Author: jiayi 加一

Introduction

With the development of AI technology, the technical threshold for Web3 products is relatively lowering, leading to intensified competition in marketing for attention and liquidity. However, market capability has always been an important aspect that most project teams tend to underestimate. Based on this, XDO attempts to launch this "2025 Web3 Market Annual White Paper," aiming to report market experiences: dissecting and sharing excellent marketing design ideas, hoping to assist entrepreneurs and industry market practitioners.

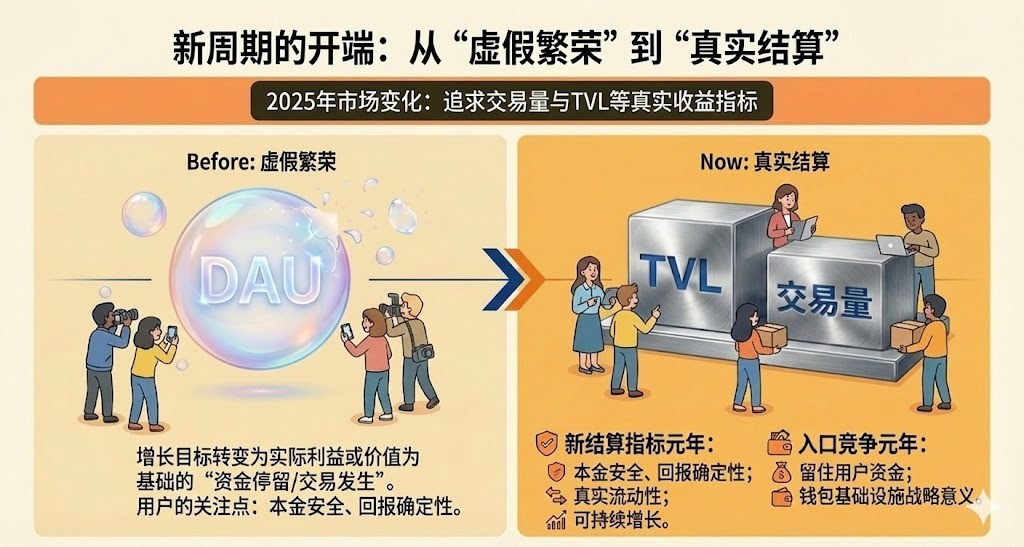

In 2025, the changes in market activities are quite clear: project teams are forced to shift from previously over-pursuing "seemingly prosperous" DAU to pragmatic targets like trading volume and TVL, which directly generate revenue. As a result, the number of activity templates has decreased, and the gameplay has become simpler, with both project teams and users adopting a more pragmatic mindset. Users are also starting to care more about the safety of their principal and the certainty of returns, while project teams are more focused on obtaining real liquidity, real trading users through market activities, and a sustainable business growth curve that can be seen by platforms and markets before listing.

In summary, 2025 is: the "Year of New Settlement Indicators" and the "Year of Entry Competition." As growth targets shift to "fund retention / transaction occurrence" based on actual benefits or value, competition naturally turns to "who can keep users' fund-related behaviors within their own ecosystem."

This is also why wallets are being redefined in their strategic significance. Taking Binance as an example, the Binance wallet is gradually becoming a new entry point for the ecosystem: driving traffic to the main site, pre-listing project pools, and binding trading behaviors into products through points and tasks. What the platform wants is not just a lively number of participants, but sustainable liquidity and users who can continuously generate transactions. Therefore, activities are no longer just unilateral subsidies from project teams, but a tripartite interest structure among the platform, projects, and users: the platform uses liquidity and trading users as advantages, project teams exchange tokens and budgets for traffic and trading behaviors, and users exchange attention and trading for predictable returns.

However, the harsh reality of 2025 is: the more pragmatic the activity expectations become, the more compressed the attention cycle is, and the "freshness period" of new projects is absurdly short. Once TGE occurs, market attention towards projects sharply declines, leading project teams to concentrate resources on launching and sprinting Pre-TGE, while the ongoing operations post-TGE are long underestimated, and Post-TGE gradually becomes a hollow zone; whether there is continuous activity after TGE is perceptible to users, but the reality is that very few projects can maintain an active state after listing. On one hand, there are very few projects with a sustainable and urgent business model, and on the other hand, project teams often do not pay much attention to ongoing operations after TGE. Once a project enters a silent period after listing, it becomes harder and more expensive to bring users back after they have churned—this is a warning left by 2025 and a topic that must be addressed head-on in 2026.

