Original Title: “James Lavish, Unchained and The Informationist”

Translation: Golden Finance

1. Signal in the Noise

Did you notice the title?

JPMorgan has officially given a trendy name to a phenomenon that has been obvious for years: governments are destroying their own currencies, while savvy money is quietly withdrawing.

They call it the "debasement trade." When Wall Street starts naming a type of trade for clients, it means two things: the trade is already underway and is about to become mainstream.

But the key point of this trend is: regardless of what Wall Street calls it, this is not a "trade" at all.

Trading implies tactical operations. Entering, exiting, perhaps repeatedly trading in waves. Timing the market, locking in profits, and moving on to the next opportunity when the trade no longer looks attractive.

Hedge funds and trading desks operate this way: entering, exiting, and cycling through.

What JPMorgan describes, whether they realize it or not, is a more fundamental transformation. This is not a trade; it is a permanent structural shift in how you think about wealth accumulation, savings, and long-term asset allocation. It is an investment philosophy suited for a world where fiat currencies are systematically debased.

This has nothing to do with timing trades, but rather recognizing that the market itself has fundamentally changed.

The core insight I want to share with you today is: gold is the signal, and Bitcoin is the ultimate beneficiary.

Let me explain this in detail and why I am so convinced of it.

2. Decoding the "Debasement Trade"

First, let’s look at JPMorgan's specific statement. Here is their explanation of the driving factors behind this trade:

"The debasement trade refers to the trend of increasing demand for gold and Bitcoin due to the structural rise in geopolitical uncertainty since 2022, the ongoing high uncertainty of long-term inflation, concerns about 'debt debasement' triggered by sustained high fiscal deficits in major economies, worries about the future independence of central banks, and a general decline in confidence in fiat currencies."

—— JPMorgan, October 2024

Now let’s break down Wall Street's jargon and explain it in plain language. For those who haven’t followed this topic for years, the truth may be shocking.

Plain interpretation is as follows:

"Structural rise in geopolitical uncertainty since 2022" = We don’t know what actions governments will take next, and they don’t know either. Trade wars, proxy wars, sanctions, and counter-sanctions are intertwined. The old rules of the global order are being rewritten.

"Ongoing high uncertainty of long-term inflation" = Inflation will not return to 2% and stay there. The government’s demand for structural, persistent inflation is too urgent. The Federal Reserve knows this. The era of stable low inflation is over.

"Concerns about 'debt debasement' triggered by sustained high fiscal deficits in major economies" = Governments are spending money they don’t have and will continue to do so. The only way to manage such massive debt is through inflationary dilution.

"Worries about the future independence of central banks" = The Federal Reserve will do whatever it takes to maintain the government's solvency. When the alternative is sovereign debt default, the illusion of central bank independence becomes increasingly difficult to maintain.

"General decline in confidence in fiat currencies" = People are gradually realizing that the dollar, euro, and yen have permanently lost purchasing power, and this trend continues. This is not just sentiment; it is reflected in actual behavior.

Summary: Your cash is being debased, and you need hard assets now.

3. Why This Is Not a "Trade"

We need to pause here to emphasize a crucial point.

Wall Street likes to package everything as a "trade." This is their way of thinking and their means of generating revenue and profit. Trades have entry and exit points, building positions, closing positions, repeated operations, calculating profits and losses, and when a trade is no longer attractive, moving on to the next idea.

But what JPMorgan describes is not that kind of trade. You cannot "exit" the debasement trade. There is no moment when you can say, "Okay, the government has stopped debasing the currency; it’s time to move back to cash and bonds."

It is not like that at all.

What we are discussing is a fundamental reconfiguration of how you store wealth in your lifetime. It is an acknowledgment that the rules have changed, and the traditional "60/40 portfolio" (allocating a large portion of assets to bonds) is no longer applicable in a world of ongoing debasement.

This is an investment philosophy, not a trade. It is a wealth preservation framework that spans decades, not quarters.

4. What Is the Nature of Debasement?

You might ask, "What does 'debasement' really mean?"

Let’s break it down.

The most basic definition is: the government deliberately undermines the purchasing power of its currency. Historically, this has often been achieved by reducing the edges of coins or lowering their precious metal content.

In ancient Rome, emperors would recall silver coins, melt them down, mix in cheaper metals, and reissue coins with the same face value but lower intrinsic value.

For example, Emperor Nero. After the Great Fire of Rome in 64 AD, he recalled Roman silver coins, melted them down, mixed in base metals, and reissued lighter coins with unchanged face value. This seemingly clever short-term budget solution was, in fact, a slow plunder of Roman savers, ultimately eroding trust in the currency and even in the emperor himself.

