China has continued its gold rush, acquiring more gold in December.

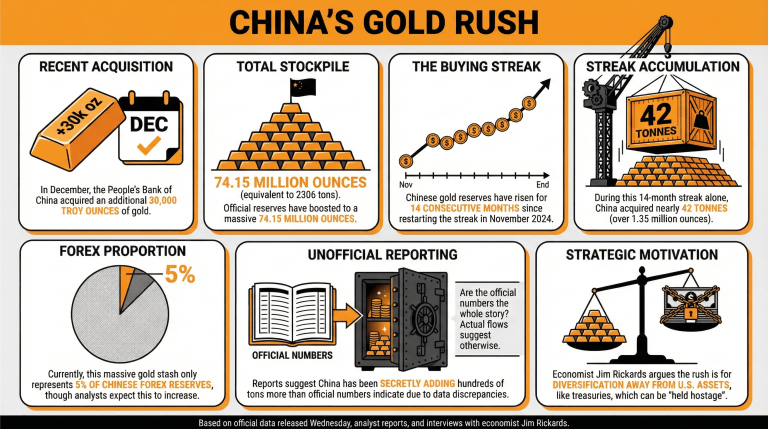

According to official data released on Wednesday, the People’s Bank of China acquired 30,000 troy ounces of gold in December, boosting its reserves to 74.15 million ounces (2,306 tons). This is the 14th month in which Chinese gold reserves have risen, a trend among central banks.

The Chinese gold reserves have been consistently rising since November 2024, when China restarted its buying streak after a brief period. During this streak, China has acquired nearly 42 tonnes of gold (over 1.35 million ounces).

Even so, China’s gold stash only represents 5% of the Chinese forex reserves, with analysts claiming that this proportion might increase as the country seeks to hedge against several factors.

Nonetheless, reports suggest China has been secretly adding hundreds of tons more than what official numbers indicate, as these figures and actual flows show discrepancies.

In a recent interview, legendary economist Jim Rickards stated that one of the main reasons behind the central bank gold rush and the general price hike in the gold and silver markets was the need for diversification from U.S.-linked assets, including treasuries, which can be held hostage by the U.S. government.

This is consistent with its retreat from U.S. debt and the recent efforts to internationalize the yuan, including its digital version in this equation.

The current Venezuelan situation can accelerate this process, as geopolitical tensions reinforce the use of gold as a hedge against geopolitical risks, fiscal uncertainty, and the weaponization of the U.S. dollar.

Read more: Jim Rickards’ Explosive Predictions: Gold to $10,000, Silver to $200 in 2026

- How much gold did China acquire in December?

In December, the People’s Bank of China acquired 30,000 troy ounces of gold, increasing its reserves to 74.15 million ounces (2,306 tons). - How long has China been increasing its gold reserves?

China’s gold reserves have risen for 14 consecutive months, restarting a buying streak begun in November 2024. - What percentage of China’s forex reserves do its gold reserves represent?

China’s gold reserves account for approximately 5% of its forex reserves, a figure that analysts expect may increase as the country diversifies. - What factors are driving China’s gold rush, according to experts?

Economists cite the need for diversification from U.S.-linked assets and geopolitical tensions as key reasons for the rush into gold as a hedge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。