A deeper issue is the cultural disconnect: many projects create impressive pre-listing metrics but overlook that long-term consensus requires cultural and spiritual symbols to sustain it. The relationship between the community and the founding team increasingly risks becoming a one-time collaboration of "completing tasks—receiving rewards—dispersing," with projects exerting effort in data but being hollow in culture, or lacking any community consensus beyond milking rewards and short-selling; meanwhile, project teams are overly reliant on KOLs, with more and more activities becoming exclusive to KOLs, detaching KOLs from the basic user group, and transforming the community from participants into bystanders. When projects only care about the KOL group, it ironically creates a sense of opposition with retail investors. Additionally, KOC (Key Opinion Consumer)—the core group in the community that participates long-term, is willing to produce long-term, and is willing to spread the word voluntarily—often gets overlooked.

This "2025 Web3 Market Annual White Paper" will unfold around three levels:

Review the most representative types of market activities in 2025: platform-based activities, TVL deposit activities, community participation activities, simplified narrative & promotional rhythm dissemination, and clarify their respective driving mechanisms and result amplification methods.

Summarize the common shift in mindset between project teams and users in 2025: users value certainty and realizable returns more, while project teams view market activities as tools for acquiring liquidity, trading users, and pre-listing momentum, while attention cycles shorten, Post-TGE hollowing expands, and cultural and community management are long underestimated.

Outlook for 2026: how these activity logics will continue to evolve, and the core trends and challenges that project teams need to face head-on.

Thank you for reading this far. If you are not a market staff member of a project team, you can skip directly to Part 3.

Notable Project Marketing Imprints Left by 2025

For project teams, as user behavior and psychological states change every year, attention flows and distribution channels also change. Therefore, before designing long-term strategic marketing, three things need to be clarified. First, what type of users do you want to attract? Second, what benefits can you offer them? (Ideally, this benefit should not overdraw your own tokens but be provided by a third party). Jiayi has previously elaborated on how to design the core business long-term marketing strategy method of “the wool comes from the pig” for further reading. Third, is it smooth for your activity users to participate? Are there any bugs to exploit? And the art of balancing the interests of the studio and current task indicators.

2.1 Using core advantages to exchange target object tokens and other benefits to seize the market, represented by Binance Wallet crushing OKX Wallet to secure the top position

Wallets were once passive tools, but they have now become a buildable marketing infrastructure. @Binance Alpha is a typical case where platform capabilities align closely with user motivations. It has surpassed OKX Wallet through the aforementioned long-term marketing strategy method, leaving it far behind.

Binance Alpha represents a true breakthrough innovation in crypto marketing, with the key change being: wallets have transformed from "asset storage tools" to "project discovery centers." Binance has directly integrated the discovery entry for early projects into @BinanceWallet. Users no longer need to go to external platforms to find new projects; they can explore projects and receive incentives directly within the wallet. Binance Alpha prominently showcases projects with momentum, and if a project performs well on Alpha, it may also have the opportunity to be considered for a spot on the spot listing. The entire system forms a positive cycle:

Projects want exposure and traffic → Users join and receive rewards → Projects gain highly matched new users → Binance achieves higher wallet usage rates and more trading activity.

In the Binance Alpha system, the most critical point is: rewards are given to users who genuinely trade, can bring liquidity, and are willing to pursue new projects. Binance's advantages are liquidity and user volume, while Alpha simply turns these two advantages into a more efficient distribution channel, further squeezing the survival space of second and third-tier players:

Project teams issue tokens as costs → Exchange for Binance's exposure and traffic, striving for liquidity + further listings.

Binance directs users into the wallet → Users generate trading behaviors.

Users trade and complete tasks → Exchange for rewards → At the same time contribute trading and liquidity to the project.

Binance needs to maintain a user structure in Alpha that can generate transactions, and as projects develop, the user structure also changes, so it must continuously optimize mechanisms and activities to ensure that core value users for projects can win effortlessly.

2.2 From completely KOL-centered marketing to valuing overall community culture building—different volume marketing strategies from Kaito to Sahara

In the first half of 2025, an innovative solution for project teams' public domain traffic attention, @KaitoAI, emerged, and most project teams began to use Kaito activities as their main marketing approach. However, Kaito's incentive structure inherently favors "whoever has greater influence is more likely to be seen and rewarded." Thus, market promotion formed a fixed route: projects want volume, collaborate with KOLs, KOLs produce content, and ordinary users observe. The entire process can indeed create a buzz for a while, but retail community participation feels weak, and the collective memory of the project is perceived as KOLs advertising for airdrops, leading to a sense of caution. Consequently, project teams' traffic is first concentrated on the Kaito platform. From Kaito's perspective, it is undoubtedly successful because it follows the core principles of strategic activity design I mentioned earlier.

