Trump's statement, "I want him to stay in his original position," caused the probability of Hassett's nomination as Federal Reserve Chairman in the prediction market to plummet from a high of 15%, while the chances for hawkish candidate Waller surged to over 60%.

On January 16, 2026, during a public speech at the White House, President Trump addressed Kevin Hassett, the Director of the National Economic Council, saying, "In fact, I want you to stay in your position."

This seemingly ordinary remark was quickly interpreted by the market as a clear political signal—the once widely favored "absolute dove" candidate may now be out of the running for the Federal Reserve Chair position.

The market reaction was immediate. Data from the prediction platform Polymarket showed that Waller's chances of being nominated for the next Federal Reserve Chair jumped from just above 40% to around 60%, while Hassett's probability dropped sharply from about 35% to approximately 15%.

1. Personnel Signals

● Trump's latest remarks quickly changed market expectations for the future leadership of the Federal Reserve. His statement to Hassett, "I want you to stay in your position," was widely seen as eliminating the possibility of Hassett succeeding Powell as Federal Reserve Chair.

● Previously, Hassett and Waller were considered the two leading candidates to replace Powell. Trump had praised both "Kevins" as outstanding but had never clearly indicated a preference.

● As early as July 2025, Treasury Secretary Basant announced that the "selection process for the next Federal Reserve Chair has officially begun." At that time, insiders revealed that Hassett, as one of the longest-serving economic advisors in the Trump administration, was an "early frontrunner" to succeed Powell.

● The market had originally expected that if Hassett, the "absolute dove," were to lead the Federal Reserve, it would be more favorable for interest rate cuts in 2026, thus supporting the performance of risk assets. His exit forced traders to quickly adjust their expectations for future monetary policy.

2. The Candidate Battle

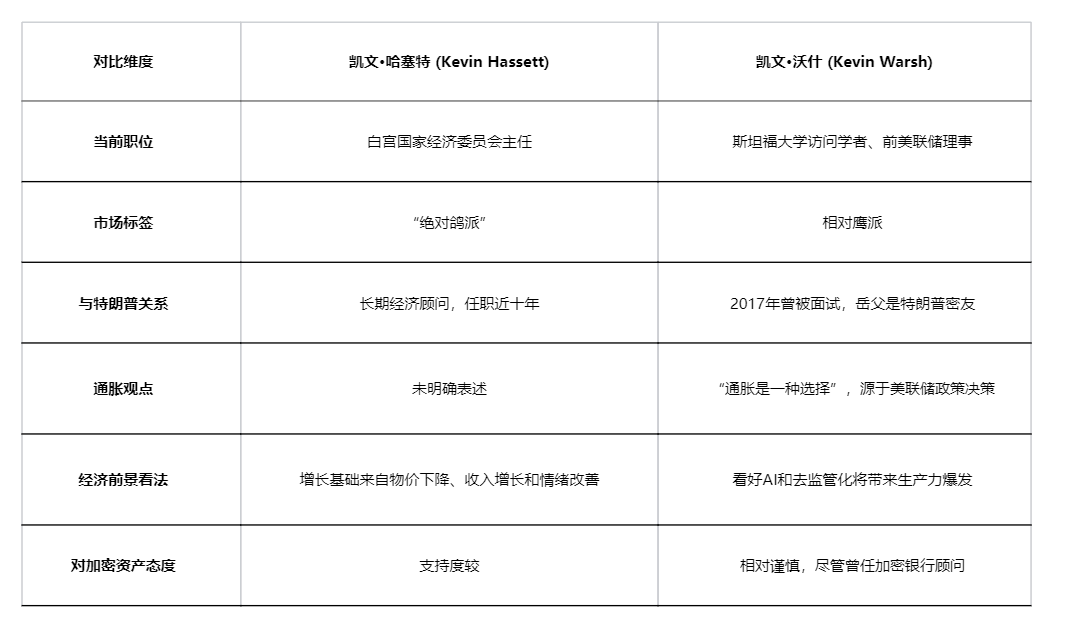

● With Hassett's probability plummeting, Kevin Waller has become the overwhelming favorite for the Federal Reserve Chair position. The former Federal Reserve Governor's policy stance sharply contrasts with Hassett's, indicating a potential shift in the Federal Reserve's direction.

