Written by: Maher, Foresight News

On the morning of January 19, around 7 AM, the cryptocurrency market experienced a sudden flash crash, with BTC's price plummeting sharply from $95,531 to a low of $91,910 in a short period. ETH dropped from $3,350 to a low of $3,177, and SOL fell from $143 to a low of $130. Some altcoins like SUI, XPL, and ASTER saw declines of over 10% within 24 hours.

According to Coinglass data, in the past 12 hours, the total liquidation across the network reached $830 million, with long positions accounting for $764 million. The largest single liquidation occurred on Hyperliquid's BTC-USDT perpetual contract, valued at $25.8337 million.

Meanwhile, traditional safe-haven assets like gold and silver rose against the trend, reaching historical highs. Spot gold surpassed $4,690 per ounce, marking a new record with a daily increase of over 2%. Spot silver climbed above $94 per ounce, also setting a historical high with a daily rise of over 4%.

U.S. stock markets are closed today, and the U.S. dollar index fell by 0.26%, quoted at 99.14. U.S. stock futures opened lower, with S&P 500 futures down 0.71% and Nasdaq futures briefly dropping by 1.1%. U.S. 10-year Treasury futures rose by 5 points, and 30-year Treasury futures also increased by 5 points.

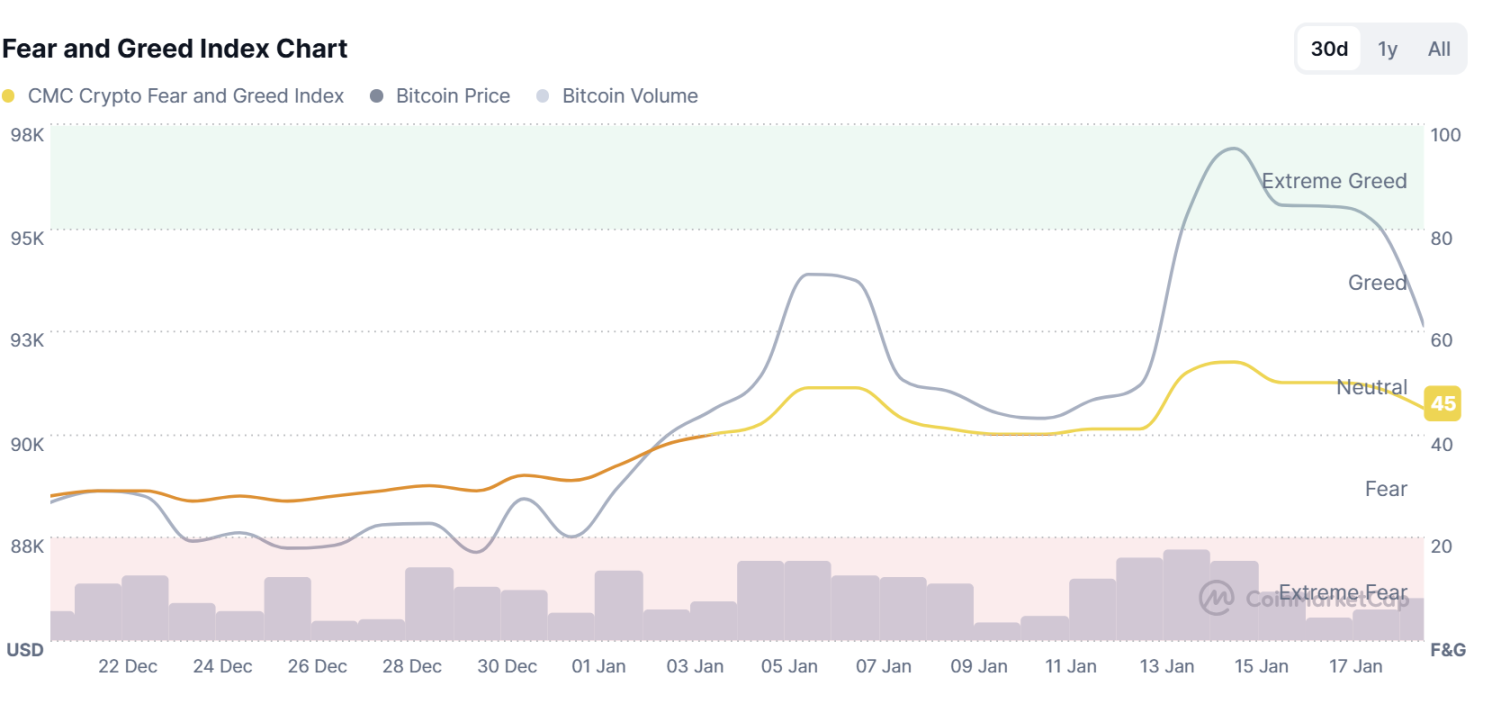

Currently, the cryptocurrency market's fear and greed index has fallen to 45.

This incident is not isolated but rather a result of intertwined macroeconomic factors and geopolitical tensions.

Trump Again Wields Tariffs, Imposing Tariffs on 8 European Countries Starting February 1

The trigger for last year's cryptocurrency market "1011 crash" was Trump's tariff threats against China, and now this scene is replaying.

On January 18, Trump posted on Truth Social that due to the Greenland issue, starting February 1, all goods exported to the U.S. from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland will be subject to a 10% tariff. By June 1 of this year, the tariff will increase to 25%. This tariff will continue until an agreement is reached on the "complete and thorough purchase of Greenland."

