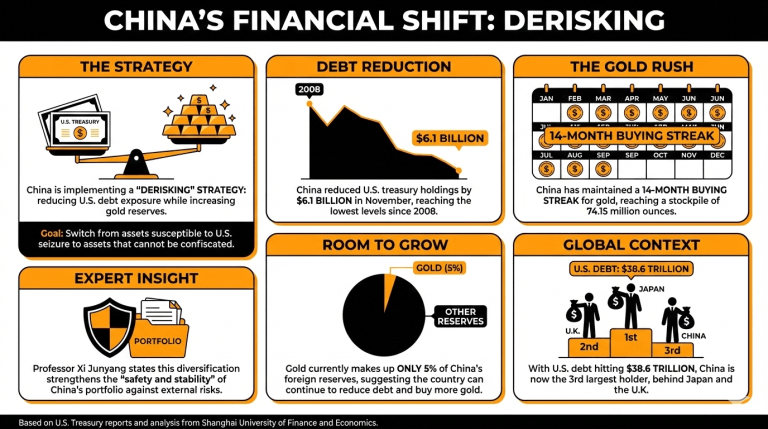

China’s “derisking” strategy seems to be in full implementation, at least when it comes to U.S. debt.

According to official reports from the U.S. Treasury, China continued its persistent sales of U.S. debt, having reduced its treasury holdings by $6.1 billion during November. China now owns $682.6 billion in U.S. treasuries, the lowest registered since 2008. This move is part of a reserve diversification policy that intensified since the start of the so-called “trade war” with the U.S.

Xi Junyang, a professor at Shanghai University of Finance and Economics, declared that this decrease was a result of “increased optimization and diversification of holdings of foreign assets seen in recent years, which helps strengthen the overall safety and stability of the portfolio.”

In contrast, China’s gold rush has reached a 14-month buying streak, as the country switches from assets controlled by the U.S. government and susceptible to seizures to assets that cannot be controlled or confiscated by third parties.

China’s gold stockpile, with 74.15 million ounces, still reaches only 5% of the nation’s foreign reserve. This means that China can continue to reduce its U.S. debt exposure and purchase even more gold.

Junyang believes that China will be allocating more of its reserves into gold in the future, as it can enhance “the stability of reserve assets” and strengthen “the ability to withstand external risks.”

China has also criticized the growth of the U.S. debt, which has recently reached $38.6 trillion, showing no signs of stopping at least in the short term.

With these movements, China is still the third-largest international holder of U.S. debt, behind Japan and the U.K.

Read more: China Steadies US Treasury Exposure as Debt Balloons Over $38 Trillion

What recent actions has China taken regarding U.S. debt? In November, China sold $6.1 billion in U.S. Treasuries, reaching its lowest exposure since 2008, indicating a shift in its investment strategy.

What reasons does China give for decreasing its U.S. debt holdings? Officials cite a focus on optimizing and diversifying foreign asset portfolios to enhance safety and stability.

How is China increasing its gold reserves? China has entered a 14-month buying streak in gold, aiming to reduce exposure to U.S. assets and acquire unconfiscatable investments.

What is the current state of China’s gold stockpile? China’s gold holdings total 74.15 million ounces, which constitutes only 5% of its foreign reserves, suggesting a potential for further purchases as it diversifies from U.S. debt.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。