Written by: @bobthedegen_, @samoyedscribes, and @ahboyash

Compiled by: Deep Tide TechFlow

Introduction

The year 2025 is a milestone year for crypto cards, transitioning from a niche entry tool to an increasingly widely used payment tool. Whether for deposits or consumption, crypto cards have shown strong growth momentum this year, driven by improvements in user experience, broader blockchain support, and increasing user acceptance of stablecoin-denominated consumption.

This report provides an ecosystem-level overview of crypto card activity over the past two years (from December 2023 to October 2025), focusing on observable on-chain behavior of leading crypto card providers.

Executive Summary

- From Experimentation to Practical Application: In 2025, crypto cards moved from the experimental phase to practical application, with both deposits and consumption showing sustained exponential growth.

- Deposits Dominate Consumption: Stablecoins dominate deposit behavior, accounting for nearly all collateral asset shares, further reinforcing a low-volatility consumption model similar to debit cards.

- @Rain Card Usage Leads: The @Rain series of crypto cards leads in usage, but most users still engage in small transactions, indicating their primary use for everyday spending as a "wallet top-up" behavior.

- Future Growth Potential: This growth trend is expected to continue into 2026, with profitability, exchange economics, and credit-related factors further developing, rather than being limited to a single goal of user acquisition.

Methodology and Scope

This report analyzes crypto card activity through verifiable data on the blockchain, prioritizing observable economic behavior over self-reported metrics.

- Card Coverage:

- Type 1 Cards: On-chain verifiable deposits and consumption (e.g., Rain series cards, Gnosis Pay cards, MetaMask cards)

- Type 2 Cards: Only support on-chain verifiable deposits (e.g., WireX cards, RedotPay cards, Holyheld cards)

- Type 3 Cards: Cards issued by centralized exchanges (CEX) (e.g., Binance cards, Bybit cards, Nexo cards) → Not included in the analysis due to limited data access

- Analysis Method:

- Deposit Analysis: Includes Type 1 and Type 2 cards to capture a broader liquidity inflow situation.

- Consumption Analysis: Limited to Type 1 cards, as their transaction behavior can be directly observed on-chain.

For wallet-native cards that do not follow traditional deposit processes, their consumption activity is treated as deposits in the analysis to maintain consistency. Non-stablecoin balances are normalized using the average price over the past 12 months, with all transaction volumes expressed in USD equivalent.

