The moment Bitcoin rapidly dropped from $95,000 to below $92,000, over 250,000 traders received liquidation alerts simultaneously, causing the market to evaporate $680 million in an instant. The cause of all this was a political game far away in Greenland.

1. Event Review

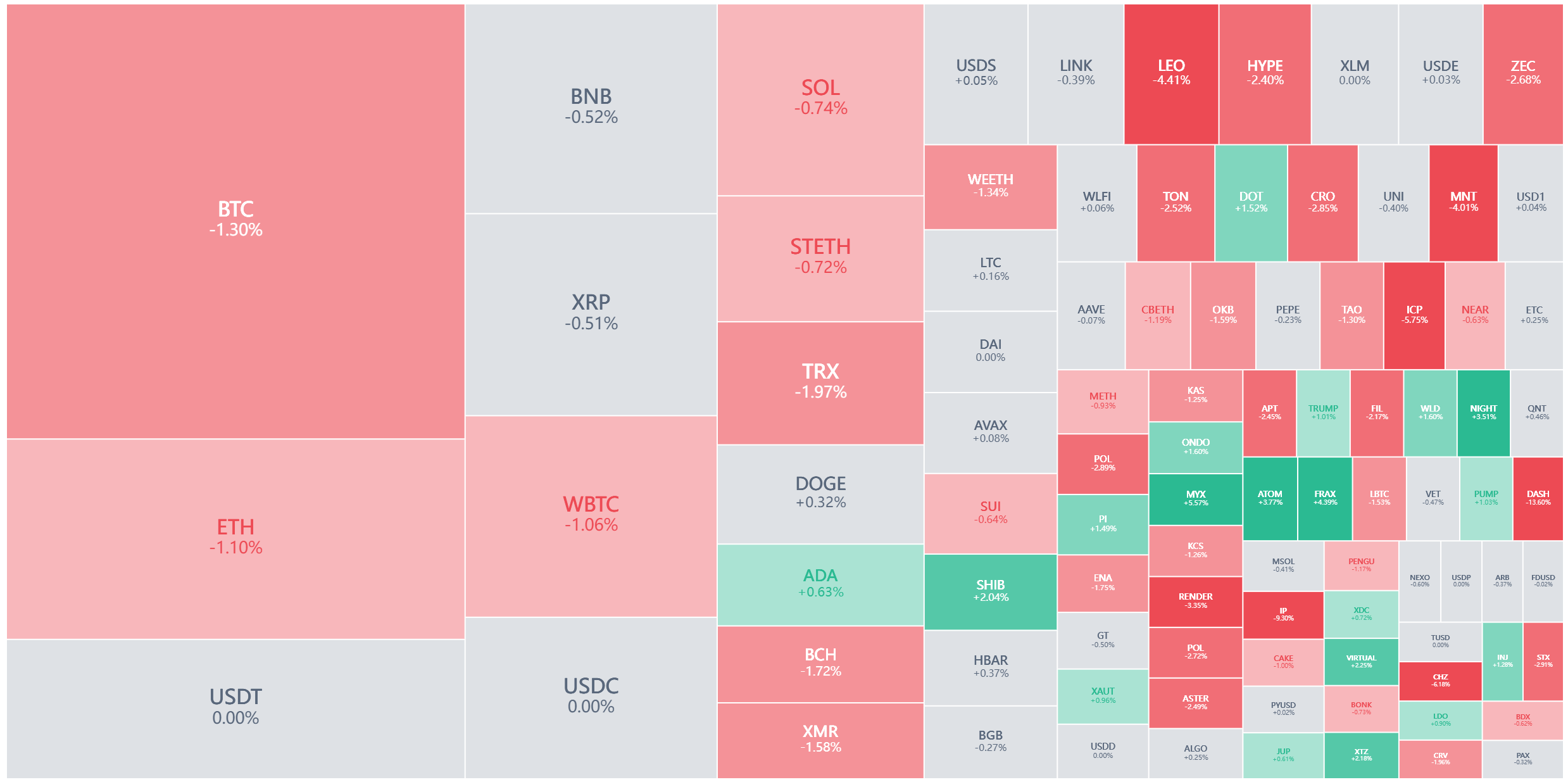

● On the morning of January 19, 2026, the global cryptocurrency market experienced a thrilling flash crash. Bitcoin plummeted from around $95,000 to $91,900 within an hour, a drop of over 3%.

● At the same time, Ethereum fell below the $3,200 mark, and SOL dropped over 6%, nearly erasing all its gains for the year. Market data showed that within the first hour of the crash, the total liquidation amount across the network reached $551 million, with long positions accounting for as much as $533 million.

● By the end of the day, over $680 million in cryptocurrency positions were liquidated within the past 24 hours, with about $600 million coming from long positions. This sudden market turmoil forced over 250,000 traders to be liquidated instantly.