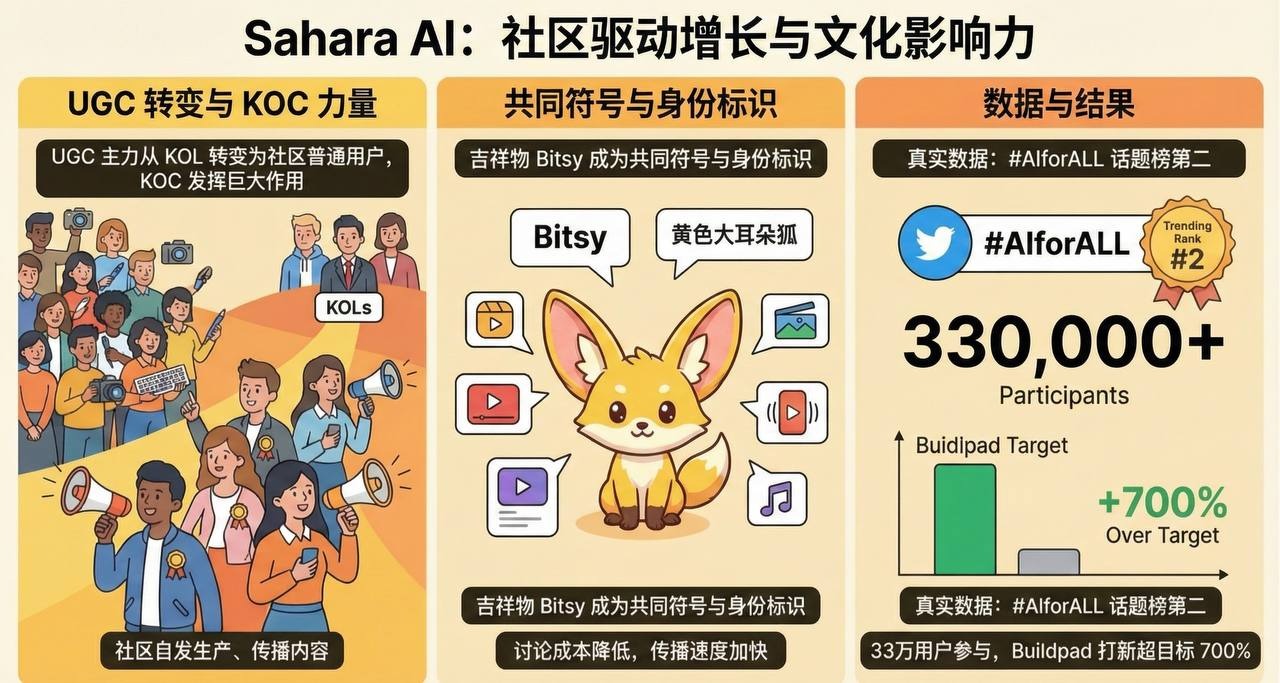

The transition of UGC from third-party platforms to self-platforms began with XDO's client @SaharaAI during its ICO on @buidlpad. The starting point for Sahara's UGC activities is "to engage the community, allowing them to participate and benefit before the project issues tokens." Sahara's UGC activities do not rely on monetary incentives, do not require users to complete tasks, and do not set up various leaderboards. Instead, they first introduce a clear cultural symbol representing the Sahara AI community and brand—mascot Bitsy (the ears in my current avatar represent Bitsy, which is super cute, and I still use it). Coupled with the timing of Sahara's ICO on @buidlpad, it encourages community evangelists to participate better in the early ICO qualifications. This group is no longer just focused on free tokens but is a target group that has a strong love and trust in the project.

You will see many users not just completing assignments but sincerely expressing themselves as members of Sahara. Some create videos using AI, some draw, some write serialized novels, some produce promotional music and shoot music videos for the community, and some even handwrite diaries daily, recording their experiences in the Sahara community and why they love Bitsy and the Sahara AI team. When users are willing to document their stories in this project through diary writing, it indicates that they have integrated this project and community into their life stories.

The results are also quite impressive.

