Abstract

• The Bitcoin white paper established the essence of wallets: they are tools for managing private keys and signatures, rather than account systems. The private key represents control, forming the basic consensus in the crypto industry—Not your keys, not your coins.

• DeFi Summer pushed wallets from low-frequency asset management tools to essential gateways for on-chain DeFi.

• The bear market did not halt the evolution of wallets; instead, it catalyzed the All-In-One model to become mainstream, validated in the real high-frequency scenarios of inscriptions and meme trends.

• CEX expanded its boundaries through embedded wallets, bridging the existing advantages of CEX to the on-chain ecosystem, achieving a closed-loop experience for exchange users to enter Web3 with one click.

I. The Starting Point of Wallets

The origin of cryptocurrency wallets can be traced back to the birth of the Bitcoin network.

1.1 The Initial Definition of Wallets: Private Key Management Tools

On October 31, 2008, an anonymous developer (or team) using the pseudonym Satoshi Nakamoto published the white paper "Bitcoin: A Peer-to-Peer Electronic Cash System," which laid the core logic of modern crypto wallets: a wallet is essentially a tool for generating, managing, and signing private keys, rather than a traditional "account" or "funds repository."

Bitcoin was born with the genesis block on January 3, 2009, and the Bitcoin Core released that same year (the early version was called Bitcoin-Qt) was the first complete reference implementation. Its built-in wallet function was positioned from the start as a manager of a collection of private keys.

According to the Bitcoin developer documentation, the earliest Bitcoin Core wallet adopted a Loose-Key or JBOK (Just a Bunch Of Keys) model: the software automatically created a batch of private key/public key pairs (initially generating 100 by default) using a pseudo-random number generator (PRNG), and these key pairs were stored in a local file called wallet.dat. The core responsibilities of the wallet were: generating private keys, deriving corresponding public keys and addresses, monitoring unspent outputs (UTXO) on the blockchain associated with these public key addresses, and using private keys to locally sign transactions and broadcast signed transactions.

Users' BTC is not stored in the wallet software or on the user's device; it always exists on the distributed ledger of the blockchain. The wallet software is only responsible for holding the private keys that prove ownership and authorize the movement of assets. Losing the private key means permanently losing control over the corresponding UTXO, which laid the early foundation for the industry rule of Not your keys, not your coins.

It is important to note that, unlike traditional bank accounts, the Bitcoin network does not have a centralized concept of account balance. Each UTXO exists independently and is locked to a specific public key hash (P2PKH was mainstream in the early days). To "spend" these UTXOs, users must provide a signature that can unlock the script, and the signature can only be generated by the corresponding private key. Therefore, the role of wallet software is more akin to that of a signer and monitor, rather than a custodian or bookkeeper. However, Satoshi did not directly use the term "wallet" to define the software in the white paper, but he mentioned several times that private keys are used to sign transactions, implicitly indicating the necessity of local key management. Subsequent implementations of Bitcoin Core solidified this logic as the default behavior of wallets.

At this stage, the wallet function was extremely pure: it was merely the "key" to on-chain assets, with a very high user experience and technical threshold, almost no user education, interface beautification, or additional services. There was no profit model; Bitcoin Core was open-source free software, and developers did not charge any fees.

II. Wallets Transitioning from Transfer Tools to DeFi Gateways

The summer of 2020, referred to as "DeFi Summer" by the crypto industry, was the most brilliant period of financial innovation in crypto history, directly driving the first leap of users towards non-custodial wallets and laying the foundation for the modern DeFi ecosystem.

2.1 The Impact of DeFi Summer on Wallets

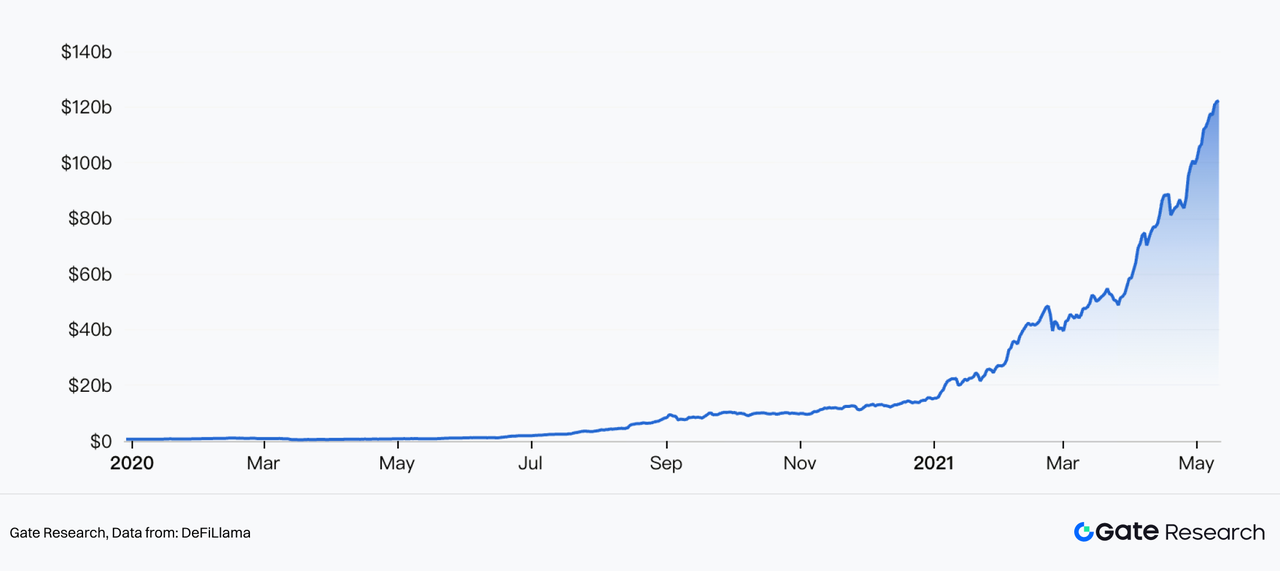

DeFi Summer marked the transition of DeFi from the experimental stage to explosive growth. During this period, the innovation of several core protocols within the Ethereum ecosystem and the overlay of liquidity incentive mechanisms led to a surge in on-chain financial activities, with TVL skyrocketing from about $600 million at the beginning of 2020 to over $10 billion for the first time in October, and surpassing the $1 trillion mark for the first time in April of the following year.

The catalysts of DeFi Summer primarily came from the successive maturation and innovation of incentive mechanisms of three major protocols: Compound, Uniswap, and Aave.

