What to know : Nvidia CEO Jensen Huang announced the Vera Rubin platform, which promises five times the AI computing power of previous systems, is now in full production. The Rubin platform will feature 72 GPUs and 36 CPUs per server, with the ability to scale into larger systems containing over 1,000 chips. The AI boom is reshaping the crypto market, with bitcoin miners pivoting to offer infrastructure services to AI customers, impacting data-center space and costs.

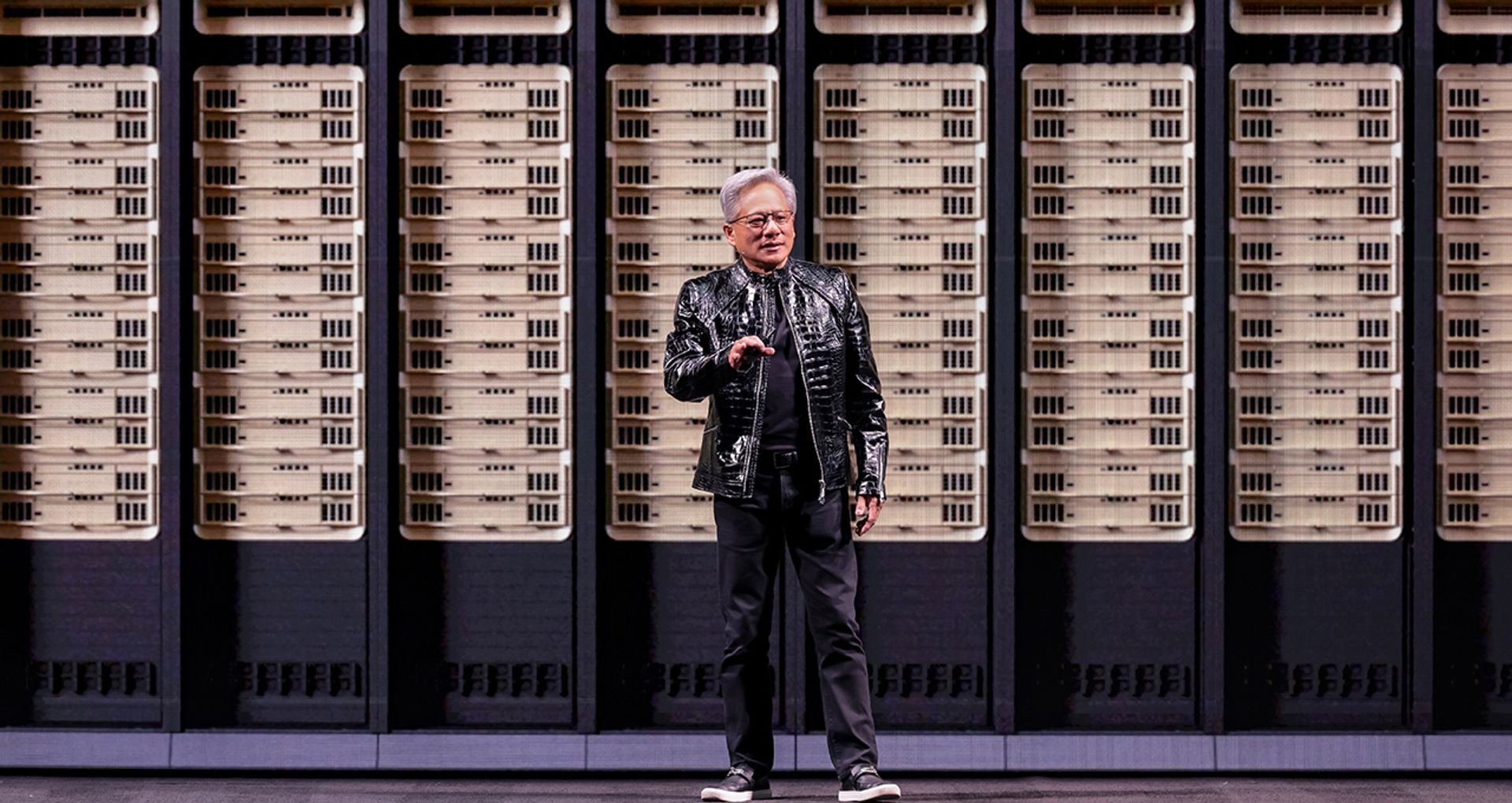

Nvidia CEO Jensen Huang said the company’s next-generation Vera Rubin platform is already in “full production,” unveiling fresh details at CES in Las Vegas about hardware that he says can deliver five times the artificial-intelligence computing of Nvidia’s previous systems.

Rubin is expected to arrive later this year and is aimed squarely at the fastest-growing part of the AI business, helping to deliver outputs from trained models.

Huang said Rubin’s flagship server will include 72 of Nvidia’s graphics processing units and 36 central processors, and can be linked into larger “pods” containing more than 1,000 Rubin chips.

Much of the talk was about efficiency. Huang said Rubin systems could improve the efficiency of generating AI “tokens” — the basic units produced by language models — by roughly 10 times, helped by a proprietary type of data the company wants the broader industry to adopt. He added that the performance jump comes despite only a 1.6-times increase in transistor count.

Huang described AI development as a race where faster processing means reaching the next milestone sooner, forcing competitors to spend aggressively on chips, networking and storage.

How bitcoin miners are impacted

That same infrastructure race has been reshaping parts of the crypto market too.

Bitcoin miners have increasingly marketed themselves as power-and-rackspace operators rather than pure crypto plays, pitching their energy contracts, cooling capacity and data-center footprints to AI customers.

Hosting AI workloads can generate steadier cash flows than bitcoin mining during down cycles, especially for firms with cheap power, existing sites and cooling capacity.

But the AI boom also raises the bar. Data-center space is becoming a premium asset, and the best sites get bid up by hyperscalers, cloud firms and AI startups.

That can lift rents, equipment costs and financing hurdles for smaller miners. In other words, miners that look like infrastructure companies may win, while those that rely on pure mining margins face a tougher 2026.

Meanwhile, Nvidia also highlighted new networking switches using a connection method called co-packaged optics, a key technology for linking thousands of machines into a single system.

The company said CoreWeave will be among the first to receive Rubin systems, and expects Microsoft, Oracle, Amazon and Alphabet to adopt them as well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。