Deposits: How Liquidity Enters the System

Deposits Expand First, Fastest Growth

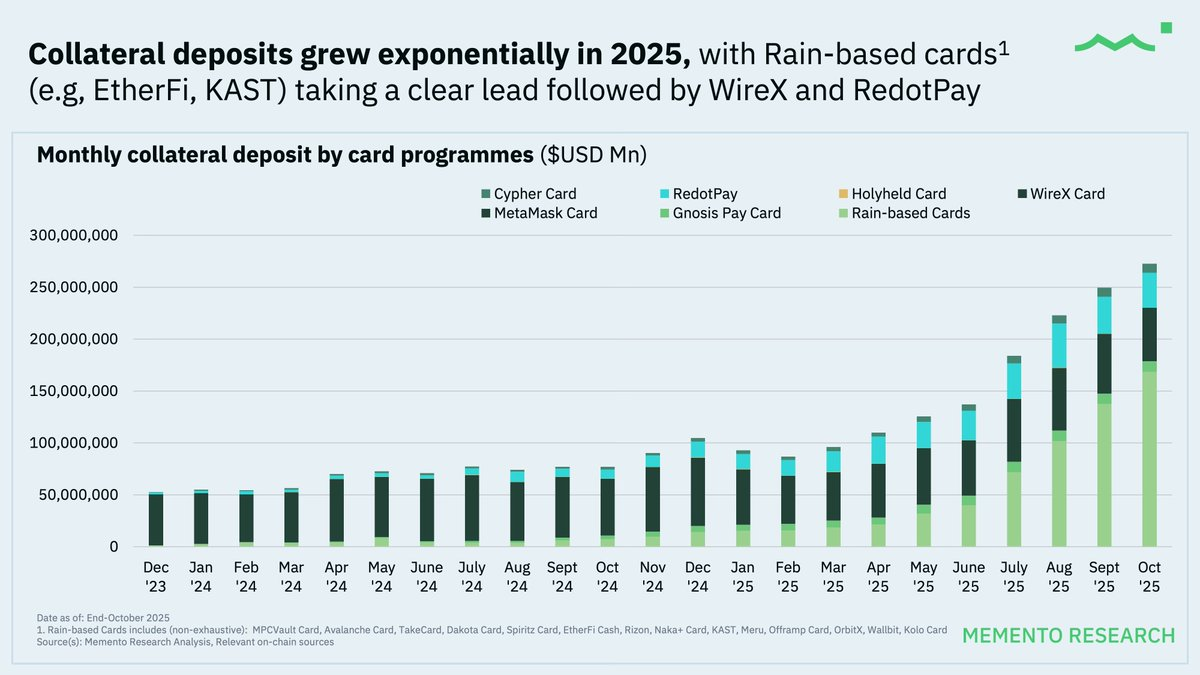

Throughout 2024, the monthly collateral deposit volume of crypto cards exhibited exponential growth, further accelerating in 2025.

Card projects based on the Rain series of crypto cards consistently maintained a leading position in deposit volume, as they serve as core infrastructure for various popular crypto card projects, including @ether_fiCash, @KASTxyz, @OfframpXYZ, and Avalanche ( @avax cards).

Market Share: Concentrated Then Diversified

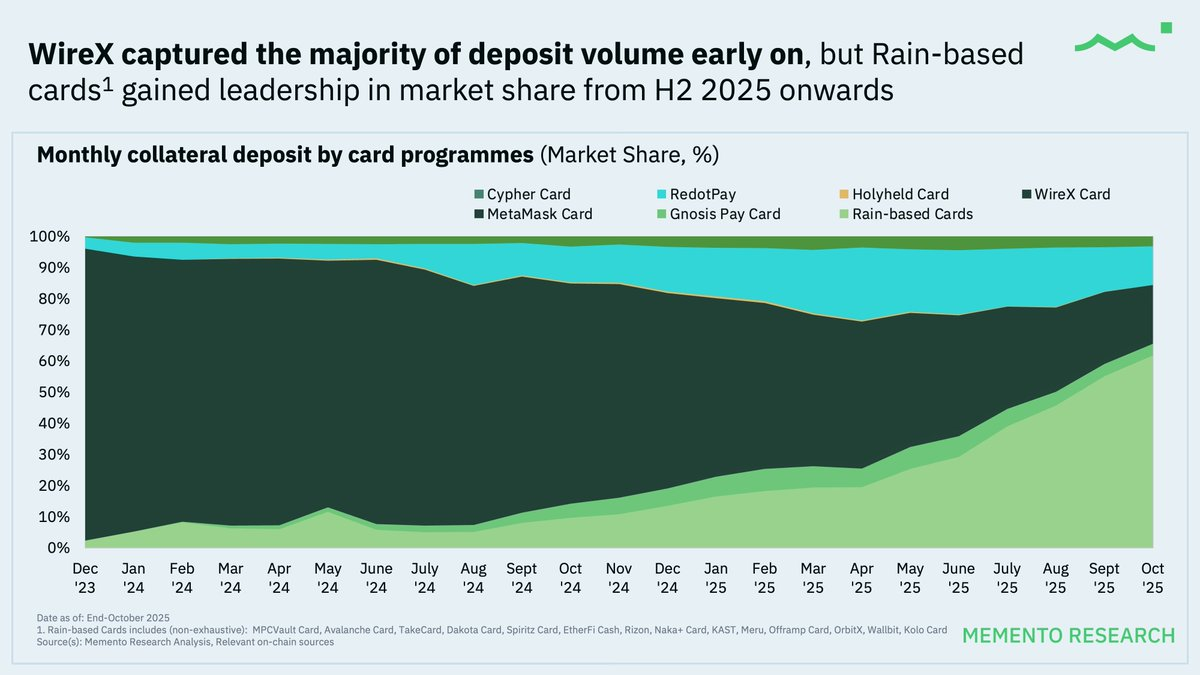

@wirexapp held a major share of deposit volume for most of 2024, but starting in the second half of 2025, the Rain series of crypto cards gained a leading position in market share.

Key Insight: Since the second half of 2025, a wave of new crypto card projects has launched, choosing Rain as a core infrastructure partner. This trend has driven higher deposit inflows while accelerating the onboarding of new users.