In his post, Trump stated, "Countries like Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland have all gone to Greenland for unclear purposes. This poses a very dangerous situation for the safety, security, and survival of our planet. These countries are playing an extremely dangerous game, and the level of risk they bring is intolerable and unsustainable. Therefore, to protect global peace and security, strong measures must be taken to swiftly and indisputably end this potential danger."

Additionally, according to CNBC, after Trump issued tariff threats regarding the "Greenland issue," several European leaders made strong statements emphasizing that Greenland's sovereignty is non-negotiable and warned that this move would further tear apart transatlantic relations.

European Commission President Ursula von der Leyen and European Council President António Costa stated that pressuring allies with tariffs would harm U.S.-European relations and could trigger a "dangerous vicious cycle"; EU High Representative for Foreign Affairs and Security Policy Kaja Kallas remarked that tariffs would only harm shared prosperity, distract from European priorities regarding Ukraine, and allow adversaries like Russia and China to "profit from the situation." Furthermore, Spanish Prime Minister Pedro Sánchez warned that if the U.S. takes more aggressive actions regarding Greenland, it would have a significant impact on NATO. The ambassadors of the 27 EU countries plan to hold an emergency meeting to coordinate a response.

On the same day, Bloomberg reported that Senate Democrats plan to propose legislation to prevent Trump from imposing tariffs on European countries opposing the U.S. annexation of Greenland. Previously, Senate Minority Leader Chuck Schumer criticized this move as damaging to the U.S. economy and relationships with allies.

