Sleepy.txt, Dynamic Insight Beating

On June 30, 2025, X welcomed a young product leader named Nikita Bier, 36 years old. Before joining under Musk, he had successfully developed several social applications that became hits and sold them to tech giants for tens of millions of dollars.

Since acquiring Twitter, Musk has been determined to transform it into a super app that integrates social networking, payments, investments, and banking. However, this path is fraught with challenges; countless tech giants have had similar dreams, and none have succeeded.

In this context, Nikita Bier's appointment carries significant meaning.

In the six months following his appointment, Bier collaborated with the algorithm team to adjust the recommendation page, increasing the proportion of content from friends, mutual follows, and fans, thereby changing X's content distribution logic and placing users' social relationships back at the core of content distribution.

Recently, Bier announced the upcoming launch of the Smart Cashtags feature. Users can mention stock or cryptocurrency codes in their tweets, and X will automatically display real-time prices, fluctuations, and related discussions. This feature transforms X from a purely social platform into a real-time financial information platform. Users no longer need to leave X to check stock prices or switch between multiple applications; all information is presented on a single interface.

On January 16, he revised X's developer API policy, no longer allowing InfoFi-type applications that reward users for posting, and directly revoked these applications' API access. At the same time, he is promoting the upgrade of X's creator incentive program.

These reforms may seem scattered, but they all point to a core goal: to transform X from a social platform into a vast ecosystem that integrates social interaction, influence, and finance.

The Birth of the Dopamine Dealer

In 2012, Nikita Bier was still a student at the University of California, Berkeley. That year, he developed an application called Politify, attempting to intervene in American politics using data and logic.

The core function of Politify was a tax calculator. Users would input their income and family situation, and the app would calculate the actual impact of different candidates' tax policies on them. Bier believed that if voters could clearly see their economic interests, they would make more rational choices.

This idea gained tremendous success during the 2012 election. Politify attracted 4 million users with zero marketing budget and briefly topped the App Store download charts. Bier believed that the information asymmetry in voter decision-making was the root of social issues, and his product could solve this problem.

However, reality quickly hit him hard. Bier discovered that despite users downloading Politify and seeing their economic interests, they did not change their voting choices. A blue-collar worker earning $30,000 a year might still vote for another candidate due to cultural identity, even if they knew a particular candidate's tax policy was more beneficial for them.

This made Bier realize that data and logic could not overcome emotional resonance. Thus, from 2012 to 2017, Bier entered a phase of frantic trial and error. According to Startup Archive, after Politify, he and his team developed a dozen applications, attempting to dissect human nature from different dimensions, but none succeeded, resulting in either failure to attract users or failure to retain them.

However, each failure deepened Bier's understanding of human nature. He began to realize that humanity's most primal desires are not rationality, knowledge, or efficiency, but the need to be seen, recognized, and praised.

By 2017, they completed their 15th product, tbh (To Be Honest).

This was an anonymous social application where users could anonymously vote for friends on questions like "Who is most likely to become president?", "Who is most likely to become a millionaire?", "Who is most likely to save the world?", etc. All questions were positive, and all feedback was praise.

tbh attracted 5 million users within two months, with daily active users reaching 2.5 million at one point. It started in a high school in Georgia and quickly achieved viral growth among American high school students. In October 2017, Facebook acquired tbh for less than $30 million.

The success of tbh marked a shift for Bier; he no longer tried to persuade users with data but began to drive them with emotions. He stopped trying to solve social issues and instead leveraged human weaknesses to create addictive products. The serious entrepreneur disappeared, replaced by a skilled dopamine dealer.

Musk's Choice

In October 2017, Nikita Bier joined Facebook with his team as a product manager.

Within Facebook, Bier shared tbh's growth strategy with colleagues. According to internal Facebook documents obtained by BuzzFeed News in August 2018, Bier's team detailed how they leveraged Instagram's mechanisms for rapid growth.

The core of this strategy was to exploit teenagers' curiosity and herd mentality. Bier's team would create private accounts on Instagram, follow all students from target high schools, and write teaser copy in the account bio, such as "You have been invited to join a mysterious app—stay tuned!"

