Ethereum Processes Record Daily Transactions and Welcomes New Wallets at Scale

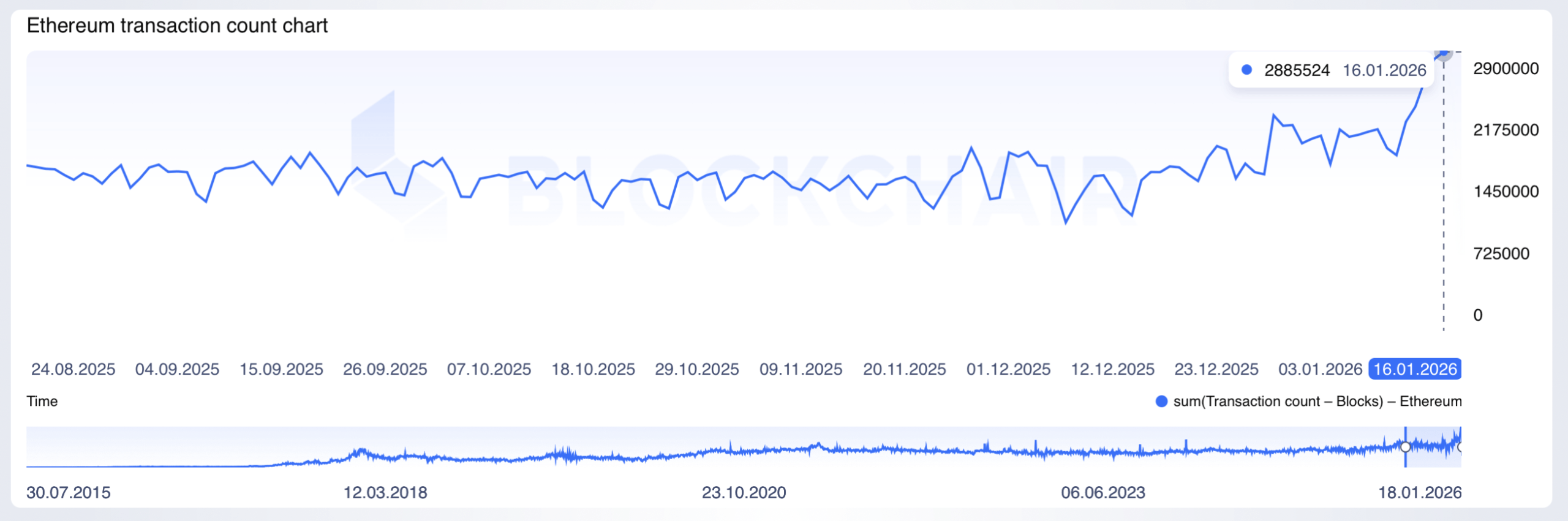

Network activity on Ethereum is accelerating fast, and January 2026 is shaping up to be the most intense stretch the chain has ever seen. Transaction counts are rising sharply from late December levels, and the network is now logging multiple days with well over two million transactions.

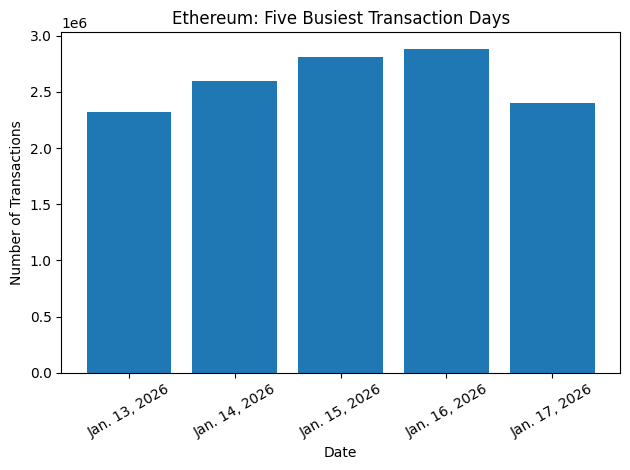

ETH transfer stats logged by Blockchair show the peak is unfolding in real time. Jan. 16, 2026, now stands as Ethereum’s most active day on record with 2,885,524 transactions processed. Right behind it are Jan. 15 at 2,812,123, Jan. 14 with 2,595,176, Jan. 17 at 2,398,473, and Jan. 13 at 2,319,935. Five of Ethereum’s busiest days ever are packed into a single mid-January window.

What’s striking is how smooth this surge looks onchain. There’s no single outlier day distorting the data. Instead, Ethereum is sustaining elevated throughput day after day, suggesting steady demand rather than a fleeting spike.

