In 2025, the Web3 security landscape shifted dramatically. According to the latest annual security report from Cyvers, the platform detected over $15.87 billion in fraudulent value—a figure that dwarfs the $2.5 billion lost to traditional exploits and hacks during the same period.

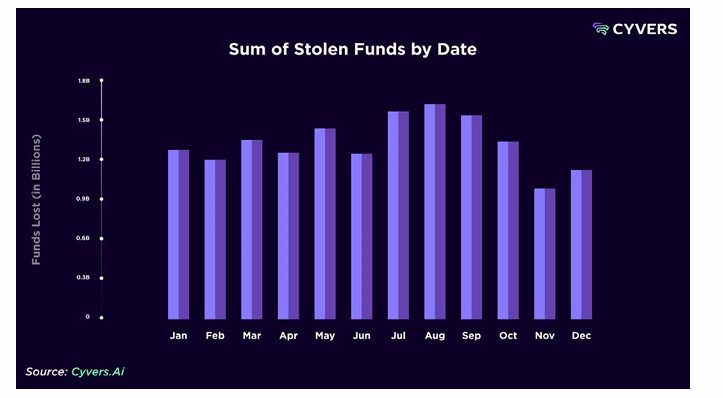

While high-profile incidents like the Bybit hack dominated the news, the billions lost to fraud often flew under the radar. This is largely because the losses were distributed across 4.29 million individual transactions, rather than a few catastrophic breaches.

The report identifies an emerging pattern of “industrialized” crime. Rather than isolated incidents, criminal networks are using address clusters tied to the same scam operations. These networks facilitate cross-platform movements that chain together multiple exchanges, payment service providers (PSPs), and off-ramps.

The most alarming evolution in the 2025 threat landscape is the aggressive pivot toward authorized fraud, epitomized by pig butchering schemes. Unlike traditional hacks that bypass security protocols, these attacks exploit human psychology to bypass the blockchain’s inherent defenses.

Read more: AI Phishing, Supply Chains, and $3.5B Lost — Crypto’s Brutal 2025

Criminal syndicates deploy sophisticated psychological playbooks, maintaining engagement with victims for weeks or even months. This builds a false sense of trust, ensuring the victim is fully committed before the final “ liquidation” event. Since victims technically authorize these transactions through their own wallets or verified accounts, they bypass traditional compromised account flags.

“Traditional fraud controls that focus on compromised accounts are often blind to these flows. Real-time behavioral analytics and entity-level risk scoring are required to catch these schemes before funds leave the platform,” notes the report.

The vast majority of fraudulent value detected was concentrated in three highly liquid assets, chosen for their ease of conversion to fiat. These are USDT, which accounted for 37% of the detected fraudulent movements, ETH (36%), and USDC (25%).

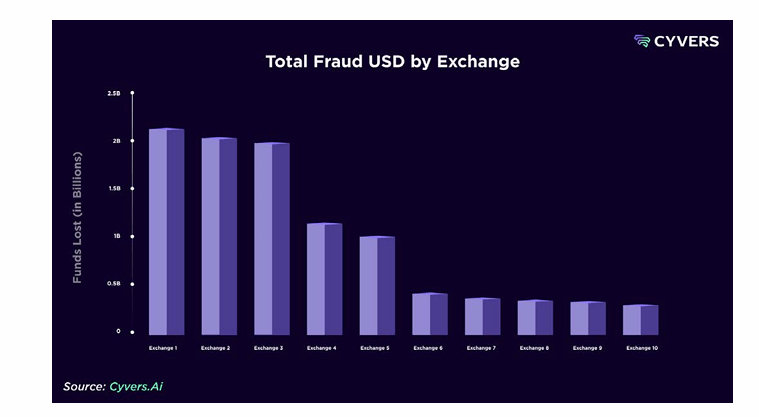

Exposure is also heavily concentrated among major players. While the report does not name specific entities, it reveals that the single most exposed global exchange accounted for over $2.3 billion in fraudulent flows. Furthermore, just three of the top ten global exchanges were responsible for nearly half of all fraud volume routed through centralized platforms.

The 2025 data confirms that crypto fraud has evolved into a global enterprise rivaling traditional organized crime. While pig butchering remains the most prominent “authorized” fraud model, it relies on the same core infrastructure: liquid stablecoins, blue-chip assets, and large centralized exchanges.

- How much Web3 fraud was detected in 2025? Cyvers tracked $15.8B in fraud, far exceeding $2.5B lost to hacks.

- What type of crime dominated the landscape? “Industrialized” scams using address clusters and cross‑platform flows.

- What is the biggest fraud trend now? Authorized schemes like pig butchering that exploit human psychology.

- Which assets and exchanges were most exposed? USDT, ETH, and USDC carried most flows, with a few global exchanges hit hardest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。