The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smoke bombs!

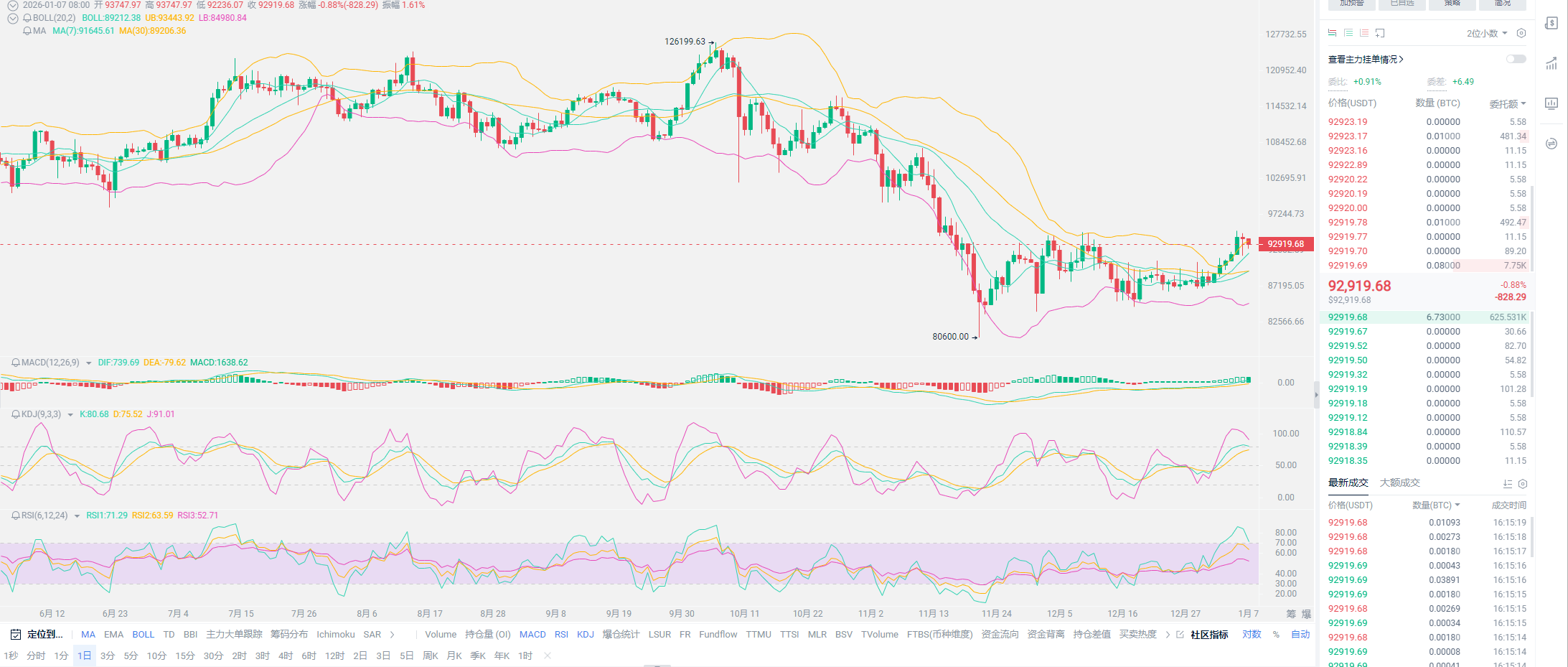

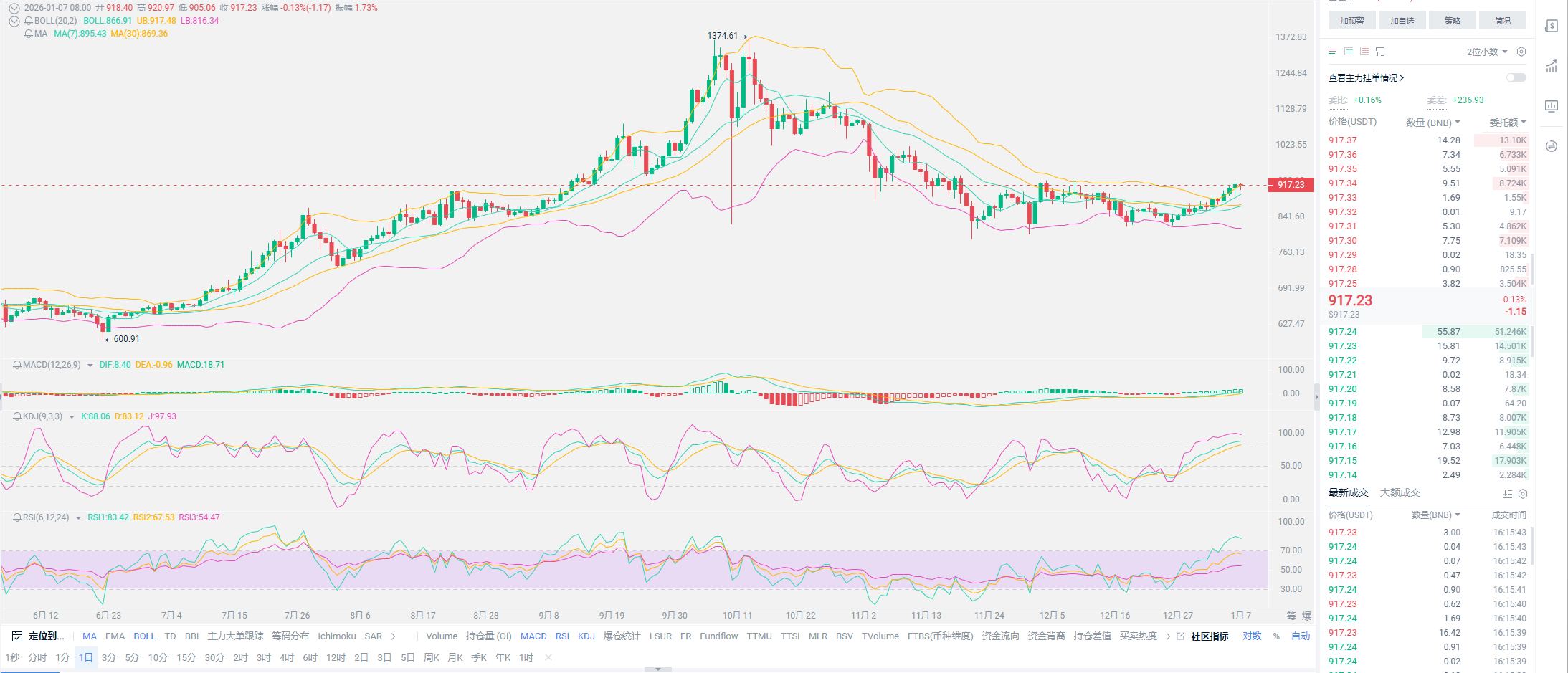

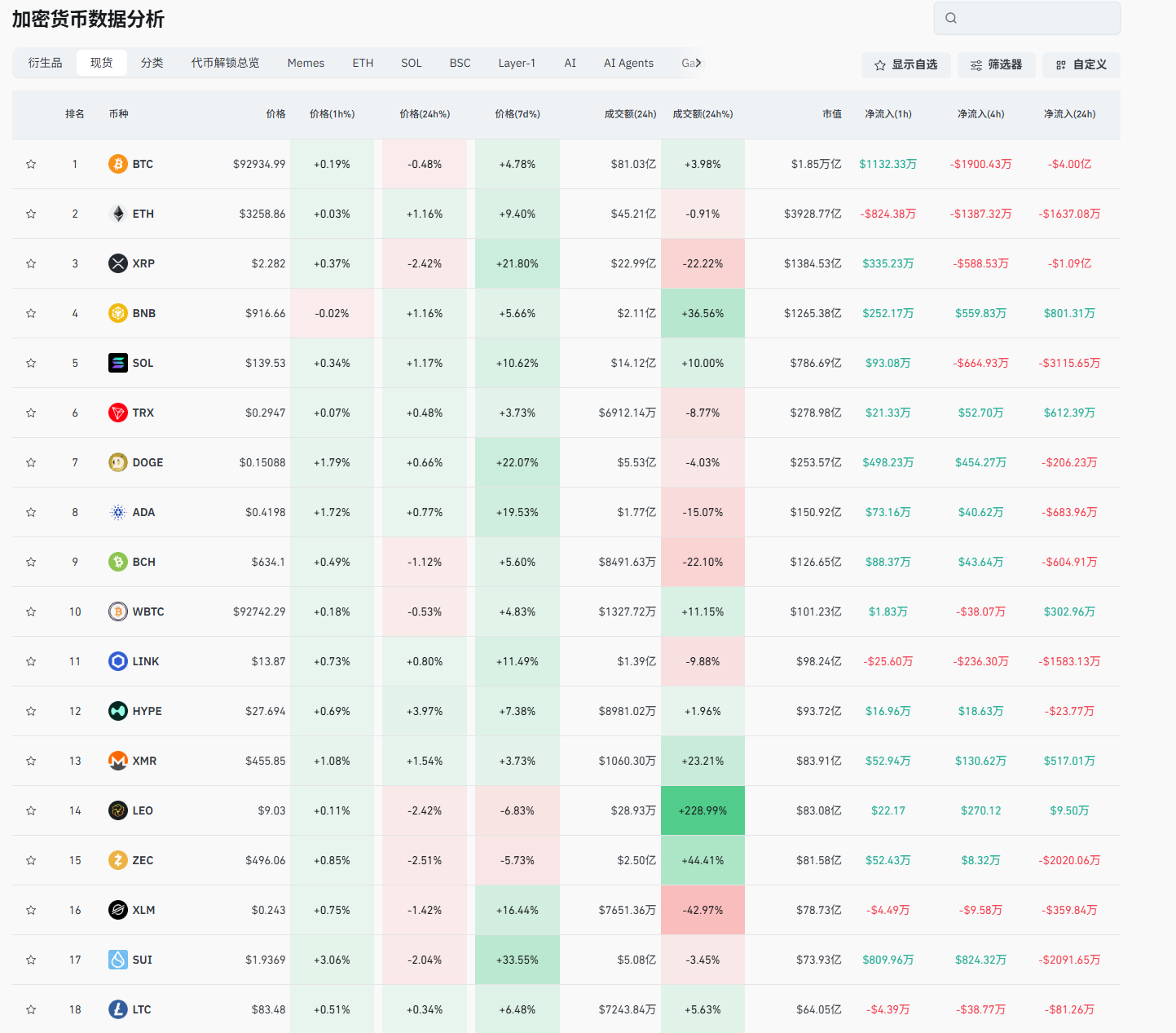

Bitcoin has officially surged to a high of 94,789, which is only a little over 100 points away from our previously analyzed first pressure point of 94,950, and has already begun a new round of correction. The lowest point of yesterday's correction has reached 91,262. Those holding short positions need to release a bit; we will see today whether it follows the repair trend or is completely crushed. Lao Cui still stands on the bullish side, and the 95,000 position is difficult to suppress successfully. The current depth of the correction is still within a controllable range, especially since Ethereum has not touched the high-pressure zone, so the intention to correct is not strong. In terms of support, Bitcoin has not fallen below our previously analyzed support level of 91,000, which is enough to prove that the range has officially formed, consistent with our previous analysis. Regarding the critical point between bulls and bears, Lao Cui has previously provided an answer; it depends on whether Bitcoin can break through the pressure point. Once it breaks through, it will signify a transition between the two, and we will enter the next stage of analysis.

