The number of initial jobless claims in the United States has reached its lowest level since November of last year, with a figure of 198,000 that not only falls below expectations but also signals to the market that the labor market has not cooled down, posing new challenges to the Federal Reserve's path of interest rate cuts.

Last week, the number of initial jobless claims in the U.S. dropped to 198,000, the lowest level since November of last year, and below the market's general expectation of 215,000. This is the latest example in a series of data showing the resilience of the labor market.

The four-week moving average of new jobless claims also fell to 205,000, the lowest in two years, indicating that the fundamentals of the labor market remain solid.

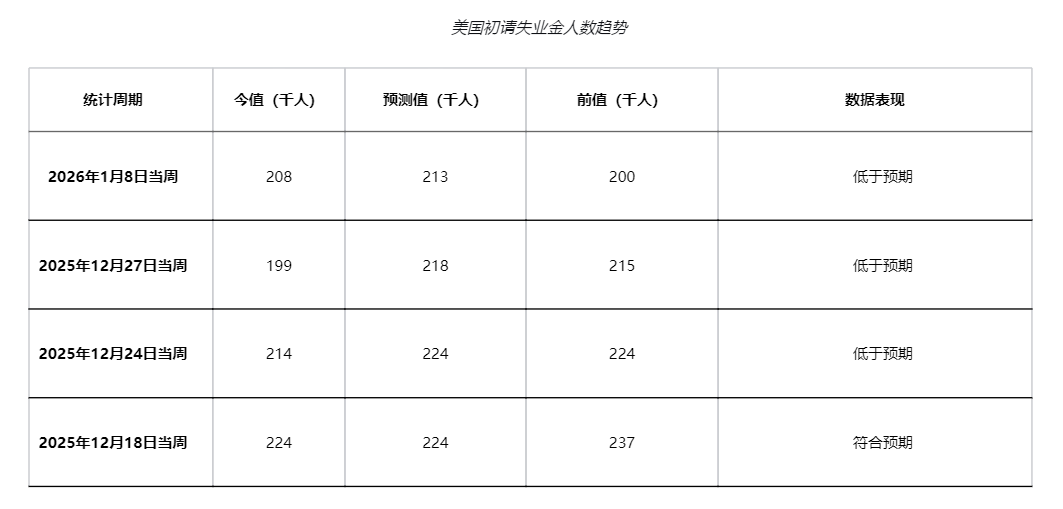

1. Latest Data: Initial Jobless Claims Fall Below Key Threshold

● The latest data from the U.S. Department of Labor shows that for the week in early January 2026, the seasonally adjusted number of initial jobless claims was 198,000, a significant decrease from the previous value and far below the market expectation of 215,000. This figure not only marks a new low since November of last year but is also an important moment as it has fallen below the psychological threshold of 200,000 on rare occasions in recent years.

● The resilience shown in the data is not an isolated phenomenon. Looking at a broader time frame, the U.S. Department of Labor reported that the number of initial jobless claims for the week ending January 3 was 208,000, also below the market expectation of 212,000.

● In comparison, the previous week (the week ending December 27, 2025) had this data at 199,000, while the previous value was revised from 214,000 to 215,000.

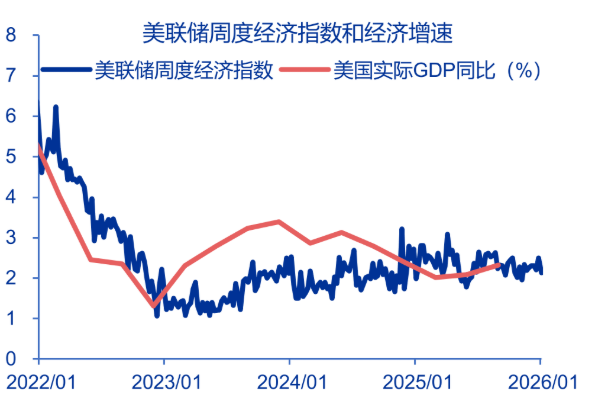

2. Indicator Analysis: Economic Signals Behind the Numbers

● Initial jobless claims are a core indicator for measuring the state of the labor market in the U.S., specifically referring to the number of first-time applicants for unemployment insurance benefits during the statistical period, released regularly by the U.S. Department of Labor every Thursday. This indicator tracks the dynamics of new unemployed individuals applying for benefits, directly reflecting trends in corporate layoffs and short-term fluctuations in the job market, and is considered a leading indicator of the economic cycle.

