Visible Alpha: How to Invest in AI Over the Next 26 Years?

Three Key Points for 2026:

- How will agents explode?

- Can energy meet the demand for computing power?

- Will Apple transform into an AI company?

Zero, Introduction

In 2025, the trend of generative artificial intelligence (GAI) continues to drive the momentum of AI development, with cloud service providers increasing capital expenditures to transform data centers into accelerated computing facilities.

The theme of artificial intelligence continues to evolve in 2025. Visible Alpha observes that companies are attempting to apply AI more broadly within their organizations, aiming to improve efficiency and enhance customer experience.

Although the usage rate and output quality of OpenAI's ChatGPT and similar products improved in 2025, there has yet to be a disruptive new type of intelligent agent application utilizing AI.

At the Consumer Electronics Show in Las Vegas, Jensen Huang predicted that agents will become the next generation of applications. Will we see the emergence of these AI agents in 2026?

In recent years, there has been a surge of innovation in the fields of chips and models, with Nvidia benefiting immensely. However, innovation at the application level has lagged, making it difficult to drive widespread adoption of AI among end users and create more competitive business models.

The extent to which AI can impact businesses and individuals remains uncertain. Can the benefits brought by AI help companies achieve stronger fundamentals and profit growth? Or will they merely scratch the surface due to high costs?

In 2025, as AI agents were introduced into specific roles within workflows, companies began to adopt AI more broadly. AI agents seem capable of executing domain and role-specific workflows, thereby complementing human roles within organizations. For example, a company might have dedicated AI agents for research, security, analysis, sales, and customer service to assist these functional departments. We look forward to seeing how companies utilize these agents and their direct or indirect impact on long-term revenue and costs.

The challenge lies in accurately identifying user profiles and generating outputs specific to certain domains. However, the high cost of complex reasoning remains a significant barrier to growth. To improve outcomes and gain user trust, token and power costs may need to be significantly reduced and optimized in data centers.

For simple, general tasks, cost and organizational requirements may make adoption easier. Incorporating unique domain and user profile characteristics into basic tasks significantly increases the risk of erroneous predictions and ultimately raises the cost of improving outcomes.

Jensen Huang stated at the CES in early January 2026 that agents will serve as a gateway to the next generation of applications, further driving the broader application of AI. Future applications will be built in the form of "reasoning agents," interacting in the cloud and at the edge.

Generative artificial intelligence can enhance testing processes by adding rare or dangerous events (such as burning cars), altering lighting or weather, and inserting new objects with correct shadows and reflections. This allows for the creation of infinite environmental variations from just one real-world scene capture. Such domain-specific, detailed, and complex testing is crucial for ensuring that AI outputs aimed at customers and internal business operations are accurate and effective.

However, it currently appears that the development of AI technology is outpacing its application.

In addition to the enormous costs of reasoning, companies also need to improve process orchestration, security, feedback, risk management, and incentive mechanisms. The Massachusetts Institute of Technology's "2025 AI Workforce Report" indicates that 12% of jobs in the U.S. can be automated, but few leaders know which jobs can be automated or how to describe the workflows of specific roles.

The study also found that over 90% of companies claim to use AI, but 97% report that productivity has seen little to no significant improvement; moreover, when early AI deployments are unsuccessful, both costs and trust levels tend to rise.

In the future, companies that combine AI with supporting functions and business strategies may gain a competitive advantage. As AI applications become more widespread, reimagining risk and incentive mechanisms may become a powerful core competency for future businesses.

I. 2025 Performance Overview

Currently, among the 58 U.S. publicly traded companies covered by the Visible Alpha AI Monitor, the top 10 companies account for 79% of the market capitalization, while the remaining 21% is distributed among 48 companies.

Whether weighted by market capitalization or AI-related revenue, the performance of the Visible Alpha AI Monitor this year is still primarily driven by the stock prices of the largest companies outperforming the S&P 500 index.

Additionally, the performance of small companies in 2025 (relative to the S&P 500 index) lagged behind that of large companies. Despite the overall poor performance of small companies, they achieved positive returns in 2025, and the gap with large companies has narrowed.

