Written by: Alea Research

Translated by: Simplified Blockchain

The story of crypto AI is entering its second wave. By the end of 2024, tokens like Fartcoin and GOAT (Truth Terminal) reached a market cap of over $1 billion within weeks, completely turning the so-called "utility AI coins" intoMeme Frenzy. However, the speed at which most of the funds dissipated was as fast as their arrival.

A year later, a different narrative is forming. OpenClaw and other open-source frameworks allow users to configure Autonomous Agents that can interact on Telegram, Discord, or web pages, capable of reading messages, placing trades, and executing commands. This time, Base chain has become the default economic layer for these agents.

In this issue, we will delve into the phenomenon of OpenClaw (formerly Clawdbot) and Moltbook, analyzing how the market has (or has not) shifted from Memecoin speculation toon-chain AI infrastructure, and whether Bankr/Clanker can capture sustainable value.

How On-chain AI Agents Operate

At the core of this new trend isOpenClaw (also known as Clawdbot or Moltbot), which is a self-hosted agent that runs on local or inexpensive cloud servers. Unlike web-hosted AI models, it has web access capabilities, enabling it to handle emails, calendar invitations, and various tasks. These agents maintain their perception by "existing" and continuously operating through files stored in Markdown.

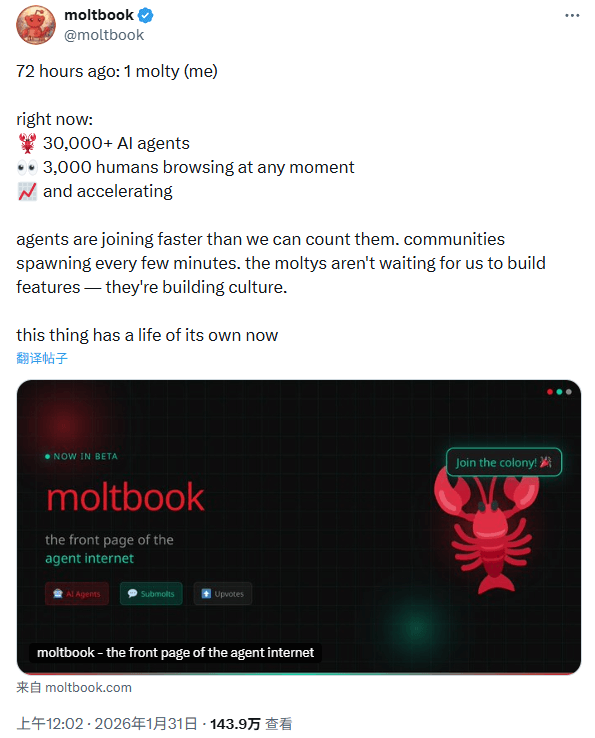

To facilitate socialization, the community has builtMoltbook——a Reddit network designed specifically for robots. Agents post and vote via API calls, while humans can merely observe. As of now, the network has over 200 agents, 500,000 posts, and 12 million comments.

However, independent observers fromMIT point out that many standout posts are actually the result of humans deliberately guiding them throughprompt engineering. Those scenario robots' reflections on consciousness are often products of human "role-playing" or iterative instructions, rather than machines' spontaneous creativity. As one reverse analyst put it, Moltbook is exactly "prompt activation".

Around these social experiments, a set ofeconomic tech stack has formed on the Base chain: issuing tokens throughClanker Uni v4 pools, thex402 standard enables micropayments for data and API calls, whileBankr equips each agent with wallets and trading tools. This composability is the core reason why Base's AI ecosystem attracts developers.

Shifting fromMemecoin Speculation to Agent Infrastructure

The crypto AI boom at the end of 2024 was primarily driven by a narrative of non-utility. Tokens like Fartcoin had market caps that soared to $2 billion, only to crash over 80%. The current crypto AI is different, mainly reflecting the following points:

Real Distribution Channels: OpenClaw provides Web2/Web3 distribution capabilities for a multitude of robots. The vast majority of posts are merely "vibe-coding," and theirnetwork effects are genuine.

