Author: Citrini Research

Compiled by: Felix, PANews

The opportunities for retail investors to achieve high returns in the stock market are becoming increasingly bleak, possibly due to companies delaying their public listings. Research institution Citrini has published an article exploring the issue of companies in modern capital markets tending to remain private for extended periods, resulting in growth value primarily being captured by VC firms, while public markets may have devolved into liquidity exit tools. Below are the details.

It is absurd for companies to remain private for long periods.

While I understand the motivations behind this and do not blame the founders for doing so, this action undermines the very system that created these companies. Fundamentally, it is a betrayal of the commitment that allows capitalism to function.

The social contract in the United States has worked quite well for capital markets.

Sure, you might work at a dull small business or have a mediocre job; you may not become extremely wealthy or have transformative ideas, and sometimes you might feel that this system does not serve you at all.

But at least you have the opportunity to participate in the great achievements created by this system.

For most of the post-war period, the deal was roughly this: the public bore the market's volatility, inefficiencies, and the tedium of holding broad indices. In return, they were occasionally given transformative growth opportunities.

It created upward mobility opportunities that did not previously exist, especially for those who believed in the prospects of U.S. economic growth but were not direct participants.

I previously shared two stories: a retired woman in her sixties who invested her two salaries in Apple stock after the company aired its first Super Bowl ad and never sold it afterward. A childhood neighbor invested in AOL in 1993, and by the time it merged with Time Warner, the stocks he sold were enough to pay for all three of his children's college tuition and pay off his mortgage.

Today, there are almost no companies that went public at the stage Apple did in the 1970s or AOL did in the early 1990s.

Even if you are just a janitor, you had the opportunity to invest in companies that are writing the chapters of American history. The elitism of the market means that if you are sharp enough, you could have bought AOL stock in 1993.

And this is just the tip of the iceberg: a few visionary individuals have noticed certain changes.

The broader and more socially significant impact is reflected in those who do not particularly pay attention to social dynamics. They clock in and out of work day after day. As part of the system's operation, they gain the opportunity to participate in the creation of immense wealth.

Even if you are not the most astute individual investor, even if you have never bought a stock in your life, your retirement funds will eventually be invested in companies that are building the future. As a small part of the engine of capitalism, you do not need to rely on luck.

You have been fortunate, as part of your salary has been invested in your future. Sometimes, you find yourself becoming a small shareholder in a company that ultimately becomes a cornerstone of the future.

Thanks to the support of this system, some companies generate annual revenues in the billions. But today, those who keep this system running cannot benefit from it, as they are not considered equal in the eyes of the capital markets.

In this dynamic, capitalism will only regress to feudalism. A small number of people control the means of production of the era (land), while others work for them, and social mobility becomes a fantasy. If companies do not go public, they merely reconstruct the same structure with different assets. The equity of transformative companies is the new land.

You must have a net worth of $1 million (excluding real estate) or an income of $200,000 for two consecutive years. The median net worth of American households is about $190,000. By legal definition, they are too poor to invest in the future. Yet it is these median households that use the products of these companies in their work and consumption, which gives these companies value.

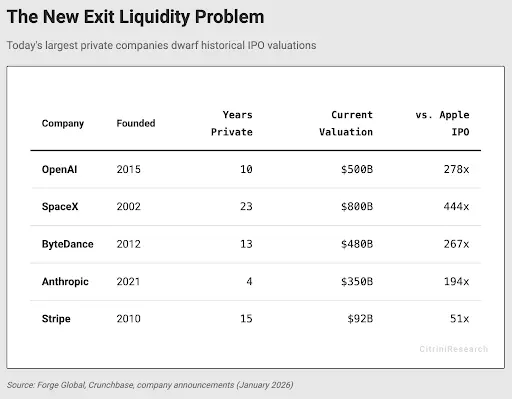

Without hundreds of millions of people using ChatGPT, OpenAI could not achieve a $500 billion valuation. Users create value. No matter how many B2B transactions occur in between, the end of the supply chain is always the individual consumer. They should at least have the opportunity to share in the benefits.

In a sense, it may even be worse than feudalism today: at least the peasants knew they were peasants. Nowadays, people "participate in capitalism" through 401(k) retirement plans, yet are systematically excluded from the most transformative wealth markets.