(1) Compound

In mid-June 2020, Compound launched its governance token COMP and introduced a liquidity mining mechanism—users could earn COMP token rewards in real-time by depositing assets for lending. This design deeply bound protocol governance rights with economic incentives for the first time, quickly attracting a large amount of liquidity. After the launch of COMP, Compound's TVL surged from less than $100 million to over $1 billion within four months, becoming the direct trigger for DeFi Summer, and in April 2021, it first broke the $10 billion mark.

(2) Uniswap

Uniswap v1 was launched back in November 2018, but v2, released in May 2020, significantly improved capital efficiency and user experience by introducing liquidity pools for ERC-20/ERC-20 trading pairs. Subsequently, in mid-September 2020, Uniswap airdropped UNI tokens to all historical users and initiated its own liquidity mining, further amplifying traffic. In September of that year, Uniswap's monthly trading volume exceeded $10 billion for the first time in history, with the community exclaiming that DEXs were poised to challenge centralized exchanges.

(3) Aave

Aave completed its V1 upgrade in early 2020, introducing innovative features such as flash loans. During DeFi Summer, Aave's TVL grew from just tens of millions of dollars in early June to over $1 billion for the first time in August, becoming a leading player in the lending sector.

The common characteristic of these protocols is that they shifted liquidity from scattered to scaled through token incentives, leading to a dramatic increase in user on-chain interaction frequency and strategy complexity.

2.2 Wallets Becoming Necessary Gateways for dApps

Before DeFi Summer, wallets were mainly used for simple transfers, asset viewing, and limited dApp interactions, with a limited user base. In the summer of 2020, with the explosion of DeFi protocols, users had to interact directly with smart contracts through wallets (signing transactions, authorizing limits, depositing and withdrawing liquidity, etc.), and wallets leaped from being an "optional tool" to becoming a mandatory gateway to DeFi. The most typical manifestation of this was the explosive growth in the usage data of MetaMask.

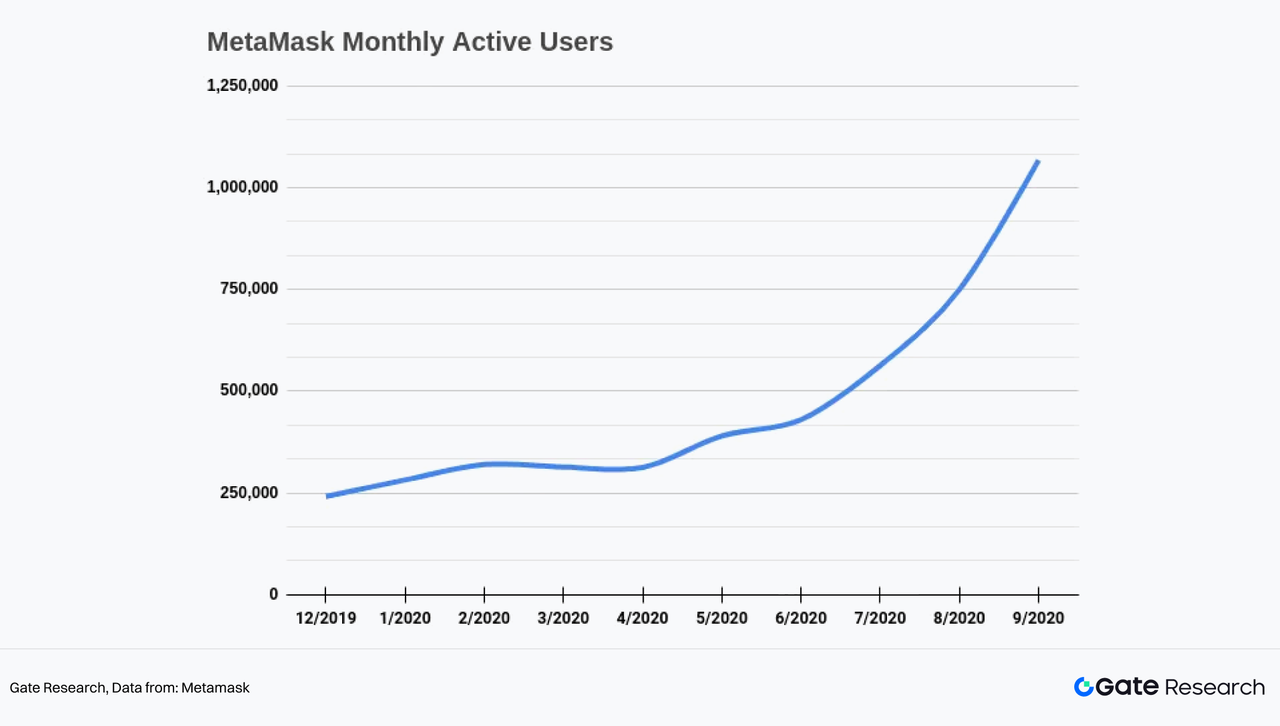

In October 2020, Metamask announced that it had surpassed 1 million monthly users for the first time in history, an increase of over 400% compared to the same period in 2019. The growth curve of the Metamask wallet mirrored the trend of DeFi adoption, indicating that new users were participating in the DeFi revolution through MetaMask, primarily to engage with protocols like Uniswap, Compound, Aave, Curve, and Yearn.

Wallets expanded from being entry points for on-chain asset management to the embryonic form of DeFi operating systems. Users experienced the paradigm of browser extension wallets on a large scale for the first time—connecting dApps directly within the wallet and signing complex transactions, which not only lowered the participation threshold for DeFi but also allowed wallets to capture a large amount of on-chain behavioral traffic, laying the user mindset foundation for subsequent built-in Swap, cross-chain, and other functions.

2.3 DeFi Summer Opened the Traffic Gateway, but Wallets Were Still Exploring Business Models

Although DeFi Summer greatly increased the frequency of wallet usage and the scale of traffic, transforming them from mere asset management tools into essential portals for DeFi interaction, the commercialization dilemma of wallets was not fundamentally resolved. The core contradiction lies in the fact that while wallets gained considerable on-chain traffic, they struggled to effectively "divert" and convert it into sustainable, high-proportion revenue. Value capture primarily settled at the underlying protocol level, rather than at the wallet layer.

