Silver is reaching new heights in a historic rally that has set new records in investment markets.

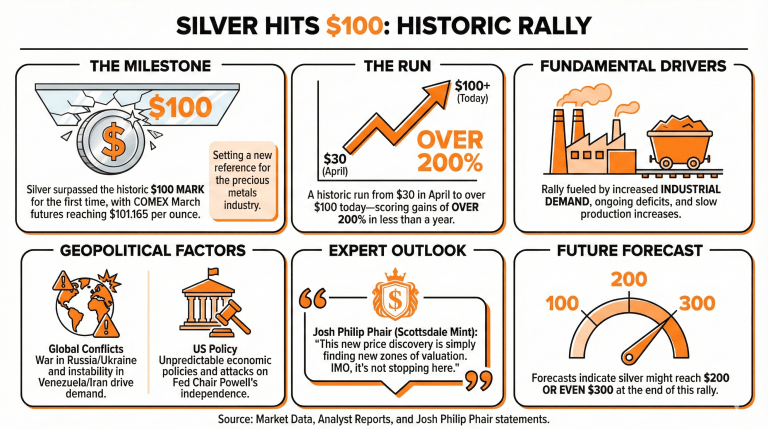

On Friday morning, silver surpassed the historic $100 mark, with COMEX March futures reaching $101.165 per ounce at the time of writing. This is the first time that the white metal has reached this price, setting a new reference for the precious metals industry.

The milestone is part of a vertiginous run that has taken silver from $30 in April to today’s prices, scoring gains of over 200% in less than a year.

Analysts have explained the reasons behind this rally, pointing to increased industrial demand, ongoing deficits, and slow production increases as the main factors backing silver’s escalation.

Nonetheless, the recent developments in Venezuela and Iran, the ongoing war between Russia and Ukraine, and the increasingly unpredictable economic policies of the Trump administration are also pushing silver demand higher, as investors hedge using silver as a financial tool.

Furthermore, the rhetoric of the current administration regarding Federal Reserve Chair Jerome H. Powell and the legal actions that the Department of Justice (DOJ) is taking against him might also fuel silver’s fire, as these can be seen as attacks on its independence.

Josh Philip Phair, Founder and CEO of Scottsdale Mint, framed this movement as part of a broader repricing that should have happened some time ago. On social media, he stated:

The reality is that these prices should have been seen years ago, and this new price discovery is simply finding new zones of valuation. IMO, it’s not stopping here as a longer-term outlook.

Earlier forecasts indicate that silver might reach to $200 or even $300 at the end of this rally.

Read more: Gold and Silver Break Records Again, Approaching Historic Levels; Bitcoin Falls Behind

What recent milestone has silver achieved in the investment market? Silver surpassed $100 per ounce for the first time, with COMEX March futures hitting $101.165, setting a new benchmark for the precious metals industry.

How much has silver increased in value over the past year? The price of silver has risen over 200%, climbing from $30 in April to its current historic highs.

What factors are contributing to this significant rally in silver prices? Analysts attribute the surge to increased industrial demand, ongoing supply deficits, and slow production growth, alongside geopolitical tensions affecting gold demand.

What are some predictions for silver prices in the near future? Forecasts suggest that silver may reach between $200 and $300 by the end of this rally, indicating a continued upward trend in its valuation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。