Author: Cat Teacher scupt

YZi Labs (related to CZ) + Hyperliquid collaboration, is it really "stable" or just marketing? Let's break it down by evidence and risks.

1) What does the project do? What problem does it solve?

One-sentence positioning: A private, non-signature on-chain trading terminal that provides professional DeFi users with unified access to cross-chain spot, perpetual, pre-issue tokens, and yields.

Target Users and Pain Points

Target Users:

High-frequency traders

Narrative-driven speculators

Whale wallet holders

Advanced DeFi native users

Institutional asset allocators

Core Pain Points:

DeFi fragmentation: Multiple clicks for trading, complex gas management, frequent switching of cross-chain wallets

Lack of CEX-level experience: Unable to achieve the speed, privacy, and aggregation capabilities of centralized exchanges, leading to trading alpha leakage and user loss

Complicated operations: Advanced users need to switch between multiple front-ends, networks, and wallets in multiple tabs

Why is it needed now: With the long-tail growth of tokens, strategies, and DeFi primitives, the market needs a solution that is chain-invisible and executes uniformly, without repeated authorizations or network switching.

Authenticity of the Problem

Evidence of Necessity:

Capital validation: In October 2024, Shuttle Labs raised $6M in seed funding for the development of Genius Terminal, led by CMCC Global, with participation from Arca, Balaji Srinivasan, Avalanche, Flow Traders, etc.

User participation: As of January 13, 2026, a daily trading competition prize of $1,000 is awarded (winners announced), Twitter has 27,600 followers, and wallet import functionality has recently launched.

Third-party endorsement: Lit Protocol praised the terminal as "super fast, free" in a tweet in December 2025 and used its technology.

Consistency of multiple sources: The official website, documentation, Twitter, and LinkedIn all focus on professional trading, with no tokens/TVL indicating application-centric rather than protocol-centric.

Conclusion: The problem is a real necessity; DeFi users have a clear demand for unified, private, and efficient trading tools, and the financing and active reward mechanisms validate market recognition.

2) How does it solve it? (Product/Mechanism)

Product Form and Core Process

Product Form: A unified on-chain trading application/terminal (not a base protocol), aggregating spot, perpetual, pre-issue trading, and yield functions.

Core Workflow:

One-time authentication: Users log in using email/Google/Apple via biometric (key method)

Wallet management: Import/track multiple wallets in a single dashboard

Non-signature trading: Users specify trading intentions/portfolio behaviors, and the terminal executes atomic routing through aggregators and the native cross-chain bridge (Genius Bridge Protocol)

Privacy enhancement: Ghost Orders feature splits orders into up to 500 wallets for transaction obfuscation

Yield management: Idle funds automatically generate yield through the usdGG stablecoin

Currently Available Features

Status: Mainnet launched (not testnet or invite-only)

Feature List:

Cross-chain spot/perpetual/pre-issue token trading

Ghost Orders privacy trading (order splitting)

Multi-wallet import and tracking

Unified portfolio and yield management (usdGG stablecoin)

Real-time market insights (heat maps, radar charts)

0% fee promotion (ending around January 13, 2026)

Daily $1,000 trading competition with a 50 million Genius Points (GP) reward system