First, wallets do not control transaction pricing. In DeFi interactions, the core pricing power of transactions (slippage, price discovery, liquidity depth) is always determined by the underlying DEX or lending protocol. Wallets merely serve as signers and relay routers for dApp usage. For example, when a user connects to Uniswap for a Swap in MetaMask, the actual execution price, slippage, and Gas costs are determined by Uniswap's AMM pool and the congestion level of the Ethereum network, and MetaMask cannot intervene or extract the core value portion.

Secondly, during this stage, most non-custodial wallets still positioned their operations as free tools. Revenue was either derived from extremely low commissions as channel providers or from no commissions and no revenue (relying on ecological influence or parent company subsidies). Metamask was one of the first wallets to launch the built-in Swaps feature, acting as an aggregator to obtain quotes from multiple sources like 1inch, Paraswap, and 0x API, which was one of the few monetization attempts by leading wallets at that time. MetaMask charges a 0.875% Swap fee for each transaction, meaning that users need to pay multiple fees when trading through MetaMask Swap, including LP fees, DEX protocol fees (if any), and MetaMask's 0.875% fee. From the current perspective, built-in Swap has become a standard feature and an important source of revenue for wallets, but at that time, not many believed this model would succeed, and a considerable number of wallets had not even launched similar built-in Swap features in their early stages.

III. The Evolution of Wallets Towards a "CEX-like" Structure

DeFi Summer established wallets as gateways to on-chain finance, but as the bull market entered 2021, market narratives quickly shifted: the NFT boom (peaking in Q1–Q3 2021) and the GameFi/P2E craze (from Q3 2021 to early 2022) took over, becoming new engines of dominant traffic. Although these two waves did not directly address the profitability loop of wallets, they significantly enriched the functional demands and user behavior patterns of wallets, laying a crucial foundation for the subsequent "All-In-One" CEX-like model.

3.1 Development of All-In-One Wallets

After entering a bear market in 2022, the overall trading activity in the crypto market declined, but the evolution of wallet products did not stagnate. Some wallet developers seized the strong demand for convenience and high-frequency interactions exposed during the previous bull market, rapidly iterating their products. Wallets gradually evolved into super applications for on-chain finance, integrating asset management, trading, cross-chain capabilities, fiat on/off ramps, and emerging assets.

In this context, the All-In-One wallet model gradually took shape. Wallets restructured around the complete on-chain behavior path of users, embedding multiple functions into a unified interface, mainly including: unified management and automatic recognition of multi-chain assets; embedded Swap aggregation and cross-chain bridge services; NFT browsing, trading, and asset display; fiat on/off ramp interfaces; and the ability to quickly access emerging assets and new protocols.

The one-stop model marks a commercial turning point for wallets from passive gateways to active platforms. On one hand, wallets began to actively carry out trading and asset allocation behaviors, significantly extending the time users spent within a single application; on the other hand, wallets gradually gained control over transaction paths and traffic distribution, making them less reliant on the incentives or fee-sharing of underlying protocols, and instead enabling the possibility of building their own fee and service models. From a business logic perspective, this signifies a key turning point for wallets from "passive gateways" to "active platforms."

3.2 The Trials of Inscriptions and Memes

After continuous iterations from 2022 to early 2023, mainstream non-custodial wallets approached a mature form in terms of functional completeness. At this point, what wallets lacked was not product capability, but an external catalyst that could reactivate user scale and bring complex functions into the public eye.

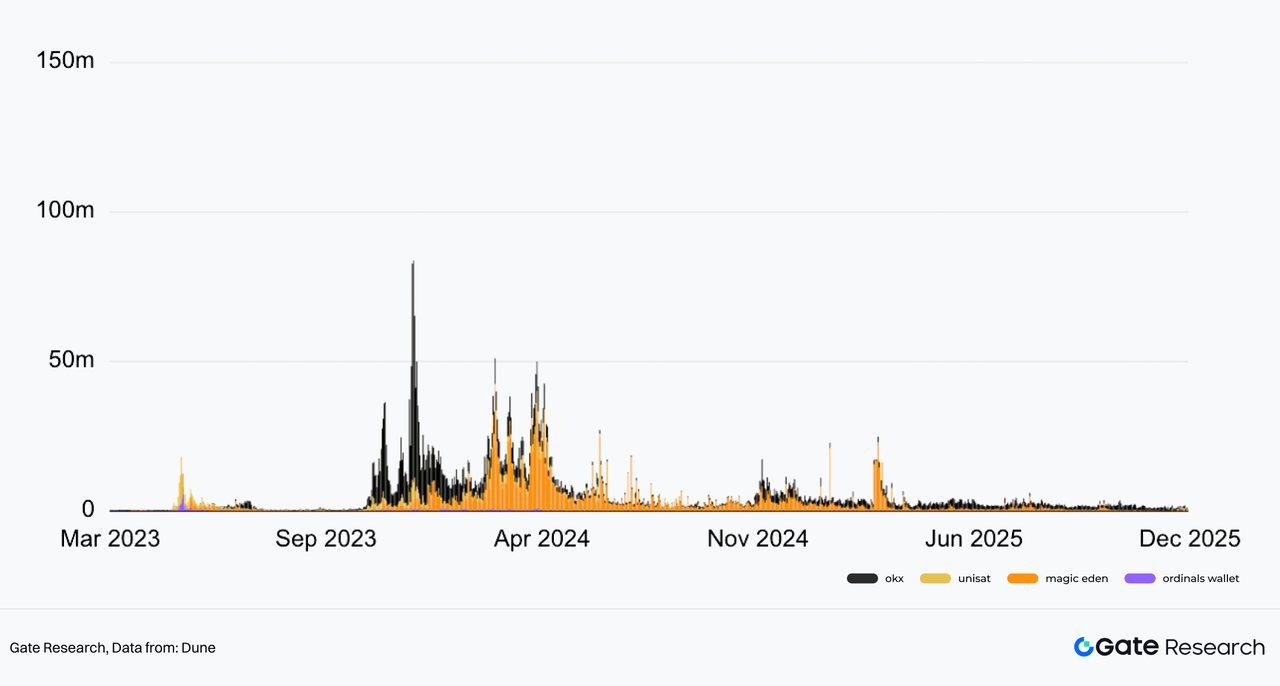

The emergence of inscriptions became the spark that brought All-In-One wallets into the public spotlight. In December 2022, Casey Rodarmor launched the Bitcoin Ordinals protocol, allowing data (such as images, text, and videos) to be inscribed onto individual satoshis (the smallest unit of Bitcoin), thereby granting new expressive capabilities to Bitcoin block space without introducing new consensus rules. Building on this, in March 2023, domo proposed a text-based asset issuance standard called BRC-20. This standard did not modify the Ordinals protocol itself but achieved a mechanism for issuing and transferring fungible tokens on the Bitcoin network through a defined JSON format for the inscribed content.

