The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to cryptocurrency enthusiasts. I welcome all crypto friends to follow and like, and I reject any market smoke screens!

Yesterday, I mentioned DOGE, which led many users to think that Lao Cui is like a weather vane, changing direction with the wind; today, I want to remind you that the DOGE I mentioned is only related to the financial trading launch on platform X, not the currency itself. Looking at platform X, once financial trading is enabled, it is very likely that the DOGE network will be integrated. If it is given the functionality of a platform token, then DOGE will experience a surge. According to my estimation, based on Musk's tendencies, it is highly probable that a platform token will be issued, and DOGE will not be reactivated. The most important point is that platform X has nearly 600 million users, combined with the ability of KOLs in the crypto space to attract people; as long as one can catch the first wave of the launch, there will be growth. Currently, the most likely cryptocurrencies to catch the early train are BTC, ETH, and SOL. These three cryptocurrencies are basically close to official announcements, and it remains to be seen whether Musk can secure the SEC's license.

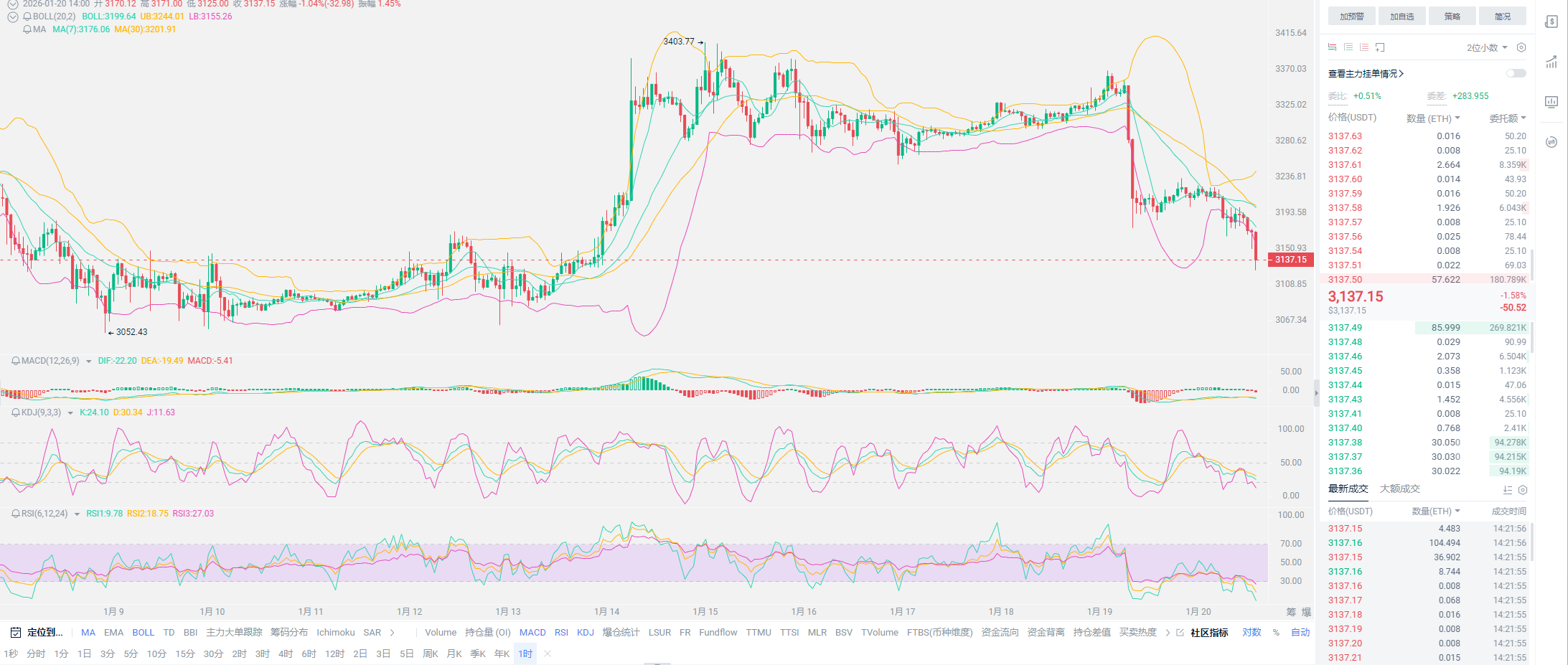

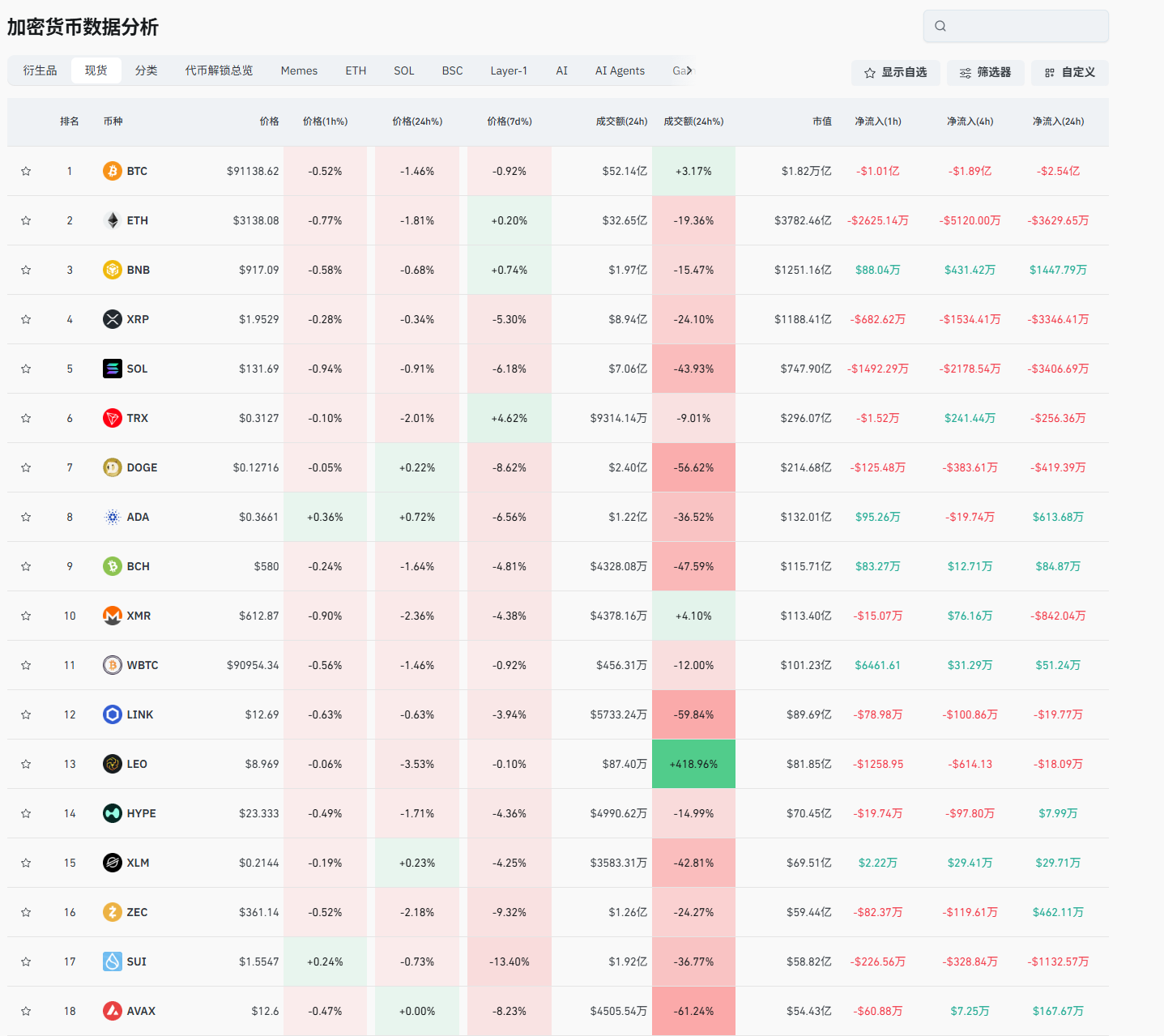

Returning to the short-term market, Bitcoin's trend today shows a downward probing tendency, which also made Lao Cui get up early; overall, since reaching a high of 97924, the upper pressure at 98000 has been unable to break through again, resulting in a short-term downward pressure. Coupled with the confrontation between Europe and the U.S., tariff issues have once again crushed Bitcoin's price. A new short-term low of 91910 has been established, with a price difference of 6014 from the previous high, which has led many friends to start questioning whether the trend is officially downward. In the past two days' articles, I did not mention the tariff issue because, from my perspective, it is difficult for these two to engage in real confrontation, meaning the strength is not equal. Even if tariffs are imposed, they will end quickly. Instead, this downward probe provides an opportunity for everyone to buy the dip, which I have mentioned in the past two days. If the upward push fails, it will still continue to decline, but this round of decline has support at the bottom.