Today’s debasement methods are more complex, at least in form, and more insidious. Because you cannot see it happening in real-time like you can with a coin being reduced.

Take the United States as an example; modern debasement is primarily achieved through excessive government spending driven by the Treasury, supported by the Federal Reserve. Additionally, the expansion of credit in the banking system, financial repression through negative real interest rates, and crisis rescue plans funded by newly created money further exacerbate debasement.

The result is: every dollar you hold will lose purchasing power over time. The key is: this is not a temporary situation that will reverse. The government needs sustained inflation to keep the debt burden manageable. But the harsh reality is:

No fiat currency can maintain its purchasing power in the long term, without exception.

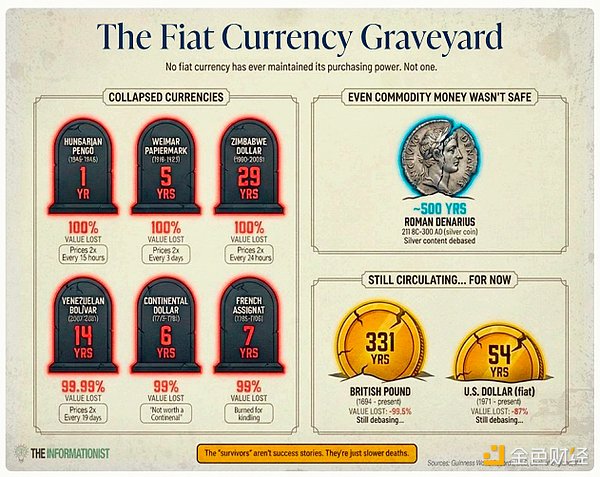

This is not an exaggeration. Depending on the definition of "failure," there have been hundreds to thousands of fiat currencies that have collapsed in history. While estimates vary, dozens of fiat currencies have perished due to hyperinflation, and many more have been gradually eliminated through slow debasement. The "graveyard" of failed currencies is vast.

The assignats after the French Revolution became worthless within seven years; the Continental currency, you may have heard the phrase "not worth a Continental"; the Weimar Republic's mark, where Germans preferred to burn money for warmth because it was cheaper than firewood; the Hungarian pengő, which experienced the worst recorded hyperinflation, with prices doubling every 15 hours; the Zimbabwean dollar, which issued absurd banknotes with a face value of 100 trillion; the Venezuelan bolívar, which was debased by 99.99%, forcing millions to flee their homes.

The graveyard of fiat currencies: no fiat currency can maintain its purchasing power in the long term, without exception.

These are just dramatic collapse cases.

There are dozens of currencies that have quietly disappeared through revaluation, replacement, or slow erosion. Argentina has changed its currency five times since 1970, while Brazil has changed it eight times. The pattern is always the same: governments print money, currencies collapse, and the people suffer.

Note: Roman silver coins were technically not fiat currency, but coins with actual intrinsic value. However, emperors still debased them, reducing their silver content from 95% pure silver to less than 5% over three centuries. The lesson is: governments can always find ways to debase currency, and fiat currency merely removes the obstacles to this process.

What took Rome 500 years to happen can now be completed in just ten years.

What about the "survivors"? The British pound has been in circulation since 1694 and is one of the oldest currencies still in existence; does that count as a success story?

Not at all. Since 1914, the pound has lost 99.5% of its purchasing power. Today’s pound has the purchasing power equivalent to a penny from a century ago. It did not collapse in hyperinflation; rather, it has been slowly eroded decade after decade through the Bank of England's money printing and debasement.

The "survivors" are not success stories; they are just dying more slowly.

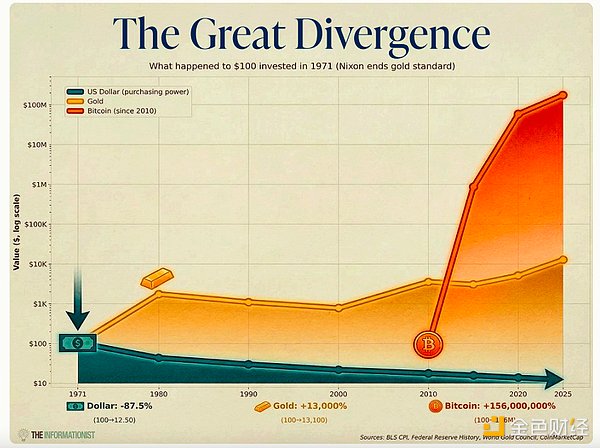

The dollar has been completely detached from gold and has been fiat currency for only 54 years, during which it has lost 87% of its purchasing power. This duration has exceeded the average lifespan of fiat currencies. And those who issue this currency are acting in ways that reveal their true views on its future.

