The S&P 500 index and Bitcoin price charts are displayed side by side, with the two curves showing remarkable synchronization recently, while gold prices are climbing independently on another trajectory. The myth of digital gold seems to be rewriting itself in the digital age.

At the beginning of 2024, the approval of Bitcoin spot ETFs marked the start of a new era for the mainstreaming of digital assets; in March of the following year, Trump signed an executive order announcing the establishment of a strategic Bitcoin reserve in the United States.

Institutional investors and governments around the world began to view Bitcoin as a store of value alongside gold. However, market data reveals another story: the correlation between Bitcoin and the Nasdaq index once reached as high as 0.8, while its correlation with gold was nearly zero.

1. Myth Evolution: The Rise and Challenges of the Digital Gold Narrative

● Since its inception, Bitcoin has been closely associated with the title of "digital gold." This analogy stems from the shared characteristic of scarcity between Bitcoin and gold—Bitcoin has a total supply cap of 21 million coins, echoing the limited supply of gold.

● The approval of Bitcoin spot ETFs at the end of 2023 and the beginning of 2024 became a turning point for the market. These financial products provided compliant investment channels for traditional investors, leading to billions of dollars in institutional funds flooding into this space.

● With the Trump administration announcing the establishment of a strategic Bitcoin reserve in 2025, the institutionalization of Bitcoin reached new heights. The U.S. government became one of the largest holders of Bitcoin globally, with holdings exceeding 207,000 coins.

This policy shift not only enhanced Bitcoin's legitimacy but also sparked widespread discussion about whether it can truly fulfill the role of "digital gold."

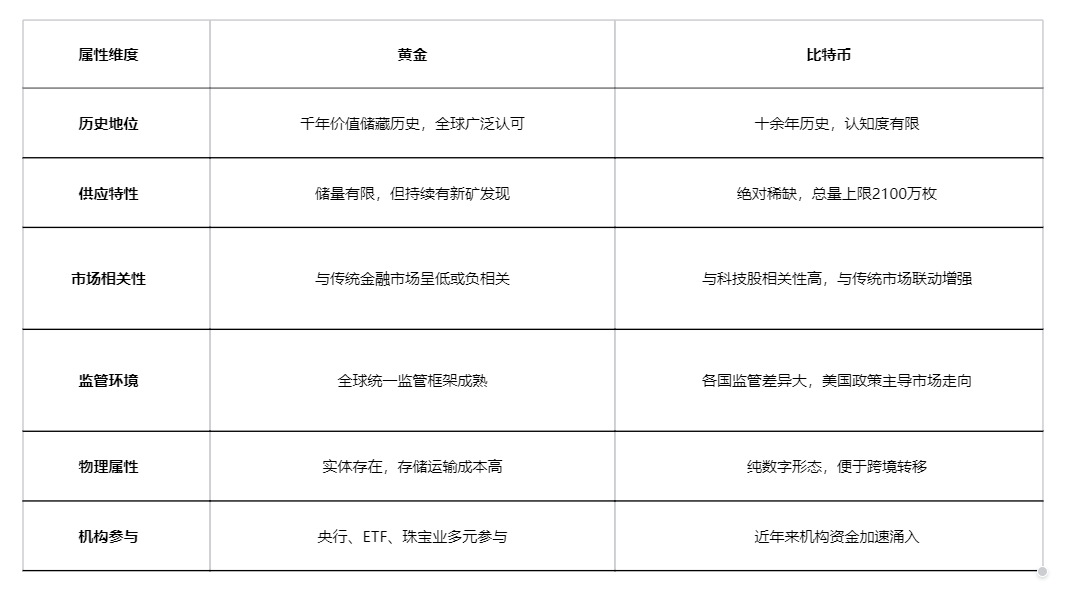

2. Attribute Comparison: Essential Differences Between Digital Gold and Traditional Gold

Although Bitcoin and gold are often compared, there are significant differences in their key attributes. Gold's status as a safe haven has been tested over millennia, while Bitcoin's "safe haven" properties are more conditional.

● According to analysis from CITIC Securities, the main reason Bitcoin's safe haven properties are inferior to gold's in the short term lies in social perception, insufficient monetization in tax systems, and the higher risk appetite of marginal price setters attracted by its high growth potential.

