Original Author: Sanqing, Foresight News

On January 12, the Trump family member project World Liberty Financial (WLFI) launched the lending platform World Liberty Markets.

Previously, on January 7, WLFI announced that its subsidiary WLTC Holdings LLC submitted an application to the Office of the Comptroller of the Currency (OCC) to establish the World Liberty Trust Company, National Association (WLTC), a national trust bank designed specifically for stablecoin operations.

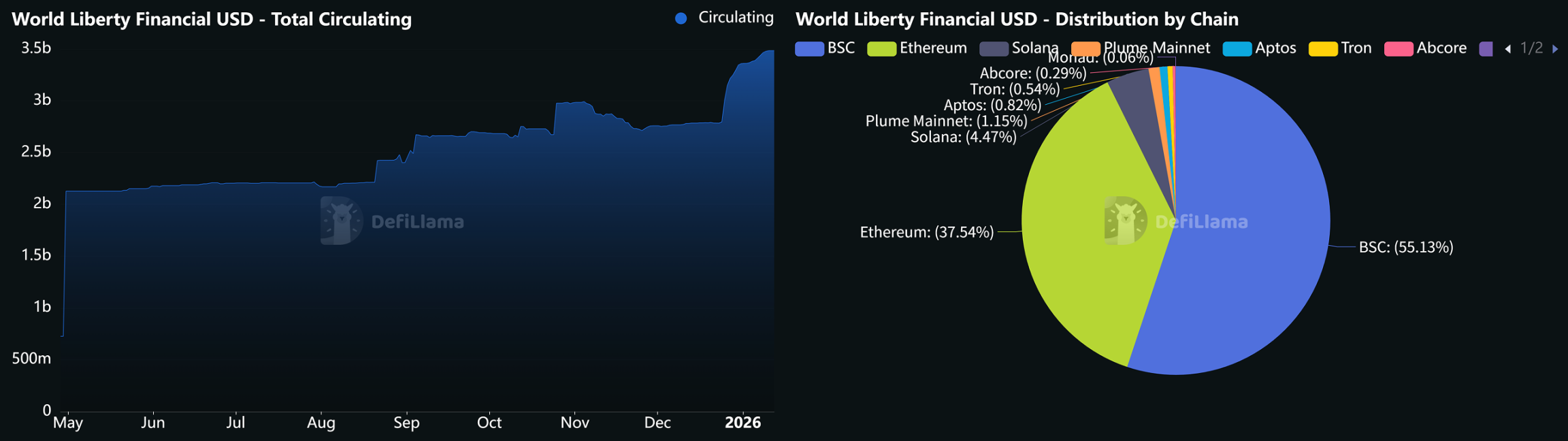

The USD-pegged stablecoin USD1 under WLFI has surpassed a circulation of $3.4 billion within a year (CoinMarketCap data), becoming one of the fastest-growing USD-pegged stablecoins.

Through the federal regulatory system and liquidity lending market, WLFI is not only seeking application scenarios for USD1 but is also attempting to bridge the gap between TradFi and DeFi.

USD1 Total Market Cap Curve and Chain Proportions | Source: DeFiLlama

DeFi Lending Platform World Liberty Markets: Practical Implementation of USD1

Five days after submitting the license application, the launch of World Liberty Markets by WLFI marks the operational phase of its DeFi business. The platform is built on the Dolomite protocol, initially launched on Ethereum, and shows intentions for multi-chain expansion.

