Written by: Yangz, Techub News

The year 2026 begins with a moderate rise in the cryptocurrency market. Bitcoin surged above $94,000 on January 5, an increase of about 8% from the end of last year’s $87,000. Although it has since retreated to around $93,000, the overall upward trend at the start of the year undoubtedly injects a positive signal into the market. Behind this stable start, however, multiple undercurrents of macro policies, geopolitical tensions, and regulatory evolution are at play.

Macroeconomic Background: Intertwined Expectations of Rate Cuts and Geopolitics

Behind the calm rise at the beginning of the year are two grand narratives unfolding, influencing the direction of the cryptocurrency market in early 2026.

First is the Federal Reserve's monetary policy and the selection of its next chair. Goldman Sachs recently pointed out in a research report that a cooling job market may force the Fed to consider more aggressive rate cuts beyond current market expectations. This forward-looking expectation acts like a shot of adrenaline for global risk assets. For Bitcoin, viewed as "digital gold," and the broader cryptocurrency assets, the improvement in liquidity expectations and the potential weakening of the dollar together form a classic macro-positive framework. However, the unresolved question of the next Fed chair casts a shadow over the future path of monetary policy. The policy inclination of the next leader will directly determine the pace and depth of this easing cycle, which will in turn affect the funding environment and regulatory temperature in the cryptocurrency market.

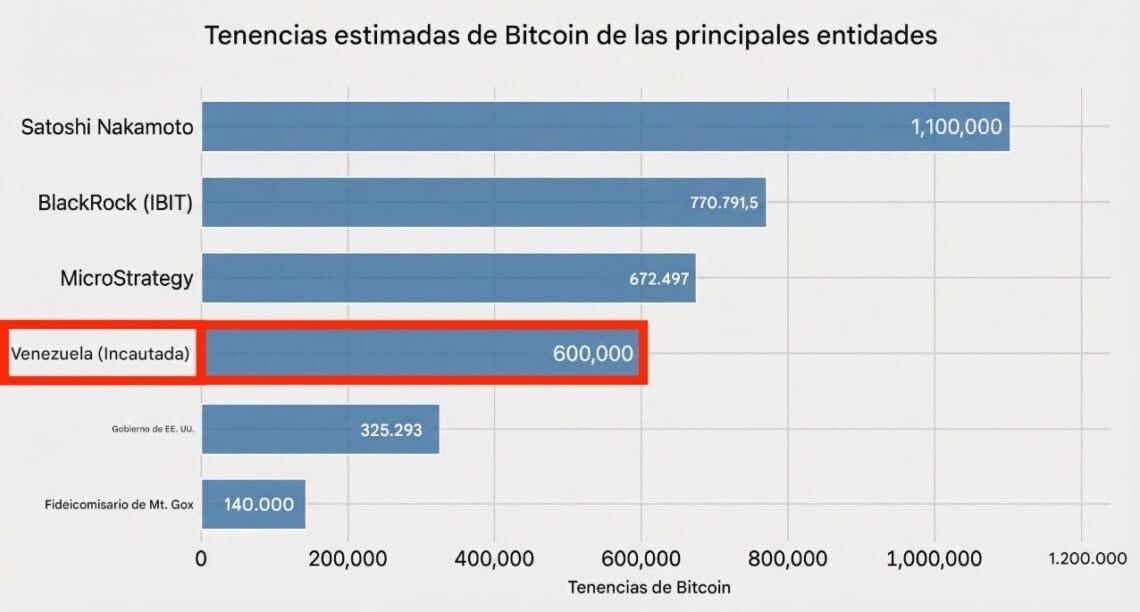

Secondly, there is the geopolitical event of the U.S. military detaining Venezuelan President Maduro. Although Venezuela's impact is negligible when measured by traditional economic metrics (Bloomberg columnist John Authers noted that Venezuela accounts for only 0.1% of global GDP and its oil production is just 1% of global supply), its secret connections to the crypto world are sparking endless speculation. According to multiple intelligence sources cited by Whale Hunting, the Venezuelan government may have secretly built a Bitcoin treasury worth $60 billion through gold reserves accumulated in earlier years, comparable in scale to the holdings of industry giant Strategy. More practically, to penetrate financial sanctions, as much as 80% of the country's oil export revenue has shifted to settlements in USDT.