The question is not whether fiat currency will fail, but how it will fail: through rapid collapse via hyperinflation or through slow demise via ongoing debasement. Either way, the outcome is the same.

Unlike past debasements that spanned decades or centuries, this time the debasement has a clear sense of urgency. To understand the reasons and methods behind it, let’s look at the relevant data.

5. Key Data Driving Permanent Change

Many of you may have heard me talk about this topic before. But for today’s theme, it’s worth a brief review, as this data proves this is not a tactical trade but a structural change with no exit mechanism.

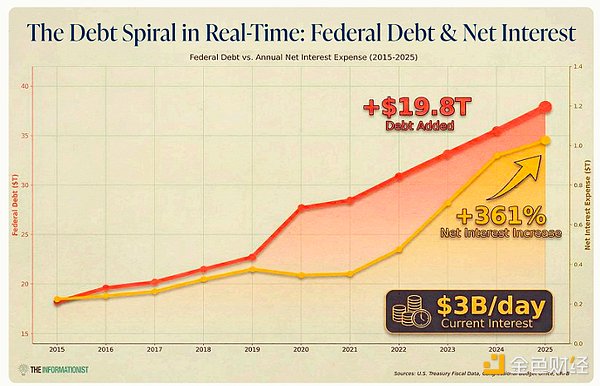

By the end of 2025, U.S. federal debt will exceed $38.4 trillion. In just three years, it has increased by over $7 trillion.

From a historical perspective: it took the U.S. from 1776 to 2005, 229 years to accumulate its first $7 trillion in debt. Yet we have added the same amount of debt in just three years.

But the real issue is not the debt itself, but the cost of servicing that debt.

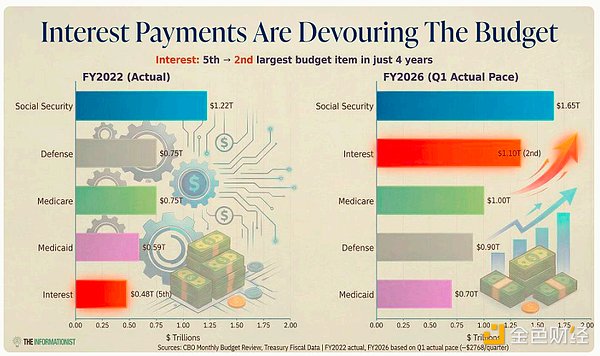

Annual interest payments have soared to over $1.1 trillion, making it the second-largest expenditure in the federal budget, only behind Social Security. We are paying about $3 billion in interest every day, not including the principal.

Real-time debt spiral: Federal debt vs. net interest (2015-2025)

This is the true picture of the debt spiral: increasing debt leads to rising interest rates, rising interest rates lead to increased interest payments, increased interest payments lead to a widening deficit, and a widening deficit requires more debt financing. It cycles and intensifies.

Interest payments devour the budget: in just four years, interest payments have jumped from the fifth-largest budget item to the second.

In just three years, interest payments have risen from the fifth-largest budget item to the second.

6. No Third Option

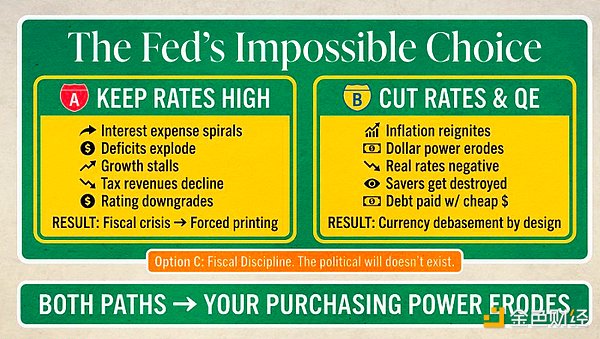

So, what will the Federal Reserve do?

Option A: Maintain high interest rates to combat inflation. But this will lead to further spiraling interest payments, explosive growth in the deficit, and stagnation in economic growth. Ultimately, the bond market will stagnate, and they will be forced to turn to Option B.

Option B: Lower interest rates and restart quantitative easing (QE). Inflation will return, and the purchasing power of the dollar will continue to erode. But the government can repay its debt with devalued dollars. This is the path of least resistance.

There is no Option C to "solve" the problem through fiscal tightening. This is politically tantamount to suicide and will never be realized. The Treasury's own data also clearly indicates the future direction: the U.S. Treasury predicts that under its assumed scenarios, the debt-to-GDP ratio will exceed 200% by 2049 and reach 535% by 2099.