The emergence of BRC-20 quickly sparked community interest and speculative enthusiasm, leading to significant on-chain trading and minting activities in the first half of 2023. Users also raised new demands for wallets: visual support for inscribed assets; encapsulation and simplification of minting and transfer processes; and operational optimizations for high-frequency, small-value on-chain transactions on the Bitcoin network.

Wallets that could quickly support inscription functions experienced significant user growth and transaction traffic in a short period. Meanwhile, the fees and service charges generated from inscription-related operations became one of the directly observable monetization sources for wallets in 2023. Although inscriptions were not the starting point for the All-In-One capabilities of wallets, they fully presented and validated the capacity boundaries of wallets as comprehensive on-chain platforms in practical operation.

After the wave of inscriptions receded, the Meme craze in the Solana ecosystem in 2024 took over, becoming a key training ground for the further explosion of the All-In-One wallet model. This wave of Meme was centered around Pump.fun, which quickly ignited after its official launch in 2024: the platform lowered the creation threshold for Memecoins to a level where anyone could issue them in seconds through a minimalist Bonding Curve mechanism and extremely low token issuance costs. Pump.fun dominated the issuance rights of Solana Memes throughout 2024. This step required deeper functional optimizations for wallets, accelerating the integration of Meme-specific tools, such as one-click launch/monitoring for Launchpads represented by Pump.fun, real-time Bonding Curve graphs, flash modes, take-profit and stop-loss features, MEV protection, and social sharing buttons.

In the high-frequency interactions and trading activities related to inscriptions and Memes, the functions of asset issuance and management, transaction execution, and user guidance undertaken by wallets were amplified, leading to a clearer market recognition of the commercialization and platformization potential of wallets: the frenzied trading volume brought enormous transaction volume and more aggressive fee extraction for wallet Swaps; wallet routing became an important diversion point; advertising space/revenue sharing, etc.

As these capabilities continued to manifest in practical scenarios, wallets gradually came to be seen not just as entry tools for transactions, but as comprehensive platforms capable of covering on-chain native assets and behavioral scenarios that CEXs could hardly reach, which also laid the groundwork for CEXs to have to pursue CEX-On-Chain and embedded wallets.

3.3 Derivative Expansion of Wallet Boundaries

Perpetual contracts, as a core category of crypto derivatives, have long been viewed as a moat for CEXs—high leverage, high-frequency trading, deep liquidity, and the resulting high ARPU (average revenue per user) user base. Between late 2024 and 2025, with the explosive rise of high-performance Layer1 derivative protocols like Hyperliquid, and the gradual deep integration of Builder Codes into mainstream non-custodial wallets, perpetual contracts officially began to penetrate the on-chain wallet system from the exclusive battlefield of CEXs, marking another substantial expansion of the functional boundaries of All-In-One wallets.

The impact of Hyperliquid goes far beyond a simple technical upgrade; it reshaped the entire on-chain ecosystem for derivative trading, promoting the popularization of the "on-chain CEX experience": a fully on-chain order book (on-chain CLOB), sub-10ms execution latency, gasless trading (achieved through consensus optimization), leverage of up to hundreds of times, and a diversified market supporting over 100 crypto assets and RWAs (such as the stock token market of HIP-3).