The rich getting richer has always been the way capitalism operates. But until recently, the strong capital markets in the U.S. could at least ensure that you were a stakeholder in it. Winners will win, but you could also participate in their victories.

You could have been one of AOL's first million users and said, "Cool, I want to invest in this company." Over the next six years, its stock price increased 80 times. Today, any good product from a new company you use is almost never traded on the public market.

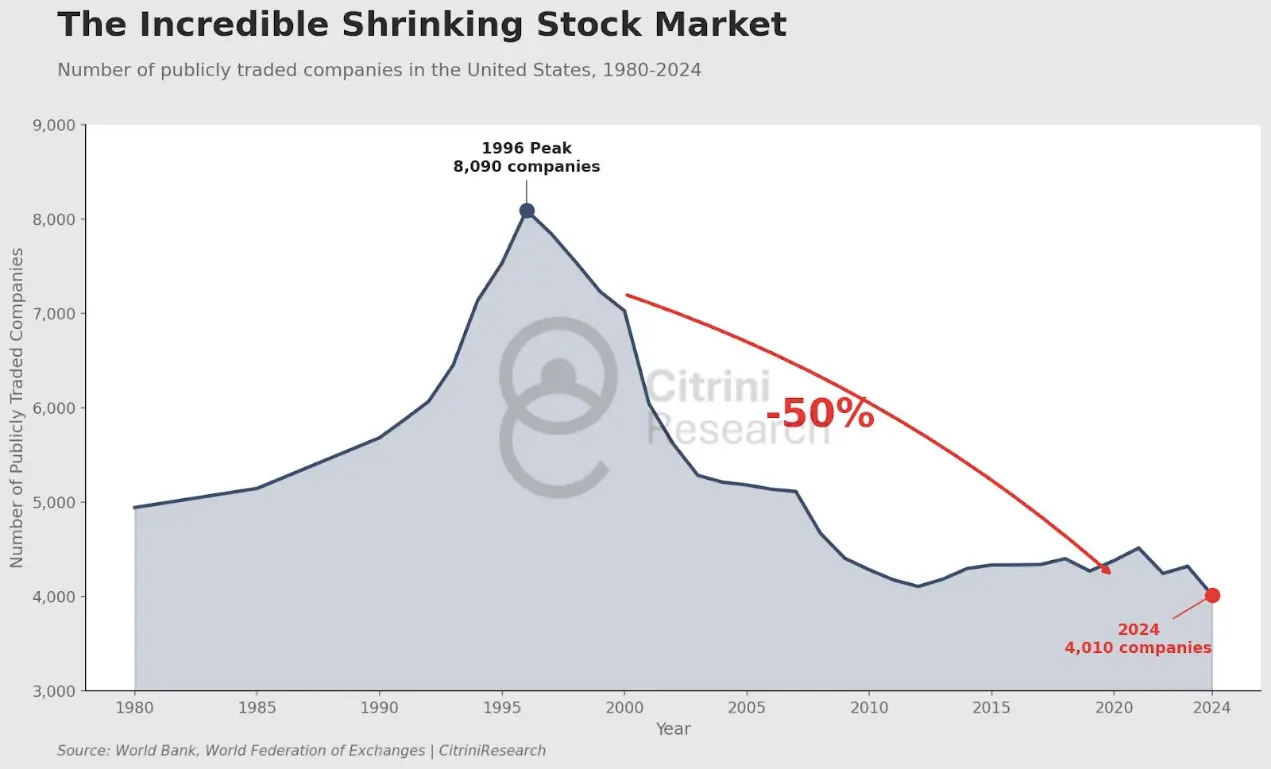

In 1996, there were over 8,000 publicly traded companies in the U.S. Despite the economy growing exponentially since then, the number of public companies is now less than 4,000.

In inflation-adjusted dollars for 2024, the median market capitalization of public companies in 1980 was $105 million. In 2024, it is $1.33 billion.

The focus of this discussion is not the median market capitalization. Over the past century, nearly half of the growth in market capitalization has come from the top 1% of companies.

Anthropologie, SpaceX, OpenAI.

These companies should be among that 1%. Today, the only way the public can participate in the growth of these companies is to wait for an IPO after their growth rate stabilizes.

