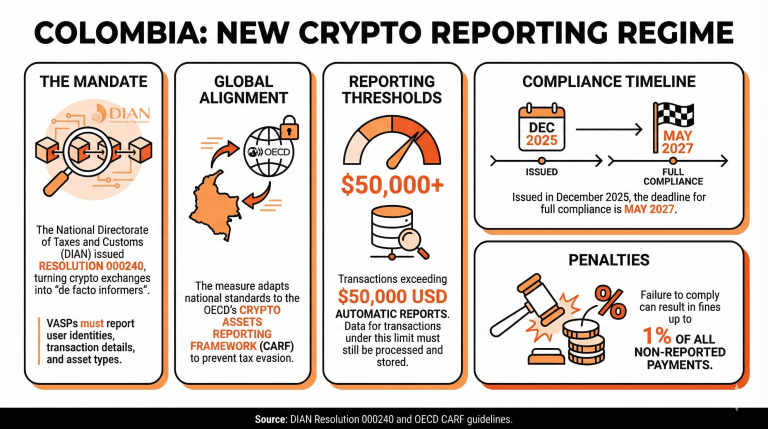

The National Directorate of Taxes and Customs (DIAN) has issued a new resolution that sets the bases for a new reporting regime for virtual asset service providers (VASPs) operating in the country.

Resolution 000240 establishes that all exchanges will now become de facto informers for the agency, reporting on the transactions of their users and other details, including the cryptocurrency assets involved in these movements and other relevant information.

The measure answers to the need to adapt the national standards to the Crypto Assets Reporting Framework (CARF), a global initiative led by the Organization for Economic Co-operation and Development (OECD). The framework focuses on promoting data exchange between countries to avoid tax evasion linked to the adoption of digital assets.

In the same way, the resolution establishes automatic payment reports of transactions going over $50K. Even if a user doesn’t reach this threshold, their data will be kept as part of an electronic report processed by the DIAN.

While the measure was issued in December 2025, the limit to deliver this data is set for May 2027, when all VASPs will have to comply with these reporting requirements.

The penalties for failing to comply with these measures can reach up to 1% of all non-reported payments. Criptonoticias states that it is now recommended that Colombian users maintain a record of all their purchase and sale operations, and the prices at which they completed them, as the DIAN might cross-reference this information, and they must be able to explain the origin of their holdings.

Read more: Kraken Expands Reach in Colombia, Implements Local Payments

- What recent resolution has DIAN issued regarding virtual asset service providers?

DIAN’s Resolution 000240 mandates that all VASPs act as de facto informers, required to report user transaction details to the agency. - What information must VASPs report under the new resolution?

VASPs must provide reports on transactions involving cryptocurrency assets, including those exceeding $50,000, and general user information. - What is the purpose of this reporting regime?

The measure aligns with the Crypto Assets Reporting Framework (CARF) by the OECD, aiming to enhance data exchange among countries and reduce tax evasion related to digital assets. - What are the consequences for non-compliance with the new reporting measures?

Failing to comply can result in penalties of up to 1% of all non-reported payments, prompting Colombian users to keep detailed records of their crypto transactions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。