The main force of this UGC activity has shifted from the KOL group to ordinary community users, and the KOC users mentioned above played a significant role in this activity. Sahara AI's UGC content is no longer concentrated in the hands of a few; the community has begun to spontaneously produce and disseminate content.

The community has developed a common language, common symbols, and shared memories with the Sahara AI team. The mascot Bitsy has become a meme and identity marker that everyone understands; whenever they see the yellow-eared fox, they know it’s Sahara AI. The cost of discussion has decreased, and the speed of dissemination has increased.

The real data brought by the spread of community sentiment saw the activity topic #AIforALL rise to the second place on Twitter's trending list, with a total of 330,000 users participating in the event. Sahara's new listing on Buidlpad exceeded the original target by 700%.

There were certainly users engaging in volume manipulation. However, the final rewards were for ICO participation qualifications, and the team manually screened each UGC creator's content. Thus, the ROI was extremely high, and based on this result and innovation, the ICO UGC activity has become a regular feature on Buidlpad.

However, Sahara AI also has a regret: while Sahara's UGC activity was able to ignite the community for a month in the market, it did not follow up with sustainable cultural extensions, leading to a drop in enthusiasm. This is a common issue for many projects; they can ignite interest but fail to sustain it. Although Sahara has proven to the market that culture can retain users, only continuous cultural output and community mechanism management can serve as a "religious" firewall to create a long-term moat. The continuation of culture post-TGE must be pursued, and even more effort is needed.

2.3 Simple slogans + precise rhythm control = beautiful sentiment before listing; Marketing rhythm control for projects like Sign and Kite (To B, weak community perception, difficult product visibility)

@sign has created a Web3 orange dynasty with the slogan "Sign Everything." The goal of Sign's rhythm is to first strengthen and expand the core user group, using the simplest slogan to brainwash users into equating Sign with major projects. It’s important to note that, for the market, Sign does not belong to the category of projects that can be quickly established as 'king' through technology or product narratives. The founder @realyanxin once said, "The important thing is whether we can have 100 people in our community earn seven figures." He also mentioned that after TGE, the foundation would use tokens to support internal entrepreneurship within the community, essentially making the community aware that "following Sign can lead to profits; TGE is not the end, but the beginning of the next phase."

I still remember that during the peak of Sign's popularity, Yan Xin and Sign's community official Twitter interacted frequently with users, prioritizing interaction with those whose Twitter profiles featured Sign elements. This provided users with clear feedback: as long as they participated earnestly and were "one of their own," they would always be seen by the official team (see the sign). Being seen could lead to becoming one of the community members who profit from Sign. The dissemination of Sign felt like a natural flow; everyone engaged in simple activities, and the official team provided ample affirmation, leading to community members sharing tweets and mutually supporting each other, while users optimized and packaged their accounts, gradually forming a positive feedback loop where the more users participated, the more visible they became, and the more willing they were to continue participating.

Another example is @GoKiteAI, which uses extremely simple keywords and precise rhythm to convey project value to ordinary users, quickly aligning community perception. Kite, as a public chain born for AI payments with AI technology as its core advantage, faces the challenge that technical projects often fail to communicate effectively, making it hard for users to see their differentiated value. To add, in the early cryptocurrency industry, public chains that did not communicate effectively would cause users to feel more FOMO, but that era has long been eliminated.

Kite's first rhythm was established by showcasing names like @PayPal Ventures and @generalcatalyst, reducing uncertainty and providing initial credibility anchors, allowing users to make a realistic judgment: if even the king of the payment track, PayPal, is willing to heavily invest in Kite as a bet on AI payments, it at least indicates that the team's technical capabilities are reliable and their capital resources are strong, amplifying the possibility of becoming a leader.

The second rhythm is that Kite AI aligned its story with the payment standards that the AI payment industry aims to unify, making it easier for community users to understand what it is doing. Kite is well aware that the narrative of the AI Payment Chain is inherently difficult to convey; if it simply explains to users "how AI agents pay, how settlements work…", most people would not understand and would lack the patience to learn. Therefore, Kite first makes users believe that the project is on the path that the mainstream is heading towards. Kite leveraged the hot topics of 402 and PayPal, releasing news in a compact timeframe about the collaboration with 402 and investment from @coinbase, as well as partnerships with PayPal. By pushing x402 towards a universal standard for AI-driven payments through Coinbase, it created an imaginative space for potential future clients among major companies before the official online launch. When users see Kite associated with these names, they can naturally guess and feel reassured about the project's layout capabilities.