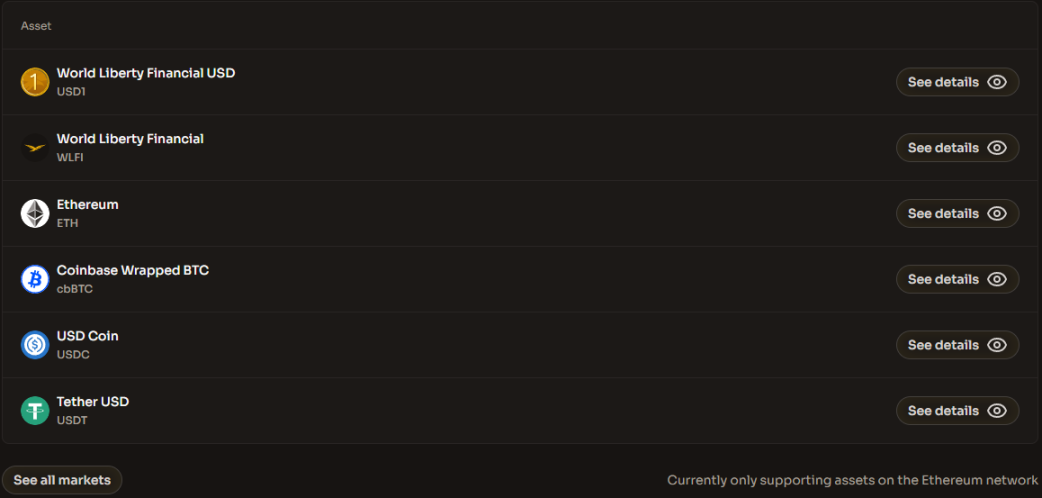

World Liberty Markets is positioned as a lending market revolving around USD1. Users can not only deposit assets on the platform to earn interest but can also use their held assets as collateral to borrow other tokens.

The lending asset system centers around USD1 while also accommodating various collateral types including ETH, USDC, USDT, WLFI, cbBTC, and more, covering mainstream crypto assets and the protocol's native tokens. This platform structure serves both the liquidity needs of USD1 and supports its establishment of a liquidity foundation in DeFi.

Currencies currently supported by WLFI Markets | Source: WLFI Official Website

In terms of governance, WLFI token holders have the right to propose and vote on key matters such as increasing collateral assets, adjusting interest rate parameters, or setting user incentives.

The platform's launch immediately triggered market feedback. Dolomite, the underlying protocol provider, saw its native token DOLO rise by 71.9% on the same day.

DOLOUSDT Daily Chart | Source: Bitget

At the same time, WLFI also launched early incentive activities to attract initial users by increasing USD1 deposit yields. According to the WLFI Markets page, the USD1 lending incentive feature is provided by Merkl, with annual interest rates changing in real-time.

While the regulatory application is still under review, the launch of World Liberty Markets allows WLFI to proactively layout business scenarios. Regardless of the final outcome of the license, USD1 has begun to transition from a conceptual issuance to on-chain lending use, truly entering the competitive arena with mainstream DeFi ecosystems.

National Trust Bank License Application: Stablecoin Business Moves Towards Regulatory Framework

The proposed subsidiary World Liberty Trust Company (WLTC) aims to obtain a national trust bank license issued by the OCC. If the application is approved, it means that the operation of USD1 will shift from a third-party cooperation model to a "full-stack" model directly regulated by the federal government.

The pre-set business scope of WLTC includes: directly handling the minting and burning of USD1 without relying on external intermediaries; providing direct exchange services between USD and USD1; and offering regulated custody services for assets like USD1, gradually replacing third-party service providers like BitGo.

The significance of this license goes far beyond business integration itself. Obtaining OCC approval means the project enters a federally regulated system, which has profound implications for user trust and institutional adoption.

Currently, Binance has deeply participated in the creation of USD1 and increased trading pairs, while Coinbase has also listed this asset. This regulatory endorsement can further reduce user concerns, and by directly accepting federal regulation, WLFI can better comply with regulatory requirements such as the GENIUS Act.

WLFI also hopes to design its structure to block any potential conflicts of interest. To address potential political scrutiny, WLFI CEO Zach Witkoff stated that the trust company's structure is designed to avoid conflicts, and Trump and his family members will not hold executive positions or exercise daily control.

Meanwhile, USD1 has gradually gained more institutional support, indicating that its penetration in the industry is increasing. The Abu Dhabi investment firm MGX once used USD1 to purchase $2 billion worth of Binance shares, which has become an important external endorsement.

Despite rapid progress, WLFI still faces multiple uncertainties. Discussions about conflicts of interest during the OCC approval period will be a focal point. Although Zach Witkoff emphasized that the Trump family does not hold executive positions and has no voting rights, whether this application can be approved on time remains uncertain in the current politically sensitive environment.

