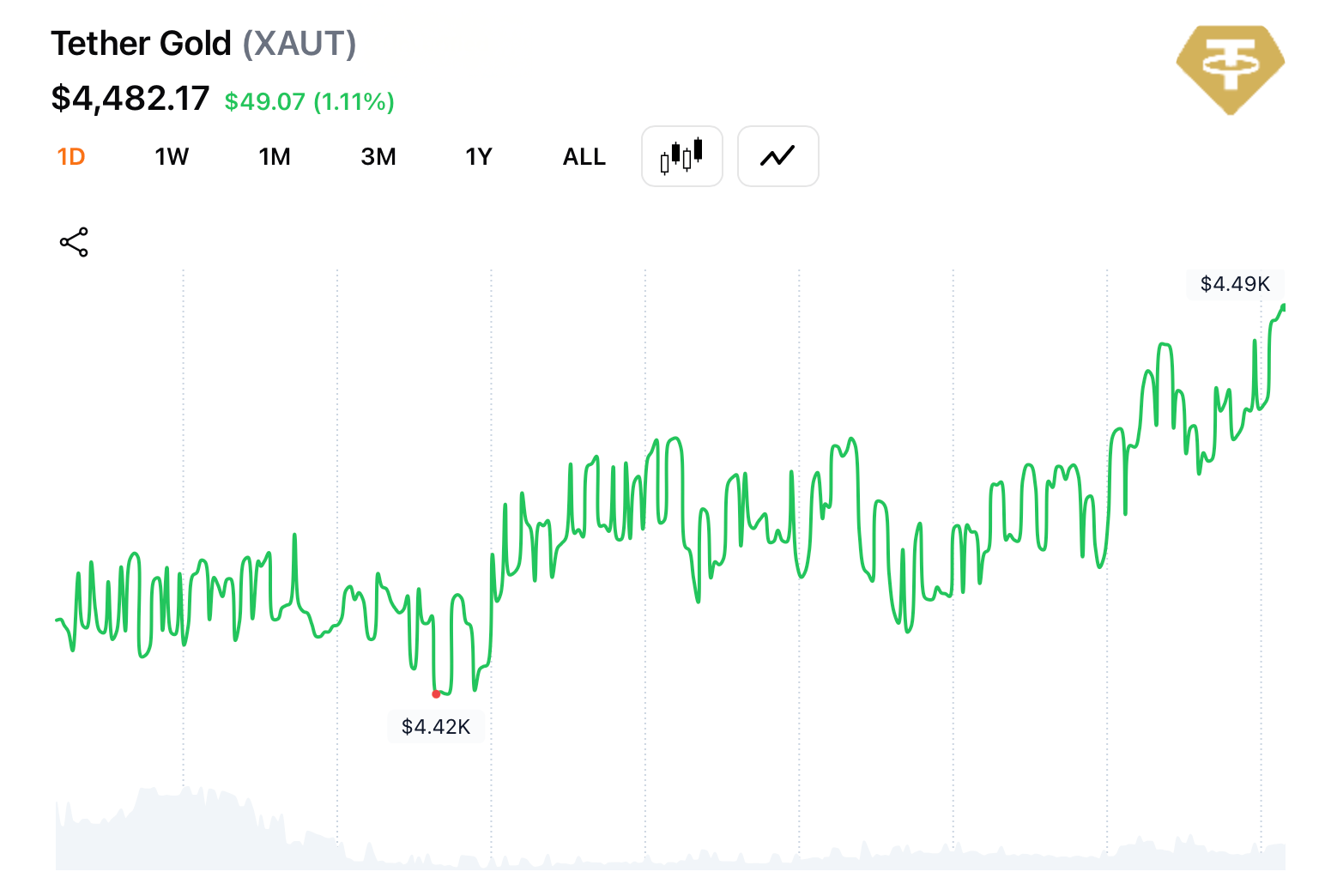

Gold prices are leaving little room for subtlety. As of Jan. 6, gold is trading at roughly $4,482 per troy ounce, extending a rally that has drawn renewed attention from investors seeking insulation from inflation, geopolitical tension, and shifting interest-rate expectations.

Against that backdrop, Tether announced the introduction of Scudo, a smaller accounting unit designed to make its Tether Gold product, XAUT, easier to price, transfer, and potentially use as a medium of exchange (MOE) rather than just a digital vault. At its core, Scudo is simply a denomination tweak. One Scudo represents one-thousandth of a troy ounce of gold, or one-thousandth of an XAUT token.

This would mean at current gold prices per ounce, a Scudo would be valued at around $4.45 (rounded to the nearest cent). The idea is straightforward: dealing in long strings of decimals can be clumsy, particularly when gold prices are measured in the thousands of dollars per ounce. Smaller units, at least in theory, make pricing more intuitive.

Tether framed the move as an effort to revive gold’s historical role in everyday commerce, arguing that while belief in gold’s value remains strong, usability has long been the sticking point. Digital tokens solved custody and portability; Scudo is meant to solve mental math.

The comparison is familiar territory for crypto users. Much like satoshis made bitcoin easier to divide conceptually, Scudo aims to shrink gold into units that feel less abstract. Whether that translates into meaningful day-to-day usage is another question, but the accounting logic is hard to dispute.

XAUT itself remains fully backed by physical gold stored in secure vaults, with ownership verifiable onchain, according to Tether. The introduction of Scudo does not alter the token’s backing or structure; it simply changes how value can be expressed and transferred.

In the growing market for tokenized gold, XAUT is not alone. Its closest rival is PAXG, the gold-backed token issued by Paxos. PAXG currently carries a market capitalization of about $1.68 billion today, trailing XAUT’s roughly $2.31 billion, underscoring the competitive stakes in digitizing bullion.

Also read: Wall Street Heavyweight Morgan Stanley Files for Bitcoin and Solana ETFs

Tether executives argue that usability remains one of the digital asset sector’s weakest links. Paolo Ardoino, Tether’s CEO, said gold continues to prove itself as a long-term store of value and that lowering barriers to ownership and transaction is a necessary step if tokenized assets are to move beyond passive holding.

Still, the announcement lands in a market where gold’s appeal has been driven less by convenience and more by macro anxiety. Central bank buying, persistent inflation concerns, and uncertainty around global monetary policy have all fueled demand, leaving digital wrappers like XAUT and PAXG riding a broader wave rather than creating one.

Scudo may help smooth out the user experience, but it does not change the underlying economics of gold-backed tokens, which remain tethered—quite literally—to the metal’s price and liquidity dynamics. If gold cools, so will enthusiasm for its tokenized counterparts.

For now, Tether’s move adds another layer to the evolving infrastructure around onchain commodities, signaling that the race is no longer just about digitizing assets, but about making them feel usable in a world accustomed to taps, swipes, and rounded numbers.

- What is Scudo?

Scudo is a new unit of account equal to one-thousandth of a troy ounce of gold within the XAUT system. - Does Scudo change how XAUT is backed?

No, XAUT remains fully backed by physical gold held in secure vaults. - Why introduce Scudo now?

The unit is meant to simplify pricing and transfers as gold prices climb to record levels. - Who is XAUT’s main competitor?

XAUT competes primarily with PAXG, Paxos’ gold-backed token.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。