Kite AI has effectively reduced the cognitive cost for users. The community no longer needs to read white papers or study technical details; they can start trusting Kite AI just by scrolling through a few news articles.

2.4 Transition Based on Behavioral Mining Design — How to Turn "Liquidity" into "Participation" in Yield Projects like Plasma

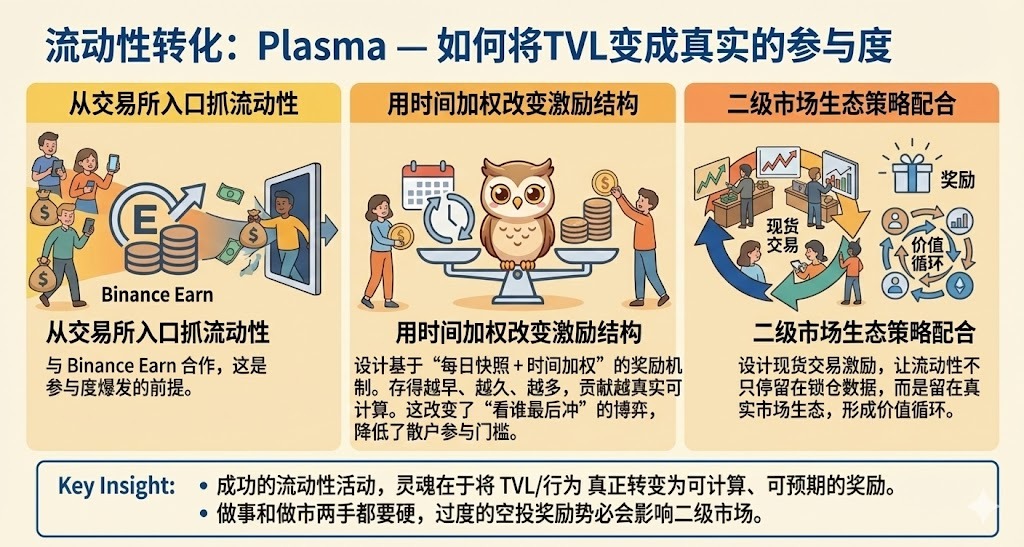

In 2025, TVL yield projects exploded, with a large number of locking activities emerging in the market, but very few projects could truly convert "liquidity into participation and retention." However, those deposit activities that performed well typically combined staking with token issuance expectations, quickly achieving FOMO effects through partnerships with liquidity giants. For example, @Plasma and @zerobasezk first attracted a large amount of liquidity through activities on Binance, then pulled this liquidity into their own ecosystem, forming deep participation; this is the essence of their market design. Additionally, Buidlpad's HODL—depositing to exchange for ICO quotas and lower valuation series project activities also achieved very good results.

The starting point of Plasma's strategy is to attract users by promoting the continuous stock behavior of stablecoins within the ecosystem. Plasma partnered with Binance Earn to launch an on-chain USDT yield product, allowing users who participate in Plasma's USD₮ regular locking to enter the airdrop range for $XPL. This design is not a one-time event; it is based on a daily snapshot and a time-weighted holding accumulation reward mechanism, where long-term holding and higher holdings amplify the final XPL rewards.

At that time, the entire market was densely packed with TVL projects, and many projects offered seemingly "high" subsidies, but the design still revolved around "who can rush in last." In contrast, Plasma's design is time-weighted— the earlier you deposit, the longer you hold, and the more you lock, the more your contribution is real, quantifiable, and calculable. This brings about a shift in behavioral incentive structure: Plasma relies on the cumulative weight of locked contributions to determine distribution. This allows retail investors to genuinely feel that even depositing 10 U can yield equivalent $XPL returns, significantly lowering the participation threshold for small amounts, while high subsidies and TVL designs attracted numerous retail investors.

Zerobase similarly established a connection with Binance Wallet, allowing users with high Alpha points to participate in priority allocations through the Booster Program. This design also first uses the exchange's own points and traffic mechanisms to bring users in, then leverages point contributions/transaction behaviors to form real distribution rights, ultimately bringing liquidity into its own ecosystem. Like Plasma, they emphasize user behavior thresholds in their activity design.

Note: This article discusses the effects of activities more, but excessive reward airdrops will inevitably have some impact on the secondary market. Our industry has already entered a phase where both execution and market-making must be strong.

The designs of Plasma and Zerobase indicate:

Grabbing liquidity from exchange entry is fundamental — collaborating with Binance as a deep traffic channel is a prerequisite for the explosion of market participation.

