Fiat currencies and altcoins face accelerating erosion as monetary expansion reshapes global markets, according to veteran commodity and foreign exchange trader Peter Brandt, who has traded since 1975. He shared on social media platform X on Jan. 18, 2026, that weakening fiat systems leave speculative digital assets especially exposed.

The veteran trader stated:

“The destruction of fiat has begun … Altcoins will become more worthless than USDs.”

“ Gold will return to the world’s most dependable store of wealth. USD-denominated assets will lose value to physical commodities — which, BTW, may or may not include bitcoin,” he further shared.

Brandt offered the assessment alongside a long-term market analysis examining how sustained growth in currency supply has historically coincided with periods of gold outperformance. His remarks portrayed altcoins as especially exposed, pressured by eroding fiat purchasing power while simultaneously competing against scarcer assets that investors increasingly favor during monetary stress.

Read more: Veteran Analyst Insists Bitcoin’s Historical Cycle Drawdowns Still Call the Shots

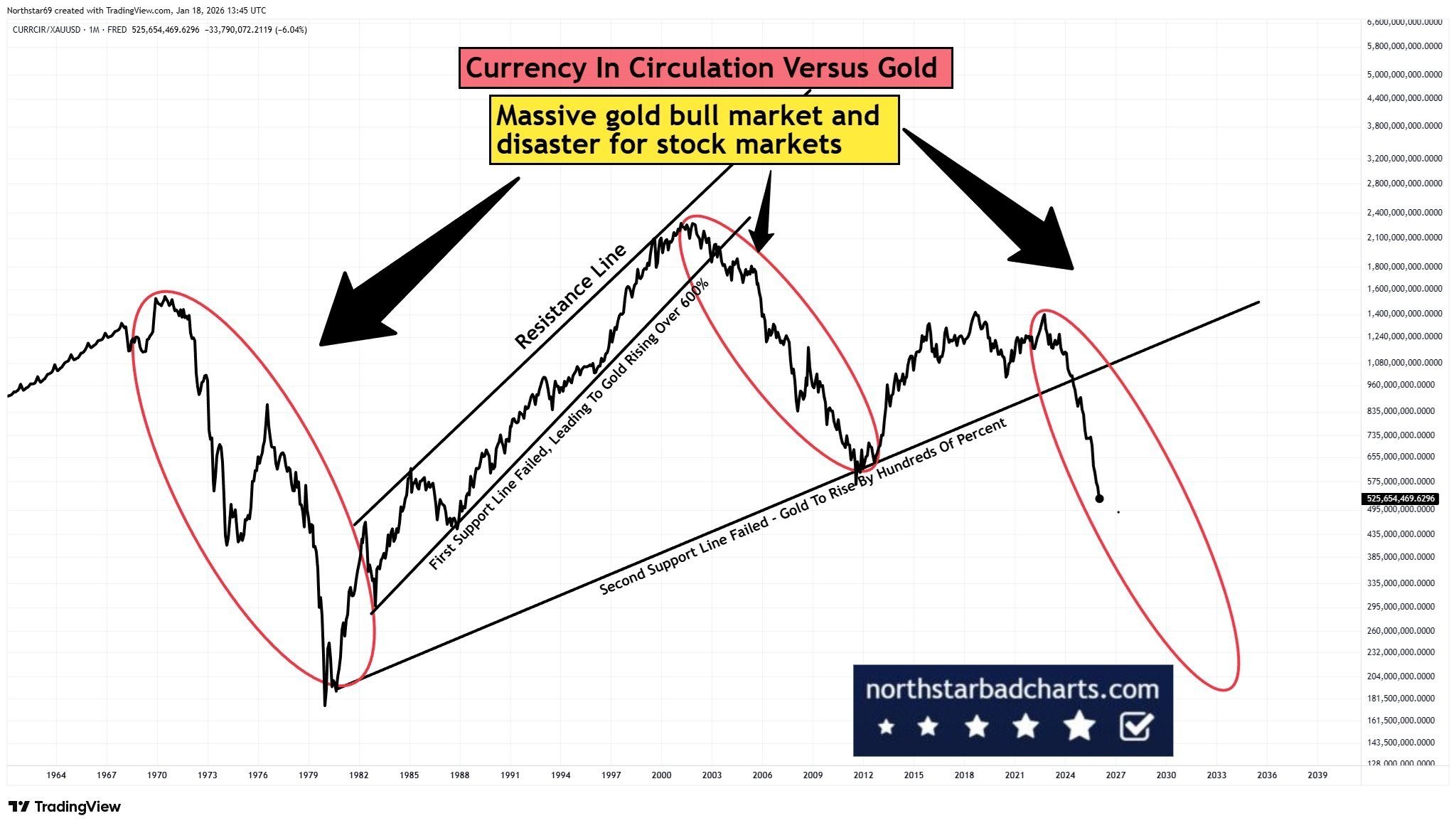

The chart examines currency in circulation relative to gold across several decades, highlighting repeated cycles where prolonged fiat expansion ultimately failed at key technical levels. Annotated breakdowns show that initial support failures were followed by gold advances exceeding 600%, while deeper structural breaks preceded even larger percentage gains. Red circled zones mark periods of currency weakness relative to gold that often aligned with equity market stress. The most recent segment suggests another breakdown phase, pointing toward a renewed gold bull market if historical symmetry holds.

Brandt’s broader framework aligns with that outlook. He has consistently argued that bitcoin is the only legitimate digital asset for long-term holding, viewing it as a unique store of value in the digital space. While he frequently characterizes most altcoins as junk or pretenders likely to deteriorate relative to bitcoin, Brandt often discusses them as part of broader market structure analysis. His view on ethereum is typically mercenary rather than ideological, and he has described the asset as technically constructive after clearing major resistance, while occasional remarks on solana focus on chart strength rather than utility-driven narratives.

- Why does Peter Brandt believe fiat currencies and altcoins are losing value?

Brandt argues that sustained monetary expansion erodes fiat purchasing power, leaving altcoins doubly vulnerable as speculative assets priced against weakening currencies. - Why does Brandt see gold as the primary beneficiary of monetary stress?

His long-term analysis shows repeated historical cycles where excessive currency growth broke key levels and was followed by gold rallies exceeding 600%, reinforcing gold’s role as a store of value. - How does Brandt differentiate bitcoin from other digital assets?

He views bitcoin as the only legitimate long-term digital store of value, while categorizing most altcoins as structurally inferior and likely to underperform during tightening liquidity cycles. - What are the investment implications of Brandt’s latest market framework?

Investors should expect pressure on USD-denominated assets and altcoins, with relative strength shifting toward physical commodities like gold and selectively toward bitcoin during fiat debasement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。