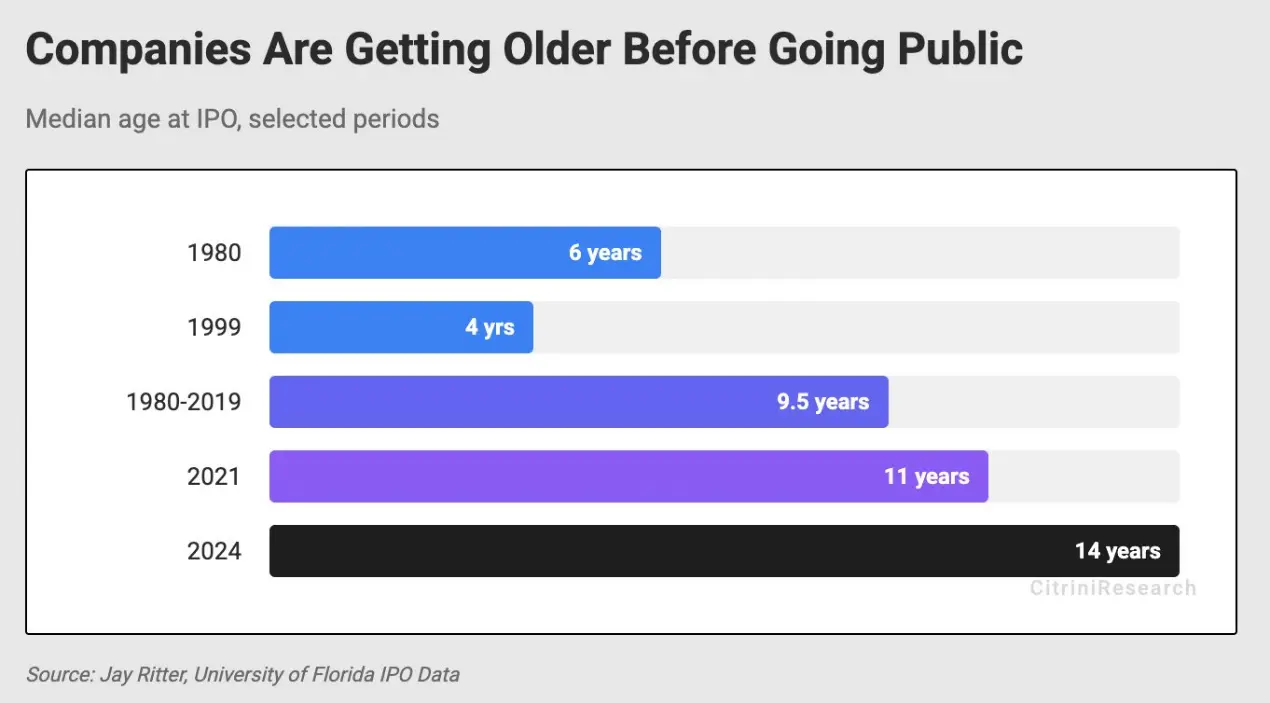

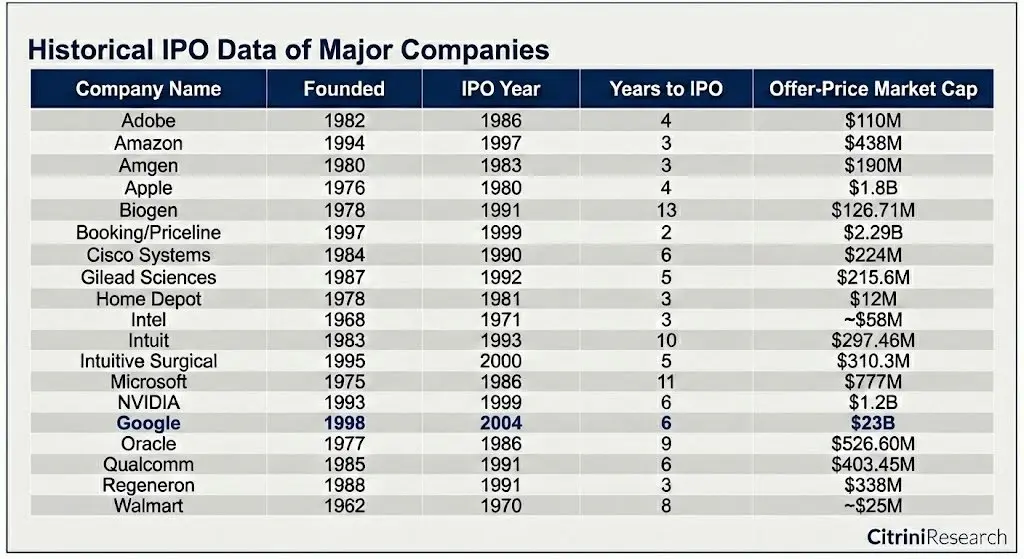

Amazon went public just three years after its founding, with revenue of only $148 million and was operating at a loss. Apple went public four years after its founding.

When Microsoft went public in 1986, its market capitalization was about 0.011% of U.S. GDP. It created about 12,000 millionaire employees within a decade. Secretaries and teachers in Washington State also became millionaires by purchasing and holding the stock of this software company.

SpaceX can be considered one of the most inspiring and milestone companies in America today, with a valuation of $800 billion. It accounts for about 2.6% of GDP.

OpenAI recently completed a $500 billion funding round and is reportedly trying to refinance $100 billion at a valuation of $830 billion. By October 2024, its valuation is $157 billion. If OpenAI had gone public at that time, it would likely have quickly been included in the S&P 500 index, possibly becoming the sixth or seventh largest holding in that index (given the trading situation of AI companies, it could even be higher).

However, most of this newly created value will not end up in the hands of American citizens but will flow into venture capital and sovereign wealth funds.

In 2024 dollar value, Apple's market capitalization at the time of its IPO was $1.8 billion. It did not even rank among the top 100 companies by market capitalization.

In 1997, when Amazon went public, its valuation was $438 million. The IPO process was chaotic and highly volatile. During the dot-com bubble burst, its stock price fell by 90%.

But because the public bore this volatility, they also reaped a subsequent 1,700-fold increase.