Transforming TVL/behavior into computable rewards — genuinely linking reward formulas with yield contributions.

Secondary market strategies cannot be ignored — Plasma's spot trading incentive design ensures that liquidity does not just remain in locked data but stays within the real market ecosystem, forming a stronger value cycle.

Common Shift in Mindset Between Project Teams and Users in 2025

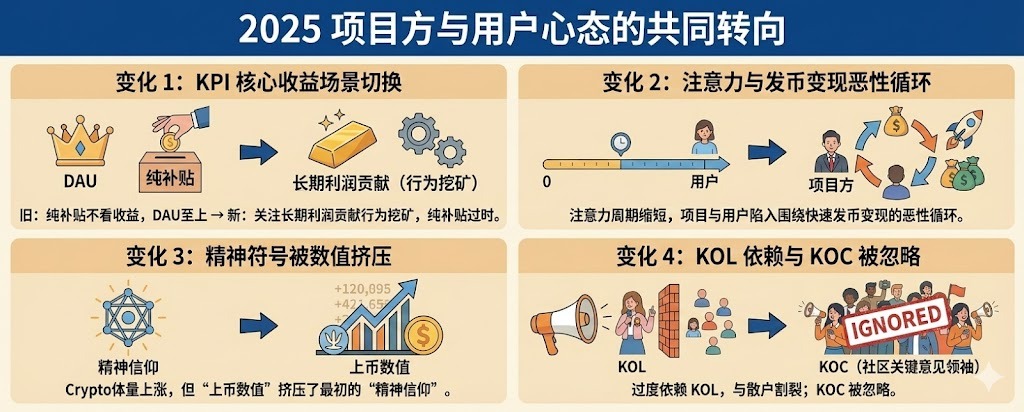

Change 1: Activity KPIs shift from "DAU" orientation to "long-term profit contribution" orientation, focusing on core revenue scenarios and sustainable behavioral incentives. Simply using subsidies to activate without measuring revenue recovery is outdated.

The "hundred billion subsidy" market logic was extremely rampant in the previous cycle, where project teams attracted users through airdrops, subsidies, and tasks, making DAU look impressive. This led to a period of "on-chain prosperity" in the last public chain cycle, but many active users did not correspond to real demand scenarios, let alone sustainable income and retention.

Thus, in 2025, the market has reawakened to the realization that:

DAU is no longer the goal and cannot independently prove value.

The goals of activities are more directly grounded in sustainable revenue scenarios.

This shift has been forcibly solidified by platform rules and activity structures: in addition to the previously shared logic of acquiring Alpha Points based on "asset balance and Alpha trading behavior," this effectively anchors the value of activities in the early asset flow and trading behaviors that can be settled.

This is also evident in the growth structures of Perp DEX / staking-type FI (such as prediction markets), where most project teams' incentive mechanisms follow the path of "trading volume/deposits → points → rewards." Users either earn points by depositing funds or through continuous trading, with the core of the activities being to exchange trading and capital occupation for future rights or rewards.

The evaluation methods on the user side are also changing simultaneously: because the anticipated altcoin bull market did not materialize in 2025, participants in activities naturally place greater importance on "principal risk" and "return certainty." When users evaluate activities in 2025, they typically look at:

Is the principal safe (will it be clawed back, are there any pitfalls in the rules, is the exit smooth)?

Are the returns calculable (is there a bottom line, is the cash-out predictable)?

What remains after the subsidies stop (product retention, revenue logic, long-term demand)?

The activity design of trading as mining first emerged seven years ago from an exchange called Fcoin, quickly seizing a large market share and even shaking the exchange landscape in the short term. However, due to massive wash trading leading to a secondary market collapse, insolvency, and team exit, it came to an end. Trading mining is an effective market capture activity, but very few projects can be played sustainably or understood long-term.

Change 2: Attention cycles are shortening, and both project teams and users have entered a vicious cycle centered around rapid token issuance and monetization

Attention is not just an issue in the crypto space; it reflects the underlying changes in society as a whole: from long videos needing to be sped up to short videos that are barely watched to completion; long articles are increasingly difficult to read in full, much like this one.