Out of curiosity, students would request to follow this account, and then Bier's team would wait 24 hours to collect all follow requests, setting the account to public at 4 PM when school ended, adding the App Store link in the bio. Instagram would simultaneously notify all students that their follow requests had been accepted, prompting them to visit the account, see the download link, and download the app.

Although this strategy was unconventional, it demonstrated Bier's precise understanding of human nature. If you want users to take action, you don't need to persuade them; you just need to create an emotional trigger they can't resist.

Less than a year after the acquisition, Facebook ended tbh's operation, citing "low usage." However, Bier chose to stay at Facebook, continuing as a product manager. During this time, he gained deep insights into the operational mechanisms and internal politics of large social platforms. He saw how Facebook created controversies through algorithmic recommendations, predicted user behavior through data analysis, and designed products to extend user engagement.

The most important lesson he learned at Facebook was that social platforms are not meant to connect people but to create emotional fluctuations. The greater the emotional fluctuations, the longer users stay, and the higher the advertising revenue.

In 2021, Bier left Facebook to join Lightspeed Venture Partners as a product growth partner. In 2022, he and his original team launched Gas, an upgraded version of tbh, which added voting, gamification, and paid features, allowing users to pay to see who praised them.

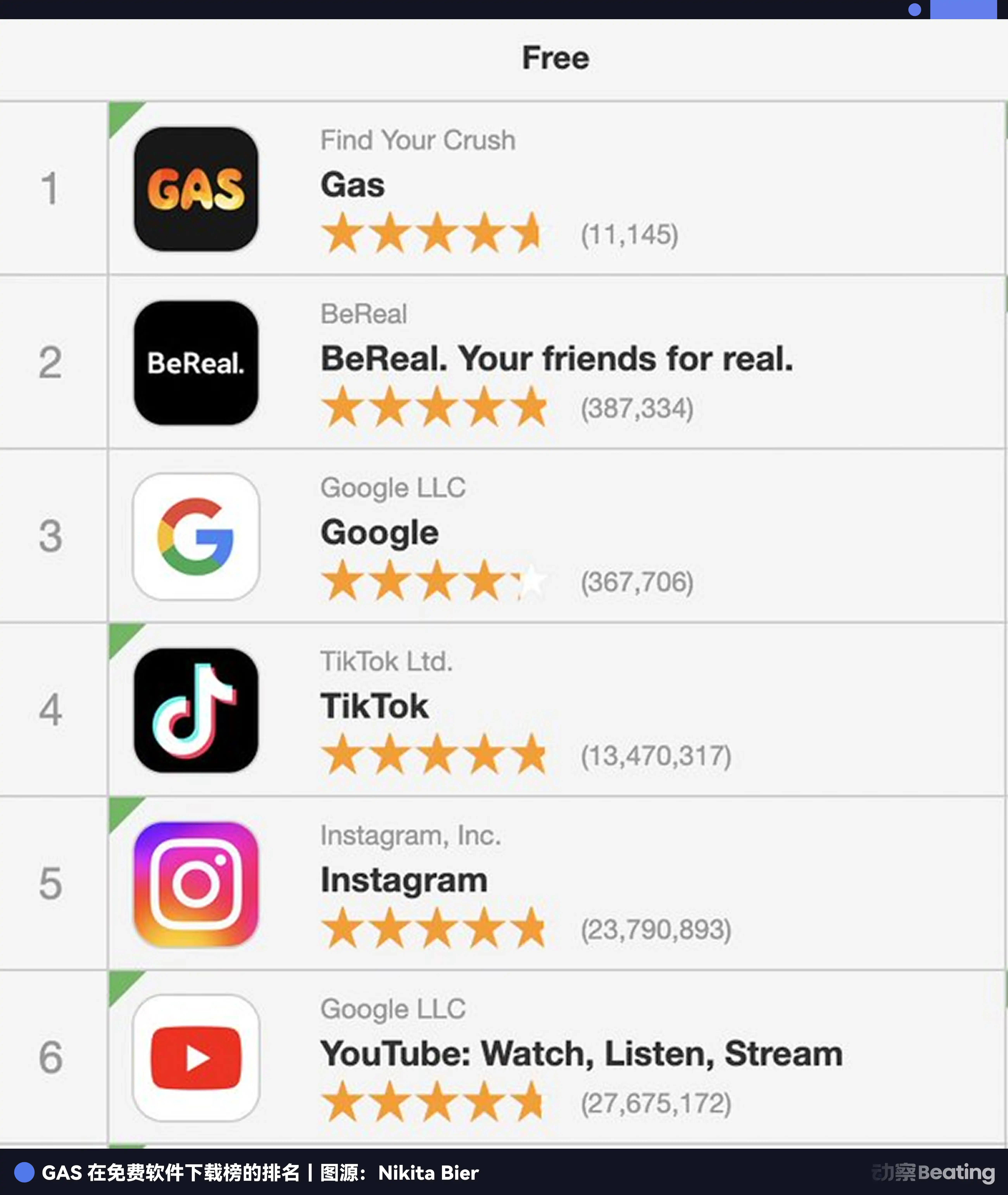

Gas attracted 10 million users within three months, generating $11 million in revenue, briefly surpassing TikTok and Meta to become the most popular app in the U.S. In January 2023, Discord acquired Gas for $50 million.

The success of Gas further validated Bier's key insight: the human desire for praise can be monetized. If you can create an environment where users crave to be seen and recognized, and then set a paywall at critical moments, users will not hesitate to spend money.

This insight was precisely what Musk needed.

In October 2022, Musk spent $44 billion to take over Twitter, renaming it X. In his blueprint, X would evolve into the ultimate closed loop of social and financial integration. But to realize this dream, Musk had to tackle a key proposition: how to dissolve the psychological barriers of users, allowing them to naturally engage in financial transactions while scrolling through social feeds.

