Author: Liang Yu

Editor: Zhao Yidan

The 2026 work conference of the People's Bank of China concluded, with "strengthening virtual currency regulation" and "steadily developing the digital renminbi" clearly placed under the same policy framework. This is not merely a simple choice of technical route, but a profound declaration of a financial development paradigm. It clearly indicates that the innovative pathway of China's financial technology is being reshaped, and all explorations attempting to connect real assets with the digital world must navigate within this newly defined waters.

According to a report by Yicai on January 6, this conference set the tone for the year's work, emphasizing "strict implementation of penetrating regulation for payment institutions" and "strengthening virtual currency regulation, continuously cracking down on related illegal activities" in terms of regulation and risk prevention. Meanwhile, in terms of financial services, "steadily developing the digital renminbi" was listed as a normalized key task. This combination of tightening and stabilizing, breaking and establishing, in the words of industry insiders, is equivalent to "a precise 'vascular cleansing' for financial innovation, cutting off the vicious cycle of speculation and risk, while paving the institutional network for the smooth circulation of 'digital blood'—the digital renminbi—serving the real economy."

The signals released by the conference quickly triggered in-depth interpretations in the RWA (Real World Assets) field. This track, dedicated to mapping real assets such as bonds, real estate, and carbon credits onto the blockchain, stands at a critical crossroads: on one side is a tightening regulatory environment aimed at eliminating speculation in virtual currencies; on the other side is the steadily advancing infrastructure of the digital renminbi, backed by national credit. This marks that the value anchor of RWA, with the mission of "connecting reality and digital," must shift from the volatile "crypto assets" to the stable and reliable "legal digital cornerstone." This conference can be seen as a watershed moment, officially incorporating the innovative narrative of RWA from the past "financial globalization experiment" into the context of "Chinese-style financial modernization."

1. Policy Interpretation: Strengthening Virtual Currency Regulation, Where is the Focus, Where are the Boundaries?

The signals released by the 2026 work conference of the People's Bank of China are very clear. The conference proposed to "strengthen virtual currency regulation, continuously crack down on related illegal activities," continuing the regulatory tone that China has taken towards virtual currencies in recent years.

This policy statement is consistent with a series of regulatory actions taken at the end of 2025. On November 28, 2025, thirteen ministries held a meeting to deploy efforts to combat virtual currency trading speculation; subsequently, on December 5, the China Internet Finance Association, the China Banking Association, and six other industry associations jointly issued a risk warning regarding illegal activities related to virtual currencies.

The core target of the policy is very clear: to combat illegal fundraising, financial fraud, money laundering, and other criminal activities, and to suppress purely financial speculation that is detached from real value. The work conference of the People's Bank of China placed this statement after "strictly implementing penetrating regulation for payment institutions," highlighting the regulatory approach of cutting off the lifeline of illegal virtual currency activities from the funding channel.

From a regulatory practice perspective, this "penetrating" regulation has already formed a system. In recent years, regulatory requirements for payment institutions have become increasingly strict, requiring them to enhance customer identity verification and transaction monitoring, and to prevent the flow of virtual currency trading funds through payment channels.

For the RWA track, which has the mission of "connecting reality and digital," this regulatory signal needs to be interpreted accurately. It does not deny the innovation of blockchain technology itself, but rather delineates clear behavioral boundaries for this emerging field, especially for RWA projects that use virtual currencies as pricing and settlement tools.

2. Is Regulatory Tightening a "Tightening Spell" or a "Purifier" for RWA?

The strong regulatory policies have had an immediate impact on the RWA industry. According to industry observations, projects that are strongly tied to virtual currencies, have opaque trading structures, and unclear asset ownership are facing unprecedented compliance pressure.

Some pseudo-RWA projects that have emerged in the market are the primary targets of regulatory crackdowns. These projects often claim to tokenize real assets such as real estate, artworks, or commodities on the blockchain, but in reality, lack genuine asset backing, and the related asset ownership documents and audit reports may be forged.

Such "pseudo-RWA" projects not only harm investors' interests but also bring a trust crisis to the entire industry. Professor Ma Mingliang from the People's Public Security University of China pointed out in his analysis that the essence of these projects is cross-border regulatory arbitrage, exploiting the cognitive misconception that RWA "anchors real assets = stability + returns," designing high-yield rhetoric, and using multi-level distribution models to pay dividends to old investors with funds from new investors.

The tightening of regulations is also reflected in specific business practices. In September 2025, the China Securities Regulatory Commission suggested that Chinese securities firms suspend RWA tokenization-related businesses in Hong Kong. Subsequently, tech giants such as Ant Group and JD Technology also suspended their stablecoin plans in Hong Kong. This "window guidance" type of regulation reflects a cautious attitude of regulatory authorities to "comply first, then develop" before the system matures.

However, from another perspective, strong regulation also plays the role of an industry "purifier." It clears out projects that engage in financial fraud under the guise of RWA, leaving space for genuine innovations that serve the real economy. This effect of "good money driving out bad" has a positive impact on the long-term healthy development of the industry.

