Written by: Wintermute

Translated by: Shenchao TechFlow

Shenchao Introduction: The four-year halving cycle, once regarded as a "iron law" of the crypto market, is facing unprecedented challenges. Top market maker Wintermute pointed out in its latest 2025 annual report that the traditional cyclical narrative has failed, and market logic has shifted from "seasonal rotation" to "liquidity lock-up."

2025 did not bring the anticipated widespread euphoria; instead, it displayed extreme emotional fragmentation: on one hand, BTC and ETH entered the institutional realm with the support of ETFs, while on the other hand, the explosive power of altcoins drastically diminished, and their lifecycles shortened.

As we face 2026, can the crypto market break the current stagnation? Wintermute has outlined three core variables that could disrupt the status quo.

The main text is as follows:

2025 did not deliver the expected bull market, but it may be viewed by future generations as the beginning of the transition of cryptocurrencies from speculative tools to a mature asset class.

The traditional four-year cycle is becoming outdated. Market performance is no longer dominated by self-fulfilling timed narratives but is instead determined by the flow of liquidity and the concentration of investor attention.

What Changed in 2025?

Historically, crypto-native wealth has acted as an alternative pool of funds. Bitcoin's (BTC) gains would spill over to Ethereum (ETH), then flow into blue-chip stocks, and finally reach altcoins.

Wintermute's over-the-counter (OTC) trading data indicates that this transmission mechanism significantly weakened in 2025.

Spot exchange-traded funds (ETFs) and digital asset trusts (DATs) have evolved into "walled gardens." They provide sustained demand for large-cap assets but do not naturally rotate funds into the broader market.

As retail interest shifted to the stock market, 2025 became a year of extreme polarization.

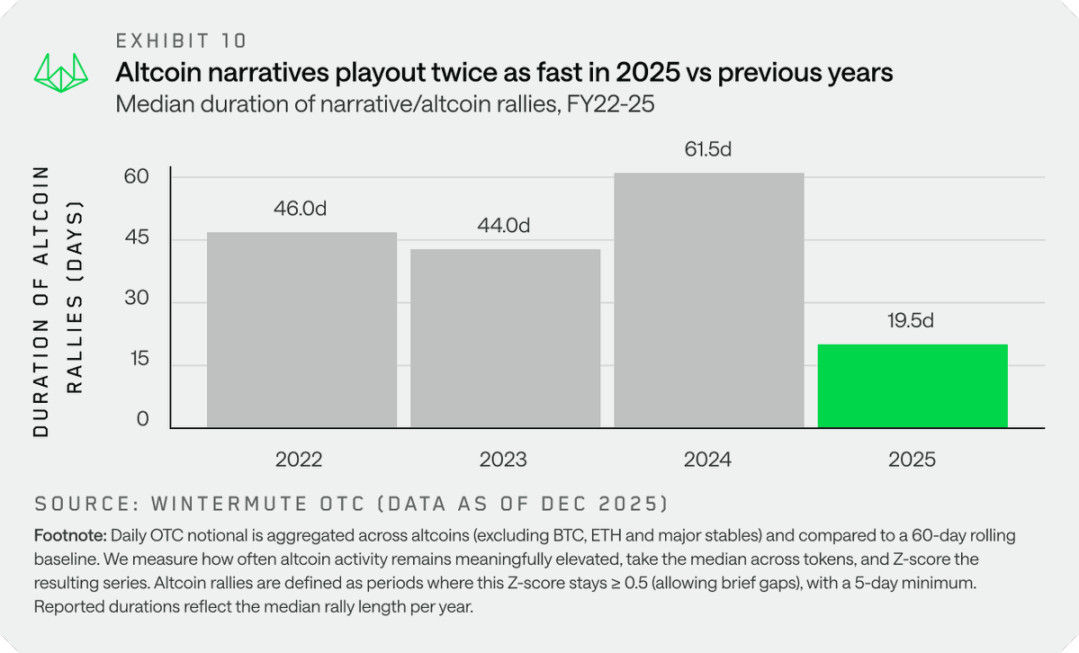

The average duration of altcoin rebounds in 2025 was 20 days, far below the 60 days seen in 2024.

A few mainstream assets absorbed the vast majority of new funds, while the broader market struggled.

Three Paths for 2026

For market participation to extend beyond mainstream assets and further expand, at least one of the following three things must occur:

1. Expanding Institutional Mandates

Currently, most new liquidity remains confined to institutional channels. A comprehensive market recovery requires institutional investors to broaden their range of investable assets.

Early signs have already emerged through ETF applications for Solana (SOL) and XRP.

2. The Wealth Effect from Mainstream Assets

A strong rebound in Bitcoin or Ethereum could create a wealth effect, spilling over into the broader market, similar to the situation in 2024.

It remains uncertain how much capital will flow back into digital assets.

3. Rotation from Equities

Retail investors' attention may rotate back from the stock market (such as in AI, rare earths, quantum computing, etc.) to cryptocurrencies, bringing fresh capital inflows and stablecoin minting.

While this is the least likely scenario, it would significantly expand market participation.

The future outcome will depend on whether these catalysts can effectively diffuse liquidity beyond a few large-cap assets or if this trend of centralization will continue.

Understanding the flow of funds and the structural changes needed will determine which strategies will be effective in 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。