● Waller is currently a visiting scholar at Stanford University and served as a Federal Reserve Governor from 2006 to 2011. Trump had interviewed Waller for the Federal Reserve Chair position in 2017 but ultimately chose Powell.

● Compared to Hassett, Waller's stance is more hawkish, having previously stated that "inflation is a choice," arguing that inflation stems from the Federal Reserve's own policy decisions. He is extremely optimistic about the U.S. economic outlook, believing that AI and deregulation will lead to a productivity surge similar to that of the 1980s.

Hassett himself seemed to have anticipated this outcome. Before Trump's statement, he had remarked: "Waller and Rieder would also make great Federal Reserve Chairs."

The backgrounds and policy tendencies of the two main candidates are compared below:

3. The Big Picture of Federal Reserve Personnel

Powell's term as Federal Reserve Chair will end in May 2026. Since Trump's return to the White House, he has publicly criticized Powell's Federal Reserve for not cutting interest rates multiple times, even threatening to remove him from office at one point.

● In addition to the Chair position, the Federal Reserve Board also faces significant personnel changes. Trump's nominee, Stephen Milan, joined the Federal Reserve Board after being confirmed by the Senate in September 2025. Meanwhile, Trump is attempting to dismiss Federal Reserve Governor Cook on charges of mortgage fraud.

● The Supreme Court has scheduled a hearing for January 2026 on the "Trump v. Cook" case, the outcome of which could affect the voting balance of the Federal Reserve Board and set a precedent for dismissing Federal Reserve Governors.

● The annual rotation of regional Federal Reserve Presidents will also influence policy votes in 2026. The four regional Federal Reserve Presidents with voting rights next year include Harmack from the Cleveland Fed, Paulson from the Philadelphia Fed, Logan from the Dallas Fed, and Kashkari from the Minneapolis Fed.

This combination includes both pragmatists and hawkish officials who consistently emphasize inflation risks, suggesting potential divisions within the Federal Reserve regarding the pace of interest rate cuts.

4. Divergence in Interest Rate Cut Paths for 2026

The direction of the Federal Reserve's monetary policy in 2026 has become a focal point of market divergence. There are significant differences between traders' and Federal Reserve officials' views on the path of interest rate cuts, and personnel changes may exacerbate this uncertainty.