Thus, the only path is one that is unfavorable to fiscal health.

All roads ultimately lead to currency devaluation.

The truth is, debasement is not a prediction but a recognition that the data has determined the outcome. And this data will not change.

This is why calling it a "trade" completely misses the point. You cannot trade around a permanent condition; rather, you should adjust your entire investment philosophy to accommodate it.

This raises a troubling question: If debasement is inevitable, what fate awaits the traditional portfolios that many long-term investors and private clients still hold?

7. The Demise of the 60/40 Portfolio

Why "balanced" portfolios are destined to lose today

For decades, the 60/40 portfolio has been the gold standard of prudent investing: 60% allocated to stocks for growth and 40% allocated to bonds for protection. Simple, elegant, and recognized with a Nobel Prize.

But the situation changed everything in 2022.

The 60/40 portfolio lost 17.5%, marking its worst performance since 1937 and the fourth worst annual performance in 200 years. Stocks fell 19%, the aggregate bond index dropped 13%, and many retirees relying on long-term government bonds for income plummeted by 31%. The so-called "balanced" portfolio completely lost its balance.

But what is concerning is that 2022 was not an anomaly; it heralds a trend for the future.

According to Morningstar's 150 years of analysis, 2022 was the only year in 150 years when bonds failed to provide any diversification benefits during a stock market decline. In a century and a half, only this once.

What exactly has changed? Everything has changed.

The end of a 40-year tailwind

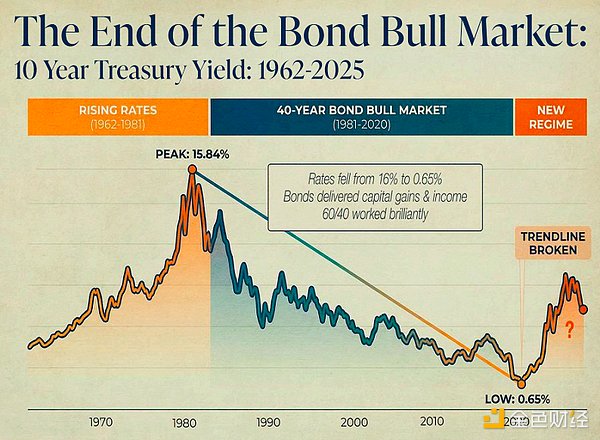

Look at the chart of 10-year U.S. Treasury yields since 1962.

10-Year U.S. Treasury Yields (1962-2025)

Phase One: Rising Rates (1962-1981). Yields climbed from 4% to a peak of 15.84% in September 1981. Bonds were a poor investment, as rising rates led to falling prices.

Phase Two: 40-Year Bond Bull Market (1981-2020). This era created the 60/40 portfolio and legends of fixed income like Bill Gross of PIMCO ("the Bond King").

What was the reason? Yields fell from 16% to 0.65%, a continuous decline lasting forty years. As rates fell, bond prices rose, allowing investors to earn interest income while also achieving capital appreciation. The 60/40 portfolio was not only "balanced" but also gained strong growth momentum from a one-way bet.

- Phase Three: New Paradigm (2020-Present). The trend line has been broken, with yields soaring from 0.65% to over 4%. The forty-year tailwind has turned into a headwind.

Many investors never understood: the stellar performance of the 60/40 portfolio was a product of a specific and non-replicable era. This was not only due to the negative correlation between stocks and bonds but also because bonds were in a continuous forty-year bull market, providing capital appreciation in addition to interest.

That era has ended. Rates cannot drop from 16% to zero again; they are already at extremely low levels. The logic that once made the 60/40 portfolio shine is no longer applicable.

Correlation Reversal

Beyond the end of the bond bull market, a more fundamental change has occurred.

The effectiveness of the 60/40 portfolio was due to the historical inverse relationship between stocks and bonds. When the stock market crashed, investors flocked to bonds for safety, driving up bond prices. This negative correlation is the cornerstone of modern portfolio theory.

But this negative correlation is a product of a specific paradigm, which has now ended.

From 2000 to 2021, the correlation between stocks and bonds remained negative, with bonds serving as a reliable hedge. However, in 2022, this correlation flipped to +0.60, meaning stocks and bonds moved in sync, with some indicators even reaching +0.70.

