The issue of bitcoin’s lack of privacy has been raised as a key concern that may affect its adoption as a central bank digital currency by state nations.

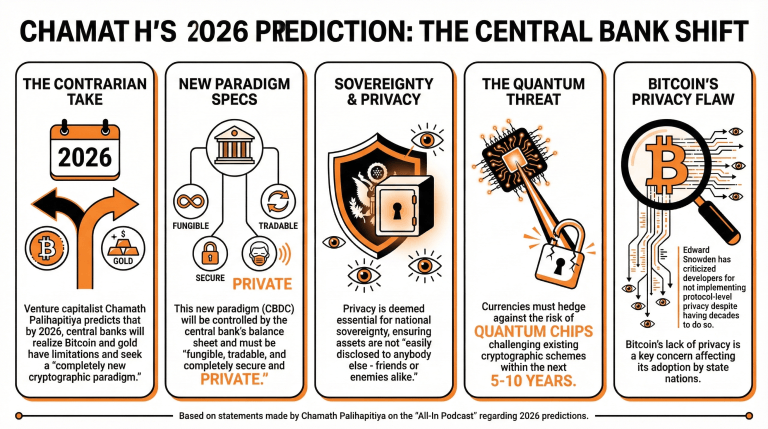

In the latest episode of the “All-In Podcast,” venture capitalist Chamath Palihapitiya presented his contrarian take for 2026, stating that central banks will realize both gold and bitcoin have limitations, and will seek out a “completely new cryptographic paradigm.”

This new paradigm will be controlled by the central bank’s balance sheet and will be “fungible, tradable, and completely secure and private.”

Explaining the motivations for this shift, he declared:

I think the reason why that privacy needs to exist is that, for the sovereignty of a country, you need to be in a position where you have assets that are not easily disclosed to anybody else – friends or enemies alike.

In addition, he also explained that quantum superiority posed risks to Bitcoin, stating that this new paradigm would have to be ready to face this upcoming threat. “If you’re going to own a currency, you need to hedge against the eventual risk in the next five to ten years that there’s a quantum chip that can challenge the existing cryptographic schemes that are used,” he concluded.

The issue of privacy -or lack thereof- in Bitcoin has been raised many times before. NSA whistleblower Edward Snowden has been calling for a robust implementation of privacy at a protocol level, criticizing that developers had years to implement this feature without advancements.

“This is the final warning. The clock is ticking,” said Snowden in 2024, warning that bitcoin transactions could be easily traced back to individuals and institutions with today’s technology.

Read more: Snowden Issues ‘Final Warning’ to Bitcoin Developers on Privacy Enhancements

What concerns about Bitcoin are affecting its potential adoption as a central bank digital currency?

The lack of privacy in Bitcoin transactions has raised concerns that may hinder its acceptance by state nations.What does venture capitalist Chamath Palihapitiya suggest for the future of currency?

Palihapitiya argues that central banks will seek a new cryptographic paradigm that is fungible, tradable, and ensures privacy and security.Why does Palihapitiya emphasize the need for privacy in a currency?

He claims that for a country’s sovereignty, there must be assets that cannot be easily disclosed to anyone, including friends and adversaries.What warning did Edward Snowden give regarding Bitcoin’s privacy?

Snowden cautioned that without robust implementation of privacy features, Bitcoin transactions could be traced back to individuals, stating it was “the final warning” as technology advances.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。