● Goldman Sachs research further points out that while Bitcoin's returns are higher than gold's, its volatility is also greater, making it more sensitive to market downturns. When market risk appetite is positive, Bitcoin and stocks often perform better; however, in hedging against stock market declines, gold is more effective as a safe haven asset than Bitcoin.

● The gold market has already formed a mature pattern of coexisting rigid demand support and speculative pricing, while the cryptocurrency market is still evolving towards this pattern.

The key attribute comparison between gold and Bitcoin is as follows:

3. Policy Reshaping: Bitcoin Strategy in the Trump 2.0 Era

On March 6, 2025, Trump signed an executive order announcing the establishment of a "strategic Bitcoin reserve" and a "digital asset reserve." This policy marks a fundamental shift in the U.S. government's stance on cryptocurrencies.

● The Trump administration's positive attitude towards crypto assets is backed by complex considerations. The socio-economic structure of the United States provides fertile ground for the popularization of crypto assets—statistics show that by 2024, 40% of American adults own crypto assets, forming what is known as the "crypto asset generation."

● The pro-crypto policies implemented by the Trump administration include the repeal of SAB 121, allowing traditional financial institutions to provide custody services for crypto assets. Traditional financial institutions like Citibank and JPMorgan have begun exploring ways to offer crypto asset services to their clients.

● The U.S. strategic Bitcoin reserve plan has triggered a series of chain reactions. Chris Kuiper, Vice President of Fidelity Digital Assets Research, noted, "In the future, more countries may buy Bitcoin, driven by game theory—if more countries include Bitcoin as part of their foreign exchange reserves, then other countries may also feel competitive pressure."

4. Linked Changes: The Integration of Bitcoin and Traditional Financial Markets

● With a significant influx of institutional funds, the correlation between Bitcoin and traditional financial markets has significantly increased. Data from Standard Chartered shows that the correlation between Bitcoin and the Nasdaq index reached 0.5, and at the beginning of the year, it even peaked at 0.8.

● The core driving force behind this change is the launch of Bitcoin spot ETFs. As of June 9, 2025, the total asset size of Bitcoin ETFs has exceeded $127.9 billion, becoming one of the main drivers of Bitcoin price increases since the end of 2023.

● Institutional investors have become the main drivers of Bitcoin price volatility. The open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) rose from less than $4 billion before the ETF approval to consistently over $10 billion, peaking at over $20 billion.

● This phenomenon indicates that Bitcoin is transitioning from a quasi-safe haven asset to a high-risk, growth-oriented asset that fluctuates in the same direction as the stock market. K33 Research points out that 2025 is a year of serious disconnection between cryptocurrency fundamentals and price performance.

5. Future Outlook: Positioning Bitcoin as a New Asset Class

Looking ahead to 2026 and beyond, Bitcoin's market positioning will continue to evolve. K33 Research holds a constructive bullish outlook for 2026, predicting that Bitcoin will outperform stock indices and gold, believing that the benefits brought by regulatory victories will outweigh the impacts of capital allocation.

● At the macro level, Trump may appoint a dovish Federal Reserve chair to replace tightening with expansionary policies, creating an "abundant" environment that will benefit scarce assets like Bitcoin. The institutional side is expected to see an explosion: Morgan Stanley plans to allow advisors to allocate 0-4% of Bitcoin ETFs for clients.

● Bitcoin infrastructure is becoming a new focus for venture capital. As early financing for Bitcoin Layer-2 projects succeeds, market attention is shifting towards investment logic that has more tangible significance and directly enhances Bitcoin's utility.

● In the long term, cryptocurrencies are expected to have significant growth potential, driven by the fundamental logic of de-globalization and de-dollarization, which fuels the monetization of gold and cryptocurrencies. Over a long time dimension, the monetary attributes of gold and cryptocurrencies may both become part of the "gold of the future."

Gold prices have risen over 50% since January 2025, while Bitcoin has only increased by 15%. Wall Street traders are beginning to reassess their portfolios, and some institutions have quietly reduced their allocation to Bitcoin.

Young investors who were once enthusiastic about the "digital gold" narrative are finding that their Bitcoin holdings are declining in sync with tech stocks. Meanwhile, central banks around the world continue to increase their gold reserves, and emerging market countries are accelerating their catch-up—China's gold reserves account for only 6.7% of total asset reserves, while the U.S. figure is as high as 77.85%.

The myth of digital gold may not completely shatter, but its connotation is being redefined. Bitcoin is carving out a unique path that is neither like gold nor traditional risk assets.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。