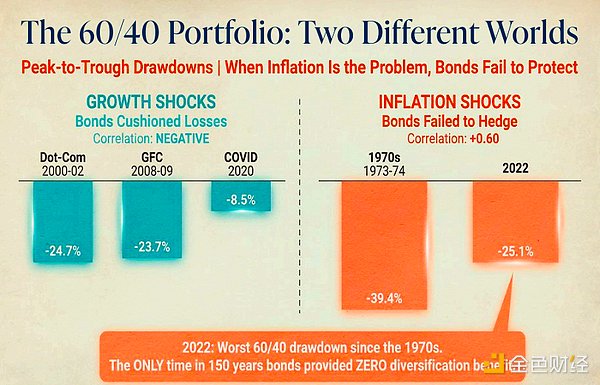

The chart below tells you the truth.

Two Worlds of the 60/40 Portfolio

During growth shocks like the bursting of the internet bubble, the global financial crisis, and the COVID-19 pandemic, bonds performed their expected role, cushioning losses. The COVID-19 crash had almost no impact on the 60/40 portfolio.

But during inflation shocks? Disaster struck. The stagflation of the 1970s led to a 39.4% drawdown in the portfolio, while the mixed portfolio saw a 25.1% drawdown in 2022, with bonds not only failing to cushion losses but exacerbating them.

Research from BlackRock clearly shows: bonds can hedge against growth shocks but cannot hedge against inflation shocks.

When the economy slows, the Federal Reserve lowers interest rates, and bond prices rise, cushioning stock losses. But when inflation becomes a problem, the Federal Reserve raises interest rates, simultaneously hitting both the stock and bond markets.

8. Why This Is Structural, Not Cyclical

This is where the argument for the debasement trade directly relates to your portfolio.

We have discussed the relevant data: the debt spiral, explosive growth in interest payments, and the Federal Reserve's dilemma. The question is not whether inflation will be high, but whether the government can bear the consequences of low inflation.

The answer is clearly no.

Economists refer to this as "financial repression": keeping interest rates below inflation for an extended period to slowly "liquidate" debt. This is not a theory but a historical fact.

After World War II, the real yield on U.S. government debt was negative in about half of the years, and this "invisible tax" on savers reduced the real value of U.S. debt by about 3%-4% of GDP each year. Combined with strong economic growth, this helped reduce the federal debt-to-GDP ratio from about 120% in 1946 to 60% in the mid-1950s, and further down to about 30% by the mid-1970s.

Today, this strategy remains the only viable path forward.

If the government needs inflation to be higher than interest rates, then bonds cannot protect your portfolio.

This is not a temporary situation but a structural inevitability.

How it works:

When your bond yield is 4% and the inflation rate is 5%, your purchasing power will inevitably lose 1% each year. As deficit spending continues, inflation will inevitably soar, and your stocks and bonds will suffer simultaneously.

The 60/40 portfolio performed well over forty years because we were in a specific paradigm: falling inflation, falling interest rates, negative correlation between stocks and bonds, and a bull market in bonds. Now, we are entering an era of structural inflation, financial repression, positive correlation, and declining bond yields without a tailwind.

In this environment, bonds cannot hedge against risk; they will only continue to erode wealth.

New Diversification Tools

If bonds cannot hedge against inflation, what can?

Assets with inelastic supply: those that cannot be printed, devalued, or eroded by inflation.

This is precisely why central banks have been steadily increasing their gold holdings recently. They understand the impending transformation. This is also why institutions like BlackRock and the Abu Dhabi sovereign wealth fund are including Bitcoin alongside gold in their asset allocations. Both assets exist outside the system that needs to be debased.

The traditional view that portfolios should be "balanced" through bond allocation is now actually harmful. You are not only failing to reduce risk but also ensuring that wealth suffers long-term losses due to inflation while missing out on potential compensatory gains.

In a world of financial repression, hard assets are not just an opportunity; they are a necessity.

Thus, it is no surprise how those who actually print money allocate their reserve assets.

9. Gold: The Signal

Hard assets are the answer, but how do we know this is not just theory?

Look at the actual actions of those who print money.

Interestingly, while most investors are still debating whether debasement is real, a group of participants has already made a decision. And they should be the ones most aware of the situation.

They are the central banks.

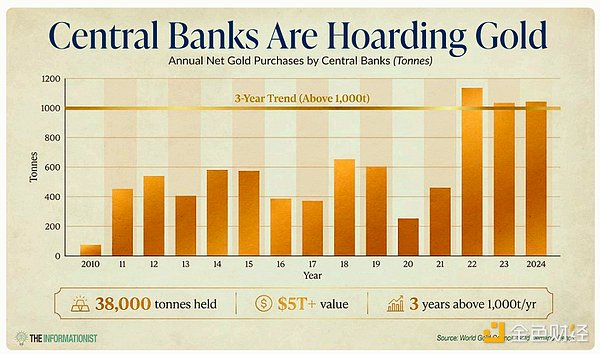

These money-printing institutions are buying gold at the fastest pace in decades, and they are doing so openly.