After applying equal weighting, the overall returns of the AI Monitor this year are lower than the composite returns weighted by market capitalization and AI-related revenue due to the lower earnings of small companies.

In 2025, larger companies continued to perform well, just as they did in 2024. Looking ahead to 2026 and 2027, small companies may benefit from new government policies and potential low interest rates.

1. Top Ten

According to the analysis of the top ten companies, the revenue forecast for AI-related business segments has increased by a total of $29.7 billion since January 2025. However, of the revenue growth expected in 2026, only $7.6 billion comes from Nvidia. Looking ahead to 2026, Nvidia's revenue forecast has been raised by $83 billion.

While this figure is already quite substantial, it is more than double the upward adjustment from last year. These forecasts seem to indicate that the growth momentum and positive sentiment surrounding Nvidia and the AI industry are likely to continue into 2026.

2. Opportunities for Small Companies

The remaining 48 companies may provide investors with a platform to discover new investment opportunities, helping them identify emerging businesses that are expanding.

Although the overall performance of small companies is not as strong as that of the top ten, some of these companies stand out relative to the overall market. Among these small companies, there is a significant variance in revenue growth expectations.

Some companies are expected to achieve strong double-digit revenue growth, while others have seen their expectations decline. These dynamics may help investors identify emerging trends in the sector.

In 2025, we saw that $BBAI, $STX, and $MDB confirmed this trend. These companies all achieved performance far exceeding that of the Russell 2000 index, positioning them as potential up-and-comers in the sector for long-term development.

In line with these high-performing companies, 31% of small companies in the AI monitoring report also achieved excellent performance in 2025. This strong momentum may indicate that the fundamentals and valuations of small companies will begin to gain support in 2026.

II. What is Driving Development?

In 2025, five of the top ten companies with the highest AI-related revenues performed strongly, while only 31% of small AI stocks outperformed the small-cap index.

AI-related revenue is expected to grow by $1 trillion, from $472 billion at the end of 2023 to $1.5 trillion by the end of 2027, primarily driven by the top ten companies in the AI monitoring report. Nvidia alone accounts for one-third of the expected AI-related revenue of these ten companies in 2027, as well as 27% of total revenue.

Nvidia and the AI Arms Race

From the end of 2023 to the end of 2026, the market's general expectations for Nvidia's AI-related business revenue have been cumulatively raised by over $400 billion since early 2024.

These upward adjustments have significantly increased the concentration of AI-related business revenue and driven the stock performance of AI monitoring metrics.

Notably, in 2024, the revenue expectations for Nvidia's data center business were raised by an additional $200 billion on top of the $200 billion increase already made in 2023. This optimism primarily stems from cloud service providers continuing to increase capital expenditures to support the transformation of data centers into accelerated computing facilities, thereby better supporting AI applications.

Capital expenditures for $META, $GOOGL, $AMZN, $AAPL, and $MSFT are expected to exceed $500 billion in 2026, a significant increase from $159 billion in 2023.

In 2025, the upward adjustment of Nvidia's earnings expectations slowed, but the growth rate also correspondingly decreased. Additionally, the pace of upward adjustments for data center earnings expectations slowed before the release of the fourth-quarter financial report.

Questions remain: How much of the surge in capital expenditure expectations has the market already digested, and will expectations be further raised? Currently, the market's general expectations seem to have stabilized, but the potential market size for AI GPUs continues to expand.

The massive capital expenditure growth driven by cloud service providers is likely motivated by the competition for text and video corpora, as AI is evolving towards different modalities. Alphabet's TPU, designed specifically for video processing, has the potential to undermine Nvidia's dominance in text processing.

III. What About Apple?

Beyond the top ten, we are also closely monitoring Apple's potential AI revenue trends. The company launched Apple Intelligence last summer and embedded many new AI features in its latest iPhone models.

However, these product updates have not garnered much attention from users, raising concerns that the new AI features may not be sufficient to prompt users to upgrade their old phones. In its recent financial report, Apple committed to increasing its investment in AI.

There are questions about Apple's strategy and whether it will make large-scale acquisitions in this field. With over $120 billion in cash reserves, Apple is fully capable of making significant moves in this area.