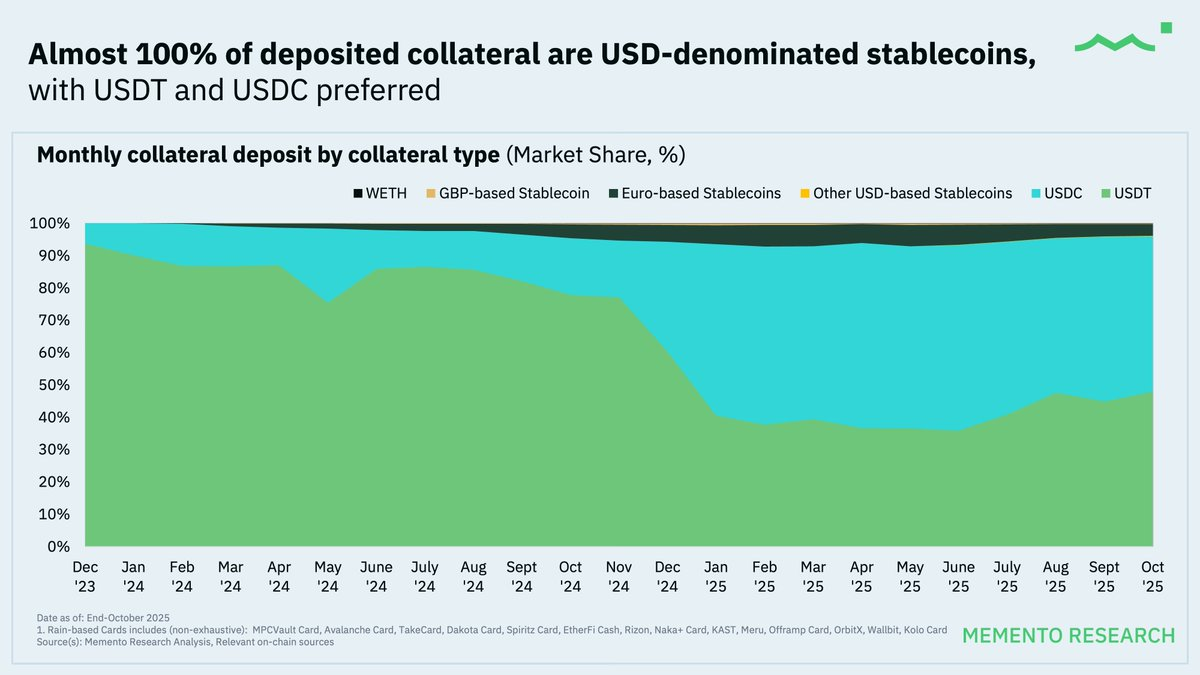

Stablecoins Dominate Almost Entirely

In the entire dataset, nearly 100% of deposit collateral assets are composed of dollar-denominated stablecoins, with USDT and USDC being the primary leaders.

This phenomenon further demonstrates that current crypto cards are closer to international payment accounts rather than speculative consumption tools, even for non-U.S. users.