Central banks currently hold nearly 38,000 tons of gold, valued at over $5 trillion at current prices. This accounts for about one-fifth of all the gold ever mined in human history, stored in the vaults of various governments.

From 2010 to 2024, central banks have net purchased over 1,000 tons of gold each year for three consecutive years.

Previously, buying 500 tons a year was considered a large-scale purchase. According to a survey by the World Gold Council in 2025, 43% of central banks plan to increase their gold reserves in the next 12 months, up from 29% last year. Meanwhile, as many as 95% of central banks expect global central bank reserves to increase, up from 81% last year.

Please read that again: nearly half of central banks plan to increase their gold holdings, and almost all central banks expect this trend to continue.

When money printers start buying gold, they are telling you something important about the currency they are printing.

This is why we view gold as a signal. Central banks are not speculating or day trading; they are making structural, long-term asset allocation decisions. They are readjusting their reserve assets for a world of currency devaluation.

Notably, they are not "trading"; they are permanently increasing their holdings.

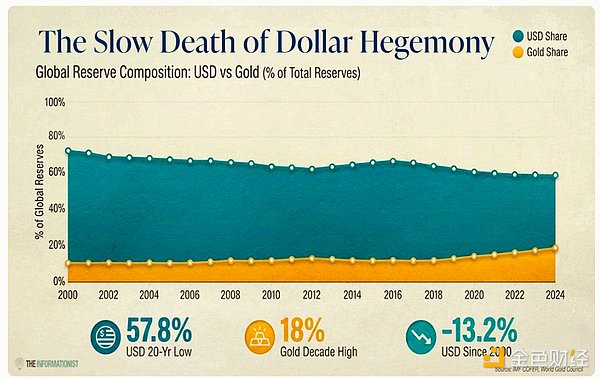

The dollar's share of global foreign exchange reserves has fallen to about 57.8%, a 20-year low. Gold's share has risen to 18%, a multi-decade high. Central banks are not only buying gold but are also actively reducing their exposure to the dollar.

By 2025, gold returns are expected to exceed 60%, with trading prices breaking through $4,500 per ounce, more than doubling from a few years ago.

This is not speculation or a bubble; it is a vote by the world's most complex monetary institutions using their reserve assets. They are clearly telling you what is about to happen.

10. Bitcoin: Following the Signal of Gold

This is where Bitcoin comes into play.

I have previously written about a pattern that is worth reiterating: Bitcoin often follows significant trends in gold, but with more pronounced gains.

When gold rises due to concerns about currency devaluation, Bitcoin eventually follows suit, and its gains typically exceed those of gold. Not immediately in sync, but over the long term, the correlation is undeniable.

Why is this?

Because gold and Bitcoin share a critical characteristic in a world of devaluation: neither can be arbitrarily created by governments or central banks.

The supply of gold is limited by geological conditions and mining costs. Bitcoin's supply is limited by its protocol: there will only ever be 21 million Bitcoins created. That’s it; no emergency Federal Reserve meeting can print more Bitcoin.

But what’s more interesting is:

Bitcoin is a superior hard currency compared to gold.

This may be controversial for gold enthusiasts; for Bitcoin supporters, it is already a consensus. But for those unfamiliar with Bitcoin, let’s explain why this is the case from a data perspective.

The supply of gold increases by about 1.5%-2% annually through mining, making its scarcity relative rather than absolute. In the foreseeable future, a fixed amount of gold will enter circulation each year.

Bitcoin's supply, however, follows a fixed diminishing schedule, with block rewards halving approximately every four years. There will only ever be 21 million Bitcoins. As of December 2025, about 19.96 million Bitcoins have been mined, accounting for over 95% of the total supply. Approximately 1.04 million Bitcoins (about 5% of the final supply) will be mined over the next century.

After that, the issuance of new coins will drop to zero. No new Bitcoins will ever be created again.

Bitcoin is the highest quality hard currency that has ever existed in human history.

For thousands of years, gold has successfully protected wealth during every instance of currency devaluation. When Rome devalued its silver coins, gold held its value; when the Weimar Republic printed too many marks, gold held its value.

Since Nixon closed the gold window in 1971, the price of gold has risen from $35 per ounce to over $4,000.

Gold can preserve value; that is its mission, and it does it well.

But what about Bitcoin? Bitcoin has the potential to significantly enhance purchasing power because it combines the monetary properties of gold with characteristics that gold has never possessed: absolute scarcity and a new adoption curve.

Bitcoin is currently lagging behind gold.

Let’s look at the situation in 2025.

