Ray Dalio, the renowned investor, has a different view of last year’s most relevant investment story.

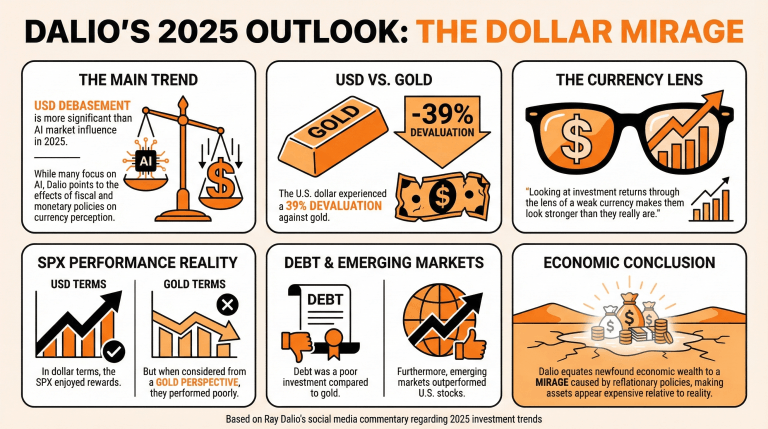

While many believe artificial intelligence (AI) and its market influence to be the most relevant story in 2005, Dalio states that the debasement of the U.S. dollar and its effects on the perception of the U.S. economy were even more significant.

In a social media post, Dalio states that the U.S. dollar lost ground to its main fiat rivals and against gold, with a 39% devaluation against this hard asset. He explained that, given this context, “looking at the investment returns through the lens of a weak currency makes them look stronger than they really are.”

For example, when the SPX is considered in dollar terms, it yielded considerable rewards. But, if observed from a gold perspective, it performed poorly. Debt was also a poor investment when compared to gold, and it is projected to keep underperforming as the Federal Reserve is expected to cut interest rates this year.

Shares faced the same problem, as investment in emerging markets outperformed U.S. stocks, even in dollar terms.

This is why Dalio equates this economic wealth to a mirage, stating that “just about everything went up a lot in dollar terms because of the big fiscal and monetary reflationary policies and are now relatively expansive.”

In consequence, Dalio declared:

The value of money issue, otherwise known as the affordability issue, will probably be the number one political issue next year.

This will likely result in political clashes that can hamper Trump’s maneuvering margin in a midterm election context, all because of an expansionary monetary policy, he concluded.

Read more: US Dollar Faces Worst Annual Performance Since 2017, Drops 9.5% in 2025

What is Ray Dalio’s perspective on the main investment trend for 2025?

Dalio believes that the debasement of the U.S. dollar and its impact on the economy are more significant than the rise of artificial intelligence.How much has the U.S. dollar devalued against gold?

The U.S. dollar has experienced a 39% devaluation against gold, indicating a significant loss of ground to major fiat rivals.What implications does Dalio see regarding investment returns?

He argues that viewing investment returns through a weak currency lens can make them appear stronger than they truly are, particularly when compared to gold.What political ramifications does Dalio predict due to the value of money issue?

Dalio suggests that concerns over money’s value will become the top political issue, potentially impacting Trump’s maneuverability after the midterm elections due to monetary policy challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。