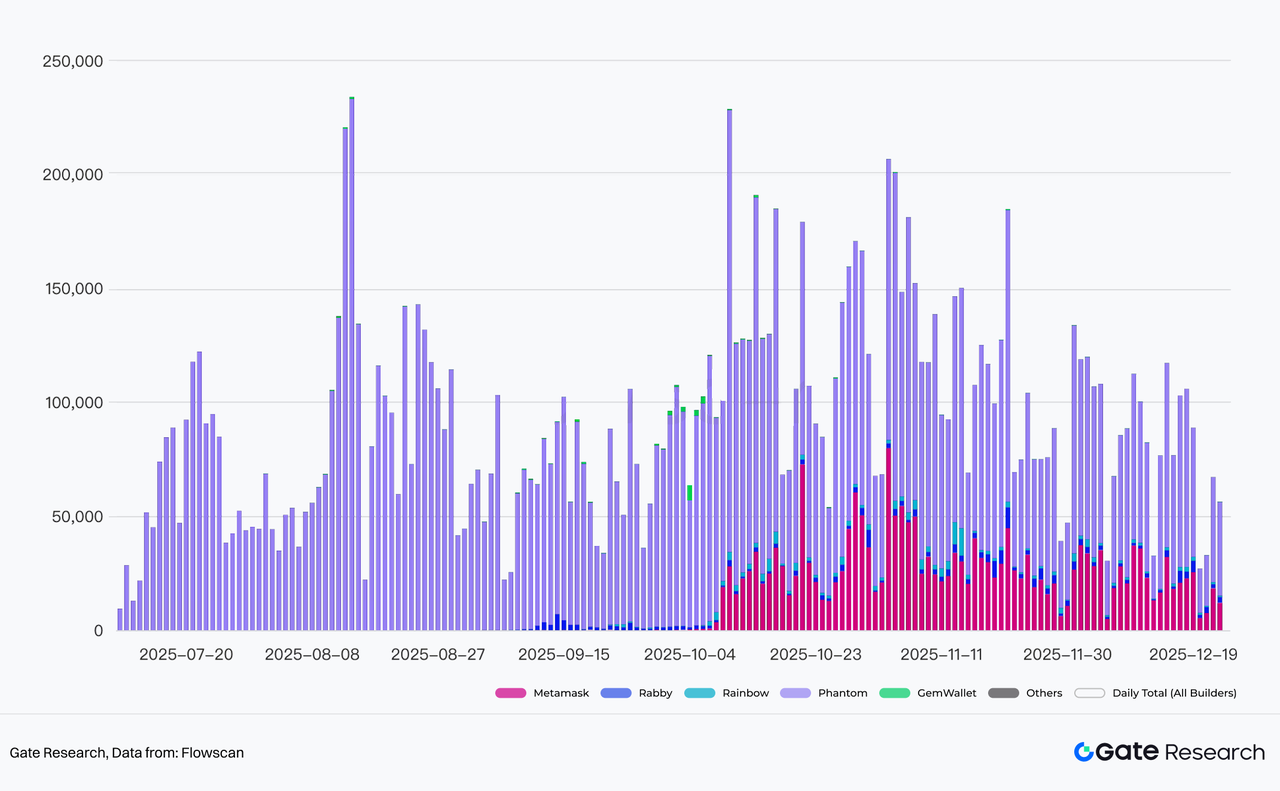

Hyperliquid Builder Codes are the key point for mutual engagement with wallets. They allow third-party applications (such as trading terminals and wallets) to relay trades to Hyperliquid's HyperCore layer through custom code, enabling users to sign and execute trades within their wallets without directly accessing the Hyperliquid interface. For Hyperliquid, Builders significantly enhance its distribution capabilities; for wallets, it also brings significant value, allowing them to seamlessly integrate all markets of Hyperliquid (including new Perp pairs deployed without permission under HIP-3) without having to build their own order books or liquidity; they can earn routing commissions/service fee shares through Builder Codes while retaining a non-custodial core, with funds always remaining in the user's wallet until settlement. Phantom directly accessed Hyperliquid through this model, quickly capturing derivative traffic and becoming one of the strongest Builders in terms of fee capture ability—having captured over $12.6 million in fee revenue since its launch in early July this year. Other wallets like Rabby, Metamask, and Rainbow have also successively integrated Hyperliquid Builders, allowing users to trade perpetual contracts directly within their wallet applications.

The rise of high-performance Perp DEXs like Hyperliquid, along with the bidirectional empowerment of the innovative distribution channel of Builder Codes, is the decisive force for the expansion of wallet boundaries in derivatives in 2025. It enables non-custodial wallets to truly possess CEX-level high-frequency, high-leverage trading capabilities, capturing high ARPU professional user groups while building sustainable revenue models through routing commissions. This not only breaks the long-standing monopoly of CEXs in the derivatives field but also accelerates the trend of CeDeFi integration: wallets become the preferred entry point for on-chain native derivatives, while CEXs are forced to respond through embedded/on-chain methods or even by creating their own on-chain Perp, leading to the most intense competition and symbiotic pattern from 2025 to 2026.

IV. Differentiation of Wallet Evolution Routes: Non-Custodial vs. Embedded

At the end of 2024 and the beginning of 2025, faced with the internal troubles of VCcoins being overvalued upon launch without any wealth effect and the external threat of Solana Meme's explosive growth that could not be launched in time, CEX users remained in exchanges but could not participate in high-yield on-chain opportunities, leading to continuous asset and user outflows, forcing CEXs to accelerate their on-chain transformation. However, some CEXs did not blindly pursue complete user self-custody in their on-chain transformation, instead shifting to a more pragmatic hybrid/embedded wallet strategy. Wallets are no longer independent tools but are extensions of CEX accounts on-chain.

4.1 Advantages and Disadvantages of Native Web3 Wallets

Native Web3 wallets, also known as non-custodial wallets or self-custody wallets, represented by MetaMask and Phantom, have adhered to the core principle of Not your keys, not your coins since their inception. Users of these wallets have complete control over their private keys and do not need to trust third-party custodians. By 2025, non-custodial wallets have fully evolved into All-In-One on-chain super applications: supporting unified management of multi-chain assets, embedded Swap/cross-chain bridge/fiat on/off ramp, rapid support for new assets, Meme launching and monitoring, Perp derivative trading, and more. The commercialization path has also become increasingly clear, primarily achieving sustainable revenue through Swap and Perp fee sharing, routing fees, MEV protection value-added services, and application promotion.

The core advantage of native Web3 wallets is that users have exclusive control over their private keys, avoiding common custodial risks associated with CEXs, such as platform hacks, bankruptcy freezes, regulatory asset seizures, or forced freezes. This advantage was repeatedly validated after the collapse of FTX in 2022, as the assets of non-custodial wallet users were unaffected by platform events, while CEX users continue to struggle for their rights, facing partial or permanent losses. As crypto increasingly aligns with traditional finance, global regulatory attention on centralized platforms and even DeFi protocols is continuously rising, making the importance of self-custody self-evident.

Of course, the user education cost for self-custody wallets is very high. Looking at the history of wallet development, the large-scale adoption of wallets has often stemmed from the explosion of new assets and narratives, such as DeFi, inscriptions, and Memes; under the wealth effect created by these new assets and narratives, users often exhibit a self-learning ability that is several times stronger than usual. However, being able to use a wallet for trading does not equate to fully understanding and managing a wallet; basic concepts such as mnemonic backup, private key/signature security, understanding gas fees, and phishing risk prevention still present a high barrier. New users, especially those migrating from Web2, are prone to making fatal mistakes, such as authorizing malicious contracts or losing mnemonic phrases, leading to permanent loss of funds.

Additionally, in a purely non-custodial model, the fiat on/off ramp of wallets heavily relies on third-party aggregators (such as MoonPay), requiring users to complete KYC/AML verification on their own. Coverage is uneven across regions, with many countries/regions facing restrictions or high costs, resulting in significant access friction. Under regulatory pressure, aggregators may suddenly adjust policies or increase fees, leading to an unstable user experience.

4.2 CEX Embedded Wallet Route

CEX embedded wallets, represented by Gate Web3 Wallet, view wallets as a natural extension of the CEX system. The core goal is not to replace CEX or fully transition to decentralization, but to expand the boundaries of CEX: seamlessly integrating the existing advantages of CEX (compliance, fiat channels, user scale, customer support, liquidity depth) into the on-chain ecosystem, achieving a closed-loop experience for CeFi users to enter Web3 with one click.

Some CEX embedded wallets no longer pursue pure self-custody, specifically adopting MPC (Multi-Party Computation) or TEE (Trusted Execution Environment) technologies to build keyless wallets, achieving a "quasi-self-custody" experience—private keys are sharded/encrypted and stored, users do not need to manage mnemonic phrases, but recovery and signing still require user authorization, while the platform retains some control for compliance risk management and customer service intervention. Wallets are deeply bound to CEX accounts, allowing users to transfer funds from exchange accounts to on-chain operations with one click, and vice versa, creating a unified experience of "exchange account bound to on-chain address."

However, for another segment of CEXs, user self-custody remains a core principle. Gate Web3 Wallet emphasizes that users hold private keys and asset sovereignty, differing from traditional CEX custodial accounts; yet its design is deeply embedded in the Gate CEX ecosystem, representing a typical CEX on-chain non-custodial route—maximizing the use of CEX's scale and convenience advantages while retaining the non-custodial core.

