The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies. Originally published on Jan. 21, 2026, by Cindy Feng.

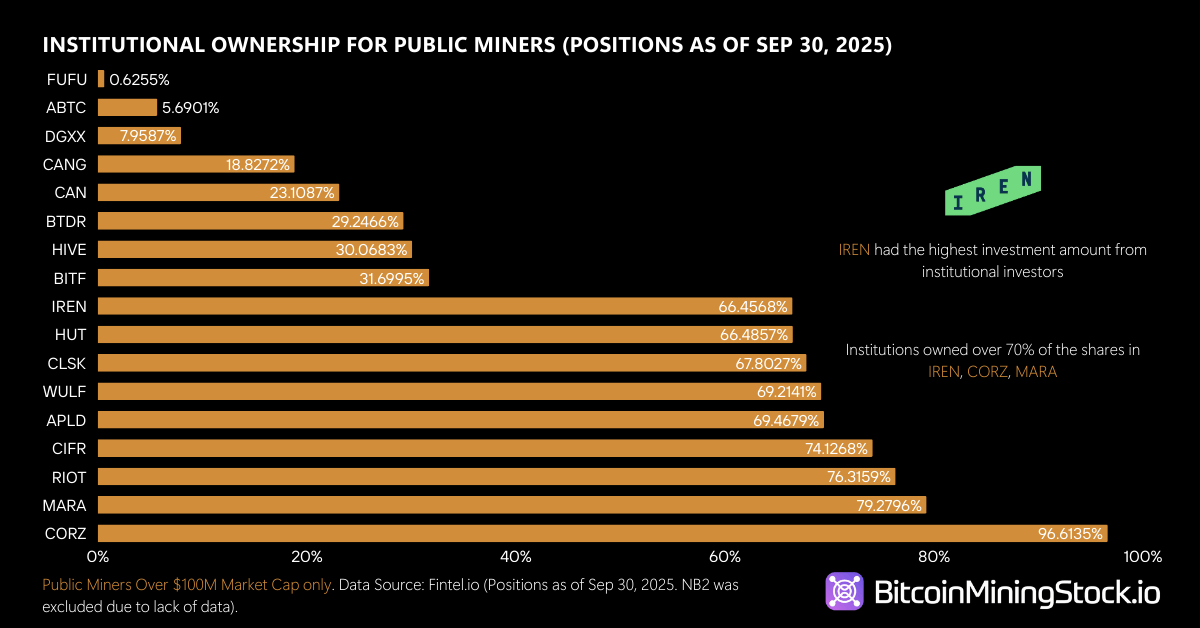

In 2025, institutional capital increasingly favored companies with AI and HPC data center exposure, rather than those focused solely on hash rate expansion.

*This analysis reflects institutional positioning based on SEC Form 13F filings covering the first nine months of 2025, the most recent data available.