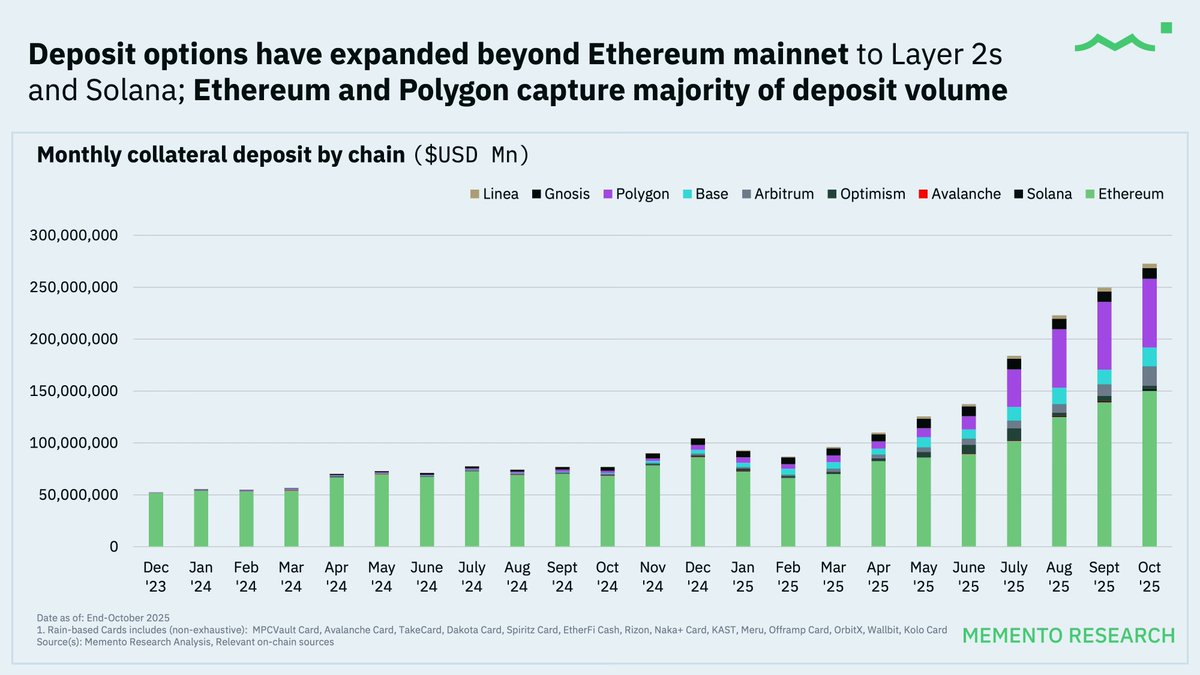

@ethereum and @0xPolygon are the leading chains for deposits, with multi-chain usage gradually increasing.

Although Ethereum (@ethereum) and Polygon (@0xPolygon) remain the primary deposit networks, other secondary chains (such as @base, @arbitrum, @Optimism, and @solana) are also steadily increasing their market share.

The rise of the multi-chain trend reflects the following factors:

- Lower Transaction Costs: Lowered the threshold for users to recharge more frequently.

- Card Service Providers Optimize Routing: No longer forcing users to use a single chain, multi-chain deposits have gradually become a "basic feature."

