U.S. President Donald Trump’s shock decision to impose a 10% tariff on eight European nations opposing Washington’s threat to seize Greenland sent tremors through global financial markets Monday, igniting fears of a renewed transatlantic trade war. The move rattled investor confidence worldwide, driving gold and silver to fresh all-time highs as traders sought refuge in safe-haven assets.

Asian markets bore the brunt of the initial fallout. In Tokyo, the Nikkei 225 plunged more than 540 points, or 1.4%, in the morning session as investors fled export-heavy sectors vulnerable to escalating trade disruptions. Hong Kong’s Hang Seng slipped 0.8%, despite the territory not being directly targeted.

Meanwhile, mainland China managed to cushion the blow; upbeat fourth-quarter 2025 GDP figures slightly beat forecasts, and Beijing confirmed it had met its 5% annual growth target. This tempered volatility in Shanghai, where the Composite Index swung between losses and gains before recovering to trade 0.3% higher at the time of writing.

South Korea’s KOSPI bucked the regional trend, surging 1.32% to close around 4,904 points. The rally was powered by semiconductor giants Samsung and Micron, whose performance reassured investors that chipmakers could remain resilient amid global uncertainty.

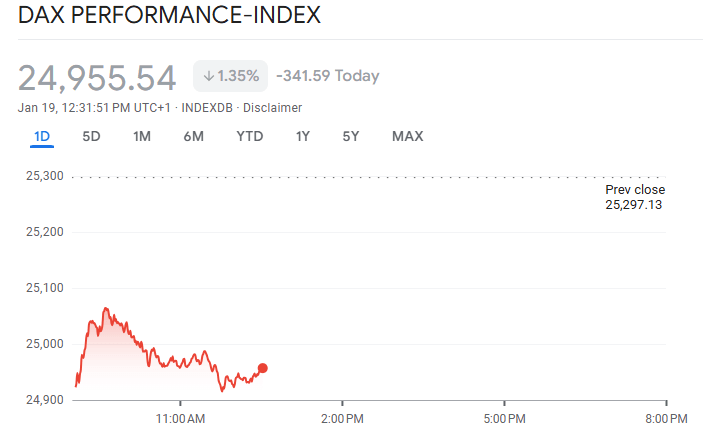

Across Europe, however, the picture was grim, at least during the morning session. France’s CAC 40 led the decline, down 1.2%, while Germany’s DAX slipped 0.9%. Carmakers bore the heaviest losses, with Volkswagen, BMW and Mercedes-Benz tumbling between 2.5% and 4%, reflecting anxiety over the prospect of tariffs hammering Europe’s auto industry.

The turbulence spilled into digital assets as well. Bitcoin plunged to $92,000 late Sunday, dragging the broader crypto market down 2.5% to a capitalization of $3.23 trillion. With U.S. markets closed for the Martin Luther King Jr. holiday, Wall Street’s reaction will not materialize until Tuesday, Jan. 20.

Read more: Bitcoin Falls Below $92K as Sunday Selloff Unleashes Hundreds of Millions in Liquidations

Trump’s tariffs targeted France, the United Kingdom, the Netherlands, Denmark, Germany, Sweden, Norway and Finland—a direct response to their unified opposition to his Greenland takeover threat. In a fiery social media post, Trump lashed out at the European deployment of military personnel to Greenland, denouncing it as “a dangerous game.” He warned that tariffs could escalate to 25% unless Europe backs down, though he dangled the possibility of negotiations with Denmark should it yield to U.S. demands.

Europe signaled it would not be cowed. Reports suggest European Union leaders are preparing a multibillion-dollar retaliatory tariff package and weighing the deployment of the anti-coercion instrument (ACI). Adopted in 2023, the ACI is the EU’s legal and trade defense mechanism against economic coercion by foreign powers. Its arsenal includes tariffs, duties, market access restrictions and the suspension of cooperation agreements—a clear warning that Brussels is ready to match Washington blow for blow.

As leaders prepare to go head-to-head later this week at the World Economic Forum in Davos, Switzerland, the atmosphere is charged. Diplomatic fault lines are deepening, and the days leading up to the summit promise to be marked by escalating rhetoric, strategic maneuvering and heightened market anxiety.

- Why did Trump impose tariffs on Europe? He targeted eight nations opposing Washington’s Greenland takeover threat.

- How did Asian markets react? Japan’s Nikkei plunged 1.4%, while China’s Shanghai index steadied on strong GDP data.

- What was the impact in Europe? France’s CAC 40 and Germany’s DAX fell, with carmakers hit hardest by tariff fears.

- How is the EU responding? Brussels is preparing retaliatory tariffs and considering its Anti-Coercion Instrument.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。