● Although unemployment insurance claims must meet specific eligibility criteria and do not cover the entire unemployed population, it maintains a critical position in economic warnings and policy formulation due to its immediacy.

Trend of Initial Jobless Claims in the U.S.

The four-week moving average that helps smooth out data fluctuations also shows a clear downward trend, dropping to 205,000, reaching the lowest level in two years. The number of individuals continuing to receive unemployment benefits (continuing claims) fell to 1.88 million in an earlier week.

3. Market Reaction: Immediate Feedback on Asset Prices

● Following the data release, financial markets reacted swiftly. Gold prices fell below the 4600 yuan mark, while silver's intraday decline expanded to 5%, as the appeal of precious metals as non-yielding assets diminished in the face of strong employment data.

● U.S. Treasury yields rose slightly, reflecting market expectations that the Federal Reserve may delay interest rate cuts. The dollar index gained support, while the U.S. stock market exhibited mixed emotions—strong employment data reduced the risk of an economic recession.

● The CME "FedWatch" tool indicates that market expectations for interest rate cuts in early 2026 have slightly cooled, particularly with a decreased probability of action at the January meeting.

4. In-Depth Analysis: The True Temperature of the Labor Market

● The U.S. labor market is sending complex signals: strong surface employment data coexists with deeper structural weaknesses. While initial jobless claims data continues to show resilience, other indicators reveal a different reality.

● The ADP National Employment Report has shown that in some months, private sector job growth exceeded expectations, but there are significant differences across industries. The construction sector remains resilient, while manufacturing growth has slowed.

● The voluntary resignation rate has fallen below the 2% psychological threshold, indicating that employees lack confidence in finding better jobs, which suppresses overall wage growth.

● Goldman Sachs' chief economist pointed out that this "stagnation" in employment leads the firm to maintain a 30% probability of a U.S. economic recession within the next 12 months. The number of job vacancies and hiring rates are both on a downward trend, suggesting that the labor market is becoming less favorable for the unemployed.