Additionally, as analyzed by figures like Arthur Hayes, Trump's intervention in Venezuela is also politically motivated. For the Trump administration, the approaching midterm elections make "economic performance" an absolute priority. Stimulating asset prices and suppressing living cost inflation through possible monetary easing and energy interventions (such as controlling Venezuelan oil to stabilize oil prices) is a clear political economic path. The cryptocurrency market happens to sit at this intersection: Bitcoin is both a "risk asset" that may benefit from ample liquidity and a "non-sovereign asset" whose value is highlighted in geopolitical confrontations.

Regulatory Evolution: The Arrival of Key Legal Milestones

While macro narratives inject directional expectations into the market, the global cryptocurrency regulatory framework is entering a critical formative period in 2026.

Currently, the core battleground for cryptocurrency regulation in the U.S. is the CLARITY Act. This act has entered a crucial stage of congressional review, with a key "bill amendment review" process set to begin on January 15. If ultimately passed, it will clarify the classification standards for cryptocurrency assets and delineate the regulatory responsibilities of the SEC and CFTC, providing the industry with a stable and predictable legal framework. Furthermore, this act will legally solidify the current relatively friendly regulatory stance, protecting against potential policy reversals that may come with future government changes.

However, positive signals in the policy-making process have not completely eliminated uncertainties at the execution level. A recent report from Bitcoin Magazine has raised concerns about the consistency of policy execution. It was reported that the U.S. Department of Justice was accused of illegally selling 57.55 Bitcoins seized in the Samourai case, conflicting with an executive order signed by Trump in March 2025 to establish a "strategic Bitcoin reserve." In response, Cynthia Lummis, who has been advocating for friendly cryptocurrency policies, publicly expressed her doubts: "Why is the U.S. government still selling Bitcoin? Trump clearly instructed that these assets be retained as a strategic reserve. Other countries are accumulating Bitcoin, while we are wasting these strategic assets, which is deeply concerning."

Meanwhile, the EU's Markets in Crypto-Assets (MiCA) framework's digital asset tax transparency bill officially came into effect on January 1. This bill extends the EU's tax administrative cooperation framework in traditional finance to the cryptocurrency sector, requiring cryptocurrency service providers, including exchanges and custodians, to collect user identity information, transaction records, and other data, and automatically report to the tax authorities of each member state.

Unlike Europe and the U.S., China continues to reinforce a clear regulatory stance. The latest meeting of the People's Bank of China reiterated the need to "strengthen the regulation of virtual currencies and continue to crack down on related illegal activities," while also "steadily developing the digital yuan." At the end of last year, 13 departments jointly stated their commitment to maintaining a high-pressure crackdown on virtual currency trading speculation, noting that "stablecoins are a form of virtual currency that currently cannot effectively meet customer identity verification and anti-money laundering requirements."

Institutional Movements: Continued Embrace by Financial Giants

As global cryptocurrency regulatory policies enter a critical formative period, recent developments show that Wall Street financial giants are deepening their embrace of cryptocurrencies.

In October last year, MSCI proposed to exclude digital asset reserve companies from its global investable market index, which sparked strong opposition from companies like Strategy. However, this event saw a key turning point yesterday. MSCI announced that it would not implement this exclusion plan in the February 2026 index review. It is important to note that this exemption is not permanent. MSCI clearly stated that it will initiate a broader consultation process aimed at systematically reassessing the treatment of all "non-operating companies" (those holding non-operating assets like digital assets as core operational elements) in the index.

At the same time, Paul Griggs, head of PwC U.S., recently stated in an interview that the company is increasing its investment in cryptocurrencies and related businesses. This strategic adjustment began last year, primarily benefiting from the appointment of pro-crypto regulatory officials and the U.S. Congress advancing multiple pieces of legislation related to digital assets. Additionally, Morgan Stanley has submitted documents to the SEC, planning to launch ETF products linked to the prices of Bitcoin and Solana.

Conclusion

The performance of the cryptocurrency market at the beginning of 2026 sets a cautiously optimistic tone for the year. Bitcoin's fluctuations above $90,000 reflect the market's complex emotions under multiple factors, including macro uncertainties, regulatory progress, and increased institutional acceptance.

Perhaps this year will not replay the narrative of a comprehensive surge driven by retail enthusiasm, but a healthier and more resilient market foundation is quietly being built in this seemingly gentle start.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。