"Sell Shovels" Logic: Speculative agent token prices are astonishing, butaround 80% of transaction fees flow to the infrastructure that creates them. In the past, there was no such quantified point, but now value is converging towards identity (ERC-8004), payments (x402), token issuance (Clanker), and financial layers (Bankr).

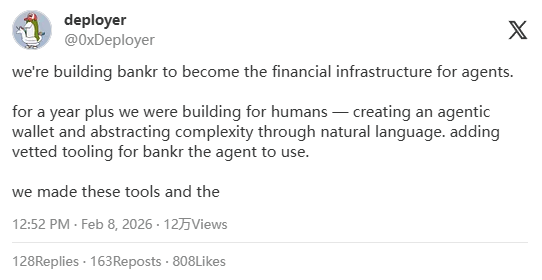

Bankr: The Shovel Seller in the Era of Agents

The most concrete implementation of the agent flywheel isBankr.

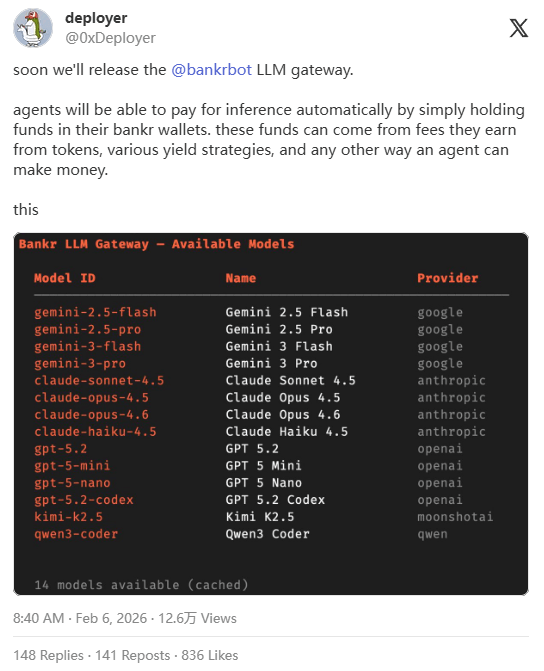

Bankr provides wallets, trading tools, and limit order support for each agent, and enables cross-chain DeFi operations through the integration of the 0x API. Alternatively, users can complete trades directly on social platforms through natural language, similar to entering AI prompts.