3. Global Landscape: The "Multiple Tracks" and "Common Logic" of RWA Development

As we focus on China's regulatory policies, the global RWA market is developing at an astonishing speed. According to industry data, as of the end of August 2025, the total value of the global RWA market has grown to approximately $66 billion. By the end of 2024, this figure was about $15 billion, indicating that the market value has increased more than threefold in less than a year.

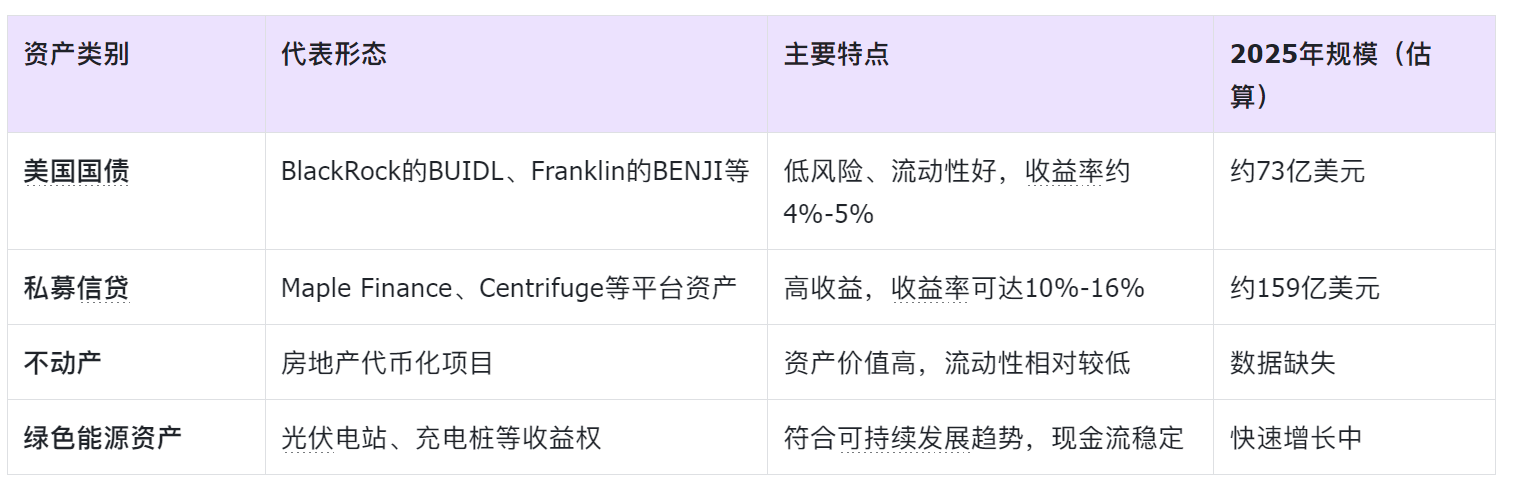

Table: Main Categories and Characteristics of the Global RWA Market

Hong Kong, as an international financial center, plays a pioneering role in the RWA field. In September 2025, UBS Group, Chainlink, and DigiFT jointly launched an RWA pilot project in Hong Kong, aiming to enhance the operational efficiency of compliant funds through on-chain automation.

This pilot project adopted a "regulatory sandbox" model and was approved under the blockchain and digital asset pilot subsidy program in the Hong Kong Internet Port area. The project manages orders through smart contracts and uses digital transfer agency contracts for instruction verification, achieving automated processing of lifecycle events such as issuance and redemption.

From a global perspective, the development of RWA shows a clear "layered" characteristic. In the initial stage, the market mainly focused on the tokenization of low-risk assets such as U.S. Treasury bonds; by 2025, capital began to flow more towards high-yield products such as private credit.

This change reflects the maturation process of the market from concept validation to practical application. As Chris Yin, CEO of Plume Network, stated: "Real progress comes from active users holding and using assets on-chain, making them liquid, composable, and part of DeFi."

4. Will the Digital Renminbi Become the "Highway" for RWA Development?

In stark contrast to the strong regulation of virtual currencies, the People's Bank of China work conference also proposed to "steadily develop the digital renminbi." This policy signal opens another door for the RWA industry—digital renminbi may become a national-level infrastructure tool for the compliant development of RWA.

The core advantage of the digital renminbi lies in its status as legal tender and the backing of national credit. Unlike the complete anonymity of virtual currencies, the digital renminbi adopts a "controllable anonymity" design, which protects user privacy while meeting regulatory requirements for anti-money laundering and anti-terrorist financing. This characteristic precisely addresses the challenge of balancing transparency and privacy protection in RWA transactions.

In practical applications, the potential of the digital renminbi has already begun to emerge. In September 2025, Guangdong United Electronic Services Co., Ltd. completed an innovative business—the first "data asset pledge + digital renminbi loan" business in the national highway industry.

In this business, the company used its "Guangdong Province Highway Digital Twin (simulation) support data" and other data assets as collateral to successfully obtain a loan of 1 million yuan in digital renminbi. This case demonstrates the practical application value of the digital renminbi in asset digital financing.

