Original Title: "Is the Yen's Plunge Forcing the Central Bank to Raise Interest Rates Early? Report: Officials Are More Concerned About the Impact of a Weak Currency on Inflation"

Original Author: Ye Huiwen, Wallstreet News

Officials at the Bank of Japan are increasingly concerned about the potential impact of a weak yen on inflation, a trend that could significantly disrupt the future path of interest rate hikes. According to sources familiar with the matter, while the Bank of Japan may maintain interest rates at its upcoming policy meeting, currency factors could prompt a reassessment of the timing for rate increases, potentially forcing an earlier action.

According to Bloomberg, Bank of Japan officials believe that the influence of a weak yen on prices is growing, especially as companies increasingly tend to pass rising input costs onto consumers, which could further intensify inflationary pressures. Although the Bank of Japan just raised its benchmark interest rate last month and has not set a predetermined path for borrowing costs, if the yen continues to weaken, decision-makers may consider advancing the rate hikes originally expected to occur later.

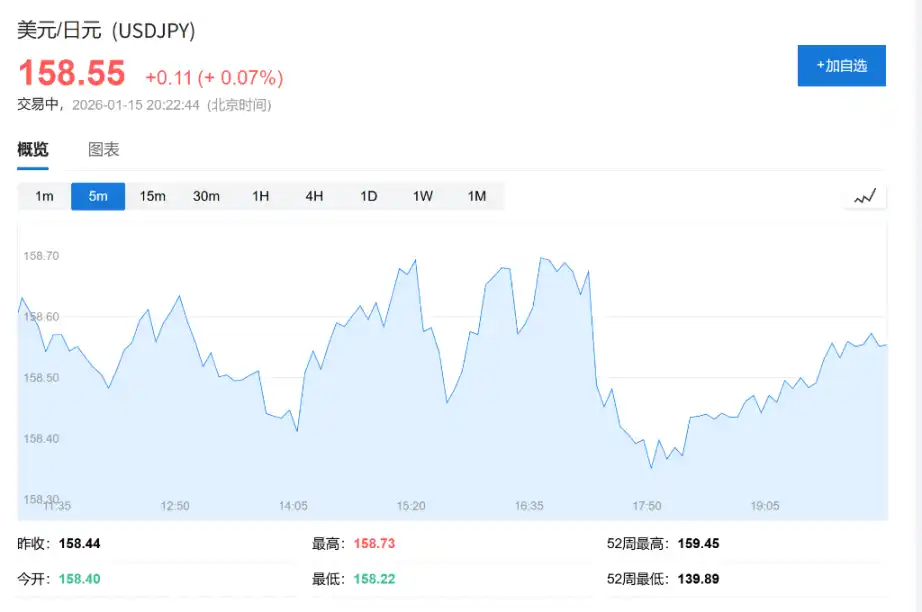

Currently, the general expectation among private economists is that the Bank of Japan will raise interest rates approximately every six months, meaning the next action could occur this summer. However, sources told Bloomberg that officials prefer to implement policy adjustments in a timely manner rather than being overly cautious, indicating that the previously anticipated pace of rate hikes may face uncertainties. Following this news, the yen briefly fell to around 158.68 against the dollar before rebounding to 158.33; as of the time of publication, the yen was at 158.55 against the dollar.

January Meeting Expectations: Maintain Interest Rates

The Bank of Japan will announce its latest policy decision on January 23. Sources have indicated that officials currently believe maintaining the interest rate at 0.75% is appropriate, a level that has reached a thirty-year high. Although there is an overall tendency to remain steady, the committee will continue to monitor economic data and financial market changes up until the last moment to make a final decision.

The focus of this meeting will be on how the central bank assesses the yen's impact on potential inflation. Sources told Bloomberg that, given that inflation trends are nearing the Bank's 2% target, officials will closely watch how exchange rate fluctuations alter price expectations for households and businesses.

Focus on Exchange Rate Transmission Mechanism

The depreciation of the yen typically increases inflationary pressures by raising import costs while also boosting exporters' profits. However, some officials have pointed out that as the yen continues to weaken, its negative impact on the economy may be increasing. Officials believe that the Bank of Japan still has room to continue raising interest rates, with the key being to seize the right timing for policy adjustments.

The Japanese business community is also increasingly vocal about exchange rate issues. Yoshinobu Tsutsui, president of the Japan Business Federation, the largest business lobbying group in Japan, made a rare comment this week, calling for government intervention to prevent excessive depreciation of the yen, describing the recent yen movements as "a bit overdone."

Market Background and Political Factors

Despite the Bank of Japan raising the benchmark interest rate on December 19, the yen remains weak against the dollar. Influenced by news that Prime Minister Sanae Takaichi will hold a snap election next month, the yen further slid to an 18-month low this week.

Data compiled by Bloomberg shows that the 10-year average exchange rate of the yen against the dollar is 123.20, while over the past two years, the yen has fluctuated roughly between 140 and 161.95. Although the yen slightly rebounded earlier this week after hitting an 18-month low, as monetary authorities intensified warnings, the overall depreciation trend continues to exert persistent pressure on the central bank's decision-making.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。