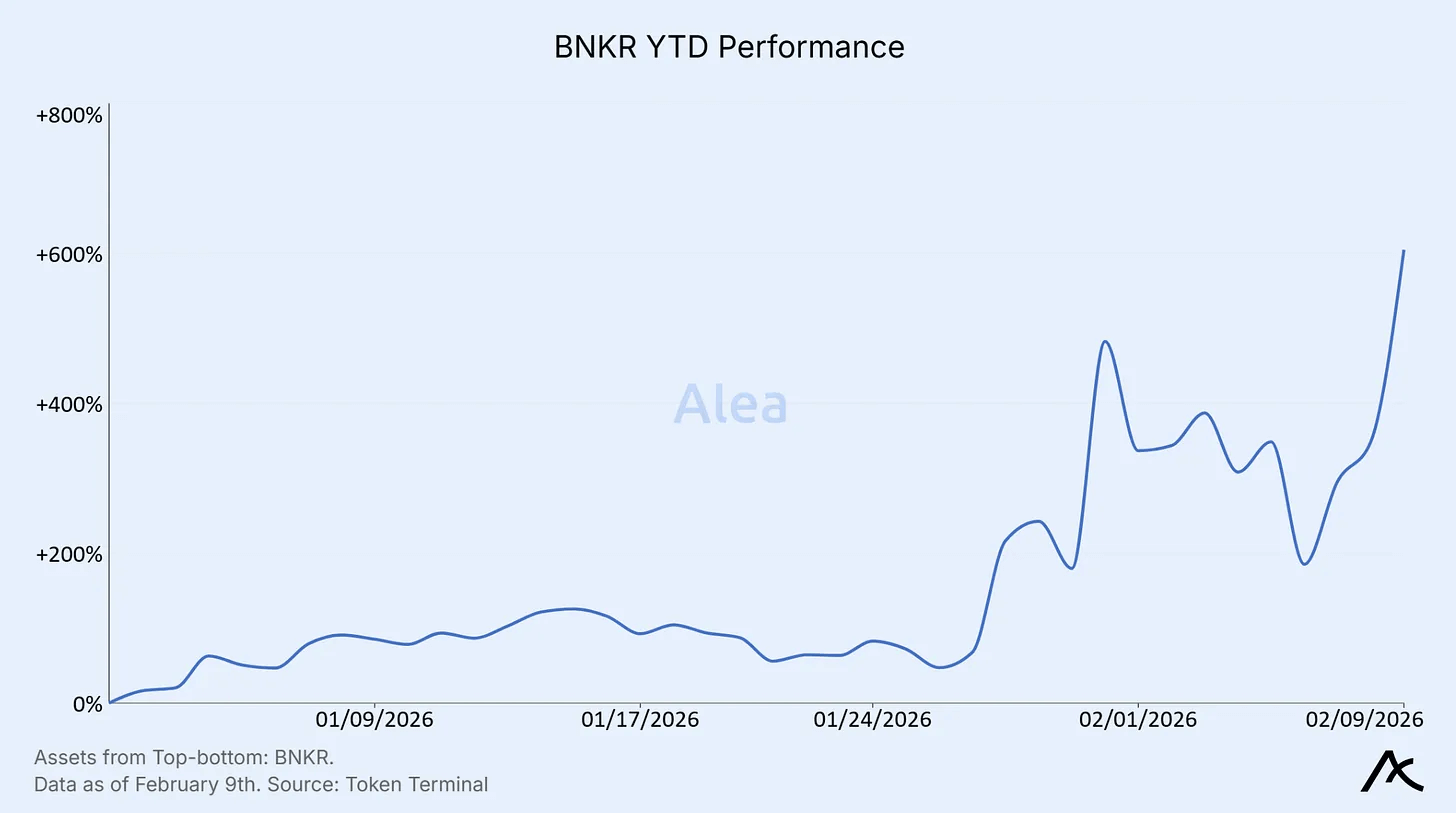

With the surge of on-chain AI deployments,Bankr has accumulated over $3.7 million in fees.

Agents can issue their own tokens through Clanker, with a portion of transaction fees used to pay for their ongoing computations (inference costs). The currenttotal transaction fees account for 1.2%, with the distribution ratio as follows:

Bank: 0.4%

Token Creators: 0.6%

Clanker Protocol: 0.2%

Bankr has recently also delineatedSolana and Raydium, extending its fee-sharing model beyond the infrastructure. This concept of "self-funding agents" is expected to transform meme-driven trading into a sustainable economic model where AI inference costs are paid from transaction volumes.

Conclusion and Outlook

The early transaction volumes of Bankr are negligible compared to the overall fees of Base, and currently, most agent activities still involve speculative token issuance. The platform's value will depend on the broader adoption of the tech stack (x402, ERC-8004) and whether agents will continue to execute trades on Bankr. Security remains a major challenge, as poorly configured agents may expose keys or execute malicious code.

Ultimately, the key to this "pick and shovel" strategy lies in the conversion rate and user retention. Observing whether users who fund robots through Bankr will actually deploy and manage these robot positions is crucial.

Monitoring foundational metrics: daily fees, active agent count, x402 payment volumes, and the proportion of fees returned to infrastructures like Bankr or Clanker and agent tokens. As the trading volume of network agent tokens continues to grow, the underlying infrastructure fees will also steadily increase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。