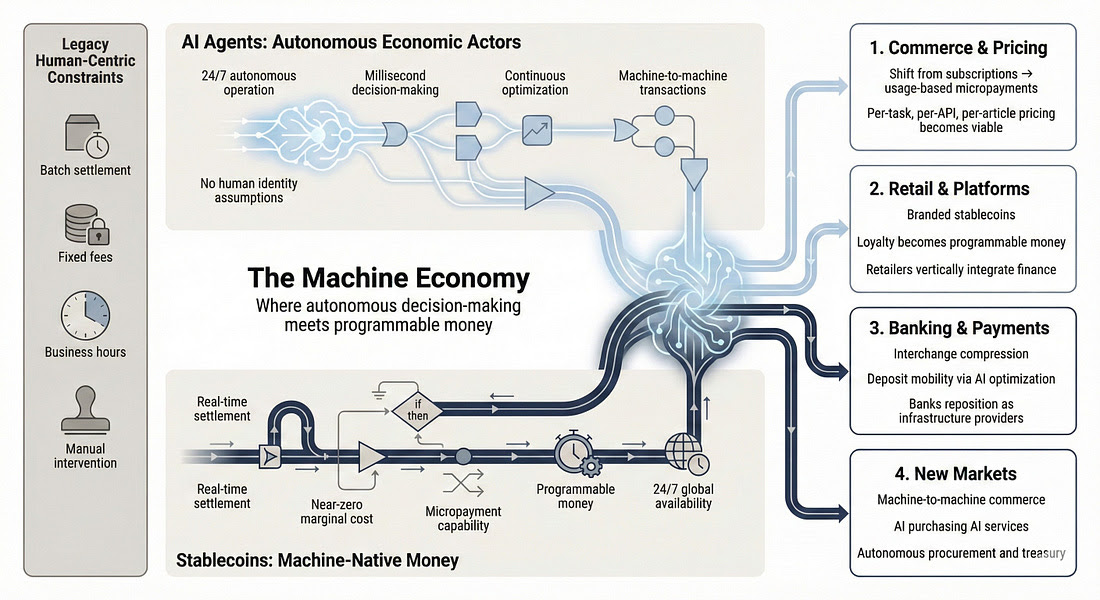

In his latest newsletter, Visser explores what he calls “the machine economy” – a new digital economy powered by artificial intelligence (AI) agents using stablecoins that will overhaul the much less efficient legacy payment rails.

To understand the concept, Visser offers the following thought experiment:

“Imagine a factory that operates around the clock, making thousands of decisions per hour, optimizing every input and output in real time. Now imagine that factory can only receive raw materials between nine AM and five PM on weekdays, with deliveries taking two to three days to confirm. The mismatch would be absurd. Yet this is precisely the situation emerging as autonomous AI agents encounter our legacy banking infrastructure.”

Source: Jordi Visser

The analyst also notes that only blockchain-based stablecoins are capable of resolving those constraints. As he puts it, “a stablecoin is simultaneously a unit of account, a settlement mechanism, and a programmable object” that can move globally in seconds at near-zero costs.

According to Andreessen Horowitz (a16z), stablecoin volume reached $46 trillion in 2025, over 20x more than PayPal, and 3x more than Visa. Coingecko data currently records the total market cap of stablecoins at $314 billion, in a seemingly constant uptrend.

Read More: COVID March 2020-Style Event Potentially Brewing for Bitcoin: Luke Gromen

That’s because stablecoins are the “on-ramp” to the digital economy, Visser says.

And when people take that on-ramp, Visser argues that it will then connect them to the entire crypto ecosystem, of which bitcoin sits at the center.

The analyst says:

“This is why I believe Bitcoin will be the best-performing major asset in 2026. Not because of speculation or narrative momentum, but because of plumbing. Stablecoins are the on-ramp infrastructure for the digital economy. As that infrastructure scales, processing tens of trillions annually and growing, it systematically expands the pool of participants with wallets, exchange accounts, and comfort transacting in digital assets. Bitcoin sits at the apex of that ecosystem as the established store of value with the deepest liquidity, the longest track record, and now, unprecedented institutional access through spot ETFs.”

Bitcoin is currently trading at $94,532, up 9% on the year so far.

- Why does Jordi Visser think bitcoin will be the best-performing asset in 2026?

Visser says bitcoin will benefit structurally from the growth of stablecoins and AI, not speculation. - How do stablecoins support bitcoin’s long-term outlook?

Stablecoins act as the on-ramp to the digital economy, expanding access to the broader crypto ecosystem where bitcoin sits at the center. - What is the “machine economy” described by Visser?

It’s a new AI-driven economy where autonomous agents require instant, always-on digital payments that legacy banking can’t support. - Why does bitcoin sit at the center of the digital economy?

Bitcoin serves as the primary store of value with the deepest liquidity, longest track record, and growing institutional access via ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。