In its report released Tuesday, the BLS said the CPI for all urban consumers “increased 0.3 percent on a seasonally adjusted basis in December.” Over the past year, the all-items index moved up 2.7% on an unadjusted basis. Shelter costs increased 0.4% in December, doing the heavy lifting for the month’s overall rise.

The BLS added that food prices added 0.7% over the period, with both grocery store tabs and restaurant bills climbing. Energy prices joined the party as well, inching up 0.3% in December. All the major stock indexes were treading water Tuesday, but by 10 a.m. Eastern time, each slipped into modest pullbacks. Bitcoin climbed about 1.8% over the past day, gold gained 0.51%, and silver kept the momentum going with a 3.99% rise on the session.

According to a CNBC report by Jeff Cox, markets aren’t penciling in a rate cut from the U.S. central bank when it meets Jan. 28. Cox cited Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management, who said:

“We’ve seen this movie before — inflation isn’t reheating, but it remains above target. There’s still only modest pass-through from tariffs, but housing affordability isn’t thawing. Today’s inflation report doesn’t give the Fed what it needs to cut interest rates later this month.”

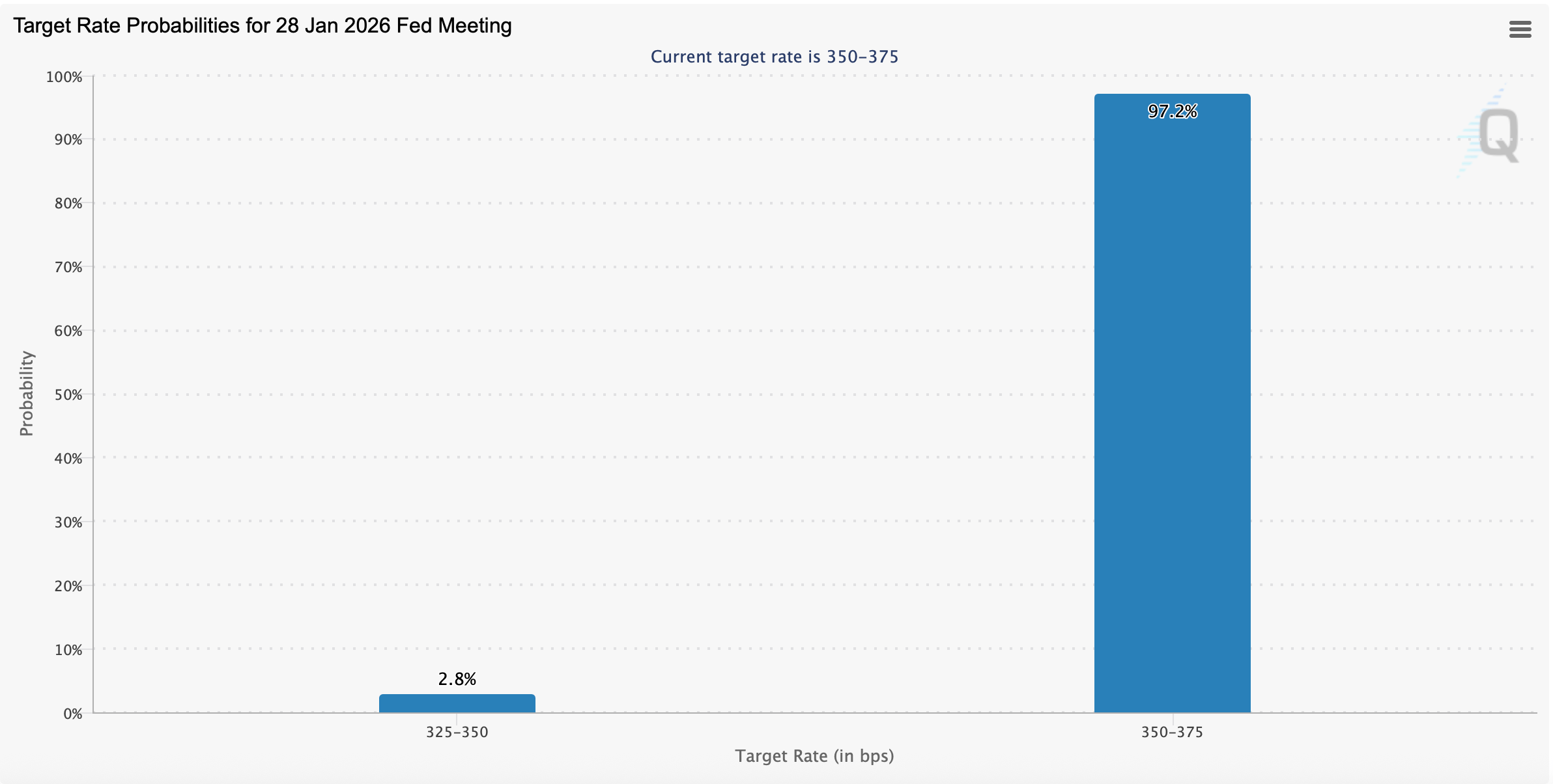

CME’s Fedwatch tool shows markets firmly expecting no change, with a 97.2% probability the rate stays put. Hopes for a quarter-point trim are faint, clocking in at just 2.8%. In the same vein, bettors on Polymarket and Kalshi peg the odds of no move at 96%.

Also read: Fed and Powell Under Fire, but Some Argue Independence Was Always an Illusion

Tuesday’s latest U.S. Bureau of Labor Statistics report did absolutely nothing to nudge those expectations. All of this unfolds as the Department of Justice continues probing the Fed’s renovation costs. Even so, the chances of Chair Jerome Powell facing charges by June 30, 2026, sit at a slim 12%.

Essentially, the data, the pricing, and the betting markets are all singing the same tune: the Fed is in wait-and-see mode. Inflation isn’t racing away, expectations are locked in, and even the noise around the renovation probe hasn’t dented confidence that rates stay right where they are. For now, markets appear content to watch the clock rather than the Fed’s scissors.

- What did the December CPI report show? U.S. inflation rose 0.3% in December, pushing the annual all-items index to 2.7%, according to the U.S. Bureau of Labor Statistics.

- Will the Federal Reserve cut rates at its January meeting? Markets overwhelmingly expect the Fed to hold rates steady when it meets Jan. 28.

- Which prices drove the latest inflation increase? Shelter, food, and energy costs all moved higher, with housing carrying the most weight.

- How are markets reacting to the inflation data? Stocks dipped modestly, while bitcoin, gold, and silver posted gains as rate expectations stayed unchanged.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。