Referral rewards and progress badges

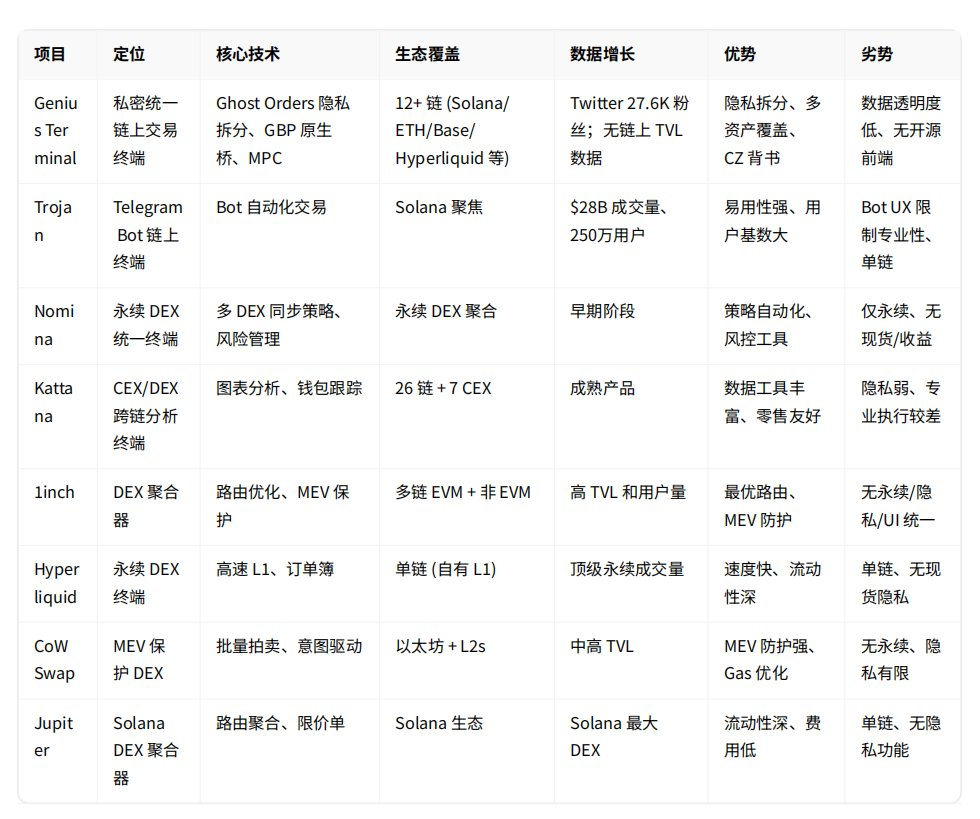

3) Core Competitiveness/Differentiation (Moat)

Differentiation from Competitors

Substitutability Analysis

Substitutability: Low

Reasons:

Proprietary privacy technology: The ability to split Ghost Orders is difficult to replicate in the short term, requiring complex liquidity management and MPC infrastructure

Native cross-chain bridge: GBP as a dedicated bridge protocol has completed audits from multiple institutions, with high reconstruction costs

Extensive integration: Covering 12+ chain ecosystems for spot, perpetual, and yield requires significant business development and technical adaptation

Endorsement barriers: Deep integration with YZi Labs associated with CZ, $6M funding, and top VC support provide a competitive moat

User experience: A professional UX with no pop-ups and no visible gas fees is sticky for whales/high-frequency traders

Risks: If large aggregators like 1inch and CoW Swap add similar privacy features, it may pose a threat; however, there are currently no direct competitors in the market.

4) Financing Situation and Quality of Investors

Financing Details

Resources brought by investors

Ecological resources: CMCC Global (Asian ecosystem), AVA Labs (Avalanche integration)

Listing/market making: Flow Traders as a professional market maker, Arca liquidity support

Business development and network: High-level relationships with Balaji Srinivasan, deep cooperation with YZi Labs (CZ advisor, $10B+ AUM)

Media Exposure: Scott Melker (podcast influence), Anthony Scaramucci / SALT (conference resources)

5) Team Background

Core Member Background

Entrepreneurial Record and Credibility

Success case: Ryan Myher's NoCodeNoProblem was acquired, proving execution capability

Credibility limitations: Limited information on other core team members, LinkedIn and company pages are inaccessible

Offsetting factors: High-quality investors (CMCC Global, Balaji Srinivasan) endorsements, deep integration cooperation with YZi Labs ($10B+ AUM) provide credibility support

Assessment: Moderate credibility; the founder has some background but lacks sufficient public information; relies on the quality of investors and partners for endorsement.

6) Awards/Qualifications/Endorsements

Audit and Security Qualifications

Audit Institutions (full-stack security verification):

Halborn

Cantina (public competition, $25,000+ prize pool)

HackenProof

Borg Research

Penetration Testing: Completed by white hat hackers

- Key partners

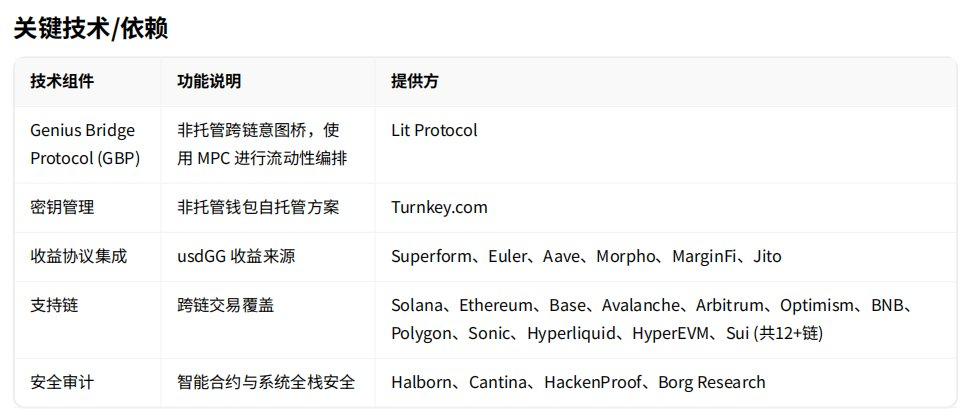

7) Technology and Security (Evidence Required)