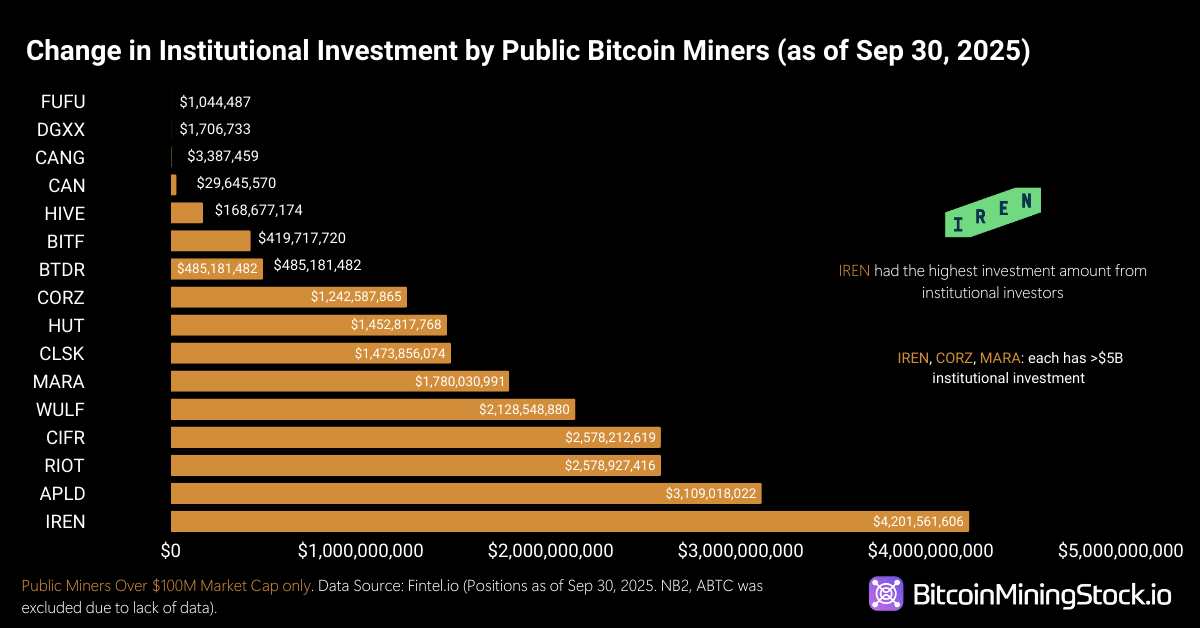

Across the latest disclosures, every publicly listed Bitcoin miner with a market capitalization above $100 million saw an increase in the dollar value of institutional holdings. But the concentration of new ownership tells a more important story.

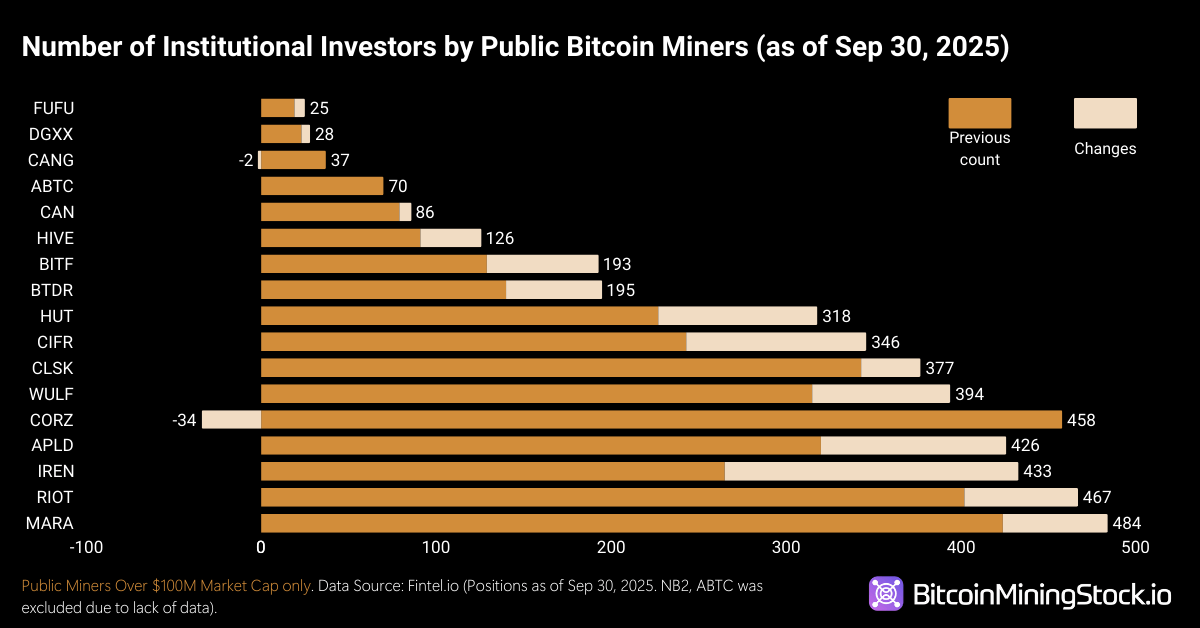

IREN, Applied Digital, and Cipher Mining recorded the largest increases in institutional holders, each adding more than 100 new owners. These companies share a common profile: direct exposure to hyperscale AI and HPC infrastructure supported by long-term contracts. Capital is not just following narratives, but also backing business models with diversified revenue potential beyond Bitcoin mining.

Dollar-weighted inflows reinforce this shift. IREN and Applied Digital led in absolute institutional capital added, followed by Riot Platforms, Cipher Mining, and TeraWulf. Riot remains an exception, drawing strong inflows despite not yet generating meaningful HPC revenue. The company, however, has repeatedly discussed their strategic pivot toward HPC/AI. Its inclusion in top inflows likely reflects its liquidity, longevity in U.S. markets, and name recognition.

Scale also matters. Large-cap U.S.-listed miners continue to attract the bulk of institutional capital. However, size alone is no longer sufficient. Several miners with billion-dollar market cap, such as Bitfarms, Bitdeer and American Bitcoin, saw comparatively less institutional traction. Factors like geolocations, IPO timing could play a role.

The main takeaway: institutions are re-rating Bitcoin miners less as pure Bitcoin proxies and more as digital infrastructure platforms. Hash rate growth alone is no longer enough to attract capital.

📙 Note: The full Investor Sentiment section of the Bitcoin Mining Market Review (2025–2026) includes the complete methodology (& its limitations) and a detailed discussion of company-level exceptions to the broader institutional allocation trends. You should refer to the original report for full context.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。