Gold rose over 60% last year, repeatedly breaking historical highs, with strong buying momentum from central banks. The signals of devaluation are extremely strong.

Meanwhile, Bitcoin fell below $90,000, down over 25% from its October high of over $125,000.

Bitcoin has significantly "lagged" behind the latest trends in gold.

Why this disconnect? Because many investors, especially traditional financial allocators, still primarily view Bitcoin as a "risk asset" rather than a monetary asset. When liquidity concerns escalate or the market shifts to risk aversion, Bitcoin often drops ahead of or alongside tech stocks and other speculative assets. Despite the fundamental differences in Bitcoin's value proposition, this reflexive behavior persists.

The result is that Bitcoin's price movements remain noisy and volatile, heavily influenced by short-term liquidity flows. It reacts to Federal Reserve announcements, stock market sentiment, and risk appetite, while gold, with its 5,000-year history, does not.

But therein lies the opportunity: this cognitive gap is temporary, and it creates asymmetric return opportunities.

As more institutions, sovereign wealth funds, and central banks understand Bitcoin's monetary properties, the "risk asset" label will gradually fade. Bitcoin will increasingly be traded as a true store of value rather than the speculative tech bet that many still perceive it to be.

Until then, every sell-off triggered by risk aversion is an opportunity for long-term investors who already understand this logic. You are buying an asset with gold-like monetary properties at a discount, and the discount comes from those who have yet to grasp its value.

History shows that when gold continues to rise due to concerns about monetary policy, Bitcoin will eventually follow, and its gains will be larger.

There are four reasons:

Superior monetary properties: absolute scarcity is better than relative scarcity.

Earlier adoption curve: a smaller market cap means the potential for larger percentage gains.

Additional utility: payment networks, programmable money, self-custodial sovereignty.

Network effects: as adoption increases, value grows exponentially.

11. Asymmetric Opportunities

The data is compelling.

At current prices, the total value of all mined gold globally is about $30 trillion. It is a mature asset widely held by households, institutions, and central banks, serving as a store of value for thousands of years.

Bitcoin's market cap is about $2 trillion.

But Bitcoin is only 16 years old.

As institutions and sovereign nations adopt Bitcoin as a reserve asset, if it captures just a small portion of the gold monetary premium, its upside potential will be substantial.

Simple calculations: if Bitcoin's market cap grows to half that of gold ($15 trillion), the current price would rise 7-8 times; if it reaches parity with gold at $30 trillion, the current price would rise 15-17 times.

More importantly, there is ample reason to believe that Bitcoin's monetary premium should ultimately exceed that of gold because Bitcoin is objectively a superior hard currency with attributes that gold cannot match.

The Great Divergence: Performance of a $100 Investment in 1971 (Nixon Ends the Gold Standard)

Consider what advantages Bitcoin offers that gold cannot match:

Absolute scarcity: precisely 21 million, not an approximation.

Portability: for just a few dollars, you can transfer $1 billion worth of Bitcoin to any corner of the globe in 10 minutes. Transferring the equivalent value in gold, even just a few miles, involves logistics and costs that are daunting.

Confiscation resistance: properly stored Bitcoin cannot be confiscated. Carrying assets across borders can pose significant risks; just ask those who have fled hostile environments or had cash or gold bars confiscated at borders.

Verifiability: cryptographic verification is more convenient and reliable than testing gold for purity and weight.

Gold is a safe, verified, time-tested choice. It is unremarkable, reliable, and stable, protecting your purchasing power during devaluation cycles.

Bitcoin, on the other hand, is an asymmetric opportunity. It possesses all the monetary properties of gold, along with additional advantages, and is in an earlier stage of adoption. For investors with a long-term view, its risk/reward ratio is highly attractive.

Some savvy investors have not only noticed this but have also committed their capital.

12. Institutional Transformation Has Already Happened

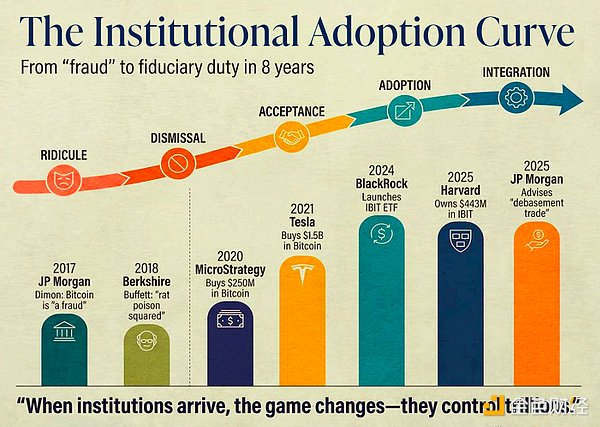

Five years ago, Bitcoin was called "rat poison squared" by Warren Buffett and labeled a "fraud" by Jamie Dimon (CEO of JPMorgan). It was seen as a fringe asset for speculators and criminals.