Consumption Behavior: How Crypto Cards Are Actually Used

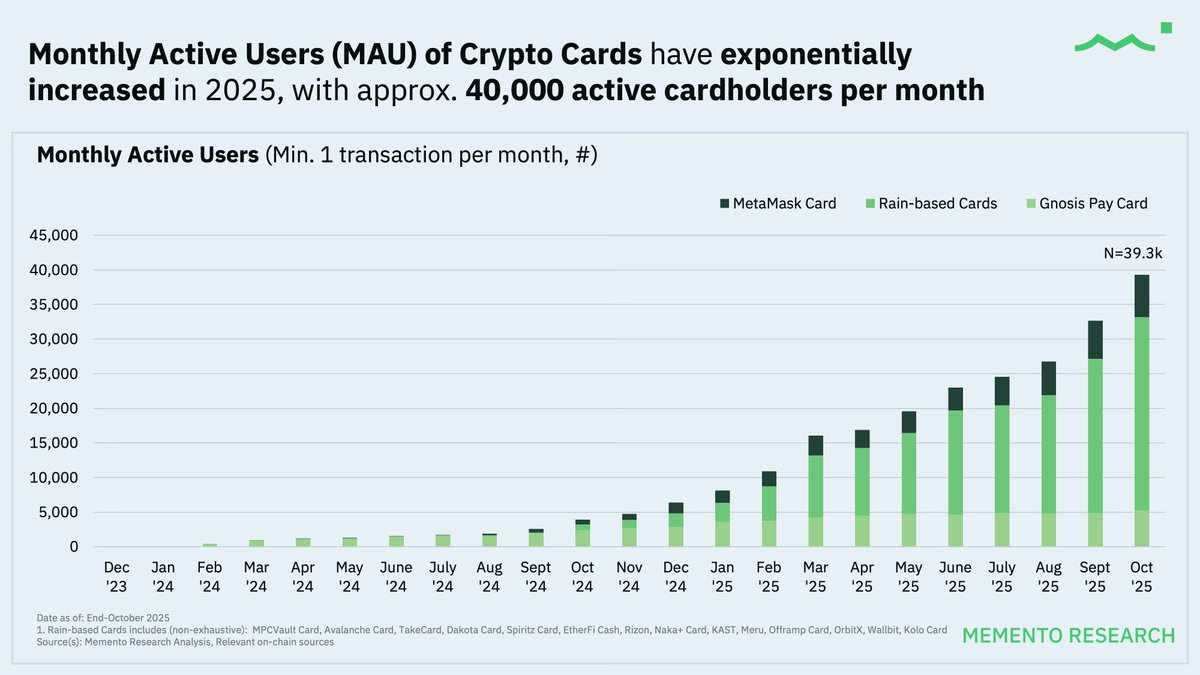

Monthly Active Users (MAU) Continue Rapid Growth in 2025

As of October 2025, the number of monthly active card users (MAU) reached approximately 40,000, indicating an increasing acceptance of crypto cards as reusable payment tools rather than merely one-time experimental tools.

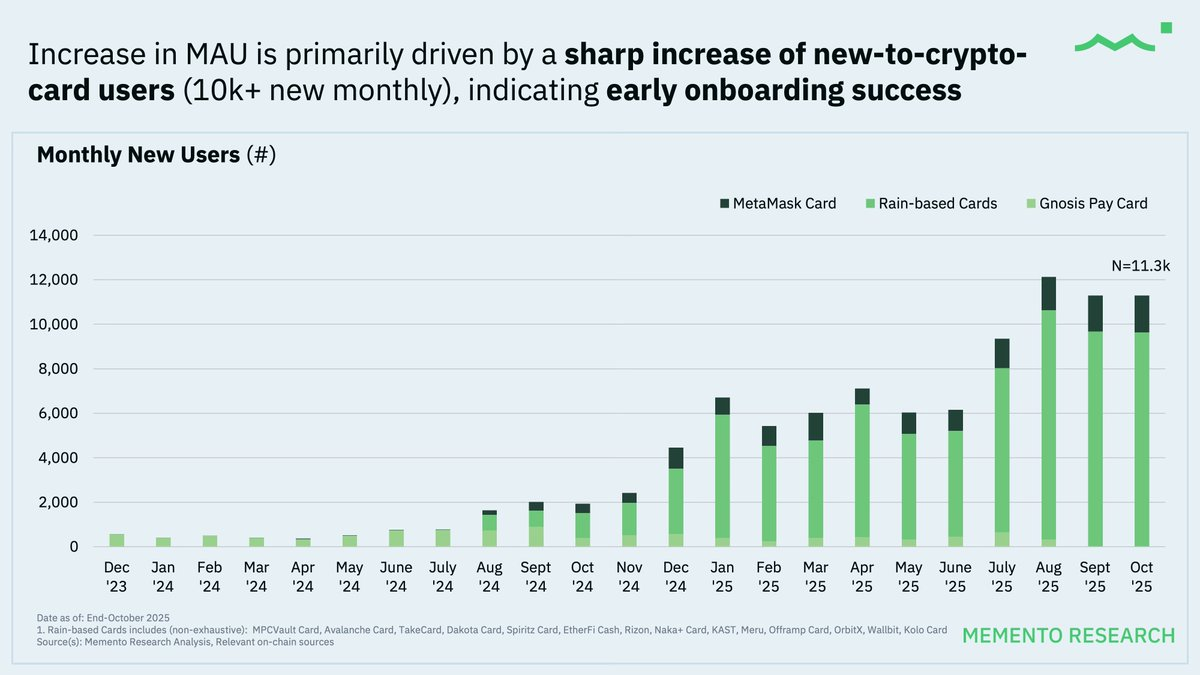

The crypto card industry is still in the early "user acquisition-driven" growth phase, indicating that the adoption curve of the industry is still in its early stages, with distribution and accessibility continuously expanding.

The Rain series cards, serving as shared infrastructure for various crypto card projects (Card as a Service), account for the majority of transaction volume. The data from these Rain series cards is more suitable for trend-level interpretation.