They do not need enough funds to invest in venture capital funds, nor do they need to "build networks." The only barrier to entering the market is the price of the stock.

Now, let's look at Uber.

This company would attract the interest of ordinary public investors at any time because Uber is used everywhere. However, when Uber went public in 2019 with a valuation of $89 billion, its value had already increased about 180 times from earlier venture capital rounds.

If this were the 1990s, individual investors might have had the opportunity to notice that the world was changing. Suppose a driver for Uber noticed it when the company surpassed 100 million cumulative orders in 2014 (when it was valued at $17 billion); that would still be a 10-fold return with a 22% annualized compound growth rate.

But the reality is that the public has only enjoyed a doubling of Uber's stock price over the past seven years.

I want to clarify one point: this is not a call for all startups to go public. Those who invested in Uber from the seed round to the C round clearly took on significant risks and received substantial returns.

But by the time Uber was in its D round of financing, one must ask whether remaining private was merely to ensure a smoother path to market dominance and easier cashing out, with all the profits ultimately flowing to the VC circle.

It must be reiterated: venture capital has always been an indispensable part of technological advancement. Many companies that would have been eliminated by the market have survived because they were able to raise funds from a group of long-term investors.

But if venture capitalists want the game to continue, they need to ensure that the entire system does not collapse under its own weight.