Due to a slowdown in growth in the Chinese market, expectations for iPhone sales in fiscal year 2026 have been revised down from 237 million units last year to 230 million units currently. It will be very interesting to see what new updates Apple may release to stimulate market enthusiasm and drive user upgrades.

Currently, the upgrade cycle for the next generation of iPhones is relatively slow. However, if Apple begins actively procuring TPUs (Tensor Processing Units), it could greatly enhance the AI capabilities of the iPhone.

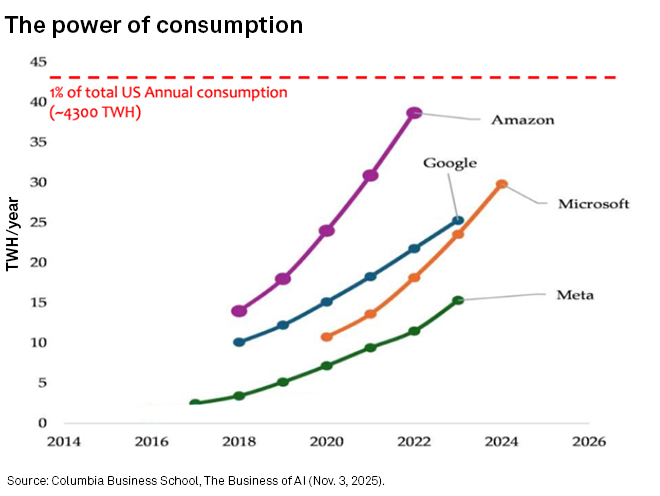

IV. Significant Increase in Power Consumption

(Top Companies' Power Consumption)

Under the leadership of the new U.S. government, the regulation, governance, and oversight of AI have been refocused on establishing new AI infrastructure in the U.S.

In early 2025, Trump launched the "Stargate Project," an AI infrastructure company that plans to invest $500 billion over the next four years to build new AI infrastructure in the U.S.

The initial funding for the Stargate Project will come from SoftBank, OpenAI (under Microsoft), Oracle, and MGX. Oracle's CTO Larry Ellison, SoftBank's CEO Masayoshi Son, and OpenAI's CEO Sam Altman outlined the ambitious goals of the Stargate Project during a meeting with President Trump, along with their initial commitment of $100 billion in investment and a subsequent $400 billion financing plan over the next four years.

As the government continues to focus on AI and its impact on the U.S., the new administration seems more inclined to build and secure infrastructure rather than attempt to regulate AI. According to a study by Columbia University, AI currently consumes 2% of the energy in the U.S., but as AI infrastructure grows, this proportion could rise to 15% to 20% by 2030. Providing sufficient power to data centers that support the operation of AI agents is crucial for the future of AI.

V. Outlook

Given the new government's support for artificial intelligence and the expansion of AI infrastructure in the U.S., cloud service providers are likely to maintain their core position. In 2025, driven by strong demand for AI solutions, Seagate and Palantir are leading the market.

We may begin to see changes in the market landscape in 2026. AI-related products could become a key investment theme for 2026. Additionally, Apple is the biggest variable in this field.

At the same time, discussions on how to best create scalable enterprise-level AI agents are increasing. For many companies, it remains unclear how to engage in bringing AI into their businesses and expanding its influence within their business models. Specialization and applying domain expertise to small models may become increasingly important for the success of these tools.

In 2026, we will closely monitor the pace at which companies leverage AI agents to drive innovation. Currently, there are still some doubts regarding practical use cases, real impacts, and return on investment. By 2026, AI agents and AI notebooks may become effective mechanisms for driving broader enterprise applications and developing specialized applications. However, the ultimate success or failure of these new AI tools remains to be seen.

We are very interested in how technological cooperation with the U.S. government will develop. For example, the "Stargate" project, a collaboration between ARM, Nvidia, Oracle, SoftBank, and OpenAI (a Microsoft subsidiary), is expected to drive sales and profit growth for key players.

The robust development of AI infrastructure in the U.S. may give rise to some emerging companies in the AI field, which will become major beneficiaries. Despite the volatility in the performance of AI-related stocks in 2025, the demand for AI from key players remains strong. This seems to partly stem from the U.S. government's ongoing focus on AI in the defense and national security sectors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。