The "rolling recession" of the U.S. economy has accumulated rebound potential like a compressed spring, while gold prices have reached historically extreme levels. Bitcoin, with its algorithmic scarcity, is becoming a distinctly different new choice for asset allocators compared to gold.

"In the next three years, the U.S. may experience a 'reinforced version of Reaganomics,'" ARK Invest founder Cathie Wood described her outlook for 2026 in her New Year letter to investors.

In her view, after the pressures of the past few years, the underlying structure of the U.S. economy is like a spring compressed to its limit, ready to unleash a powerful rebound. She predicts that the relative advantage of U.S. investment returns will drive the dollar exchange rate significantly higher, potentially even replicating the nearly doubling trend of the 1980s.

I. Macroeconomic Outlook

● Cathie Wood refers to the current state of the U.S. economy as a "rolling recession." Although the U.S. real GDP has continued to grow over the past three years, the core of the economy has experienced successive recessions in different sectors. This suppressed economic energy has now evolved into a "spring ready to launch," prepared for a strong rebound in the future.

● To address the supply shocks caused by the COVID-19 pandemic, the Federal Reserve raised the federal funds rate dramatically from 0.25% to 5.5% over 16 months from March 2022 to July 2023, setting a historical record of 22 times.

● This aggressive rate hike policy has pushed housing, manufacturing, and non-AI-related capital expenditures into recession. Wood points out that measured by existing home sales, the housing market has declined by 40% from an annualized 5.9 million units in January 2021 to 3.5 million units, returning to levels seen in November 2010.

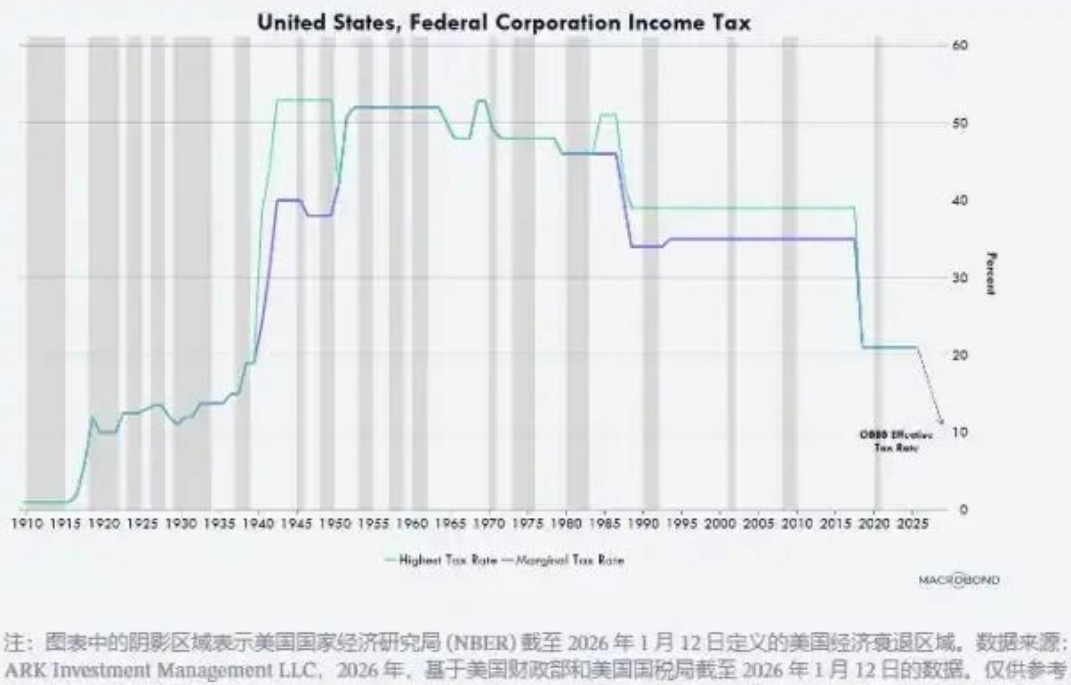

● Wood emphasizes that the scale of corporate tax rebates will increase significantly. The accelerated depreciation policy for manufacturing facilities, equipment, software, and domestic R&D expenditures will reduce the effective tax rate for corporations to around 10%, which is low on a global scale.

II. Inflation and Productivity Outlook

Wood believes that inflation may drop to unexpectedly low levels in the coming years, and negative inflation may even occur.

● She points out that the decline in oil prices, housing prices, and tariffs, along with various technologies that drive productivity improvements and lower unit labor costs, are reasons why inflation may further decrease.