Companies like Desheng Technology have also made progress in exploring the integration of digital renminbi with the livelihood sector. The company has assisted in completing the first sample card of the Beijing livelihood card loaded with a digital renminbi hardware wallet and has been deeply involved in the national benefits subsidy and pension distribution work.

The "programmability" feature of the digital renminbi provides more possibilities for the innovative development of RWA. By loading smart contracts, the digital renminbi can automatically execute payments, settlements, and other operations according to preset conditions, enabling it to support more complex financial product designs and trading structures.

5. How Can RWA Find a Way Between Innovation and Regulation?

Globally, the balance between regulation and innovation is the core challenge facing RWA development. In this field, mainland China and Hong Kong have formed a regulatory landscape that is both distinct and complementary.

Mainland China's regulation currently adopts a prudent attitude. In 2024, the China Securities Association released the "Guidelines for the Application of Blockchain in Asset Management (Draft for Comments)," which proposed three major principles: asset on-chain must be based on real and verifiable underlying assets, must have on-chain data that is traceable, auditable, and subject to penetrating regulation.

In contrast, Hong Kong has adopted a more open regulatory innovation path. The Hong Kong Monetary Authority's Ensemble project requires RWA projects to embed a "regulation as code" module, and non-compliant projects will face a daily penalty of 2% of revenue. This technology-driven regulatory approach represents the forefront direction of global regulatory technology.

Technological solutions are changing the interaction model between regulation and innovation. Projects like KRNL are creating programmable kernels that abstract regulatory requirements from various countries into composable code modules, allowing RWA projects to quickly adapt to rules across multiple jurisdictions.

This "compliance as code" innovation transforms complex regulations into inclusive financial infrastructure, potentially reducing compliance costs from millions of dollars to thousands, making financial innovation a broader opportunity rather than an institutional privilege.

For cross-border RWA projects, the compliant flow of data and funds is another major challenge. Projects need to simultaneously meet the data security, privacy protection, foreign exchange management, and anti-money laundering requirements of different jurisdictions. Regulations such as mainland China's "Data Security Law" and "Personal Information Protection Law," along with Hong Kong's "Anti-Money Laundering and Terrorist Financing Ordinance," need to be coordinated and complied with.

6. How Will RWA's Path in China Evolve Moving Forward?

Looking ahead, the development of the RWA industry in China will exhibit characteristics of "dual circulation" both domestically and internationally. Domestically, the focus will be on the digital renminbi ecosystem, exploring its applications in asset digitization, supply chain finance, and data asset pledges.

The characteristic of this path is "devirtualizing towards reality," emphasizing the deep integration of blockchain technology with the real economy. As demonstrated by the case of Guangdong's highway data asset pledge, the focus is on using technological innovation to enhance the liquidity and financing efficiency of traditional assets, rather than creating financial products detached from reality.

In the cross-border field, Hong Kong will continue to play the role of a "super connector." Mainland enterprises can connect global capital and markets through Hong Kong's compliance framework. Regions like Shenzhen and Hainan may explore regulatory collaboration with Hong Kong, forming innovative models such as "Hong Kong residency, Hainan going global."

In terms of asset types, fields that align with national strategic directions, such as green energy and the digital economy, may become priority areas for RWA exploration. The tokenization case of GCL-Poly's photovoltaic power station assets has already demonstrated this trend. These assets have clear business models and stable cash flows, making them easier to gain regulatory understanding and market recognition.

For practitioners, the strategic focus needs to shift from "how to ride the wave of virtual currency" to "how to integrate into the new national financial technology infrastructure represented by the digital renminbi." This means enhancing the understanding of real assets, improving compliance structure design capabilities, and mastering the application of innovative tools like the digital renminbi.

Industry development will also drive the improvement of related standard systems. In March 2025, the "Technical Specifications for Trusted Blockchain Real Asset On-Chain Technology," led by the China Academy of Information and Communications Technology and involving nearly 20 companies, has officially been initiated and is in the process of being drafted. Such standards will provide the industry with a technical framework and operational guidelines.

As the central bank's work conference concluded, discussions in the financial market did not cease. Some industry insiders began to reassess their RWA project structures. Those projects that once considered virtual currency as a core element are now exploring how to shift their pricing and settlement systems to a more compliant track.

On the other end of the industry, technical teams are intensifying their research on the open interfaces and smart contract functionalities of the digital renminbi. A leader of a fintech company in Shenzhen stated, "The 'programmability' of the digital renminbi may be more powerful than we anticipated; it could support the automatic clearing and compliance checks of complex RWA products."

By 2025, the total value of the global RWA market had approached $66 billion. Meanwhile, China's unique path in this global wave—relying on national infrastructure such as the digital renminbi and adhering to serving the real economy—may provide a different development model for global financial technology innovation.

Sources of some materials:

· "Steady Development of Digital Renminbi, Continuous Strengthening of Virtual Currency Regulation"

· "Central Bank's Lu Lei: Upholding Integrity and Innovation, Steadily Developing Digital Renminbi"

· "Strengthening Virtual Currency Regulation, Maintaining Stability in Economic and Financial Order"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。