This is fundamentally a question of human nature. What kind of driving force can encourage users to cross the psychological barrier of conducting transactions, investing, and saving on a social platform?

Bier's connection with Musk began with a bold self-recommendation. When Musk announced the acquisition of Twitter, Bier tweeted: "@elonmusk Hire me to run Twitter as VP of Product." This tweet received no response at the time, but Bier did not give up.

In the following three years, he continued to post on X, sharing deep thoughts on product growth, user psychology, and social networks. His tweets gradually accumulated significant influence, allowing Musk to see his profound understanding of products and human nature.

Thus, by June 2025, when X needed a product leader capable of integrating social and financial elements, Musk thought of Bier. When announcing his joining, Bier wrote: "I've officially posted my way to the top," and replied to his self-recommendation tweet from 2022: "Never give up."

This story itself is the best interpretation of Bier's concept that "influence is currency."

Before joining X, Bier also served as an advisor to the Solana Foundation, managing mobile strategy for the Solana Foundation. During this experience, he witnessed firsthand how cryptocurrencies achieved viral growth through social power and realized that influence itself had become a priceable and tradable financial asset.

Musk's choice of Bier aligns with his first principles thinking, where the essence of finance is not technology, but trust and emotion. You must know how to effectively leverage emotions.

And Bier is an expert in this area.

His series of actions on X are essentially a masterful manipulation of emotional leverage. Take, for example, his reform of X's creator incentives. Bier understands that for a platform to continuously generate high-quality content, it must address the core anxieties of creators. Thus, in plain sight, he upgraded X's creator incentive program, allowing creators to earn more money each cycle; meanwhile, behind the scenes, he is actively manipulating the algorithm to create stars.

In January 2026, well-known creator Dan Koe published a long article on X titled "How to Fix Your Entire Life in One Day." This article garnered 150 million views and 260,000 likes within a week, becoming the most-read long article in X's history.

This is the kind of strategy Bier employs. By pushing a deep long article to reach hundreds of millions of exposures, Bier sends a clear signal to all creators, especially those hesitating to invest in deep content on X: as long as your content is of high quality, X's algorithm will help you spread it.