Now? The transformation is shocking.

Vanguard, the most conservative asset management company in the U.S., with $9.3 trillion in assets under management, has just opened its platform to Bitcoin ETFs. After 691 days of refusing to allow clients to participate in spot Bitcoin ETF trading, the company has completely changed its stance. The former CEO, who called cryptocurrencies "too volatile and speculative," has left, and the new CEO, Salim Ramji, was a former BlackRock executive who helped launch the world's largest Bitcoin ETF (IBIT).

This is no coincidence; it is a signal.

JPMorgan, the very bank whose CEO once called Bitcoin a "fraud," now allows institutional clients to use Bitcoin as collateral for loans.

By 2026, you will be able to apply for credit lines at the largest banks in the U.S. using Bitcoin holdings. The bank will also launch crypto asset-backed lending products with loan-to-value ratios of up to 25%. Morgan Stanley will also open Bitcoin trading to E*Trade clients in 2026.

This is not limited to U.S. institutions.

The Abu Dhabi sovereign wealth fund doubled its Bitcoin holdings in the third quarter of 2025. The Abu Dhabi Investment Authority increased its IBIT holdings by 230%, from 2.4 million shares to nearly 8 million shares, valued at over $517 million. Their statement to Bloomberg clearly stated: "We view Bitcoin as a store of value similar to gold, and as the world continues to move towards a more digital future, we believe Bitcoin will play an increasingly important role alongside gold."

Read that again: a sovereign wealth fund managing over $1.7 trillion in assets explicitly categorizes Bitcoin alongside gold.

And then there’s Harvard University.

The Harvard endowment currently holds 6.8 million shares of the BlackRock Bitcoin ETF (IBIT), making it the fund's largest publicly disclosed stock holding.

This position is also accelerating; in just the third quarter of 2025, they added 4.9 million shares. They are not just dipping their toes in; they increased their holdings nearly threefold in a single quarter. At $50 per share for IBIT, this represents a $340 million exposure to Bitcoin.

One of the world's most prestigious and conservative institutional investors has made Bitcoin its largest stock holding and is actively increasing its position.

Note: None of these institutions are "trading" Bitcoin. They are not seeking quick profits but are making strategic allocation decisions based on long-term portfolio construction.

This is the transformation: from a trading tool to a strategic asset class.

Institutional Adoption Curve: From "Fraud" to Fiduciary Responsibility in 8 Years

"When institutions enter the game, the rules change—they control trillions of dollars in capital."

We are witnessing in real-time a typical technology adoption curve:

Ridicule ("Bitcoin is a tool used by drug dealers")

Denial ("This is a bubble that will eventually burst")

Acceptance ("Perhaps there is some value in it")

Adoption ("We should allocate some")

Integration ("This is the new normal for how money works")

When institutions enter the game, the rules change. Not because they are smarter, but because they control trillions of dollars in capital. Even if just 1% flows into Bitcoin, the price will experience significant volatility.

Vanguard alone has 50 million clients, JPMorgan manages $4 trillion in assets, the Abu Dhabi sovereign fund controls over $1.7 trillion, and Harvard's endowment is $50 billion.

And this is just the beginning.

13. From Trading to Philosophy

So what does all this mean for you?

We have covered a lot: debt data, the Federal Reserve's dilemma, the demise of the 60/40 portfolio, the signaling role of gold, the opportunity in Bitcoin, and the institutional transformation that has already occurred.

Now let’s summarize.

JPMorgan calls it the "debasement trade," but as we have clarified, this is not just a trade. It is an investment philosophy applicable to the new monetary reality.

Every investor needs to ask themselves: what proportion of my long-term wealth should be allocated to assets that cannot be devalued?

Recently, some experts have shared their views.

Ray Dalio suggests that investors allocate 15% of their total assets to gold or Bitcoin to hedge against high government debt and currency devaluation risks.

Morgan Stanley recommends allocating up to 20% of assets to gold and Bitcoin in a new "60/20/20 portfolio" (stocks/bonds/hard assets).

Fidelity suggests that young investors allocate up to 7.5% of their assets to Bitcoin.

The answer varies by individual, depending on liquidity needs and the willingness and ability to endure volatility. The longer the investment horizon, the higher the allocation can be.

Wall Street packages it as a "trade" because that’s their sales product, but money printing will not stop, and devaluation will not end.

Does this still sound like a trade?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。