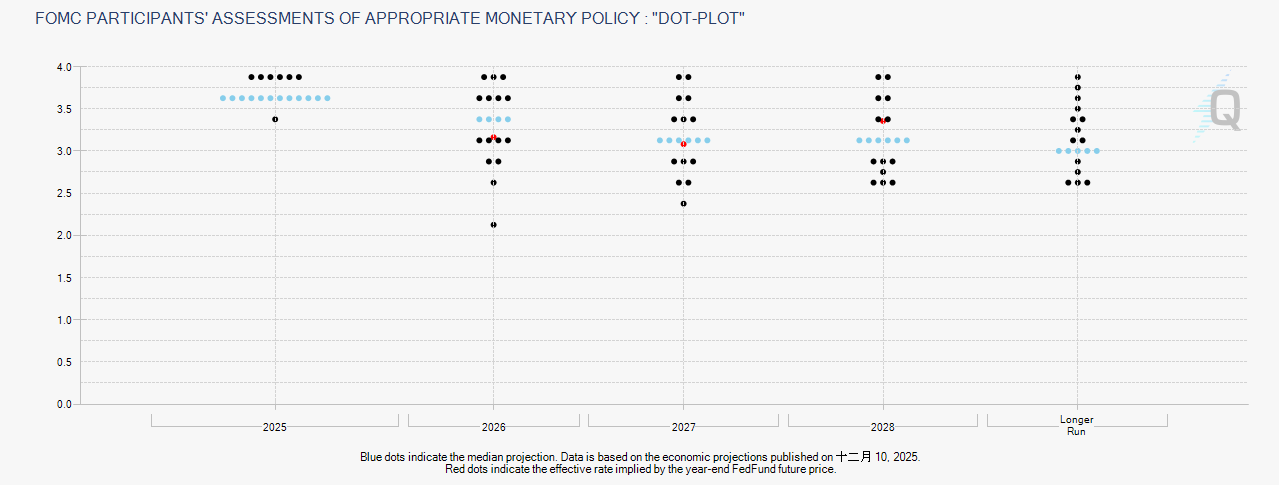

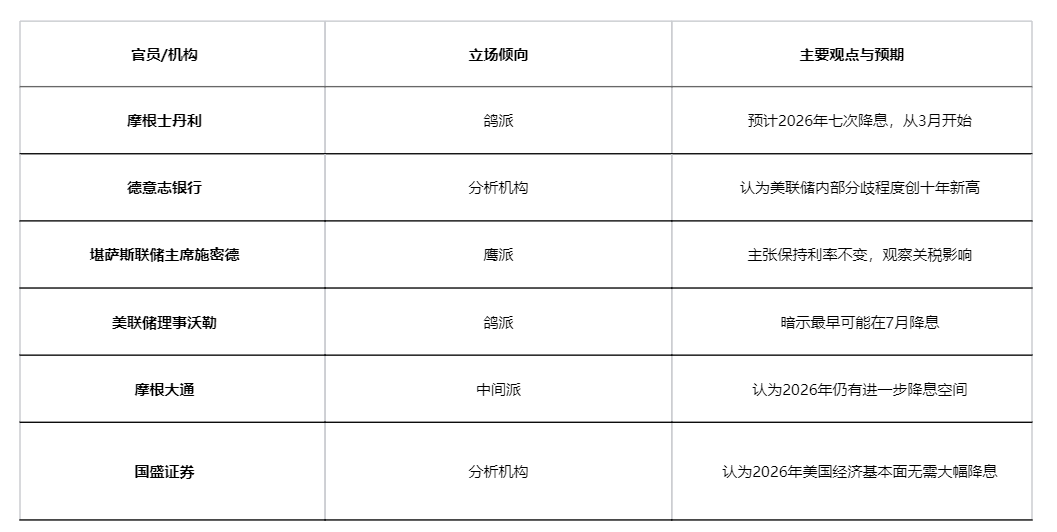

5. Policy Dilemma: Growing Divisions Within the Fed

There are fundamental divisions within the Federal Reserve regarding how to balance inflation control and economic growth. Research from Deutsche Bank shows that the degree of this division has reached a ten-year high.

● According to the Deutsche Bank report, Federal Reserve officials' predictions for the federal funds rate in 2025 show a highly polarized distribution, with the gap between the most common and the second most common predictions reaching 50 basis points. In terms of inflation forecasts, the divergence among Federal Reserve officials regarding core PCE inflation has reached the highest level in the past decade at 1 percentage point.

Discrepancies Among Key Federal Reserve Officials

J.P. Morgan analysis indicates that the interest rate cut at the end of 2025 is viewed as a "hawkish" cut, given the relatively cautious future rate guidance. Guosheng Securities warns that in early 2026, with the nomination of the next chair and more economic data being released, there may be intense competition over "easing expectations," potentially increasing asset price volatility.

6. Rate Cut Path: Challenges of Data-Dependent Decision Making

● The Federal Reserve's path for interest rate cuts is becoming increasingly unclear. The chief economist of Mellon Investment Management points out that the Fed's initiation of rate cuts must simultaneously meet three key conditions: signs of weakness in the labor market, inflation clearly returning to target paths, and the decision-makers having full confidence in these judgments.

● Recent strong employment data presents new challenges to the Fed's "data-dependent" decision-making model. The number of initial jobless claims continues to fall below expectations, combined with some strong performance in ADP employment data, indicating that the conditions for showing weakness in the labor market have not yet been met.

Although inflation has retreated from its highs, the latest data suggests that the process of returning to the 2% target may be slower than expected.

7. Key Market Trends for 2026

● Looking ahead to 2026, the trajectory of the U.S. labor market and monetary policy will depend on several key factors. The full impact of tariff policies will become clearer in the coming months, which may simultaneously push up prices and suppress economic activity.

● The change in the Federal Reserve chair will occur in May 2026, and the policy inclination of the new chair will be a key variable affecting the direction of monetary policy. The midterm elections in Congress will take place in November 2026, and political pressure may impact the Fed's policy independence.

● The latest initial jobless claims data shows that despite facing multiple challenges, the U.S. labor market remains resilient, which may delay the market's widely expected timeline for interest rate cuts. Strong employment data, while potentially suppressing rate cut expectations in the short term, also reduces the risk of a hard economic landing, providing fundamental support for risk assets.

As of early January 2026, the number of continuing jobless claims in the U.S. has dropped to 1.88 million, while the continuously declining initial jobless claims contrast with the still high number of job vacancies. The market expects that as tax refunds are distributed to households in the first half of 2026, the U.S. economy may experience a period of strong growth.

J.P. Morgan believes that if the labor market underperforms relative to the Fed's predictions, there is still room for further rate cuts in 2026. However, this outlook is fraught with uncertainties, just as the weekly fluctuations in initial jobless claims are difficult to predict.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。