Open Source Status

Partially open source: EVM contract code (e.g., GeniusVaultCore.sol) can be found on GitHub (inferred from Cantina audit scope as genius-foundation/genius-contracts)

Front-end closed source: No official Genius Pro / Shuttle Labs main front-end repository is publicly available

Third-party code: There are unrelated fan/third-party repositories (e.g., itechdp/Tradegenius-Portal, last commit in January 2024)

GitHub Activity: No recent submission records in official repositories for nearly 30/90 days (as of January 13, 2026 UTC)

Evidence: Search results show no verifiable official repositories with recent activity; the Cantina competition referenced Lit Actions and service code (8,000+ lines) but did not provide specific commit timestamps.

Assessment: Low GitHub transparency, lacking public evidence of active development.

8) Product and On-chain Data (Traction)

Users and Growth

Data Availability: No public DAU/MAU/retention/conversion rate data

Indirect Growth Signals:

Reward system active: 50 million Genius Points (GP) earned through trading

USDC referral rewards: >45% referral fee sharing

Progress badges and points multiplier unlocking mechanism

Historical competition prize: $250,000 total prize pool (past)

Current daily competition: $1,000/day prize (ongoing as of January 13, 2026)

Social Media: Twitter 27,600 followers, tweet interactions 100-500 likes, 5,000-50,000 views (as of January 13, 2026)

On-chain Metrics

TVL: $0 (no record on DefiLlama as of January 2026) Active addresses/trade count/fees/income: No verifiable data

Block Explorer: No publicly available deployed contract addresses

Dune Dashboard: dune.com/geniusterminal exists but has no public data

Revenue Mechanism: Fees collected through FeeCollector.sol; usdGG LP earns native yield from trades (no token issuance); but no specific data disclosed.

Growth Driver Analysis

Subsidy-driven risk: High

Growth mainly relies on points/referrals/competition incentives

0% fee promotion is expected to end around January 13, 2026

Lack of organic user metrics (DAU/retention) verification

Event conclusion risk: If subsidies stop and no alternative incentives are provided, the probability of user loss is high; data performance after the promotion ends needs to be monitored.

Assessment: Extremely low data transparency, on-chain traction cannot be verified; growth may heavily depend on incentives rather than product stickiness.

9) What has been done in the past? What is being done now? (Activities and Tasks)

Historical Activity Timeline

Current Activity/Task List (as of January 13, 2026 UTC)

- Participation threshold and cost

10) Activity Entry Point: How to Maximize Cost-Effectiveness

Key Weights of Points/XP/Contribution Rules

High Cost-Effectiveness Task Priorities (1-5)

- Priority 1: Daily small transactions to increase frequency

Utilize 0% fees (if still valid) or low gas chains (like Base, Arbitrum) for small transactions

Goal: Accumulate GP and unlock progress badge multipliers

Cost: Only gas fees (approximately $0.01-0.5 per transaction)

- Priority 2: Refer high-quality users

Invite DeFi users with real trading needs (like community members)

Earnings: >45% ongoing fee sharing + referral GP

Cost: 0 (pure promotion)

- Priority 3: Cross-chain diversified interactions

Complete at least 1 transaction on each of the supported 12+ chains (preferably Solana, Base, Hyperliquid perpetual)

Goal: Increase GP diversity weight (speculative)

Cost: Total gas fees per chain ~$5-20

- Priority 4: Participate in daily competitions (if resumed)

Monitor competition restart, focus on trading volume/profit ranking

Earnings: $1,000 cash reward (distributed to top performers)

Cost: Requires significant capital and time investment; high risk

- Priority 5: Use Ghost Orders feature

Test the privacy splitting feature (even for small amounts) to demonstrate product usage depth

Goal: Potential additional GP or airdrop weight recognition

Cost: Normal trading gas

Risk Control Recommendations

11) Competitors and Benchmarking

List of Similar Projects and Comparisons

Competitive Landscape Summary

Genius leading dimensions: Privacy splitting (unique Ghost Orders), multi-asset coverage (spot + perpetual + yield + pre-issue), cross-chain breadth (12+ chains)

Competitor advantages: 1inch/Jupiter higher TVL, Hyperliquid faster speed, Trojan larger user base

Differentiated positioning: Genius focuses on privacy + professional trading tools, filling the gap for high-frequency/whale users in multi-chain privacy trading

12) Community Evaluation and Public Sentiment

Community Size and Quality

Scale Metrics:

Twitter: 27,600 followers (verified as of January 13, 2026 UTC)

Tweet interactions: 100-500 likes, 5,000-50,000 views per tweet

Discord/Telegram: No official community found

Quality Assessment:

Trader-oriented: Community focuses on trading competitions, feature releases, partnership announcements

Developer content: Low, no clear developer discussions, GitHub issues, or technical contribution evidence

Airdrop attributes: Medium to high, points system and competitions attract users with airdrop expectations

Major Positive and Negative Opinions

Positive:

Multi-chain support (12+ chains) and 0% fees are popular

Collaboration with YZi Labs (CZ related) and Hyperliquid enhances confidence

Privacy feature (Ghost Orders) seen as an innovative highlight

Negative:

No prominent negative opinions found in high-interaction tweets (within the search window)

Implied risks: Low data transparency, lack of community channels may raise trust issues

Official Response Speed

Response Method: Through promotional tweets and feature announcements (like wallet import, competition winners)

Frequency: Moderate (2-3 updates per week)

Specific Cases: No clear examples of responses to community issues

Community Health Conclusion

Rating: Below average

Reasons:

Stable growth in Twitter followers and interactions

Incentive mechanisms drive active participation

Lack of in-depth community channels like Discord/Telegram

Low developer participation, strong airdrop attributes

Insufficient data transparency may affect long-term trust

13) Token and Airdrop Expectations (Focus: Uncertainty)

Is there a clear indication of token issuance?

Official Evidence:

Points system: 50 million Genius Points (GP) earned through trading and referrals, implying future token conversion

Tweet hints: An official tweet on January 5, 2026, mentioned "Genius is changing that for you in 2026" (regarding airdrops)

Vague roadmap: Documentation and tweets lack clear TGE timing or token economics

Conclusion: High probability of token issuance, but no official confirmation; the GP system strongly suggests tokenization, but lacks a clear roadmap.

Possible Airdrop Recipients and Measurement Indicators

Anti-manipulation/clearing/KYC/regional restriction risks

Maximum Uncertainty (1-3)

Unknown GP conversion ratio: How 50 million GP will convert to tokens, whether linear exchange, total supply ratio unclear

Uncertain TGE timing: No official timetable; "2026" is only a vague hint, may be delayed or canceled

Airdrop distribution criteria vague: Specific weights for trading volume, referrals, badges not disclosed, final distribution may differ significantly from expectations

14) Compliance and Governance

Entity Location and Regional Restrictions

Entity:

Genius Foundation (deploying GBP protocol)

Shuttle Labs (operating entity, New York, established in 2022, 11-50 employees)

Regional Restrictions:

No clear regional restrictions

Headquarters in the U.S., supporting a global multi-chain network

Founder interview (October 2024) mentioned that KYC/jurisdiction issues have been resolved

Potential Compliance Risks:

U.S. Regulation: Based in New York, may face SEC/CFTC scrutiny over securities-like tokens or derivatives trading

Future KYC: KYC may be introduced before TGE to meet compliance requirements

Cross-chain Regulation: Involves multi-chain bridges and perpetual contracts, may trigger multi-jurisdictional regulation

Governance Structure

Known Information:

Genius Foundation controls the deployment and maintenance of the GBP protocol

Shuttle Labs operates the frontend and products

Non-custodial design (Turnkey + Lit Protocol MPC)

Power Concentration:

Medium concentration: Foundation and Shuttle Labs control core infrastructure

No mention of DAO governance

No multi-signature details disclosed

No community governance mechanism

Risk: Project decisions and upgrades are led by a centralized team, lacking decentralized governance safeguards.

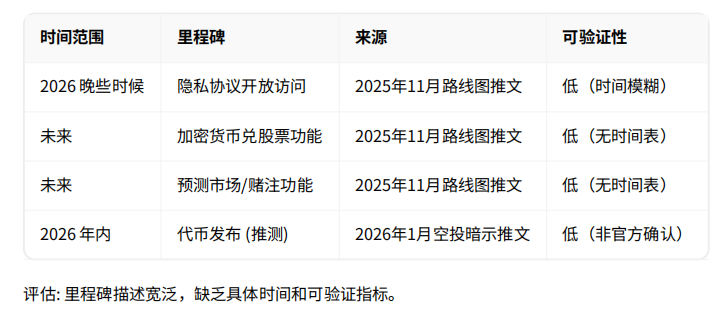

15) Roadmap Credibility

Milestones for the next 3-12 months

Historical Deliveries on Time

Delivered Features:

Wallet import feature launched (January 13, 2026)

Hyperliquid perpetual integration

Multi-chain support (10+ networks)

Ghost Orders privacy feature

Daily competitions ongoing ($1,000/day prize, winners announced on January 12-13, 2026)

Missed Deadline Record: No clear record of delays

Delivery Quality: Features delivered on time

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。