With gold recently breaking records due to geopolitical tensions and other factors, investors want to assess the real limit to gold’s upside.

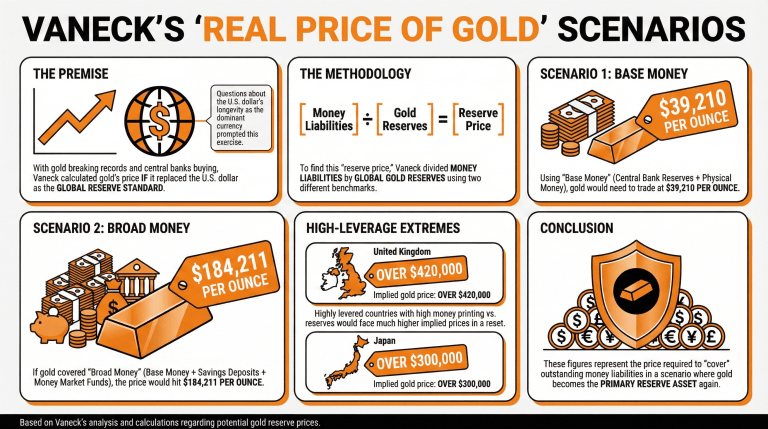

Vaneck, a global asset management investment firm with over $181 billion in assets under management (AUM), ran numbers to estimate the “real price of gold,” meaning its price if it were adopted as the global reserve standard, substituting the U.S. dollar.

The company completed this exercise as the trend of central banks’ gold purchases has solidified, and there are questions about the longevity of the U.S. dollar as a dominant currency.

To reach this “reserve price,” Vaneck divided money liabilities by gold reserves, using two benchmarks for this calculation. The first one includes only central bank reserves and physical money -defined as “base money”- and a second one, which adds savings deposits and money market funds -labeled as “broad money.”

Using the base money benchmark, gold would need to trade at $39,210 per ounce. Also, if gold were to become broad money, it would have to trade at $184,211 per ounce.

“These figures represent the price required to ‘cover’ the outstanding money liabilities in a scenario where gold becomes the primary reserve asset again,” Vaneck explained.

Nonetheless, levered countries like the United Kingdom and Japan would be more affected in a reset scenario, with implied gold prices of over $420K and $300K respectively, due to their high level of money printed compared to their gold reserves.

Conversely, countries like Russia and Kazakhstan would fare much better due to their high level of gold reserves.

While Vaneck’s team does not believe the dollar will lose its status as reserve currency, it does envision a future where it “shares that role with gold and the bonds of fiscally disciplined emerging markets.”

Read more: UBS Predicts Silver Might Reach Triple Digits in 2026

- What factors are driving gold prices to record levels? Geopolitical tensions and central bank purchases are significantly contributing to the surge in gold prices.

- What is Vaneck’s analysis on gold’s “real price”? Vaneck calculates that, under a global reserve standard, gold could reach prices between $39,210 and $184,211 per ounce, depending on the money benchmark used.

- How do leveraged countries impact gold’s price in a reset scenario? Countries like the UK and Japan would see implied gold prices exceeding $420K and $300K, respectively, due to their substantial money printing compared to gold reserves.

- Will the U.S. dollar maintain its status as the reserve currency? While Vaneck doesn’t foresee the dollar losing its status, they predict it may share this role with gold and fiscally disciplined emerging markets in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。