2. Geopolitical and Policy Uncertainty

● The direct trigger for this market flash crash came from the escalation of geopolitical tensions. On January 17, former U.S. President Trump announced via social media that he planned to impose a 10% tariff on goods from eight European countries, including Denmark, Norway, Sweden, France, and Germany, starting February 1.

● More worryingly, he further threatened that if Europe did not "cooperate with the U.S." on the issue of Greenland's sovereignty, tariffs would be raised to 25% on June 1. This statement quickly triggered a strong reaction from the EU, which began discussing the initiation of "anti-coercion tools" to impose counter-tariffs on U.S. goods worth up to €93 billion.

○ The market's reaction was swift and real: Bitcoin crashed by 3.8%, Nasdaq futures fell by 1%, while traditional safe-haven assets like gold and silver reached historic highs. Funds made a choice in an instant: fleeing risk assets.

● In addition to the threat of a trade war, the uncertainty surrounding the selection of the Federal Reserve Chair also added variables to the market. The market had originally expected the relatively dovish White House economic advisor Kevin Hassett to be the next Federal Reserve Chair.

○ However, the latest signs indicate that his chances have dropped from previously being a toss-up to about 15%-16%. Meanwhile, the probability of the more hawkish former Federal Reserve Governor Kevin Warsh taking over has surged to about 60%.

3. Market Vulnerability: High Leverage and Structural Flaws

● Although external events were the trigger, the structural flaws within the cryptocurrency market amplified the magnitude and speed of this decline. The crypto market has three "original sins": 24-hour trading, high leverage, and low liquidity on weekends.

These characteristics make the crypto market the first "risk asset" that investors sell off when macro risks rise.

● More importantly, a large number of high-leverage long positions had accumulated within the market. Before the flash crash, Bitcoin had attempted multiple times to break through the $98,000 mark, attracting many investors to establish high-leverage bullish positions.

● Once the price fell below the critical support level of $95,000, it triggered a chain of stop-loss orders, creating a cascading effect that accelerated the price decline.

● On-chain data revealed an interesting phenomenon: the night before the flash crash, hundreds of millions of dollars worth of assets were withdrawn from exchanges, indicating that professional institutional investors may have already hedged their risks through methods such as purchasing put options.

4. Institutional Perspectives: Cautious Interpretations of Market Trends

In the face of this market turmoil, various institutions and analysts provided different interpretations.

● Jane Foley, an analyst at Rabobank, pointed out that while there was no widespread panic in the market, the demand for safe havens was strong, which could drive traditional safe-haven assets like gold to continue rising.

● Michael Brown from Pepperstone believed this was Trump's usual negotiation strategy: first creating market volatility through extreme threats, then seeking compromise, ultimately reaching an agreement.

● Richard Galvin, co-founder of hedge fund DACM, analyzed that the early-year rebound in the crypto market stemmed from last year's oversold conditions, while recent tariff concerns suppressed this rebound. The historic high in gold prices also confirmed that this sell-off was more driven by risk aversion rather than fundamental issues with cryptocurrencies themselves.

● However, some institutions took a more cautious stance. CryptoQuant pointed out in its weekly report that Bitcoin is still below the 365-day moving average near $101,000, a price level that has historically been seen as a dividing line for market trends.

Despite a slight improvement in demand conditions, no substantial changes have occurred, and spot demand continues to shrink, with little inflow of funds into U.S. spot ETFs.

5. Impact of the Regulatory Environment

● In addition to macro factors and internal market issues, the uncertainty of the regulatory environment has also put additional pressure on the cryptocurrency market. The U.S. Senate's originally scheduled discussion on the cryptocurrency market structure bill was postponed, which the market interpreted as a sign of disagreement between Congress and the industry on key issues.

● Key points of contention in the bill include the yield mechanisms for stablecoins, DeFi provisions, and more. Alex Thorn, research director at Galaxy Digital, believes the delay indicates significant disagreements between the two sides on these issues.

● The postponement of the regulatory agenda increases market uncertainty. When rules are unclear and timelines are delayed, investors naturally become more cautious and reduce their position allocations. The hearing may not take place until January 26-30, which means regulatory uncertainty will persist in the short term.

6. Market Outlook

● Ryan Lee, chief analyst at Bitget, expects that Bitcoin will maintain a range-bound fluctuation in the second half of January, with support potentially forming around $85,000. He noted that rising macro uncertainty, combined with profit-taking after previous significant gains, has led investors to adopt a more cautious strategy across various markets.

● Notably, the crypto market has shown significant weakness compared to other risk assets. Despite trade concerns between the U.S. and Europe dominating market sentiment, risk assets like South Korea's KOSPI have remained flat or even risen. This indicates that the crypto market has clear internal weaknesses, with investors preferring to allocate to other risk assets.

● Min Jung from Presto Research analyzed: "In the context of most markets rising, crypto assets remain the laggards."

On-chain data shows that over 110,000 Bitcoins have been absorbed by long-term addresses this month. While the market experiences panic selling, another group of investors is quietly accumulating. The $90,000 mark has become a focal point for the entire market, with panic sellers and quiet accumulators coexisting.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。