Additionally, as we approach the Federal Reserve's interest rate decision in January, even if the market does not expect a rate cut this time, it will still lead to major players selling off in response to the trend. The closer we get to the interest rate decision, the more unstable the market will become. At the same time, the January cycle will be accompanied by the release of data from many countries, and this series of data will cause a chain reaction, with year-end summary data being extremely critical. The latest prediction shows a 95% probability that the Federal Reserve will maintain interest rates in January. The release of such data will depend on whether Bitcoin can hold above the 90,000 mark. If it collapses, the market may likely trend towards 85,000, but lower positions are currently not visible. Looking at Bitcoin's holding data can also intuitively reflect the problem; a large number of major players have purchased in the 85,000-95,000 range. Before the market makers fill their positions, this range will need to be maintained for a certain period, so do not have too high expectations for the short-term market. We are still in the distribution area of the major players.

Regarding territorial disputes, Lao Cui cannot express an opinion, but I can only say that tariff confrontations are a fatal blow to the financial industry. There is no absolute free trade in the world, especially when it involves military aspects. Europe has no effective countermeasures against the U.S. They can only be forced to accept this path. Currently, there is nothing to guess; we can only wait for the results after the EU meeting. Perhaps this meeting will not yield clear results, but everyone should remember one thing: as long as there is no resolution to the confrontation between the two sides, any opposing news will lead to a downward trend in the crypto space. At this stage, Lao Cui cannot predict the exact downward point but can only confirm the downward trend. If you are shorting, you can hold on, especially as we approach the U.S. interest rate decision. Perhaps this decline will be the new low for the year, and the new low will definitely appear at the beginning of the year.

This also includes domestic trends, which everyone needs to treat with caution. This year, the domestic stock market has basically been set, and from the perspective of maintaining healthy growth, there will not be explosive shocks. Everyone's expectations should not be too high; if you gain something, withdraw in time. Looking at gold, you can also see the problem; frequent new highs only indicate that geopolitical conflicts are becoming more significant. The current trend is not the normal volatility that should be present. In my understanding, we are extremely close to a financial crisis. The top ten tech companies, including Buffett, have preserved a significant amount of cash, perhaps they are also waiting for the moment of collapse. Many friends do not understand why the crypto space, which advocates free settlement, is impacted by U.S. military risks. Shouldn't the more intense the conflict, the more widespread the application of cryptocurrencies? For example, in the Russia-Ukraine conflict, the final settlement method was beneficial for the crypto space. Why is the price of cryptocurrencies showing the opposite trend now?

This is easy to understand. The current giants in the crypto space are basically overlapping with U.S. stocks. Except for MicroStrategy, almost all giants have heavy positions in dollar assets. Regardless of where the U.S. conflicts occur, they will first sell off crypto assets to invest in other markets. These giants are not retail investors. Looking at Ukrainian assets, most have already been packaged by the U.S., so in the short term, this is a fatal blow to the crypto space. The outflow phenomenon will be extremely terrifying, but in the long run, it will definitely show a growth pattern. If we take history as a lesson, the conflict phase between Russia and Ukraine provided significant growth space for the crypto space, rising from 70,000 to 126,000, with the market cap increasing from 1.5 trillion to over 4 trillion, all completed during the Russia-Ukraine conflict. Therefore, as long as there is U.S. involvement, especially when it is impossible to determine whether it is a long-term struggle or a short-term struggle, it will lead to an outflow phenomenon in the crypto space in the short term, causing a decline in cryptocurrency prices.

Lao Cui summarizes: If you can understand this trend, you will clearly know what you should do at this stage, which is to keep your positions flowing into the market before the giants return. This kind of verbal battle or substantive action will only cause short-term declines. In terms of trends, the crypto space is still within the dollar asset industry. As long as the U.S. can succeed, the rebound rate will be very strong. However, the current dilemma facing the crypto space is that there are too many ancient wallets, and the burden of the giants pulling the market is too heavy. A washing effect needs to be formed at this stage. I have mentioned that the 85,000-95,000 stage will create long-term back-and-forth fluctuations. Unless there is a significant historical-level message, the crypto space will not break through too much beyond this range. Lao Cui also gives a conclusion that everyone can witness together: the arrival of February will definitely allow Bitcoin to reach the 100,000 mark; but at the end of January, barring any accidents, it will still decline. Rest assured, there will not be a historical-level new low this year; the decline is within a controllable range, and spot users need not worry too much. As long as Europe compromises, the crypto market will definitely be forced to open, and this will become their destiny!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。