The cryptocurrency market's tug-of-war between bulls and bears is intensifying. Bitcoin continues its downward adjustment today, with an overall weak trend. The critical level of $90,000 has experienced thrilling fluctuations of "breaking and re-establishing," becoming the core focus of the current market. Against the backdrop of repeated tugging at this key price level, the initial jobless claims data to be released tonight will directly impact the effectiveness of the support at this level, thereby dominating the short-term market direction.

Looking at the specific market, Bitcoin's volatility has been particularly turbulent from this morning until now. Although there was a brief rebound in the morning, the upward momentum was weak, failing to break through the short-term resistance level of $92,000, with a peak only reaching around $91,700 before facing pressure and falling back. Before the European trading session in the afternoon, selling pressure further released, and the decline continued to expand, dipping to a low of $89,640, briefly breaking below the $90,000 mark. However, buying at lower levels quickly responded, pushing the price back up to around $90,900, but the bulls could not hold onto the rebound, and it slightly retreated again. The current price hovers around $90,200, with both sides in a heated battle over the $90,000 level.

In the short term, selling pressure remains the core factor driving market trends. Looking back at recent market movements, Bitcoin rebounded to the high area before December at the beginning of the week but faced heavy selling pressure from trapped positions, leading to a price correction as major funds took the opportunity to withdraw. Coupled with the large amount of profit-taking from the previous continuous rise, this further exacerbated price volatility, keeping the market in a state of oscillation and adjustment.

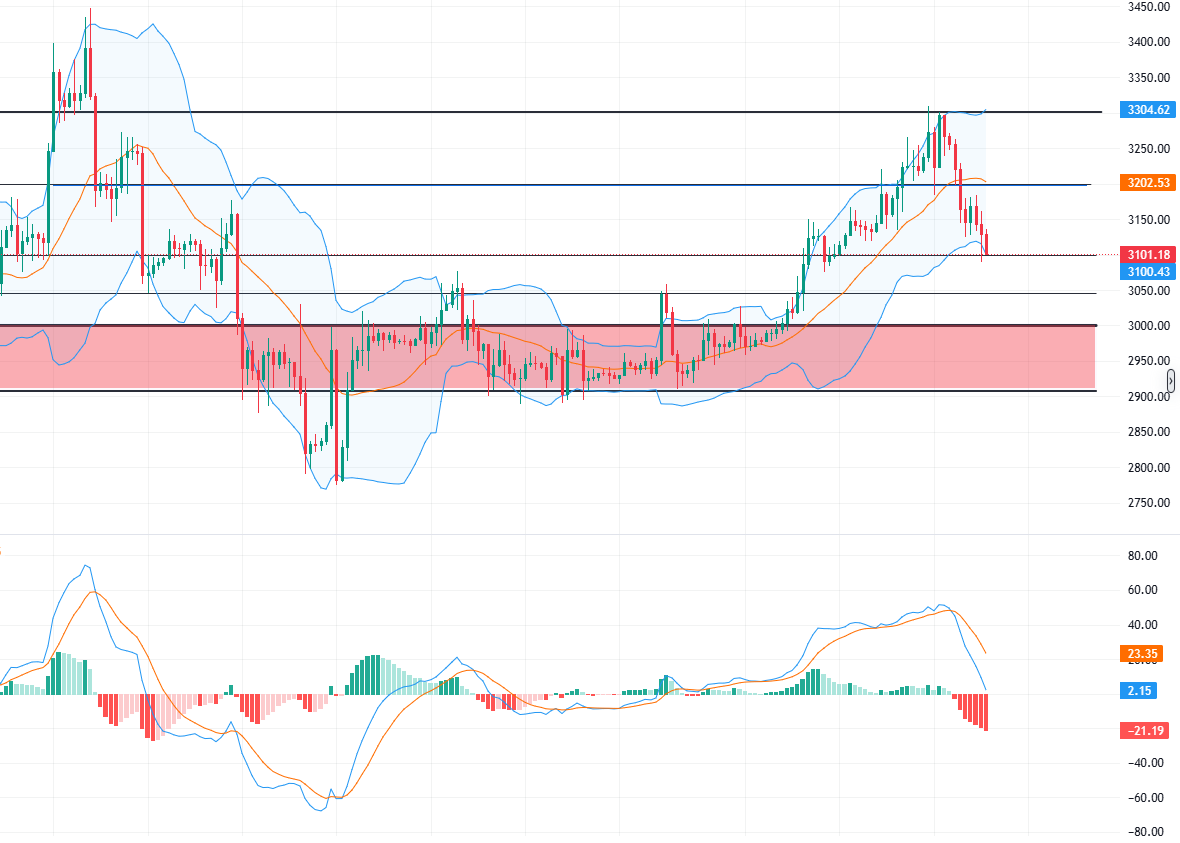

It is noteworthy that Ethereum's trend is synchronized with Bitcoin, also caught in a weak pattern of oscillating declines. In the afternoon, Ethereum followed market sentiment downwards, hitting a low near $3,090 before quickly bouncing back, showing some buying support at lower levels. However, the rebound momentum was limited, only rising to around $3,135 before facing pressure and falling back again, currently consolidating around the $3,110 level. The battle between bulls and bears is relatively mild, but the weak tone remains unchanged.

In the current weak situation, the initial jobless claims data tonight will also have a critical impact on Ethereum's short-term volatility. From a support and resistance perspective, the $3,080-$3,050 area is the core support zone to focus on tonight. This area is not only an important consolidation platform for previous corrections but also has accumulated a certain amount of buying support. If this area is lost in subsequent corrections, the price will likely test the important psychological defense line of $3,000 again; the upper resistance still focuses on the $3,200 and $3,250 areas, which are key points in the previous battle between bulls and bears. Only a significant breakout can temporarily reverse the current weak situation and open up space for subsequent rebounds.

Overall, the current cryptocurrency market is generally weak, and the defense of Bitcoin at the $90,000 level and Ethereum at the $3,080-$3,050 support zone is crucial. The initial jobless claims data tonight will become a "watershed" for short-term market trends, with its performance directly affecting market expectations for interest rate cuts and capital sentiment, thereby determining the gains and losses of the key support levels for both currencies, which need to be closely monitored.

It is worth noting that at this critical juncture where Bitcoin fluctuates around the $90,000 level, the release of the initial jobless claims data tonight will serve as an important market barometer. Logically, if the data exceeds market expectations, it indicates that the U.S. labor market is looser than expected, which will further strengthen market expectations for interest rate cuts, benefiting risk asset sentiment and potentially providing upward momentum for Bitcoin to hold the $90,000 level. Conversely, if the data falls short of expectations, it will weaken interest rate cut expectations, and market sentiment may turn cautious again, leading to renewed selling pressure. Bitcoin will likely face another decline, testing the support pressure in the $90,000-$89,000 area.

This article is exclusively contributed by Jane Crypto (WeChat Official Account: Jane Crypto) and represents personal views only. Due to the timing of the article's release, the above views or suggestions may not be real-time and are for reference only; risks are borne by the reader. Trade with reasonable position control, and avoid heavy or full positions. Developing good investment habits is essential for a positive cycle!

Market fluctuations are time-sensitive. Feel free to scan the QR code to follow the official account for daily market information and real-time communication.

Friendly reminder: This article is solely owned by the official account (as shown above) of Jane Crypto. Any other advertisements at the end of the article or in the comments section are unrelated to the author! Please be cautious in discerning authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。