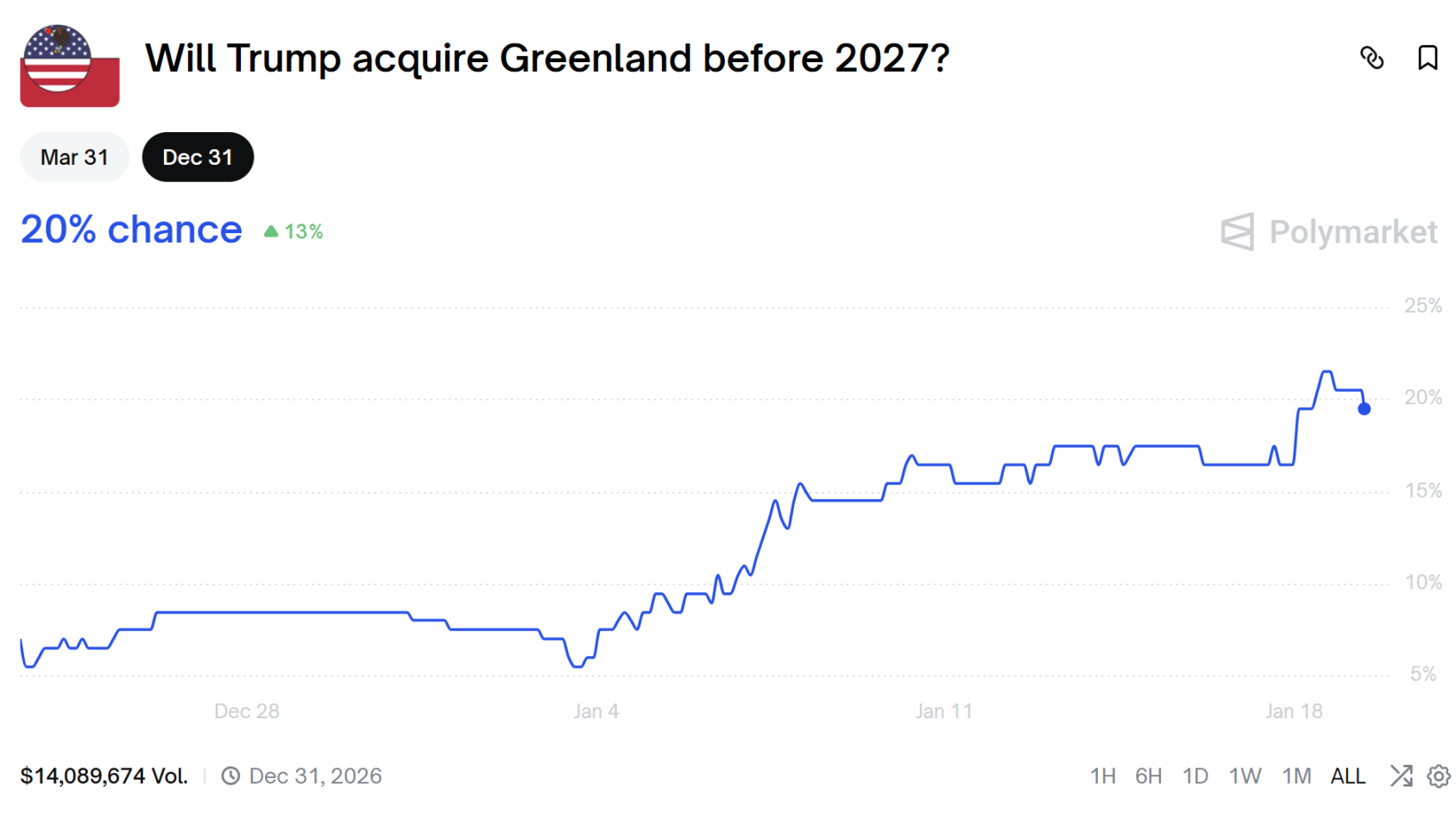

Polymarket's latest data shows that the market bets on the probability of Trump acquiring Greenland by 2027 at 20%.

Tariffs and geopolitical concerns have led investors to turn to gold and silver for safety, resulting in capital flowing out of cryptocurrencies.

Additionally, in January, the probability of the Federal Reserve remaining on hold is very high; according to Polymarket data, the current market bets on the probability of no rate cuts have risen to 96%, putting pressure on risk assets.

On the evening of January 18, the cryptocurrency trading indicator analysis platform CoinKarma stated, "BTC rose to nearly $98,000 earlier this week, but as it approached that price level, the market experienced the most significant selling pressure in recent weeks, causing a slight price retreat. However, overall liquidity between buyers and sellers has not shown a significant imbalance and remains relatively balanced. Other key market indicators have not yet shown clear signals. Based on the current situation, long holders who entered at relatively low points at the beginning of the year may consider taking profits, choosing to close all or part of their positions and waiting for clearer signals before re-entering."

Veteran crypto investor Dan Tapiero stated, "If I were to invest $10,000 in crypto assets in 2026, I would allocate the funds directly to Bitcoin, Ethereum, and Solana; how to allocate specifically depends on personal preference."

Dan Tapiero believes that the biggest opportunities in the cryptocurrency space in 2026 lie in the proliferation of infrastructure and stablecoins. Tapiero expects Bitcoin to rise to $180,000 in this cycle, citing the combined effects of increasing demand and shifts in global monetary policy. Declining interest rates and massive government investments in AI infrastructure will bring strong positive factors. This global push is leading to the depreciation of all fiat currencies, including the dollar, which is very favorable for Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。