4.3 Case Study: Analyzing the CEX Wallet Evolution Path with Gate Web3 as an Example

4.3.1 Strategic Positioning of Gate Web3: All-In-Web3

Gate Web3 Wallet is positioned as an important entry point for Gate's core strategy, All-In-Web3. The All-In-Web3 strategy is a long-term layout that Gate aims to promote in 2025, intending to deeply integrate the advantages of traditional CEX (user scale, compliance capabilities, liquidity depth, security experience) with the decentralized potential of Web3, building an open, scalable, and user-friendly all-on-chain ecosystem.

Using Gate Web3 Wallet as an entry point, Gate is accelerating the construction of an integrated Web3 ecosystem, including the high-performance Layer2 network Gate Layer, which provides low-cost infrastructure; the decentralized perpetual contract platform Gate Perp DEX, combining CEX performance with DeFi transparency; and the zero-code on-chain token launch platform Gate Fun, supporting rapid issuance of Memecoins, real-time cross-chain Meme coin trading, and data analysis through Meme Go, among other modules.

4.3.2 Product Design and User Mindset

The product design of Gate Web3 Wallet revolves around the core principle of non-custodial architecture, allowing users to fully control their private keys and assets while being deeply embedded in the Gate CEX ecosystem, achieving seamless integration between CEX and Web3. The design focuses on balancing security, convenience, multi-chain compatibility, and user-friendliness, further enhancing AI empowerment and modular functionality after the 2025 upgrade. The core design principles and technical foundations of Gate Web3 Wallet include:

(1) Non-custodial architecture: Users hold complete private keys, and Gate has no authority to access or control assets. This ensures the sovereignty of "Not your keys, not your coins," while supporting private key export, mnemonic backup, and hardware wallet connections (such as Ledger/Trezor), allowing users to manage recovery independently.

(2) Multi-platform and multi-chain support: Supports synchronization across Web, mobile app, and browser plugins (Chrome extension); covers over 100 public chains including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Solana, Base, and other mainstream EVM and non-EVM chains, with unified asset management, automatic recognition, and cross-chain transfer.

(3) Security protection model: The 2025 upgrade introduces hardware-level security + AI-driven protection, including chip-level mnemonic protection, biometric (fingerprint/face) + cloud encrypted backup, and AI risk scanning, such as abnormal transaction alerts, smart contract audit prompts, and phishing detection.

(4) User experience-oriented interface and interaction: The new user creation process adopts a guided design, simplifying the interface layout to complete initialization in a few steps; supports Gate account/email/Google login, eliminating the need for mandatory mnemonic memory (while retaining full self-custody options).

(5) Seamless integration with the Gate ecosystem: One-click transfer of funds from CEX accounts to Wallet (and vice versa), shared KYC/compliance channels, direct access to Gate Layer, Gate Perp DEX, Gate Fun, Meme Go, etc. DApp connections support thousands of protocols, with one-click marking of high-risk applications.

The product layer design of Gate Web3 Wallet reflects a typical paradigm of CEX on-chain non-custodial: establishing non-custodial as the baseline, achieving convenience without sacrificing sovereignty through multi-end unification, multi-chain compatibility, three-layer security, AI empowerment, and deep binding with the CEX ecosystem.

4.3.3 Business Logic

Gate Web3 Wallet is not merely an accessory to the Gate ecosystem or a simple on-chain tool, but rather a growth engine for the next stage. Its business logic is closely built around the overall platform revenue of CEX, extending user behavior from centralized trading to on-chain, achieving multi-channel incremental monetization, extending user lifecycle, and improving asset retention rates. The core idea is that on-chain traffic does not dissipate but is converted into value that the platform can capture.