Image source: Blockchair.com

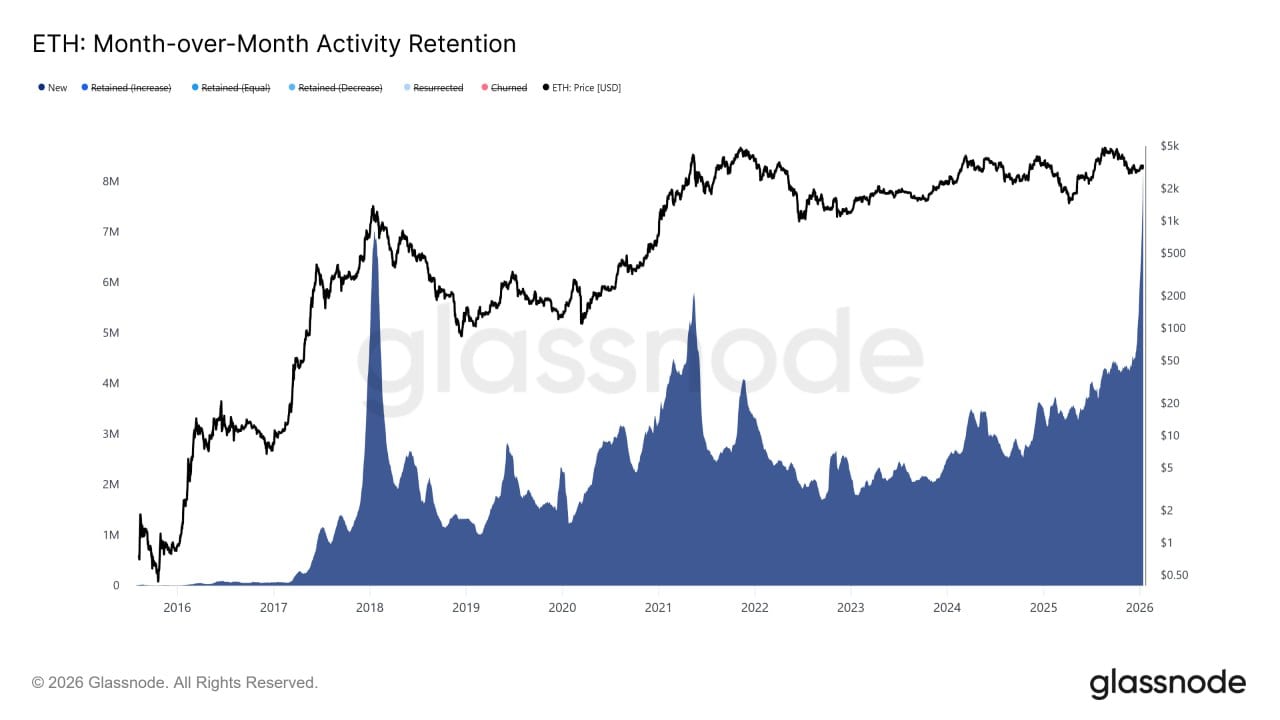

Glassnode’s latest month-over-month activity retention data adds crucial color to what’s happening. The analytics firm is reporting a sharp increase in the “new” cohort—addresses interacting with Ethereum for the first time within the past 30 days. In simple terms, fresh wallets are arriving en masse, and they’re actively using the network.

Image source Glassnode.

That distinction matters. This isn’t just long-time users pushing buttons faster. Ethereum is actively onboarding new participants, broadening its base rather than recycling activity among the same set of addresses. The current transaction boom is being fueled by expansion, not repetition.

Under older conditions, this kind of activity would typically send gas fees soaring. But that’s not what’s happening now. Average Ethereum transaction fees, logged by bitinfocharts.com, remain muted, continuing a downward trend that started after a brief spike in early November when costs briefly approached $2.

As January progresses, average transaction fees are hovering between a few cents and roughly $0.20. Even with transaction counts climbing into record territory, fee pressure remains super minimal, and confirmation times are staying quick especially given the fact that those fees are simply an average.

Right now, real-time gas pricing from Etherscan’s Gas Tracker tells the same story. Ethereum gas fees are sitting around 0.026 to 0.028 gwei, translating to less than one cent per transfer, with confirmations landing in about 30 seconds. It’s difficult to overstate how cheap that is by historical standards.

More complex activity isn’t breaking the bank either. Onchain swaps and borrowing transactions are currently costing around $0.03, non-fungible token ( NFT) sales are averaging $0.05 to $0.06, and bridging transactions are coming in near $0.01 across low, average, and high priority settings. Whether users are trading, minting, or moving assets across chains, costs remain exceptionally low.

Also read: Is Bitcoin About to Go Parabolic? Bitwise Sees ETF Demand Draining Supply

All things considered, the picture is hard to ignore. Ethereum is absorbing record transaction volumes, welcoming a wave of new wallets, and doing so without triggering the familiar gas-fee backlash. The network is busy, crowded, and active—but it’s not congested.

As January 2026 continues to unfold, Ethereum is quietly demonstrating something it and many chains have long been criticized for lacking: the ability to scale activity without punishing users via massive fee hikes. Millions of transactions are flowing through the network, and for now, the fee meter barely moves.

FAQ ❓

- Why is Ethereum activity rising right now?

Onchain data shows both increased usage and a growing number of first-time wallets interacting with the network. - What are Ethereum’s busiest days ever?

The top five all occur between Jan. 13 and Jan. 17, 2026, led by Jan. 16 with nearly 2.9 million transactions. - Are gas fees increasing with higher activity?

No, fees remain low, with most transactions costing just a few cents or less. - What does Glassnode’s data indicate?

Glassnode shows growth in new addresses, meaning fresh users—not just existing ones—are driving activity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。