. The crypto circle gives a sense of a doomsday carnival rhythm.

Lao Cui summarizes: The story of the crypto circle will continue to be written; 2026 will not be the final chapter. Of course, this story will not be continued by Lao Cui. According to the latest news, Trump may start visiting China in April; we will see what the results are. In a downward state, it is essential to control your inner self. The timing for the arrival of the bull market will not exceed a range of 3-6 months; it will definitely come. This year's crypto market will at least double compared to 2025, as all banks and even more central banks are validating the feasibility of the cryptocurrency market. Capital has been continuously purchasing; the current timing feels more like the giants are releasing chips from ancient wallets that are collapsing, and the gathering of chips requires a certain timing. As long as the Americans regain some things, the cryptocurrency market will return to the right track. This layout pattern has basically formed; once growth starts, the entire main upward wave will rise in less than half a month. This year, Bitcoin will at least touch the range of 130,000 to 150,000, while the so-called altcoin season that has not yet been listed requires careful consideration; it is difficult! The frequency of future updates will decrease, so please bear with me.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。