The crypto space is a microcosm of the real world, leveraging the effects of capital and time, as the industry narrative updates quickly and project lifecycles are short. Consequently, the attention cycle for projects has been further compressed to extremes, with new projects becoming "old projects" in just two weeks. Both project teams and users have formed a default consensus: the days surrounding TGE are often the times of highest liquidity, so everyone's attention converges at the same moment. Project teams focus on Pre-TGE data, users on cashing out during TGE, and platforms on trading volume, ultimately leading the entire industry to become a "top-heavy" structure—extremely crowded in the early stages and long-term hollow in the later stages; the first half relies on marketing to attract exchanges for compliance, while the second half seeks profits through the secondary market. Such mainstream operations inevitably lead to a trend of altcoins going to zero.

The consequence is that after TGE, everyone quickly turns to the next TGE, with Post-TGE systematically abandoned. Project teams lack the motivation for long-term operations, and users have even less reason to stay. The market appears to have new projects every day, but behind this is merely the stock liquidity being shuffled between different pools, while truly driving mass adoption through new narratives, products, and scenarios becomes increasingly difficult.

For project teams, continuously maintaining community relationships, retaining users, and forming a positive business model should be as important as TGE, if not more so, rather than burning the entire budget at the moment of TGE. Once users scatter after the token listing, the cost of recalling them will be very high, which is the biggest hidden danger I see from the market rhythm in 2025.

Change 3: The overall size of crypto is increasing, but the initial spiritual belief has faded—“token value” has squeezed out “spiritual symbols”

In 2025, many projects' market actions increasingly resemble a pure "numerical engineering" approach: points, leaderboards, tasks, and subsidies can be scheduled weekly, KPIs can be reviewed daily, and growth can be dissected by funnel. However, founders are talking less about dreams and are less willing to spend time clarifying "who we are, why we exist, and what needs we want to solve." The community and the team also more easily become two separate language systems—the team is only responsible for pushing the data up, while the community is only responsible for completing tasks to earn rewards.

Once the spiritual symbols are absent, the sense of participation is hard to solidify into a sense of belonging. Behind any great business lies a cultural revolutionary symbol. Blockchain, BTC, ETH, and Binance have all achieved their current status due to this cultural consensus. However, today, the path taken by successful individuals is quickly forgotten by entrepreneurs and the market.

This is also a pitfall many projects encountered in 2025: they initially put in a lot of effort to build volume and participation but lack a sustainable mechanism and rhythm, thinking that "culture has been established" after one round, and then leaving the follow-up to the community to grow freely; the reality is that culture is not like data.

It does not automatically compound after a one-time spike; it resembles "repetitive labor"—you must continuously provide the community with a reason to participate, a symbol that can be retold, and a scenario that can solidify identity. The ROI may not be attractive at first; many things require persistence and what seems "unwise" but can catalyze significant power in the long run. Yes, I want to mention again that Binance became the first exchange to propose the "unwise" plan of allowing profitable users to withdraw tokens after the Chinese government's crackdown on exchanges in 2017, resulting in hundreds of users from around the world eventually becoming Binance Angels for eight years, becoming the core spark for Binance's internationalization.

Change 4: Over-reliance on KOLs → Alienation from retail investors; KOCs (Key Opinion Consumers) are overlooked

In 2025, I see many project teams mistakenly believe that "the market" = "KOLs."

It seems that as long as they gather the top influencers, fill topics, and pile up heat, users will naturally stay. However, KOLs, while important as a channel for amplification, do not equate to building relationships; they can elevate emotions but do not guarantee consensus. When projects allocate resources and benefits solely to KOLs, ordinary users naturally develop a sense of detachment, feeling like they are merely providing liquidity, data, or background. Once this mentality forms, activities shift from "closing the distance" to "creating opposition."

Aster's recent Human vs AI trading competition is a very intuitive example: the official event itself is a "quota-based" funded trading competition, where not all users can directly sign up to participate; instead, they watch a group of KOLs trade, leading to the absurd yet inevitable scene of someone allegedly "arbitraging $10,000" and leaving. Such activities are certainly strong in terms of dissemination and can easily create dramatic conflict, but they also amplify a problem—when the main stage of the activity belongs only to a few, retail investors inherently lack a sense of participation, leaving behind discussions that are often just "spectator" comments rather than strong links relevant to users.

KOLs are an important part of the industry, but their value has been exaggerated too much in 2025. Many projects mistakenly believe that doing marketing means only developing KOLs, neglecting that the real connectors of public domain traffic are KOCs—KOCs may not have the most exposure, but they are definitely the most stable supporters, organizers, and long-term participants in the community, even penetrating into other communities. They can sustain the heat of an event into a regular occurrence and can steer discussions back to constructive directions when projects face fluctuations and doubts.