This is a more sophisticated strategy than direct monetary incentives. It alleviates creators' fear of their content sinking into oblivion. Dan Koe's case allows them to believe that on X, deep thinking and high-quality content can be discovered and amplified by the platform.

This strategy is consistent with the psychological techniques Bier used in tbh and Gas. He realized that what creators need is to be seen and recognized. By establishing a benchmark for exposure, Bier precisely leverages the enthusiasm of the creator community, attracting more high-quality content to the platform, thus forming a positive ecological cycle.

Wealth Anxiety of Generation Z

This grasp of human nature enables Bier to repeatedly hit the pain points of target demographics. In financial matters, Bier faces a young generation repeatedly ravaged by financial anxiety.

In October 2024, BuzzFeed published an article titled "This Woman Reveals How She Deals with Financial Anxiety in Her 20s." The protagonist of the article is 27-year-old Hayley, who lives in northern Colorado and works as a receptionist at an animal clinic, earning $17 an hour.

She can only schedule 33 hours of work per week, and her monthly fixed expenses include: $600 for rent, $400 for a car loan, $150 for car insurance, $50 for electricity, $70 for her phone bill, $100 for student loans, and $50 for the minimum credit card payment, totaling $1,420. Although she sets aside $50 as pocket money each payday, this money often runs out quickly.

Hayley said, "Every expense comes with guilt; I always feel that this money should be saved. As long as the financial black hole isn't filled, I can't gain that fundamental sense of security that allows me to feel at ease. Maslow's hierarchy of needs is so right. I hate this society; it forces people to survive while depriving them of the space to live."

Hayley's story is a microcosm of an entire generation.

According to a Bank of America survey in July 2025, 72% of young people have changed their lifestyles due to rising living costs, and 33% of Generation Z feel significant financial pressure, with over half attributing it to economic instability. A study by Ernst & Young also emphasized that financial issues are the primary source of anxiety for Generation Z. Furthermore, a report by Arta Finance in 2024 indicated that financial pressure has even led 38% of Generation Z and 36% of millennials to enter a midlife crisis prematurely.

This anxiety has become the fuel for X's expansion into the financial realm.

After Nikita Bier joined X, he quickly initiated a series of product adjustments mentioned at the beginning of this article. However, Bier's true ambition is not just to make X a financial information platform; he wants X to become a financial trading platform.

According to a report by the Financial Times in November 2025, X is developing in-app trading and investment features, allowing users to purchase stocks and cryptocurrencies directly on X. X's CEO, Linda Yaccarino, revealed that Visa will be the first partner for XMoney accounts. As of December 2025, X Payments has obtained money transmission licenses in 38 U.S. states, covering approximately 75% of the U.S. population.

On X, every like, every comment, and every retweet is an expression of user emotions. Bier's task is to convert this emotional data into financial signals. If a user frequently likes tweets about a particular stock, X can infer their interest in that stock and push a purchase link at the right moment. If a user frequently comments on tweets about cryptocurrencies, X can infer they are a potential cryptocurrency investor and then push relevant investment products.

This is an emotion-based financial service. It does not require users to actively search, fill out complex forms, or undergo tedious verification. It only needs to capture users' emotional fluctuations and provide a simple trading entry point at moments of heightened emotion.

In an interview, Bier said, "Consumers do not choose to use a product because of functional differences, but because of the emotional resonance they experience while using that product." Similarly, the core logic of X's financialization is not to provide better financial services but to capture user emotions and convert them into transactions at moments of heightened emotion.

This model is particularly effective among Generation Z. According to a research report by the CFA Institute, 31% of Generation Z began investing before the age of 18, 54% of Generation Z investors obtain investment information through social media, and 44% of Generation Z investors hold cryptocurrencies, with an average of 20% of their investment portfolios consisting of cryptocurrencies.

For this generation, social media is not only a channel for obtaining information but also a place for making investment decisions. They do not trust traditional financial institutions and Wall Street analysts; they trust KOLs on social media, their own emotions, and intuition. X is precisely the amplifier of these emotions and intuitions.