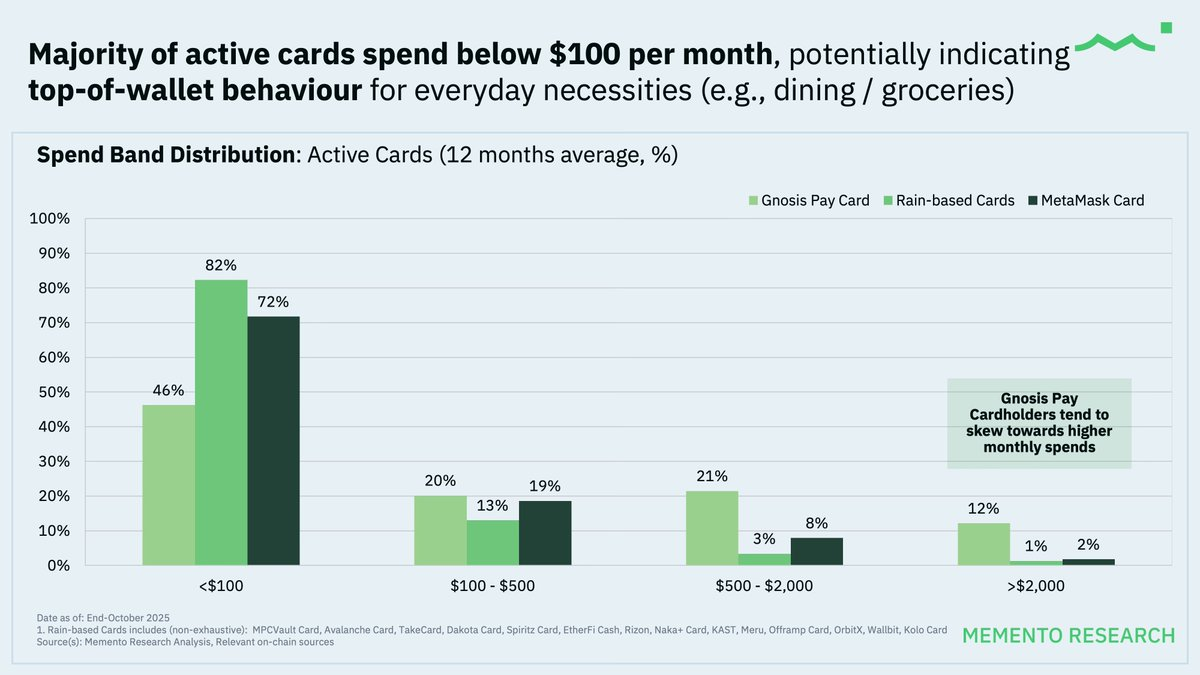

Overall, consumption amounts remain at a low level, which may indicate that crypto cards are primarily used for everyday spending.

The low-value card usage pattern may also suggest that users are using crypto cards as a cash withdrawal tool, thereby directly eliminating the manual conversion step from stablecoins to fiat.

