Russell 2000 & Ethereum & Altcoin Season (Part Two)

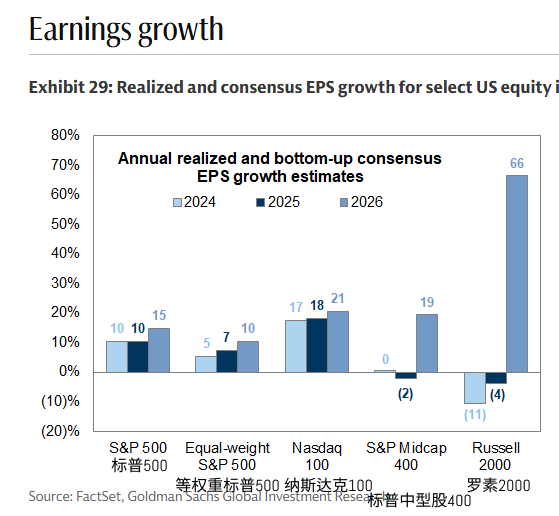

According to the expected data on earnings growth for 2026 provided by Goldman Sachs Global Investment Research, Goldman believes that 2026 should be a year of comprehensive explosion for the U.S. stock market. The five indices include the S&P 500, equal-weighted S&P 500, Nasdaq 100, S&P MidCap 400, and Russell 2000, all of which are expected to exceed their 2025 and 2024 levels in 2026.

However, the first three indices have relatively limited growth, while the S&P MidCap 400 and Russell 2000 show significant improvement, especially with the Russell 2000's earnings expected to increase by 66%. This indicates that Goldman anticipates a cyclical explosion for small-cap stocks in 2026, likely transitioning from an earnings trough to an earnings reversal.

Small-cap stocks are inherently more sensitive to interest rates, credit, and the financing environment. The high interest rates and financial tightening in 2024 and 2025 will put the most pressure on small-cap stocks. However, once a rate-cutting cycle begins or financial conditions significantly ease, small-cap stocks are likely to experience profit recovery due to base effects and operational leverage.

In simpler terms, the earnings of the S&P and Nasdaq are continuously growing, while the earnings of the Russell 2000 resemble a turning point trade. The expected 66% earnings increase does not indicate the quality of small-cap stocks but suggests that under loose monetary policy, the rebound of small-cap stocks will be more rapid and intense.

If 2026 indeed sees a strengthened version of monetary easing, the upward structure of the U.S. stock market will likely not resemble the past two years of a few leading stocks rising alone, but rather a rotation and diffusion from large-cap tech to mid and small-cap stocks. Once market risk appetite rises, the first assets to be repriced by funds are often not the already clustered leaders but the financing-sensitive assets that have been suppressed for two years.

Of course, this is not a certainty and requires at least two conditions to be met:

The U.S. truly moves towards monetary easing.

No economic recession occurs.

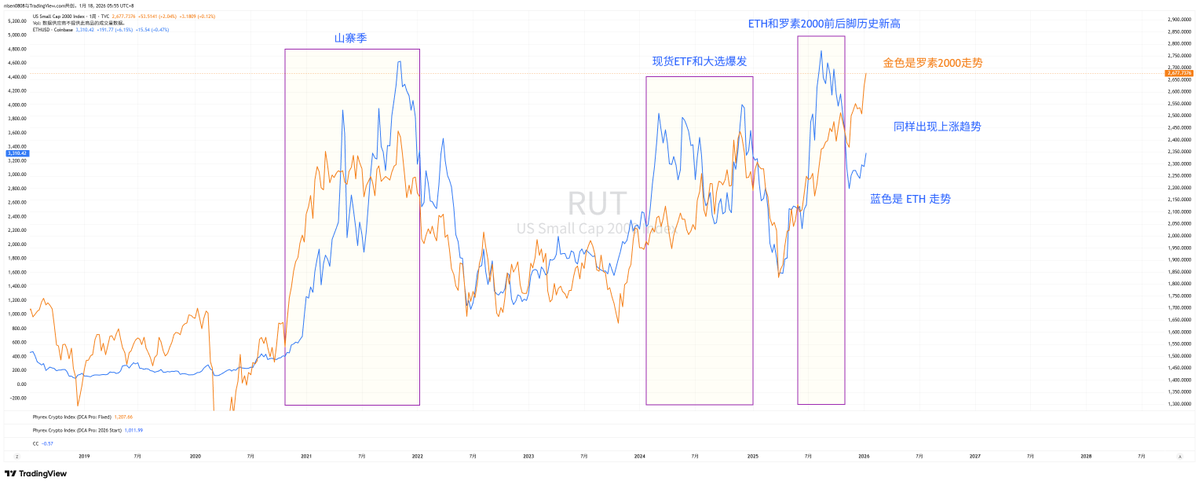

When small-cap stocks do start to rise, it indicates that investors' risk appetite is strengthening. At this point, the overflow of funds from leading stocks will enter small-cap stocks, and similarly, the overflow of profits from leading cryptocurrencies, including $ETH, $BNB, $SOL, and even $BTC, may also flow into altcoins, triggering an altcoin season.

Due to the diffusion of liquidity and the increase in investors' risk appetite, some high-net-worth investors will no longer be satisfied with modest earnings growth and will seek to bet on the possibility of significant asset increases.

To reiterate, it does not mean that an altcoin season will definitely occur in 2026, but under certain conditions, the explosion of the Russell 2000 has a high probability of simultaneously triggering an altcoin season in the cryptocurrency space. In my view, the Russell 2000 is a flag for assessing investors' risk appetite.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。