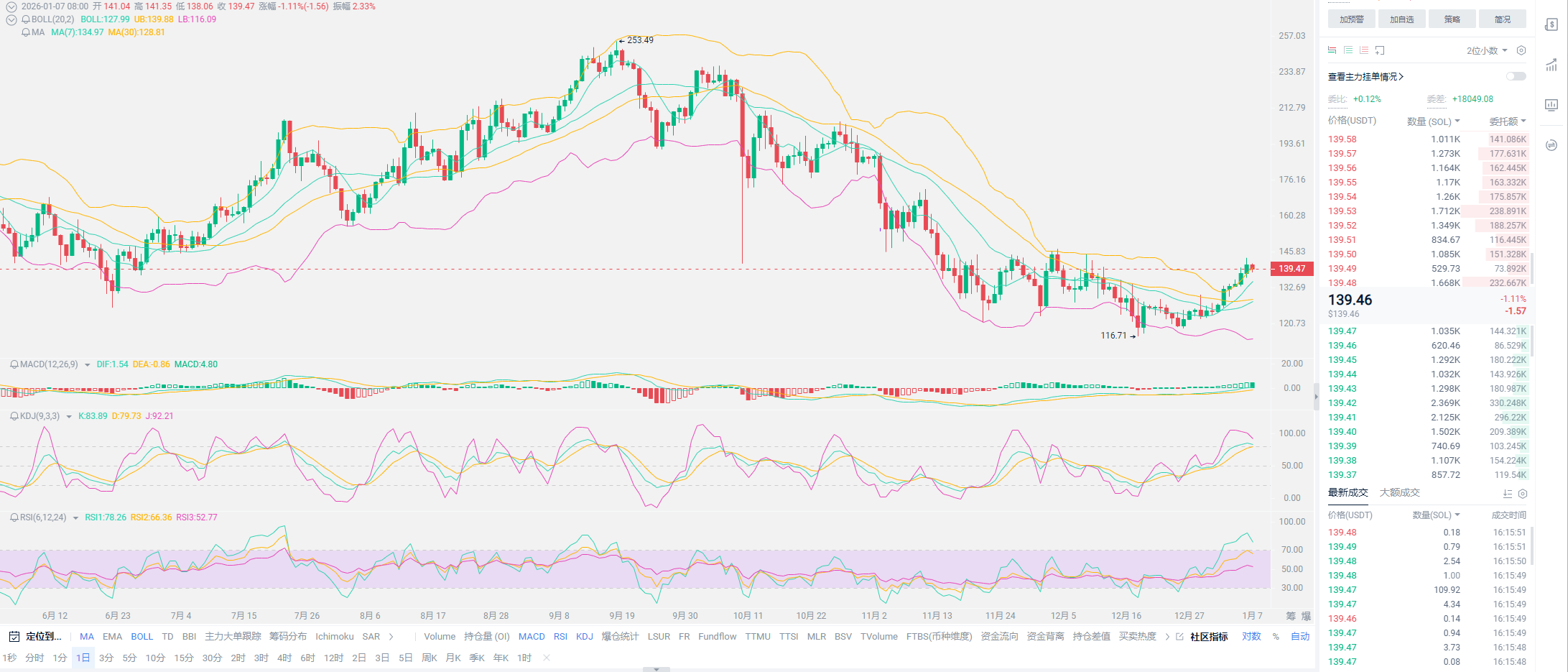

Many friends have different opinions about the coins recommended by Lao Cui, and today Lao Cui will appropriately respond to everyone's questions. First, let's talk about the main recommendation, SOL. Why choose it? Of course, Lao Cui is not the issuer but an investor. As the stock god said, when you invest in a company, you naturally have confidence in its prospects. The ecosystem of SOL can be said to be among the top three, and Lao Cui does not worry that they will abandon this market. Secondly, regarding the total supply issue, many friends often criticize the price of SOL; they always feel that a price over a hundred is too heavy for a small coin. But everyone, currently 605 million SOL are in circulation, accounting for 88% of the total supply, with 71% in active staking, far exceeding ETH's 30% staking ratio. The total supply of SOL has no upper limit, and the current inflation rate is 4.395%, which will gradually decrease to stabilize at 1.5% in the future. Major holders include Coinbase (4.7%), Binance (3.97%), Jito (1.61%), and other institutions, with top holders accounting for over 20%.