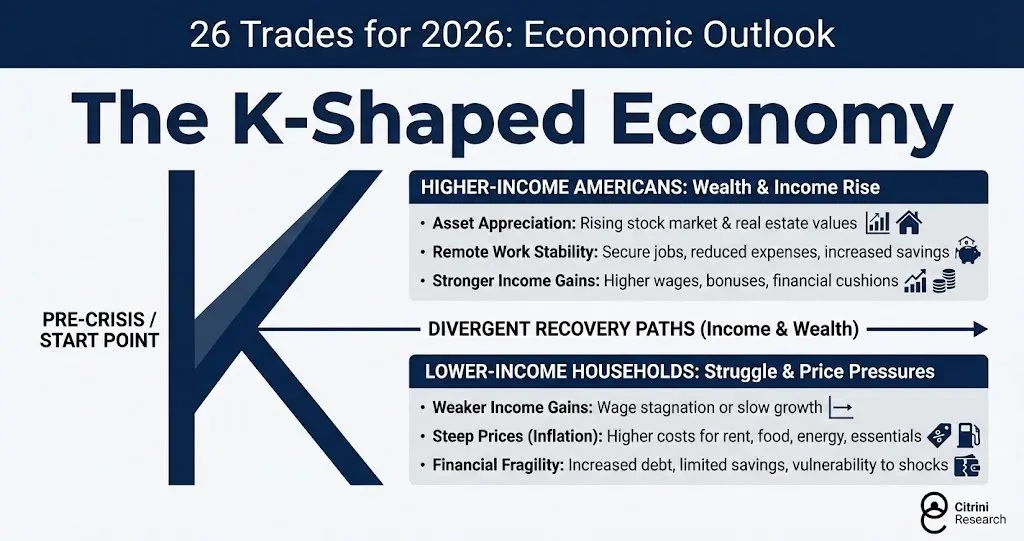

We are now witnessing the emergence of a "K-shaped economy."

High-income Americans: Wealth and income growth:

- Asset appreciation: Rising stock market and real estate values.

- Stability of remote work: Job stability, reduced spending, increased savings.

- Stronger income growth: Increased wages, bonuses, and financial buffers.

Low-income families: Living on the edge, facing price pressures:

- Slower income growth: Stagnant or slow-growing wages.

- Soaring prices (inflation): Rising costs of rent, food, energy, and necessities.

- Financial vulnerability: Increased debt, limited savings, and susceptibility to shocks.

There is more than one way to address this issue, but anything that can more broadly increase asset ownership aligns with incentives. The impact of AI is likely to exacerbate this dynamic. If the upper half of the K becomes narrower due to the concentration of beneficiaries, the situation will worsen. If the public market devolves into a liquidity exit tool for already mature venture capital projects, then this dynamic is essentially unsustainable.

Capitalism will give way to a new feudalism. Social unrest will become more common.

In contrast, China may see more early and mid-stage AI companies go public this year, with the number of companies exceeding that of the U.S. The Sci-Tech Innovation Board looks astonishingly similar to the Nasdaq of the early 1990s, providing opportunities for the public investors to create immense wealth. China seems to understand that this move helps build a strong middle class, while the U.S. seems to have forgotten this.

Companies do not want to bear market volatility. They do not need to enter the public market until they are large enough that venture capital can no longer fund them. Venture capitalists know that they can simply inflate valuations in higher funding rounds, so they do not push companies to go public.

It is uncertain whether this situation will change or how it might change, but it is clear that the U.S. is heading toward a world where the S&P 500 index essentially devolves into a liquidity exit tool.

OpenAI and Anthropic will go public as one of the largest companies in the world, while the index that people rely on to sustain their retirement will be forced to buy their stocks. By then, even if the stocks perform well, the public will have been excluded from wealth creation, and future returns will be compromised.

The total value of companies on the Crunchbase unicorn list reaches $7.7 trillion, exceeding 10% of the market capitalization of the S&P 500 index.

Given the successful companies listed in the last century, some may accuse of survivor bias. But that is precisely the point. The effectiveness of investing in passive indices like the S&P 500 is partly due to the fact that over time, it tends to retain quality companies while filtering out poor ones. It benefits from periods when companies dominate, especially during their active pursuit of dominance.

Apple was included in the S&P 500 index just two years after its IPO, replacing Morton Norwich Company (a salt company that later merged with a pharmaceutical company, becoming responsible for the Challenger Space Shuttle disaster, and was ultimately split by private equity).

Let’s look at the companies that have truly created wealth over the past 50 years:

Even the highest-valued IPO company—Google ($23 billion)—was just at the bottom level among the top 100 companies at that time.

If we hope for the capitalist system to continue, we need to encourage people to invest. But if investing merely becomes a tool for a few to profit, then it is difficult to sustain such a system. Viewing going public as an exit strategy and restricting companies from becoming national giants overlooks the very system that created the conditions for these companies to survive. If the returns on investments in epoch-making companies are monopolized by a few, the majority will gradually lose confidence in this system.

It is unclear how this situation could change or whether the existing incentives are so deeply rooted that they cannot be altered, but if there is a capacity to change it, it should be improved.

Related reading: Robinhood vs Coinbase: Who is the next 10x stock?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。