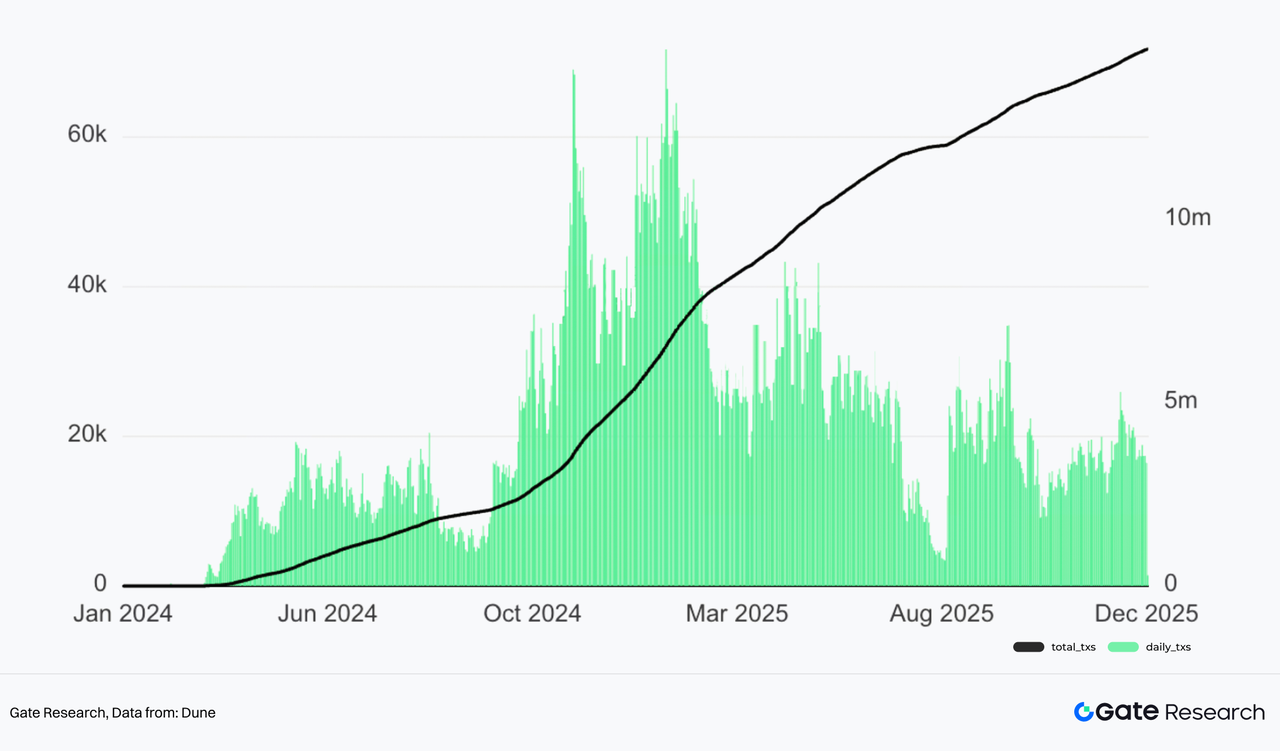

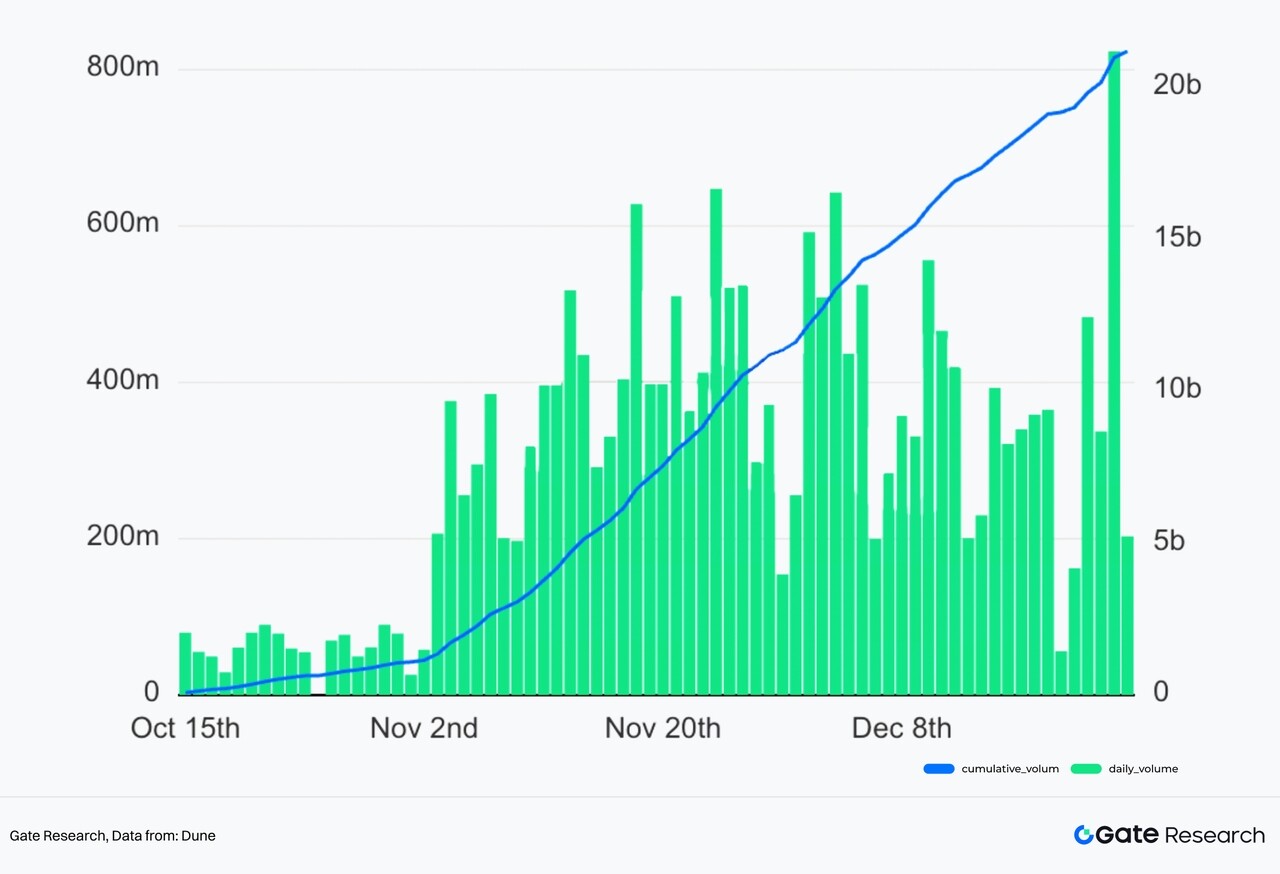

Gate Web3 Wallet directly captures on-chain trading fee sharing through built-in functions such as Swap, cross-chain bridges, and Perp DEX. Among these functions, Gate Perp DEX is growing the fastest and is expected to become an important supplement to the overall revenue of CEX in the future. Since its launch at the end of September, Gate Perp DEX has accumulated a trading volume exceeding $21 billion in less than three months, with a new daily trading volume record of over $800 million set on December 24.

Through Gate Web3 Wallet, users can quickly expand from exchange accounts to on-chain scenarios, effectively extending the active cycle of users while keeping their assets within the Gate ecosystem.

Five, Future Outlook: The Next Stage of Competition for Wallets

Wallets are not the endpoint but the starting point of a new round of competition in on-chain finance.

5.1 Key Competitive Dimensions

As wallets have completed a structural migration from tools to platforms, the focus of the next stage of competition will no longer be on who has more features, but on who can establish sustainable barriers in four dimensions: transaction quality, experience abstraction, compliance risk control, and intelligent execution, and stably sediment these capabilities into user retention and revenue.

(1) Transaction Depth

The depth of wallet transaction competition focuses on three things: deeper available liquidity, composable depth across chains, protocols, and assets; stronger routing and execution mechanisms, with smart order routing becoming a fundamental capability of aggregators, and an increasing number of intent-based executions to enhance efficiency and MEV resistance; and a more systematic MEV protection, shifting from "prompting users to raise slippage" to "default protection for users," for example, reducing sandwich and front-running risks through intent matching/solver competition, batch/atomic execution, etc. Overall, competitive metrics will be closer to CEX transaction metrics (effective spreads, slippage distribution, failure rates, transaction time), establishing brand awareness around more certain transaction outcomes.

(2) UX Abstraction Capability

The upper limit of wallet experience does not lie in UI but in abstracting on-chain complexity to a point where users do not see it. Account abstraction ERC-4337 may be a key differentiator, enabling programmable accounts, gas payment/batch transactions/social recovery capabilities, making it more suitable for product forms aimed at the general public, integrating fragmented experiences such as gas, cross-chain, signature pop-ups, authorization management, and failure retries into default paths that do not require explanation.

