U.S. equities finished broadly lower Tuesday as selling pressure snowballed through the session. The Dow set the pace to the downside, tumbling 870.74 points to 48,488.59, while the Nasdaq Composite slid 561.06 points to 22,954.32, the S&P 500 dropped 143.15 points to 6,796.86, and the NYSE Composite lost 333.85 points to 22,473.22, sealing a bruising, no-hiding-place kind of day.

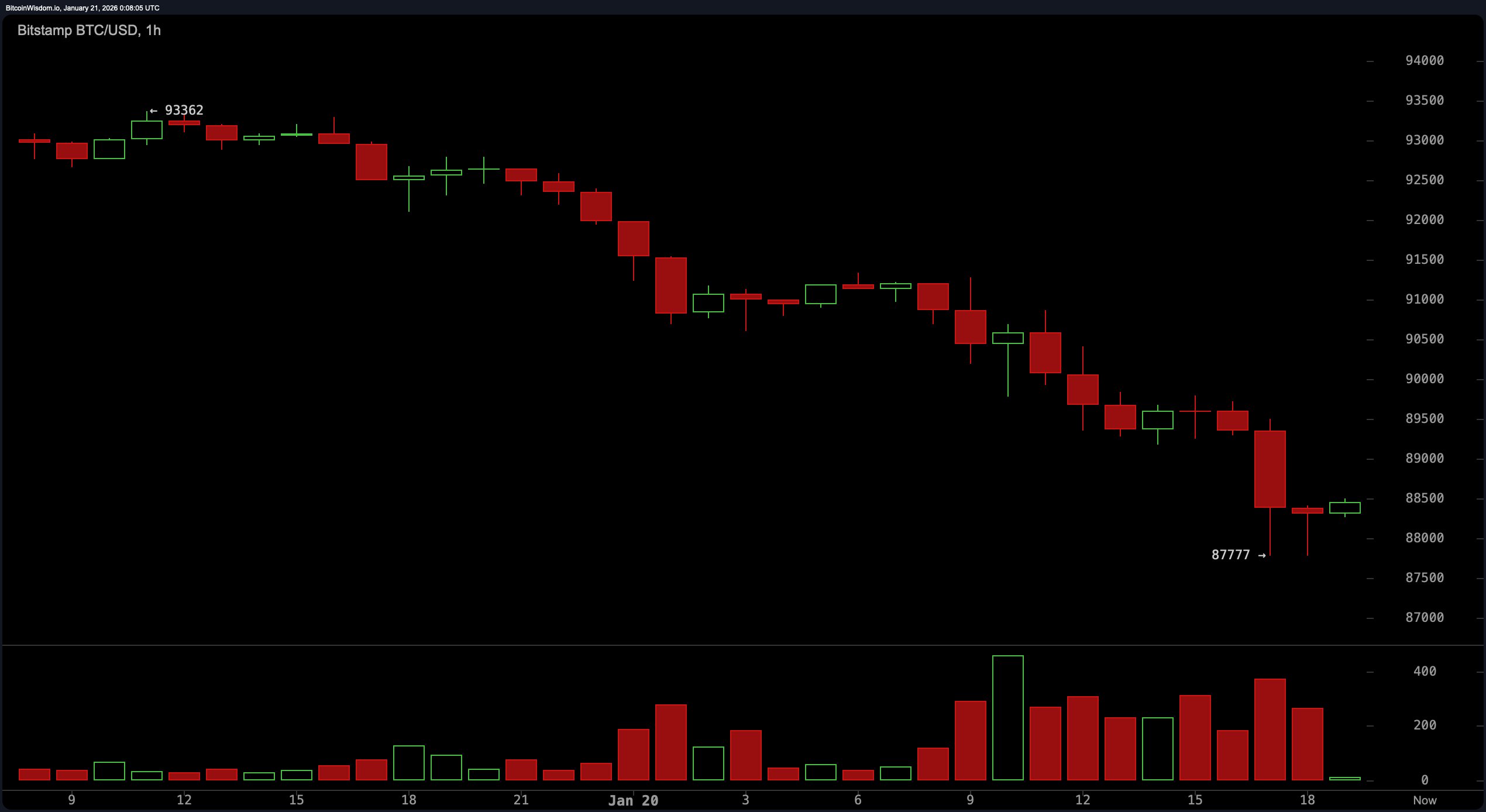

Financial media is pinning much of the blame on U.S. President Donald Trump’s tariff threats aimed at several European nation states. The sell-off on Tuesday was sizable, marking the biggest single-day slide since early October 2025. The crypto market overall is off 4.72%, sitting at $2.99 trillion and wobbling away from the $3 trillion mark for the first time this week. Bitcoin (BTC) slid 3.8% and was trading under $89,000 as of 7:15 p.m. Eastern time at $88,302 per coin.

Strategy (Nasdaq: MSTR) sank 7.76% on the day, while Coinbase (Nasdaq: COIN) fell 5.57% by the closing bell. USDC issuer Circle Internet Group, Inc. dropped 7.52% Tuesday on the New York Stock Exchange (NYSE), and Bullish (NYSE: BLSH) managed a comparatively mild 0.10% dip. Publicly traded bitcoin miners were painted red across the board Tuesday, with losses sweeping the entire top ten by market cap.

MARA Holdings set the pace to the downside, dropping 8.75% to $10.37, with Bitdeer close behind, off 7.45% to $14.65, and IREN Limited sliding 6.50% to $54.06. Mid-tier losses followed at a brisk clip, with Applied Digital (-4.75%), Riot Platforms (-4.73%), Cipher Mining, Inc. (-3.72%), Cleanspark, Inc. (-3.59%), and Terawulf, Inc. (-3.14%) all taking hits.

Also read: XRP Slides Sharply as Global Tensions Trigger Broad Risk-off Selling

Smaller pullbacks rounded things out, as Core Scientific, Inc. (-2.62%) and Hut 8 Corp. (-2.33%) capped a bruising session for the top ten positions in the mining sector. Tuesday’s rout was a sharp reminder of how fast macro nerves can spread across equities and crypto in tandem. More telling, bitcoin flashed warning lights well ahead of U.S. stocks — and even global markets and bonds — before fear fully set in.

BTC/USD 1-hour chart via Bitstamp on Jan. 20, 2026. The price tapped a low of $87,777 per coin.

Tariff talk keeps rattling risk appetite, pulling stocks, miners, and bitcoin-linked names down in lockstep. Bitcoin has managed to hover above $88,000 — but for how much longer? The marks left across major indices and mining shares made one thing clear: sentiment is on thin ice. Markets now stare down a near-term test of whether policy noise quiets or snowballs into a broader risk-off spell for global assets in the days ahead.

- Why did U.S. stocks fall on Jan. 20? Markets slid after President Donald Trump’s tariff threats toward Europe unsettled investors and sparked a broad risk-off move.

- Which index was hit the hardest? The Dow Jones Industrial Average suffered the biggest drop, falling 870.74 points in the session.

- How did bitcoin and crypto markets react? Bitcoin dipped below $88,000 as the total crypto market value slid to about $2.99 trillion as of 7:15 p.m. EST.

- Why did bitcoin mining stocks decline? Mining shares tracked the wider market downturn, with falling bitcoin prices and risk aversion weighing on the sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。