KOLs are very important community representative partners. However, activities must prioritize users, especially not overlooking the power of KOCs, treating them as core assets to manage, and establishing mechanisms for their identity, participation paths, and long-term material and spiritual incentives.

2026 Marketing Trends and Challenges

My thoughts on the marketing trends for 2026 are based on the premise that a bull market driven by national and traditional capital giants will find it difficult to enter the altcoin market; attention will be even more fragmented, with marketing focused solely on public domain traffic seeing ROI approach negative infinity; the era of AI will make it harder for projects to differentiate themselves technically and product-wise, while the homogenized content of "universal creators" on X will gradually lead users to lose interest; more open regulations will give rise to increased competition for attention in both public and private domains.

Based on this, I believe 2026 will be a return to simplicity:

1. The market will continue to compete for subsidies before TGE.

2. Low market cap projects with heavy community participation before TGE, designed for activities that generate profits and can cycle long-term, will become the mainstream operational strategy for successful projects.

3. Users achieving significant results will rely on trust built through companionship and co-creation trends (a beautiful wish, but I believe some project teams will awaken).

4. Private community management will be emphasized again.

Purely sharing with the pioneers navigating this chaotic market

In a fiercely competitive and chaotic market cycle, becoming the next unicorn is exceptionally difficult. Therefore, at the end of this article, I want to share an eternal example of market operations from Binance, hoping to provide concrete hope for everyone.

Let’s not forget that in the market environment when Binance was established, it was generally believed to be very difficult to create the next centralized exchange giant; let’s not forget that Binance also experienced the awkward situation of launching a product that no one used:

$BNB was first ICOed in July 2017, with 50% allocated for public sale at a valuation of $20 million. When enough chips were initially given to retail investors, they were motivated to see themselves as "shareholder-style users" following the project team (low opening, high rise). Of course, we can see the results; Binance did not disappoint everyone, quickly establishing itself as the leading exchange and providing thousands of times in returns for holders in just a few years.

Binance captured the market through gaining user trust and strong PMF business capabilities. In 2017, during the 94 crackdown, when Chinese exchanges were completely banned, Binance quickly made the decision to shift its operational focus to overseas markets and chose to buy back tokens at high prices amid severe market panic and when most project teams opted for rug pulls. This is how Binance gained hundreds of angel investors globally, creating a grassroots community that is imitated but cannot be replicated. From then on, Binance became their faith. Thus began Binance's rapid penetration into local markets through angels from around the world. Binance transformed from a "Chinese exchange" into a global exchange.

@cz_binance and @heyibinance, the two co-founders, entered entrepreneurship without burdens, fully aware that becoming KOLs was the most cost-effective marketing strategy. They frequently voiced their opinions on social media, maintaining high exposure and communication, coupled with regular AMAs and deep community interactions, effectively managing both public domain traffic and private domain management (angels).

After eight years of development, I still believe the biggest trust crisis comes from the previous massive hacking incident involving North Korean hackers. CZ faced the market head-on with an AMA, and SAFU subsequently became one of the cultural symbols. This textbook example of crisis public relations is something many project teams still have not learned. Market operations can sometimes be particularly simple; it’s not about whether you can do it, but whether you want to do it. I have given many project teams very effective advice. Unfortunately, the projects that ultimately fell into big pitfalls did so due to a lack of courage and decisiveness.

The growth of Binance into the world's largest exchange is closely intertwined with the rise of BNB, creating a positive spiral. The story of BNB is not just about "the token increased, so it succeeded," but also about turning "holding" into a reason for "using": transaction fee discounts, consumption and rights within the platform, and continuously providing clear return expectations to holders, leading to BNB chain gas growing into today’s strong mainstream token. These mechanisms ensure that the token is not just a trading target but also expands through the wealth effect of BNB and solidifies support, pulling user behavior back into the platform ecosystem; the stronger the platform, the more usage scenarios for the token, the stronger the willingness to hold the token, leading to a situation where users are reluctant to sell BNB for fear of missing out. Thus, it has become today’s mainstream token, transforming many original buyers into more frequent users. Moving from "buying tokens" to "using tokens," and then from "using tokens" to "holding tokens." When holders continuously gain returns in usage scenarios, the platform's trading and cash flow can also be more easily expanded; a stronger platform will, in turn, reinforce everyone’s confidence in BNB—this is what I believe to be an excellent "product growth ↔ token value" positive spiral.

Sincerity is always the killer skill in the market. Only with PMF can a startup stand firm in the market long-term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。