● The price of West Texas Intermediate crude oil has fallen about 53% from its post-COVID peak in March 2022, with a current year-on-year decline of about 22%. Meanwhile, the sales price of newly built single-family homes has dropped about 15% since peaking in October 2022.

● She predicts that with productivity growth of 5%-7%, labor growth of 1%, and an inflation rate between -2% and +1%, the nominal GDP growth rate in the U.S. is expected to remain in the range of 6%-8% in the coming years.

III. Comparative Analysis of Bitcoin and Gold

In 2025, gold prices rose by 65%, while Bitcoin prices fell by 6%.

● Wood notes that since the end of the U.S. stock market bear market in October 2022, gold prices have soared from $1,600 per ounce to $4,300, a staggering increase of 166%. She attributes this phenomenon to the speed of "global wealth creation" outpacing gold's moderate annual supply growth of about 1.8%, rather than simple inflation fears.

● From a historical perspective, measured by the ratio of market capitalization to M2, gold prices have only reached higher levels during one period in the past 125 years—the Great Depression of the 1930s. Recently, the ratio of gold to M2 has exceeded the previous peak.

● Wood emphasizes that gold miners can respond to rising gold prices by increasing production, while Bitcoin's supply is fixed and cannot do this. According to mathematical calculations, the annualized growth rate of Bitcoin supply is about 0.82% over the next two years, after which it will drop to about 0.41%.

● For asset allocators, the low correlation between Bitcoin and gold is a significant advantage. Data shows that the correlation between Bitcoin and gold is even lower than the correlation between the S&P 500 index and bonds. Bitcoin broke through the long-term compression level of about $87,000 in the first week of 2026, rebounding about 8.5% to reach $94,400.

The pressure for profit-taking has significantly eased, marking the exhaustion of the distribution pressure that had been suppressing price movements in the previous quarter.

IV. Dollar and Stock Market Predictions

Wood predicts that the dollar exchange rate may replicate the strong trend of nearly doubling seen in the 1980s, primarily due to the relative attractiveness of U.S. investment returns. She warns that although gold prices have risen significantly in recent years, the strengthening of the dollar will suppress gold prices.

● Regarding the widely discussed AI bubble, Wood does not believe that an AI bubble has formed. She points out that while current price-to-earnings ratios are at historical highs, the explosion of productivity driven by technologies like AI and robotics will help absorb the high valuations.

● She believes that the market may achieve positive returns while compressing price-to-earnings ratios, similar to the bull market path of the mid to late 1990s.

● Wood's view is that AI is driving capital expenditures to their highest levels since the late 1990s. In 2025, investment in data center systems grew by 47% to nearly $500 billion, and is expected to grow another 20% in 2026 to about $600 billion.

V. Perspectives on Bitcoin from Other Institutions

Several institutions have provided predictions for Bitcoin's future.

● Bernstein analysts predict a target price of $150,000 for Bitcoin in 2026, with a peak of $200,000. The firm believes that 2026 will be a year dominated by a "tokenization supercycle," with Bitcoin rebounding from its lows.

● Chris Kuiper, Vice President of Research at Fidelity Digital Assets, states that more countries may purchase Bitcoin in the future, driven by game theory considerations. He points out that if more countries incorporate Bitcoin as part of their foreign exchange reserves, other countries may feel competitive pressure.

● An analysis by ChainCatcher synthesizes views from institutions like Messari, a16z, and Coinbase, suggesting that the four-year cycle logic of Bitcoin may fail, with the potential to reach $250,000 driven by sovereign and institutional funds. The analysis notes that in 2026, crypto assets will officially enter an era of value reassessment anchored by cash flow and utility.

● Data from Glassnode shows that the flow of funds into U.S. spot ETFs is beginning to show early signs of renewed institutional participation. After a long period of net outflows and low participation, recent weeks have marked a shift to positive net inflows.

As positions roll over at the end of 2025, the market is no longer constrained by structural hedging mechanisms, and the expiration environment provides clearer signals of market sentiment.

The market is shifting from defensive hedging to bullish participation, with the skew in the Bitcoin options market continuing to normalize, with put option premiums compressing and call option participation rising.

As prices approach $100,000, the market structure is transitioning from defensive deleveraging to selective risk-taking. Glassnode analysts note that Bitcoin will enter a new phase in 2026 with a clearer structure, and the theme of expanded selectivity will dominate the market.

In Wood's predictions, Bitcoin remains closely linked to the fate of gold but is gradually moving away—the luster of gold may dim due to a strong dollar, while Bitcoin, with its inherent scarcity and low correlation with traditional assets, is embarking on a path of independent value discovery.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。