(3) Risk Control and Compliance

When wallets provide services such as aggregated trading, fiat on/off ramps, custodial/semi-custodial services, yield, and derivatives entry, they may be viewed as service providers in different jurisdictions, needing to meet corresponding compliance and consumer protection requirements. Compliance and risk management capabilities may directly determine the boundaries of wallet expansion. Future wallets may not just be a department of CEX but will increasingly resemble a regulated fintech company, with KYC/AML, transaction monitoring, blacklists, and risk alert systems becoming standard features.

(4) AI + Wallet

The impact of AI on wallets is not about AI-generated customer service but rather closer to trading and execution capabilities, representing an intent-driven paradigm. For example, if a user expresses a desire for an annualized x% financial product, AI can provide customized DeFi strategies based on the user's historical behavior and can automatically complete these complex operations with the user's consent, as well as manage the user's position automatically.

5.2 Wallet's Endgame Hypothesis

(1) All-In-One Wallet vs. Vertical Wallets

It is foreseeable that All-In-One will continue to be the mainstream evolution route for wallet products for a considerable period, whether for non-custodial wallets or CEX embedded wallets. Wallets can continuously expand their service boundaries across different chain scenarios and asset types, systematically exploring commercialization space. With the continuous addition of functional modules, wallets no longer rely on a single narrative or short-term opportunities but gradually form comprehensive service capabilities covering multiple assets and protocols.

Correspondingly, there are phased opportunities for vertical wallets in specific niche areas. Such wallets typically focus on a clear vertical track, providing highly specialized experiences through a deep understanding of asset standards, interaction methods, and user needs. For example, UniSat, which focuses on Bitcoin network native assets (Ordinals inscriptions and Runes), was the first to support new asset forms before mainstream wallets fully covered related needs, gathering a group of highly active early users.

The advantages of vertical wallets often stem from the flexibility of their teams and product structures. Compared to larger mainstream wallets, small teams can quickly complete integration and iteration in the early stages of new assets and standards, thereby serving user groups that have not been fully covered. The path of "first mover—validate—aggregate" has repeatedly appeared in various niche tracks of crypto assets.

However, from a longer-term perspective, the advantages established by vertical wallets are not inherently stable. As mainstream All-In-One wallets continue to accumulate product integrity and technology stacks, their speed of identifying, evaluating, and integrating new assets is significantly improving. Once mainstream wallets choose to enter a gradually validated niche track, their large user base and mature distribution capabilities often quickly amplify market recognition of that asset, objectively creating competitive pressure on vertical wallets. Thus, the timing of new assets being integrated by mainstream wallets has gradually become an important variable affecting narrative diffusion and market structure.

(2) Wallets Replacing Some CEX Functions

For a long time, CEXs have had five core advantages over DEXs or wallets: serving as the entry point for fiat on/off ramps; aggregating multi-chain token trading and liquidity on a single platform; providing perpetual contract experiences; having large customer service teams; and offering compliance guarantees. These advantages constitute the moat of CEXs. However, with the continuous evolution of wallet products, some of these advantages are gradually being weakened.

In terms of fiat on/off ramps, traditionally, CEXs have been the only fiat channel for the vast majority of users entering the crypto world. This status has formed due to CEXs' centralized integration of banking channels, compliance qualifications, and localized operations. However, third-party fiat service providers like MoonPay have been widely integrated into mainstream wallets, gradually transforming fiat on/off ramp capabilities into services that can be modularly accessed. Although CEXs remain important entry points, their monopoly is beginning to crumble.

In terms of multi-chain asset trading and liquidity aggregation, CEXs have long been the only place that can provide users with cross-chain asset trading and deep liquidity within a single interface. Now, DEX aggregators and built-in routing engines in wallets have achieved cross-chain liquidity aggregation.

In the perpetual contract field, CEXs have long monopolized the perpetual contract experience with high leverage, sub-second execution, unified margin, and real-time risk control. However, on-chain derivatives protocols represented by Hyperliquid have significantly narrowed the gap with CEXs in terms of trade ordering, execution delays, and user experience through dedicated execution environments and on-chain matching mechanisms. Meanwhile, deep integration methods like Builder Codes allow wallets to directly access Hyperliquid's on-chain perpetual contract liquidity without needing to build their own derivatives exchanges. Users can perform operations such as opening and closing positions, adjusting leverage, and monitoring funding rates within the wallet environment while always maintaining the non-custodial status of their assets.

In contrast, in terms of customer support and compliance guarantees, CEXs still have significant advantages that are difficult to fully replicate in the short term. Most leading CEXs are equipped with 24/7 human customer support, a comprehensive ticketing system, and cross-language support, enabling them to provide quick responses in cases of account anomalies, operational errors, or system issues. Even the team behind Hyperliquid, which can exert pressure on CEXs, consists of only a dozen members, which is still far from the thousands of personnel in global CEX teams. Compliance also constitutes one of the most solid moats for CEXs. Through mechanisms such as KYC/AML, regulatory licenses, reserve proof, and insurance funds, CEXs can provide users with institutional guarantees to some extent in the event of hacks, platform risks, or regulatory incidents.

In summary, the core advantages of CEXs have not disappeared in the short term, but their moat is undergoing structural changes: traditional advantages such as fiat channels, liquidity aggregation, and some derivatives capabilities are being dismantled into integrable modules and gradually migrating to wallets and on-chain infrastructure layers. Thus, the industry landscape is not moving towards a one-way replacement of CEXs by wallets but entering a deeper functional reorganization—wallets continue to undertake financial capabilities that can be on-chained, productized, and standardized, becoming the default interface for users to participate in on-chain assets and high-frequency trading activities. Meanwhile, CEXs are also responding to the pressure of eroded boundaries by using embedded wallets, on-chain trading, and tighter ecological binding, extending their advantages in compliance, fiat, and institutional services to on-chain scenarios. The key to future competition lies not in who eliminates whom, but in who can establish a more stable combination of security, experience, liquidity, and compliance, and long-term sediment user relationships and transaction paths within their own systems.

VI. References

•bitcoindeveloper, https://developer.bitcoin.org

•Metamask, https://medium.com/@JS_MetaMask/metamask-exceeds-1-million-monthly-active-users-9da72a1e915d

•Dune, https://dune.com/gateresearch/gate-perp-dex

•Dune, https://dune.com/domo/ordinals-marketplaces

•Flowscan, https://www.flowscan.xyz/builders?builder=all

•Dune, https://dune.com/hashed_official/pumpdotfun

•DeFiLlama, https://defillama.com/

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of the assets and products they purchase before making any investment decisions. Gate does not bear any responsibility for losses or damages resulting from such investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。