The Curse of the Super App

However, before Musk and Bier, countless giants attempted to create super apps, and they all failed.

As a former mobile powerhouse, BlackBerry and its BlackBerry Messenger (BBM) were once just a step away from becoming a super app. Executives ambitiously planned to layer payments and services on top of social networking, attempting to build a digital empire of that era. But reality was harsh; a series of poor decisions led BlackBerry to suffer defeat in competition. By 2013, its once 20% market share had shrunk to less than 1%, and that grand imperial dream ultimately ended in failure.

BlackBerry's failure is not an isolated case. Amazon's attempt also ended in failure. In 2014, the Fire Phone, carrying Bezos's grand vision of merging e-commerce and social networking, quickly collapsed within a short time. This attempt not only cost Amazon a $170 million write-down but also became a significant blunder in Bezos's business career.

Reviewing these cases, we can summarize three reasons why super apps have not succeeded in the West.

First, there are highly specialized user habits. Users in Europe and America prefer independent applications that each serve a specific purpose. A small business owner often relies on Shopify for transactions, QuickBooks for accounting, and Slack for collaboration. In their view, being all-encompassing often means being mediocre, and super apps struggle to challenge the leaders in these specialized fields in terms of professional depth.

Second, there are stringent regulatory barriers and privacy red lines. The essence of super apps is data hegemony, while privacy protection is a critical issue for regulators in Europe and America. A single platform integrating vast amounts of data raises significant social concerns and exponentially increases compliance costs and the risk of data breaches.

Finally, there is an already entrenched landscape of giants. Mature markets do not have vacuum spaces; Google, Amazon, and Apple have long divided users' digital lives. New super apps not only face functional competition but also challenge users' brand loyalty to existing ecosystems.

So, can X achieve what others have failed to do?

X's advantages are clear; it comes with 550 million active users, and Musk has enough money and political resources to navigate regulatory challenges. Most importantly, X is not trying to build from scratch but is gradually adding financial functions on top of its existing foundation.

This incremental approach eliminates the hassle for users. There is no need to download anything or relearn operations; they just need to click an extra button on a familiar interface, and social and financial functions are integrated.

However, X faces significant resistance. American users are already accustomed to using Venmo for transfers and Robinhood for trading stocks and cryptocurrencies; these specialized applications are working well, so why switch to X?

This is the problem Nikita Bier needs to solve. His strategy is to integrate financial transactions into users' daily social behaviors. He is not begging you to "do business" on X; instead, he wants you to seamlessly buy a stock or cryptocurrency while scrolling through tweets. This seamless experience is the key to whether X can succeed.

But this seamless experience also brings a new problem. When social and financial functions merge, users' emotional fluctuations will be directly converted into financial transactions. Will this model exacerbate irrational market booms? Will it lead users to make poor investment decisions during emotional highs? Will it invite more regulatory troubles?

This question currently has no answer.

Emotional Alchemy

Over the past decade, we have witnessed the transformation of social media from "connecting people" to "creating emotions." We have seen the shift in the attention economy from "content is king" to "emotion is king." We have observed the change in wealth distribution from "capital is king" to "influence is king."

Nikita Bier's career is a microcosm of this transformation. He has evolved from an entrepreneur trying to change the world through rationality to a dopamine dealer who harvests users through emotional appeal.

This transformation is, in fact, an inevitability of the entire era. In an age of information overload and scarce attention, rationality gives way to emotion, logic yields to intuition, and the long term is sacrificed for the short term. In this era, whoever can create emotions can gain attention; whoever can gain attention can gain influence; and whoever can gain influence can gain wealth.

This is a new era, an emotion-driven era, an era where influence equals wealth.

In this era, each of us is a product of Nikita Bier. Our likes, comments, and shares are being captured by algorithms, analyzed by data, and amplified by emotions. Our attention, our emotions, and our influence are all being transformed into liquidity, wealth, and power.

In this era, emotion is the most powerful weapon and also the most dangerous poison.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。