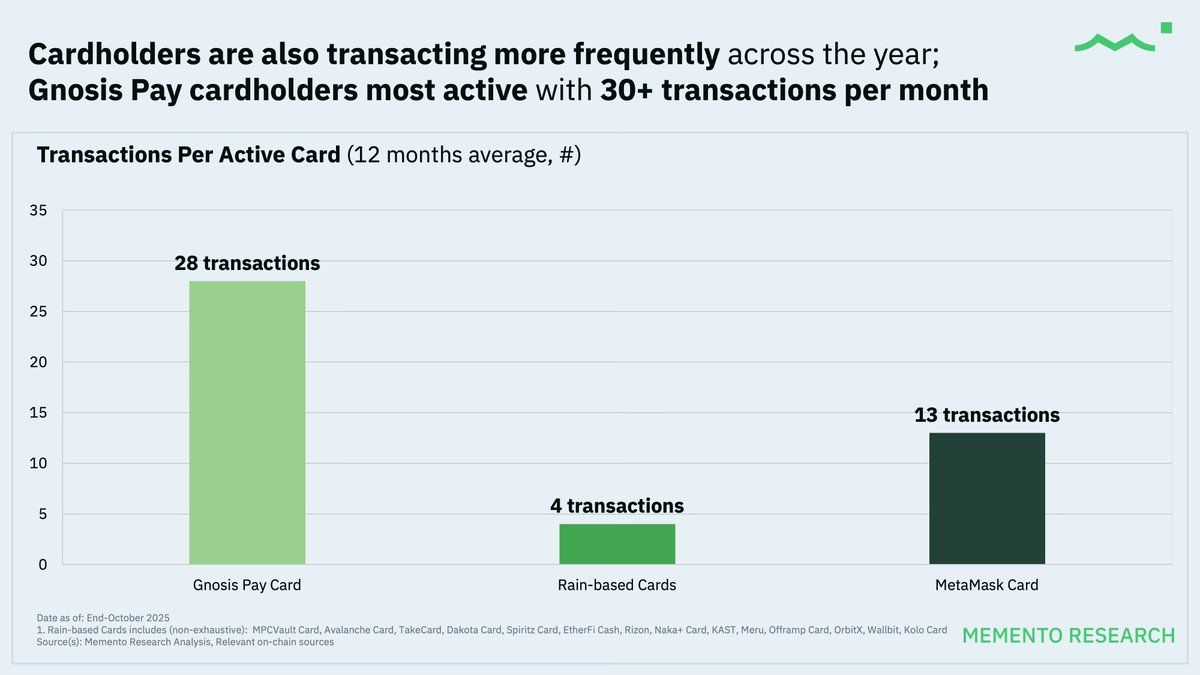

Notably, @gnosispay cardholders have higher monthly spending amounts, indicating that their users are more inclined to use it as a primary payment card for more consistent usage.

Over time, the transaction frequency of active cardholders has increased year by year; similar to the consumption pattern, @Gnosis Pay cardholders exhibit the highest activity, with an average of over 30 transactions per month, fully reflecting the characteristics of daily payment behavior.

Key Insights

- Increased User Activity: More and more people are genuinely starting to use crypto cards, not just registering, with consumption and activity levels steadily rising in 2025.

- Focus on Small Daily Transactions: Users rely more on stablecoins for small, routine spending rather than large or speculative transactions.

- Core Role of Infrastructure Providers: The shared "Card as a Service" model has driven the concentration of transaction volume and determined the way the ecosystem expands.

Outlook for 2026: From Experimentation to Sustainable Scaling

Data from 2025 indicates that crypto cards have transitioned from the experimental phase to the early application phase. Although deposits, consumption, and active usage have seen significant growth, user behavior remains cautious, resembling a prepaid card model centered around stablecoins rather than a complete replacement for traditional credit cards.

Currently, crypto cards primarily serve as a bridge between on-chain liquidity and real-world payments, rather than a complete substitute for traditional credit cards.

Looking ahead to 2026, growth is expected to be driven more by economic sustainability and product design rather than solely relying on user acquisition momentum. As the scale of use expands, card service providers will need to find a balance between expansion, cross-border and domestic traffic exchange economics, routing efficiency, and increasingly complex operational management.

Key Issues to Watch:

- Privacy Issues Persist: Transaction records are publicly available on-chain, and consumption behavior may be exposed. Once an address is clustered or linked to a deposit address at a centralized exchange, tracking ownership becomes easier based on on-chain behavioral traces (such as time, amount, etc.).

- The Double-Edged Sword of Public Data: While public data facilitates analysis, it can also be exploited by competitors. Rivals can monitor traffic, mimic incentives, and even attack high-value users through predatory offers.

- Risks of Non-Vertical Integration: Most crypto card projects rely on issuers, payment processors, and a few "Card as a Service" providers. This model may lead to single points of failure or be constrained by upstream compliance events or policy changes, resulting in sudden restrictions or shutdowns.

- High-Risk Merchant Categories: High-risk merchant categories such as gaming, online casinos, and adult entertainment often face higher fraud and dispute/chargeback rates, which may lead card networks and issuers to implement stricter controls. Additionally, these categories may face more stringent anti-money laundering (AML) scrutiny across different jurisdictions.

- Homogenization Issues: Most crypto cards currently on the market offer similar core functionalities, with limited differentiation beyond selected cardholder rewards like cashback or points. The ongoing reliance on prepaid structures and a few card-as-a-service providers (like Rain) may pose long-term challenges for crypto card issuers seeking to compete with large traditional banks globally.

Future Trends to Watch:

- Expansion from prepaid models to credit card-related designs, similar to the @Coinbase One AMEX card.

- Continued dominance of stablecoins as the primary unit of account.

- Increased focus on profitability and unit economics as competition intensifies.

Crypto cards are gradually becoming foundational tools for embedded payments in wallets and applications. The market demand has been established in 2025, while 2026 will determine which models can achieve sustainable scaling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。