Among the data mentioned above, one point that can be criticized is the inflation rate, which has reached 4.4395%. The strategy of the Americans is very clear; their ideal inflation is around 2%, while SOL's target is to stabilize at 1.5%. The current inflation rate of SOL is an undeniable fact, which means there is some excess bubble. But do not overlook that 71% are in active staking; as long as SOL is used in the chain, it needs to be staked, which means it is more stable. This also means it won't crash suddenly, especially since the top holders account for over 20%, providing a strong support base. Latest news: Morgan Stanley has submitted a Solana trust application to the SEC. Meanwhile, SOL's market cap is not high, at just under 80 billion, ranking fifth in the crypto space. The most favorable point is that its speed is the fastest in the crypto space, with the downside being that it cannot support large data calculations, which is the intervention of giants.

Lao Cui chooses SOL based solely on its market cap; its current market cap does not match its value. You can see from Bitcoin's decline that since SOL was listed as an ETF, it has been unwilling to follow the decline. Now, with the support of Morgan Stanley, further declines will be more difficult. By calculating the listing cycle, Bitcoin and Ethereum both started their main upward trends after six months, while among the coins listed at the same time, XRP, DOGE, and SOL may currently be in a silent period. If it weren't for the sudden drop this time, they might have already become the market's vanguard. DOGE is an exception; many friends are focused on this launch, not realizing that it is one of the coins that has suffered the most in this round of decline. Its optimization cannot reach the peak of the crypto space, and its ecosystem cannot compete with Ethereum and SOL, destined to lack momentum. Lao Cui defines it as having growth but no historical new highs. You need to understand one thing: the total circulation of Dogecoin is approximately 146.97 billion, and to reach 1 USD per coin, it would require nearly 120 billion. This over 100 billion relies on Musk's slogans?

XRP also has the support of cross-border payment applications, which is gradually improving. In the future, as compliance comes to the crypto space, without its own characteristics to support it, giants will also begin to evaluate. The era of dividends has basically passed; the current crypto space is different from when we first entered, which is the process of compliance. The landing of applications is extremely important. Walmart has launched Bitcoin and Ethereum trading services through OnePay; these are the things we should think about and measure. Only visible landings will receive feedback in coin prices. Everyone needs to learn to distinguish between slogans and the actual landing of applications. The application landing rate in the crypto space is not high; previously, NFTs, DeFi, including MEME and even the internet memes of dogs, which can be applied? Which will be eliminated with the tide of the times? And which good theories will be retained? This is the game between speculation and investment. If you can clarify the underlying logic, your investments will not be too far off. If your investments are more on the losing side, it proves that you do not understand the underlying logic at all!

Lao Cui summarizes: I am not someone who is willing to follow the majority opinion; the current financial environment is like this. The entire stock market is growing rapidly, and what I am more worried about is the bubble issue. You don't need to worry about the direction of the US stock market; barring any accidents, new stocks will emerge to prop up the bubble in the US stock market. You can pay attention to SpaceX; it will become the savior of the US stock market. So regarding the inflation issue, you don't need to worry too much, especially since the US is currently at a strategic peak, and its strength in all aspects is beyond doubt. The short-term US stock market is also influenced by military factors, and both the US stock market and assets will see growth. Therefore, do not short the crypto space in the short term; this is going against the trend. The continuation of monetary easing policies will not reverse the trend. As long as Bitcoin breaks through again and continues the previous pressure point, the crypto space will soon welcome a new bull market. The current market is extremely bullish, and there will always be someone to support it. As long as the range does not break, it will remain in this state of fluctuation. Long positions should be made according to the support and resistance mentioned by Lao Cui earlier! If you have any questions, feel free to ask Lao Cui directly.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。