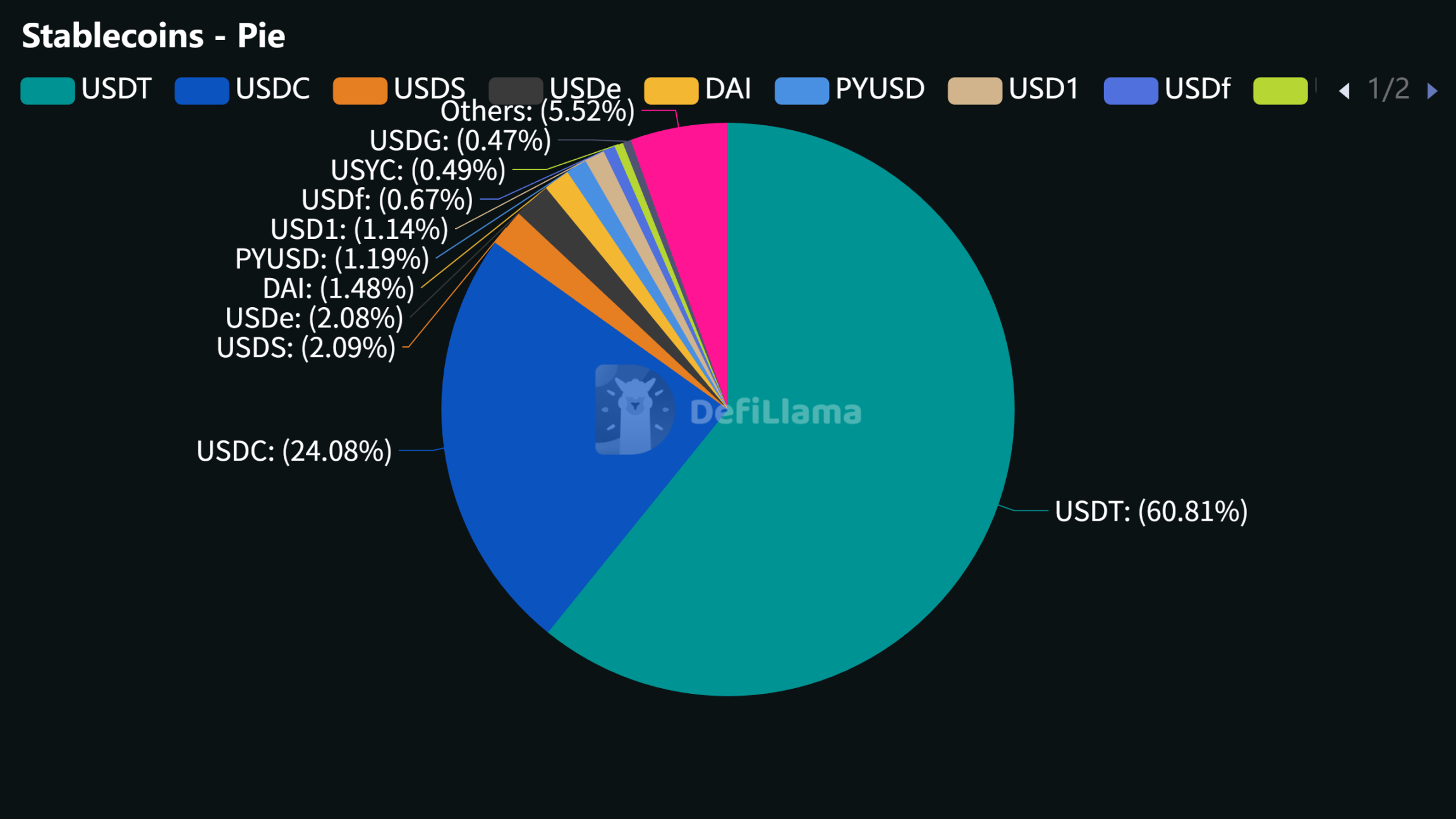

Additionally, although USD1 is growing rapidly, it still has significant gaps in liquidity depth and application scenarios compared to the two leading stablecoins, USDT and USDC. To further expand, WLFI needs to prove that its advantages come not only from compliance narratives and endorsements but also from providing a technical experience, capital efficiency, and DeFi composability that are comparable to or even superior to mainstream products.

Market Cap Proportions of Various Stablecoins | Source: DeFiLlama

The Relationship Between Licenses and DeFi Lending: Indirect but Strategically Complementary

As the OCC gradually approves companies including Circle, Ripple, BitGo, Paxos, and Fidelity for similar licenses, a regulated cryptocurrency banking system is taking shape.

There is no direct regulatory binding relationship between the national trust bank license and DeFi lending, but there are significant indirect benefits.

Enhancing the credibility and liquidity of USD1 in DeFi. Federal regulatory status provides credit backing for USD1, attracting more funds into liquidity pools, thereby increasing the depth and stability of the lending market.

Bridging TradFi and DeFi. The fiat currency entry brought by the license lowers the user threshold, facilitating traditional users' participation in DeFi lending.

Building a truly closed-loop business system. In the future, WLFI plans to launch a mobile app, USD1 debit card, and RWA integration (such as tokenized real estate as collateral), all of which will benefit from regulatory clarity and credit backing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。