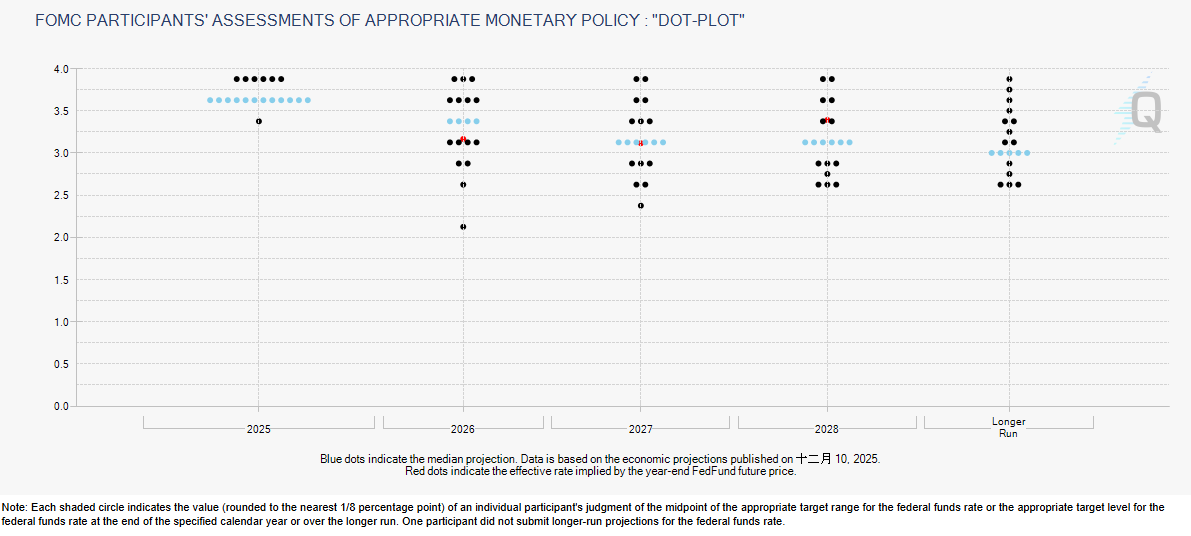

● According to the CME Group's FedWatch Tool, the market currently expects interest rates to drop to a range of 2.75% to 3.0% by the end of 2026, which is 1.25 percentage points lower than the current range of 4% to 4.25%. This sharply contrasts with the median forecast of Federal Reserve officials.

● In September 2025, the median forecast from Federal Reserve policymakers indicated that interest rates would be 3.4% by the end of 2026, only 0.2 percentage points lower than the 2025 forecast. Officials predict that the core inflation rate in 2026 will be 2.6%, still above the central bank's annual target of 2%.

● Federal Reserve Vice Chair Bowman expressed a relatively moderate view in a speech on January 16, 2026. She noted: "As labor market conditions weaken and inflation continues to decline, I support the 25 basis point cuts made in September, October, and December of last year."

● Bowman is particularly concerned about the fragility of the labor market, stating: "As the unemployment rate rises and wage employment growth stabilizes, we see labor market conditions gradually weakening." This concern may prompt the Federal Reserve to adopt a more accommodative policy stance.

5. Market and Independence Impact

Trump's intervention in Federal Reserve personnel has raised concerns about the central bank's independence, which could have far-reaching effects on global capital markets. Wall Street almost universally believes that interfering with the Federal Reserve's independence could significantly impact global capital flows.

● Jamie Dimon, CEO of JPMorgan, told The Wall Street Journal: "Using the Federal Reserve for political purposes could have negative consequences, completely opposite to what you hope for. It's important that they maintain their independence." He was the first major financial institution leader to publicly respond to Trump's harsh criticism of Powell.

● Analysts warn that if market participants believe the Federal Reserve's independence is weakening, financial assets could experience significant volatility. One of the biggest risks is that investors may sell U.S. Treasuries, thereby pushing up interest rates on long-term bonds relative to short-term bonds in the U.S. bond market.

● Some analysts are concerned that this could trigger a range of issues, from trading disruptions to a rebound in inflation. Vincent Reinhart, chief economist at the Bank of New York Mellon, pointed out: "If we were to distill the Trump administration's agenda into a guiding principle, we might choose 'personnel is policy.' Those appointed to government positions determine how policies are interpreted, executed, and implemented."

● For the cryptocurrency market, Trump's personnel signals are also seen as a potential turning point. As Bitcoin prices approached $100,000 in early 2026, Hassett's exit could exert short-term pressure on crypto assets. Analysts believe that Waller's monetary policy stance is not as accommodative as Hassett's, suggesting that a high-interest rate environment may persist longer.

As of January 17, the prediction market shows that Waller's chances of being nominated as Federal Reserve Chair have surpassed 60%, while Hassett's probability has shrunk to 15%, comparable to that of Federal Reserve Governor Waller.

Trump's earlier proposal to establish a "shadow Federal Reserve Chair" is becoming clearer with Hassett's exit and Waller's lead.

Regardless of who the final candidate is, the Federal Reserve in 2026 will face the balancing act of inflation and employment, the interplay of political pressure and independence, and the gap between market expectations and actual policies under new leadership. The Powell era is coming to an end, and a new chapter in U.S. monetary policy is slowly unfolding.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。